Find What You Need to Invest Towards Your Goals

Whether you are just beginning to save or want to continue growing your investments, you can start investing at RBC. You don’t need a lot to get started—and, depending on your investing style, you can access advice and powerful tools to help you build your wealth and achieve your goals.

Three Convenient Ways to Invest

Work with an advisor, do it yourself or be hands-off. Choose one, two, or all three, based on the level of support you need.

Receive Ongoing Support and Investment Advice

RBC Royal Bank

You can get support from an RBC advisor whether you want to invest $100, $10,000 or more. Best of all, you can choose to meet by phone, in person or over video chat1.

- Get answers to the financial questions that are on your mind

- Receive guidance and advice to help you reach your savings goals

- See how we can help you build an investment portfolio that’s designed to weather the ups and downs of the market

Contact us today and benefit from RBC’s 150 years of experience serving Canadians, including RBC Global Asset Management’s 63-year history of managing money.

Existing Clients:

Sign in to RBC online banking to book an

appointment.

New to RBC:

Call 1-888-476-0949

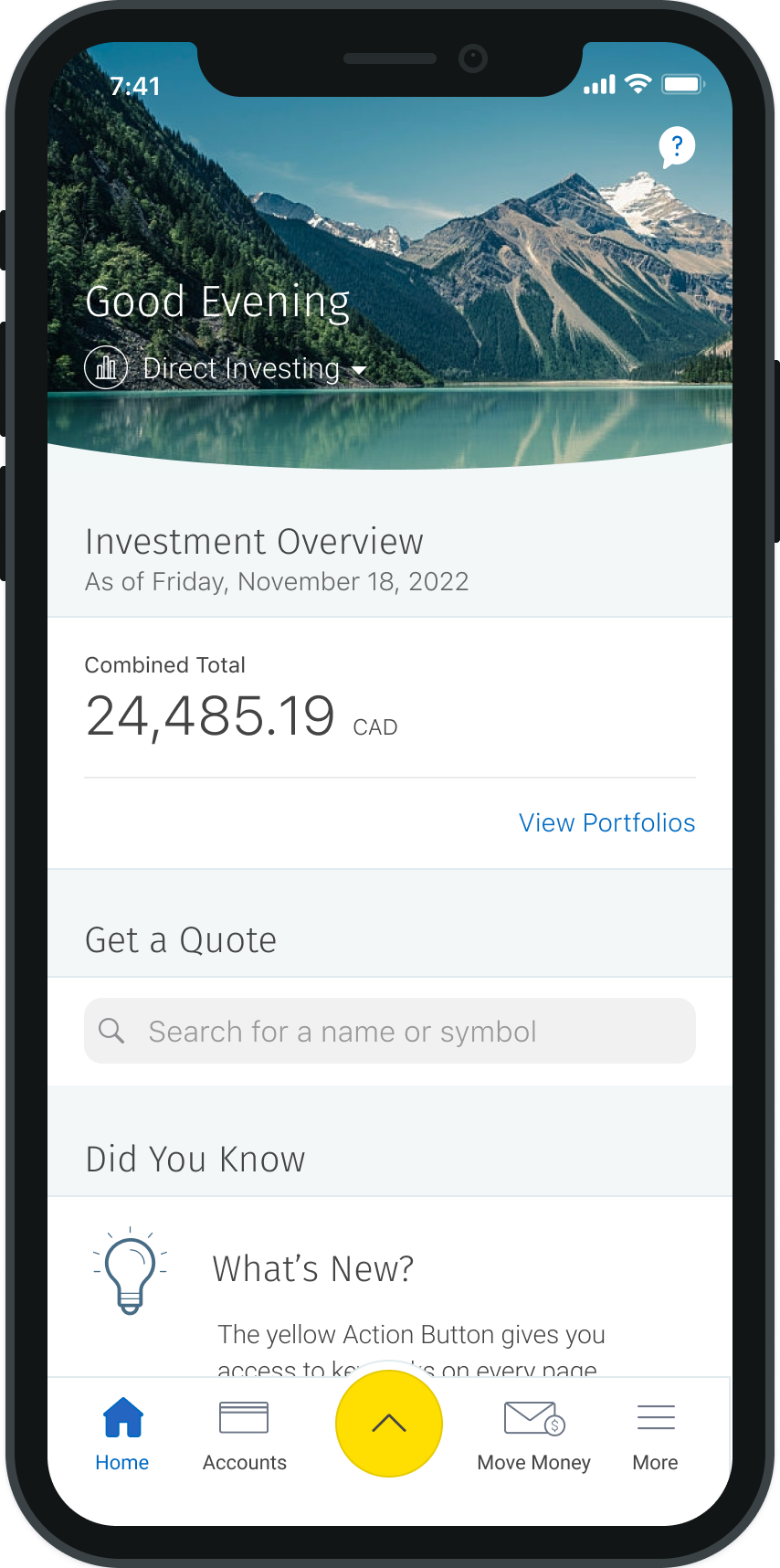

Call the Shots on Your Investments Using Powerful Tools and Research

RBC Direct Investing

Build a portfolio that meets your needs and comfort level, with research, insights and tools to support your trading decisions.

