RBC Right Pay: Training and Resources Page

Welcome to the RBC Right Pay service centre. Here you have access to the tools and materials you need to manage your card program and service your clients’ needs.

Tip: Bookmark this page for quick access to the resources you need, as you need them.

Training Library

Our series of short self-serve videos will guide you through the RBC Right Pay Prepaid Administration Tool (PAT) and the RBC Right Pay Prepaid Management Application (PMA). Whether it’s your first time using PAT and PMA or if you’re back for a refresher, these quick videos will help you get started and effectively administer your card program.

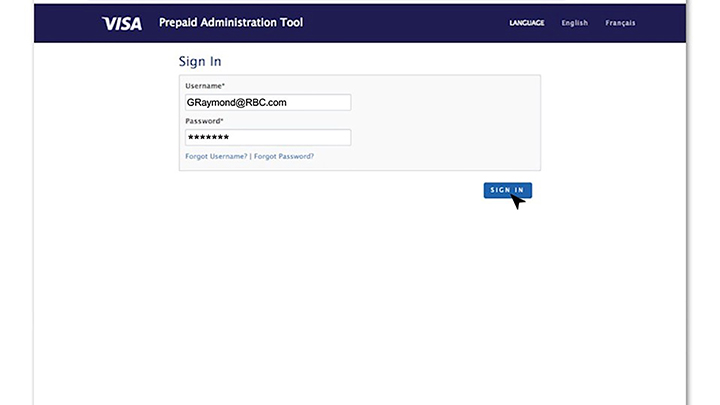

Accessing the PAT system

Learn how to log in for the first time and change your PAT password.

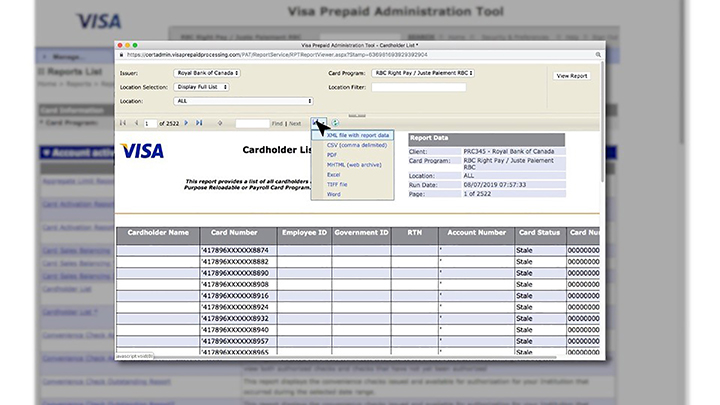

PAT Reports

Get to know the basics of the system’s reporting functions, including accessing and exporting reports.

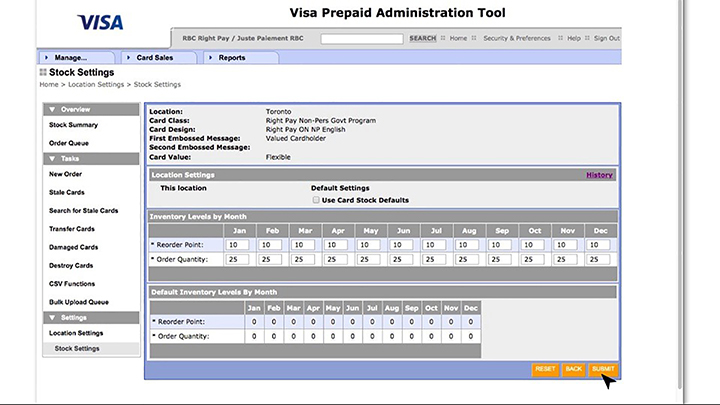

Managing Card Inventory within PAT

Learn how to manage your Prepaid Card inventory settings as well as order cards, check the status of cards, view card inventory and add location contacts.

