Give the gift of knowledge with an RESP.

One of the best ways to save for a child’s post-secondary education is through a Registered Education Savings Plan (RESP). Whether you want to save for your own children, your grandchildren, a niece, nephew, or family friend, an RESP offers flexibility, tax-deferred investment growth and direct government assistance to help you save for a child’s education.

- Interest income and investment growth earned within an RESP are not taxed as long as the funds remain in the plan.

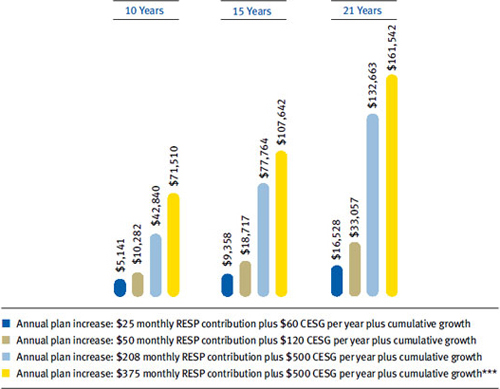

- The Canada Education Savings Grant (CESG) matches 20% on the first $2,500 contributed annually to a maximum of $500 a year ($7,200 overall) for a child under the age of 18, plus possible catch-up grants.

- Incentives are also available for qualifying families through the Alberta Centennial Education Savings (ACES) Plan and the Quebec Education Saving Incentive (QESI). Some children are also eligible for a $500 Canada Learning Bond (CLB) with an additional $100 a year up until the age of 15.

Key Benefits of an RBC RESP

![]()

![]()

![]()

![]()

![]()

Talk to an Advisor

Call or visit us today to open an RESP or to speak with an RBC advisor about the right investment strategy for your young scholar's future.

![]() Call 1-800-463-3863

Call 1-800-463-3863

![]()

![]() Visit Your Local Branch

Visit Your Local Branch ![]()

Talk to an Advisor

Talk to an Advisor

An RBC advisor can help you plan an investment strategy for your young scholar's RESP.

Call 1-800-463-3863

Call 1-800-463-3863

Download Your FREE Guide

Download Your FREE Guide

View our guide for information on your education savings options, including RESPs.

View our guide for information on your education savings options, including RESPs.