Last year we enhanced the way the costs of investing are displayed on your mutual fund statements. Your investing costs are not changing; rather, you will see additional information on your statements to help you understand how much and what you’re paying for, so you can better assess the value you’re receiving.

Why did your statement change?

The enhancements provide more clarity around investment costs and performance. These changes are part of an initiative by investment industry regulators to provide you with:

- Added clarity on how your investments are performing

- Enhanced information on the costs associated with your mutual funds

Working with an RBC advisor

Don’t have YouTube access? Watch the non-YouTube version

Don’t have YouTube access? Watch the non-YouTube version

An RBC advisor can play a vital role at any stage of your investment journey. Working with you to understand your unique goals and priorities, your advisor can help you:

- Evaluate your financial goals and create a plan to meet them

- Build your wealth through tax-efficient savings strategies

- Adjust your plan to meet your needs as your life and priorities change

- Help you achieve your goals with regular automatic investing

Your RBC Mutual Fund Advantage

Research indicates that Canadians working with advisors have more retirement savings than Canadians who are saving without the advice of an advisor.1

Studies show that investors working with advisors are more likely to start investing early, invest regularly, save enough for their needs, diversify, and have a financial plan.2

Featured videos

Featured videos

-

Mutual Fund Fees Explained

Learn more about the costs of Mutual Funds.

-

What is the Management Expense Ratio?

All Mutual Funds have a Management Expense Ratio (MER). See how it covers the cost of managing the fund.

-

What is the Trailing Commission?

Understand what the trailing commission is and the value you receive for this fee at RBC.

-

The Benefits of Mutual Fund Investing

Explore some of the benefits that mutual funds provide that investors can’t usually get on their own.

Costs of Mutual funds. Your questions answered.

With your annual statement, you will receive two helpful reports:

- Annual Charges and Compensation Report, which provides information to help you understand the costs of mutual fund investing including the Management Expense Ratio (MER) and any applicable account fees (for those holding series F Mutual Funds).

- Annual Performance Report, which shows how the mutual funds in your account have performed throughout the year after costs