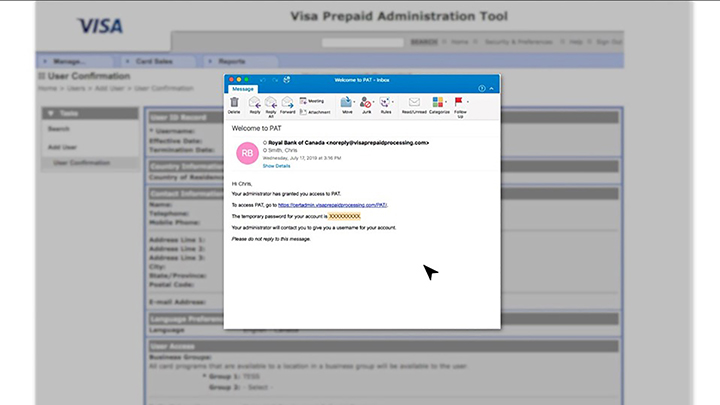

Manage Users and Security Functions within PAT

Intended for PAT users with administrator rights, this video will show you how to manage users and roles within the system. You will learn how to add and remove access, assign roles, reset passwords and more.

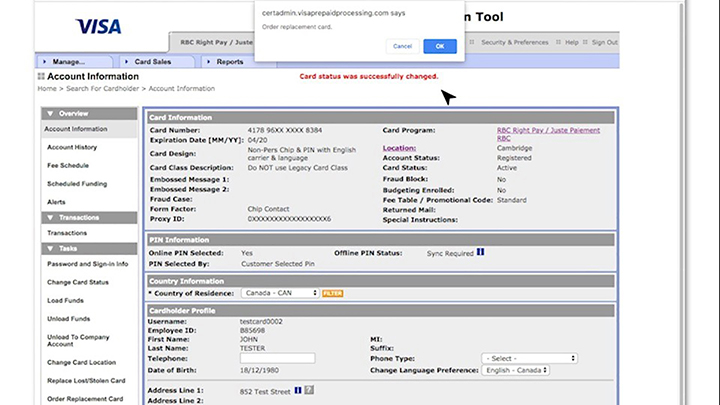

Managing Cardholder Accounts within PAT

Learn both the “Quick” and “Advanced” ways to search for cardholder account information, replace a lost or stolen card and how to unload funds.

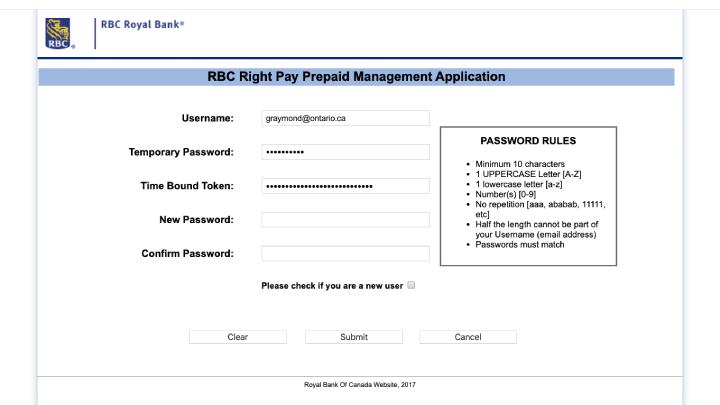

Signing into PMA

Learn how to sign in for the first time, add a new user and reset a forgotten password.

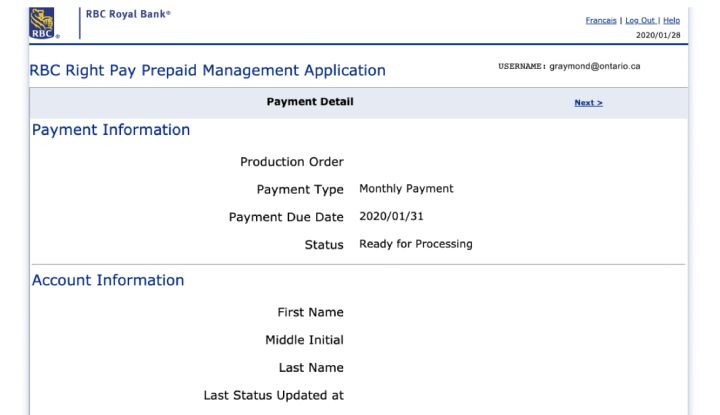

Viewing Payments & Account Inquiry within PMA

Learn how to view payment details using Payment Inquiry and Account Inquiry.

