Key banking benefits for Canadians

For over 20 years, RBC has been providing secure and easy U.S. banking to over 500,000 Canadians.

Cross-border banking bundle

Cross-border banking bundle

U.S. Bank Account

U.S. Bank AccountDirect Checking

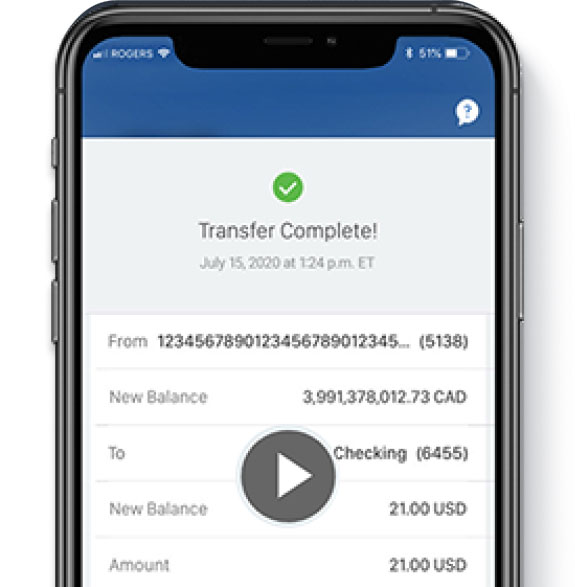

Make unlimited instant online exchanges and transfers between the U.S. and Canada.

- 10 debits/month; $1 per additional debit11

- Pay your U.S. credit card and other bills and deposit U.S. checks online

- $0 minimum balance; $50 deposit required to open

- Link your RBC Bank and RBC Royal Bank accounts with a single sign-in and transfer funds back and forth across the border

- FDIC insured up to $250,000 per ownership category12

U.S. Credit Card

U.S. Credit CardVisa‡ Signature Black

Pay no annual fee, earn rewards and use your Canadian credit history to qualify.

Introductory APR: 0% for 6 months

- Avoid currency fluctuations for U.S. dollar transactions

- Roadside assistance

- Emergency cash and card replacement

- Enjoy travel perks such as signature concierge services to scheduled events and access to tickets

- You’re covered by Visa’s Zero Liability Policy8 protecting you against unauthorized use

Partners & perks13

Maple

Skip the waiting room and get discounted consultations – see a doctor online in the U.S. and Canada with Maple

Avis

Save on select Avis car rentals

Budget

Save on select Budget car and truck rentals

MyUS.com

Shop at any U.S. online retailer and save on shipping with MyUS.com

Puls

Enjoy 15% off any home electronic service including installation and repairs with Puls

Apply online in just 5 minutes

It’s easy and quick.

Apply online with your Canadian address

You don’t need to be a U.S. resident or have a U.S. address.