Return Scenarios

-

Scenario 1: Market is Up

If the underlying index moves from 100 to 120 over the 5 year term of the GIC, this would indicate an increase of 20% in the index. In this scenario the increase is above the minimum and below the maximum. You would receive 100% of your principal plus a 20% return on your investment. -

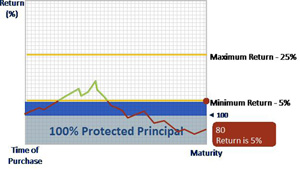

Scenario 2: Market is down

If the underlying index moves from 100 to 80 over the 5 year term of the GIC, you would, in this scenario, receive 100% of your principal plus the 5% guaranteed minimum return set out at the time of purchase. -

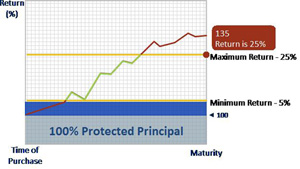

Scenario 3: Market is Way Up

If the underlying index moves from 100 to 135 over the 5 year term of the GIC, this would indicate an increase of 35% in the index. In this scenario, since the increase is above the maximum, you would receive 100% of your principal plus the 25% maximum return set out at the time of purchase.