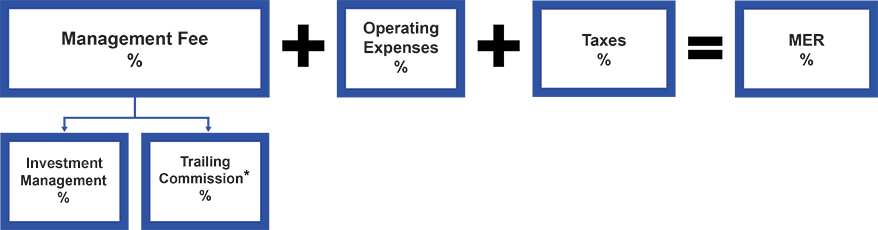

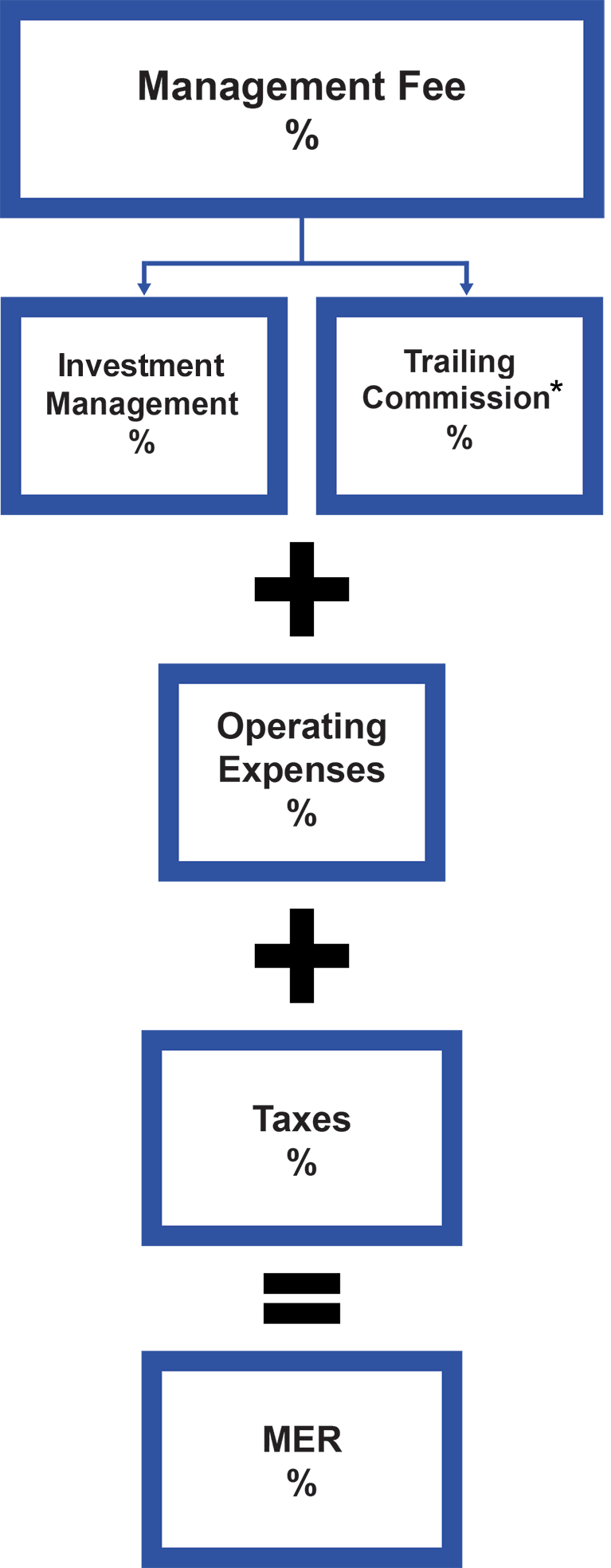

The primary cost associated with mutual funds is the Management Expense Ratio (MER). It includes the Management Fee, Operating Expenses and Taxes. This pays for the management of the fund by the portfolio manager as well as any operating expenses and taxes. It also covers any trailing commission*, which pays for the ongoing access, service and advice you receive from your advisor.

* Trailing commissions are not applicable to Series F mutual funds held within an RBC Investment Advantage Account

For more information regarding fee based investing:

Fee-based Investing - Series F mutual fundsThe Management Fee includes two components:

- The investment management fee is paid to the mutual fund manager (i.e. RBC Global Asset Management Inc.) and covers professional investment management, supervision of the fund, administration of fund operations and service support.

- The trailing commission* is paid to the mutual fund dealer (i.e. Royal Mutual Funds Inc.). RBC and your RBC advisor provide a number of value-added activities for this fee, including advice, access and service.

* Trailing commissions are not applicable to Series F mutual funds held within an RBC Investment Advantage Account

Each fund pays an administration fee that is used to cover the costs of regulatory filing fees and other day-to-day operating expenses.

RBC and your RBC advisor provide a number of value-added activities in exchange for the trailing commission, including:

- Advice: We offer advice about retirement planning and other goals, explain available investments and recommend solutions that will help you achieve your goals. This also includes advice on portfolio recommendations that will help you determine an appropriate asset mix, as well as ongoing monitoring and rebalancing to ensure you’re on track to meet your goals.

- Access: We offer convenient locations where you can discuss your investment goals, 24-hour telephone support with RBC Advice Centres, and online and mobile access anytime.

- Service: We work to keep you informed and make sure your accounts are properly administered. A few examples include: opening accounts and processing transactions; issuing regular statements; and ensuring your accounts comply with all laws, regulations, and tax requirements.

* Trailing commissions are not applicable to Series F mutual funds held within an RBC Investment Advantage Account

In addition to the MER, there’s the Trading Expense Ratio, or TER. These are the fees the fund managers pay when they buy and sell stocks in a fund. Some mutual funds also have sales charges or loads, which are one-time commissions. However, none of the RBC mutual funds have sales charges.

These costs are automatically deducted from the fund. This means that the investment return that is reported on your account statement is shown on an after costs basis. For example, if the investments in a fund you own return 8% for the year and the MER is 2%, you would earn 6% after fees–and the fund’s rate of return would be reported as 6%.

Fund Facts highlight key information for investors, including a description of the fund and the performance and the risks and costs of buying and owning the fund, all in a short, easy-to-read document. You can also find information about MERs on a mutual fund company’s website or at many third-party research sites that provide mutual fund information. For MER information on RBC Funds, PH&N Funds and BlueBay Funds, please see A Guide to Understanding Fund Facts ![]() .

.

Your RBC Advisor is Here to Help

Contact an RBC advisor today to book your investment review or to learn more about these upcoming changes to your statement.

RBC Funds are offered by RBC Global Asset Management Inc. and sold by Royal Mutual Funds Inc. Royal Mutual Funds Inc., Royal Bank of Canada, RBC Global Asset Management Inc., Royal Trust Company and The Royal Trust Corporation of Canada are separate corporate entities that are affiliated. Royal Mutual Funds Inc. is licensed as a financial services firm in the province of Quebec.

There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Mutual funds are not guaranteed or covered by the Canada Deposit Insurance Corporation or by another government deposit insurer. For funds other than money market funds, unit values change frequently. For money market funds, there can be no assurances that a fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in a fund will be returned to you. Past performance may not be repeated. Please read the Fund Facts or prospectus before investing.