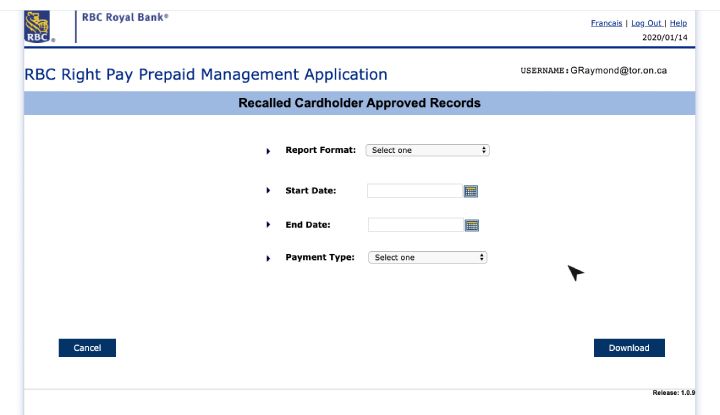

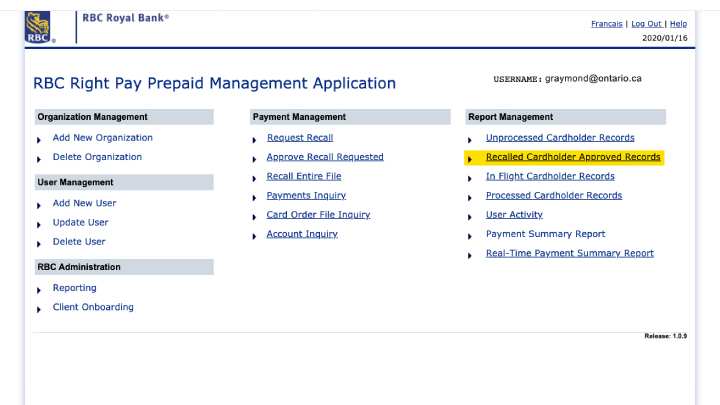

Viewing Reports in PMA Report Management

Get to know the basics of the system’s reporting functions, including accessing and exporting reports.

How to Recall a Payment Request within PMA

Learn how to request a recall, approve a recall and reject a recall request.

PMA Training Guide

For further details about the Prepaid Management Application, please see the User Guide.

Client Information

For your reference, some of the material your clients receive with their RBC Right Pay Visa Prepaid card (“Right Pay Visa card”) is included below.

Frequently Asked Questions

What happens when a client disputes a transaction on their RBC Right Pay Visa card?

RBC Right Pay cardholders are protected against unauthorized use of their card, including if the card is lost or stolen, provided reasonable precautions are taken as set out

in the RBC Right Pay Reloadable Visa Prepaid Card Agreement.

To report an unauthorized transaction or a lost/stolen card, the cardholder must contact RBC Right Pay Customer Support at 1-855-232-06751-855-232-0675 and report the matter. A representative will review the disputed transaction with the cardholder advising if it qualifies for dispute and is within the applicable timelines.

If a dispute claim is opened, the cardholder will be advised of the timeline required to process the dispute. It is very important to note that the dispute process follows established network rules, allowing time for merchants, ATM owners and other parties to investigate and respond to claims made against them. As such, dispute investigations may take up to several weeks to complete and the resolution date communicated to the cardholder. The dispute funds are NOT available to the cardholder while the dispute is in process.

Once the dispute has been completed, a letter will be sent to the cardholder’s address on file indicating if the dispute was approved or denied. If approved, the disputed amount will be credited to the cardholder’s account.