- Choose from a full range of investment products including stocks, ETFs, mutual funds, GICs and more

- Talk to an Investment Services Representative if you need help getting started or have questions about your account

- Whether you’re new to investing or a seasoned trader, experience our online investing site using a free Practice Account with $100,000 of no-risk “practice money”. The Practice Account is not a demo, it lets you place practice trades and monitor performance

Plus, see all your RBC accounts under a single login and easily move money with free, instant and unlimited transfers2 from an RBC bank account.

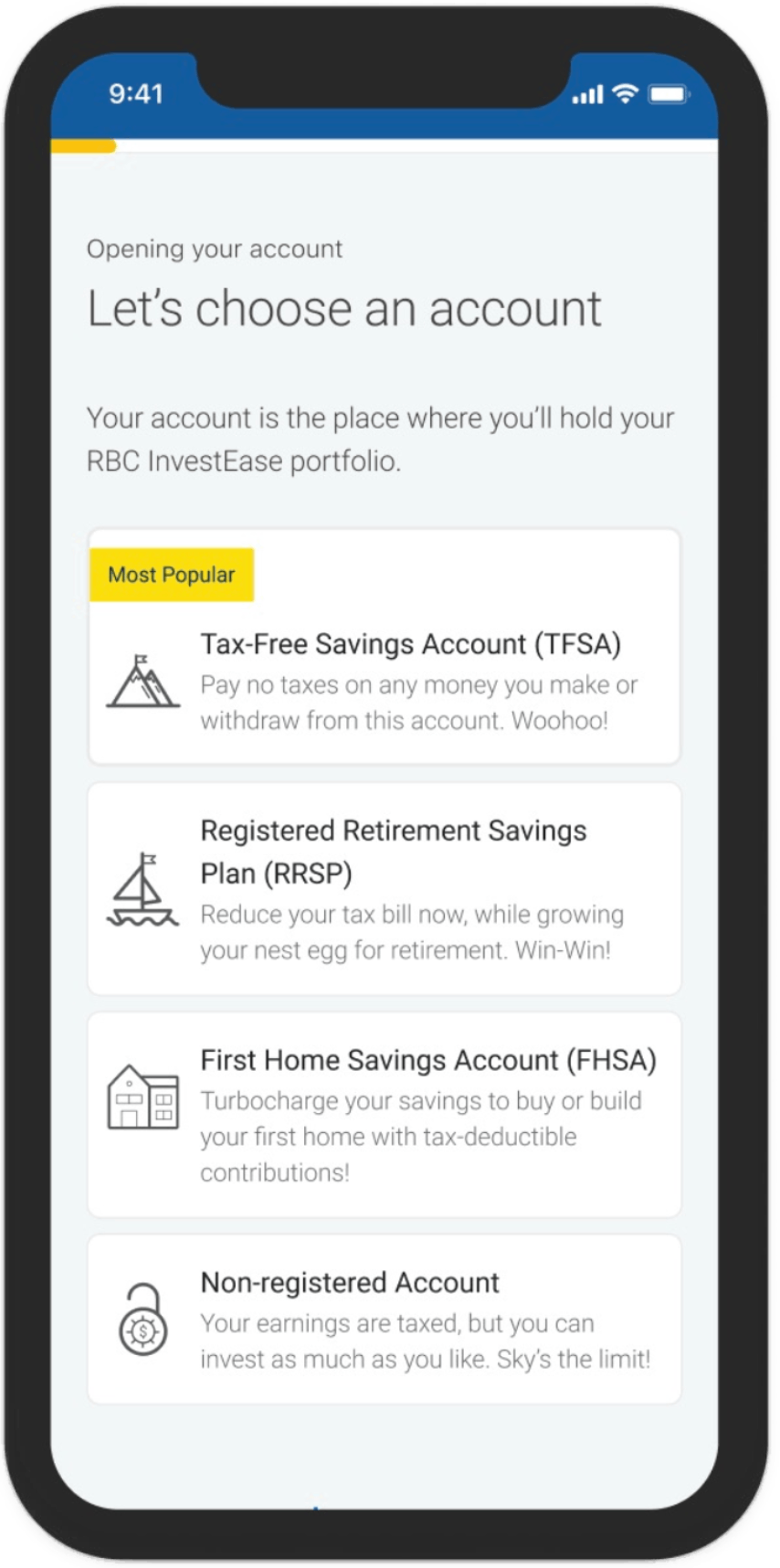

Let the Pros Pick, Buy and Manage Your Investments—and Get Advice When You Need It

RBC InvestEase

Get a professionally-built investment portfolio at a low cost and flexible support from Portfolio Advisors. Plus, you can start investing with just $1003.