NOTE: Provisional credits are not offered to cardholders at the time a dispute is filed. Funds are only credited back once the dispute process is completed and only if the outcome is in the cardholder’s favour.

What do I need to know about declined transactions?

Similar to credit or debit cards, all transaction attempts on the RBC Right Pay Reloadable Visa Prepaid card are subject to authorization.

As a prepaid card product, RBC Right Pay Reloadable Visa Prepaid cards do not extend credit to cardholders. Instead, funds are loaded onto the card and the cardholder draws down from the available balance with each transaction. For any transaction to be authorized and completed, the amount of the transaction must not exceed the available balance. Any transaction attempt (purchase or withdrawal) that exceeds the available balance on the card will result in a decline.

Insufficient funds is the reason behind the majority of declined transactions. Other reasons for declines include: incorrect PIN or a card status that prevents transactions from occurring, for example lost/stolen card, fraud blocked card etc.

If a declined transaction occurs, cardholders should first check their available balance and/or the status of their card via the program website at www.rbcrightpay.com or by calling RBC Right Pay Customer Support at 1-855-232-06751-855-232-0675.

What are the RBC Right Pay Fees and Limits?

Many cardholder questions relate to fees, so it’s important for cardholders to know and understand what fees apply to them when using their Right Pay Visa card.

ATM Cash Withdrawals

- Cardholders are allowed no fee cash withdrawals from RBC ATMs per month, and $2 for each additional withdrawal.

- All non-RBC ATM withdrawals will incur a $2 fee and potentially a convenience fee from the ATM owner.

- Foreign ATM withdrawals outside of Canada will incur a $5 fee, plus a convenience fee from the ATM owner.

- Cardholders are allowed two no fee ATM card balance requests per month, and $0.50 for each additional request. Checking a card balance via www.rbcrightpay.com or by phone at 1-855-232-06751-855-232-0675 is always free.

Purchase Transactions

- There are never fees for purchase transactions made in Canadian dollars.

- Foreign/International Transaction Fees: Transactions in a foreign currency will be converted into Canadian dollars at an exchange rate that is 2.5% over the benchmark rate Royal Bank of Canada pays the payment card network that is in effect on the date of conversion.

See the following chart with the full listing of applicable fees:

| Type of Fee | Amount of Fee |

|---|---|

| Purchases – using your RBC Right Pay Visa card to buy goods or pay for services | No Fee |

| Cardholder Support via RBC Right Pay Cardholder Website | No Fee |

| Automated Telephone Cardholder Support | No Fee |

| Live Agent Cardholder Support | No Fee |

| Cash Withdrawal from an RBC Royal Bank® ATM | Four no fee withdrawals per month. Additional withdrawals are $2 each. |

| Cash Withdrawal from a non-RBC Royal Bank ATM | $2 per withdrawal. Convenience fee as set by ATM owner may also apply. |

| Cash Withdrawal from an ATM Outside Canada | $5 per withdrawal. Convenience fee as set by ATM owner may also apply. |

| ATM Balance Inquiry Fee | Two no fee card balance requests per month. Additional card balance requests are $0.50 each. |

| Replacement Card Fee | No Fee |

Inactivity Fee

This fee is charged after 12 consecutive months of inactivity.

Your RBC Right Pay Visa card is considered inactive in any month that:

|

$2.50 per month |

Foreign Currency Conversion – transactions in a foreign currency will be converted into Canadian dollars no later than the date Royal Bank of Canada posts the transaction to the RBC Right Pay Visa account at an exchange rate that is 2.5% over the benchmark rate Royal Bank of Canada pays the payment card network that is in effect on the date of conversion.

| Limits | |

|---|---|

| Cash Withdrawal Limits at an ATM – the amount you can withdraw from ATMs | $500 per withdrawal $2,000 withdrawal limit per calendar day |

| Maximum Daily Purchases – based on the available balance on your RBC Right Pay Visa account, the maximum amount you can purchase using your RBC Right Pay Visa card per calendar day | $4,000 per calendar day |