- Answer some simple questions and we’ll match you to a portfolio of exchange-traded funds (ETFs) aligned to your goals

- Deposit any amount you’re comfortable with and we’ll manage and rebalance your investments for you to help you stay on track

- See how your investments are doing, add more money or manage ongoing deposits at any time online

- Reach out to a Portfolio Advisor by phone or email if you have questions or want advice

Open your account online in minutes and leave the heavy lifting to us.

Which RBC investing service may be a good fit for you? Find your fit now.

RBC Direct Investing Inc., RBC InvestEase Inc., and Royal Bank of Canada are separate corporate entities which are affiliated.

MyAdvisor is an online platform from RBC where you can view your financial information including visual representations (charts and graphs) of your retirement readiness, net worth, cash flow, and financial goal tracking. You can also see how varying your current approach can affect your savings and goals. The MyAdvisor platform also enables you to book an appointment with an RBC advisor and to meet with your advisor using video chat or phone to open new accounts, including investment accounts, and get advice on meeting your financial goals.

Financial planning services and investment advice are provided by Royal Mutual Funds Inc. (RMFI). Investment advice provided by RMFI may be delivered through the MyAdvisor platform. RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Investment Industry Regulatory Organization of Canada and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc.

RBC InvestEase Inc. is a restricted portfolio manager providing access to model portfolios consisting of RBC iShares ETFs. Each model portfolio holds up to 100% of RBC iShares ETFs. RBC iShares ETFs are comprised of RBC ETFs managed by RBC Global Asset Management Inc. (RBC GAM) and iShares ETFs managed by BlackRock Canada Limited (BlackRock Canada). RBC GAM and BlackRock Canada entered into a strategic alliance to bring together their respective ETF products under the RBC iShares brand, and to offer a unified distribution support and service model for RBC iShares ETFs.

Other products and services may be offered by one or more separate corporate entities that are affiliated to RBC InvestEase Inc., including without limitation: Royal Bank of Canada, RBC Direct Investing Inc., RBC Dominion Securities Inc., RBC Global Asset Management Inc., Royal Trust Corporation of Canada and The Royal Trust Company. RBC InvestEase Inc. is a wholly-owned subsidiary of Royal Bank of Canada and uses the business name RBC InvestEase.

The services provided by RBC Direct Investing and RBC InvestEase are only available in Canada.

There may be commissions, trailing commissions, investment fund management fees and expenses associated with investment fund and exchange-traded fund (ETF) investments. On or after June 1, 2022, any trailing commissions paid to RBC Direct Investing Inc. will be rebated to clients pursuant to applicable regulatory exemptions. Before investing, please review the applicable fees, expenses and charges relating to the fund as disclosed in the prospectus, fund facts or ETF facts for the fund. Mutual funds are not guaranteed, their values change frequently and past performance may not be repeated. For money market funds there can be no assurances that the fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in the fund will be returned to you.

RBC Global Asset Management is Canada's largest fund company by assets. IFIC, September 30, 2021

Available with MyAdvisor

Fund transfers from an RBC Royal Bank account to your RBC Direct Investing account using RBC Online Banking, Direct Investing Online Investing, or the RBC Mobile app are processed in real time between the hours of 4:30 a.m. and 7:54 p.m. ET, seven days a week. Transfers into an RBC Direct Investing account made outside of these hours will be processed the next morning. Transfers out of your RBC Direct Investing account to an RBC Royal Bank account are processed in real-time between 9:00 a.m. and 4:00 p.m. ET, Monday to Friday (excluding holidays). Transfers out of your RBC Direct Investing account made outside of these hours will be processed the next business day. Locked-in, Registered Retirement Income Fund, and Registered Education Savings Plan (transfer out only) accounts excluded. Other conditions apply.

Your money will not be invested until your account balance reaches $100 or more. Small balances (less than $1,500) may be allocated to a Small Balance portfolio that invests in a limited selection of RBC iShares ETFs and/or cash. Our Small Balance portfolios follow similar risk profiles to our Standard Portfolios while investing in fewer RBC iShares ETFs.