Key Benefits for Canadians Banking in the U.S.

For 17 years, RBC has been providing secure and easy U.S. banking to over 400,000 Canadians.

U.S. Bank Account

U.S. Bank AccountDirect Checking

A U.S.-based account giving you the freedom to bank in all 50 states from your mobile device – without the need for a U.S. address.

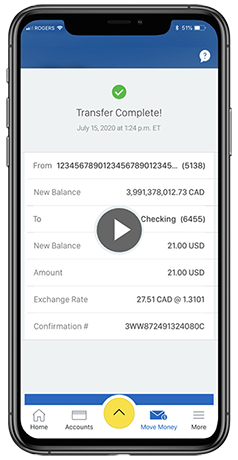

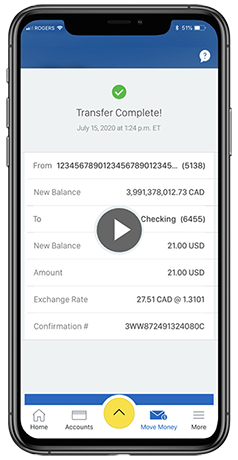

No more drafts and wires. Enjoy free cross-border transfers up to $25,000, between your RBC Royal Bank (Canadian) and your RBC Bank (U.S.) accounts – 24/7 with no delay2 from your computer or mobile device.

Watch How Easy It IsWith no Interac eTransfer in the U.S., it can be challenging to send money person-to-person. With a U.S. account and using your Canadian address, use your U.S. bank account to transfer funds to other U.S. accounts in Online Banking or with U.S. third party apps such as Venmo^, Apple Cash^, Cash App^ or PayPal^ – an option not available with a Canadian U.S. dollar account.

With Online Banking and Bill Pay you can make your U.S. payments from your desktop or mobile device, through our website or on the RBC Mobile App10 and even deposit U.S. checks with your smartphone or tablet.

U.S. Credit Card

U.S. Credit CardVisa Signature Black

A No-Annual-Fee3 U.S.-based rewards credit card that uses your Canadian credit history to qualify.

Introductory APR: 0% for 6 months

Save 2-3% on U.S. purchases by avoiding foreign transaction fees4 – and make returns in USD, without concern for currency fluctuations.

Redeemable for travel, gift cards, merchandise, unlimited 1% cash back7.

- No blackout periods or seat restrictions.

- Redeem points for flights and hotels.

- Easily manage and redeem your points for travel through Online Banking.

- Trip cancellation or interruption insurance up to $5,000

- Travel accident insurance up to $500,000 and lost luggage reimbursement up to $3,000

- Auto rental collision damage waiver

- Cell phone insurance up to $200 ($50 deductible)

- Purchase security up to $500 per occurrence

- Emergency cash and card replacement

- Enjoy travel perks such as signature concierge services to scheduled events and access to tickets.

- You’re covered by Visa’s Zero Liability Policy13 protecting you against unauthorized use.

Get Online Cross-Border Shopping & Shipping with MyUS.com

Through our partnership with MyUS.com9, shop U.S. retailers online tax-free and save up to 80% on shipping costs home to Canada. You'll save on your first year membership fee, set-up fee and get a 10% discount on the cost of your first shipment.

The Only U.S.-Based Bank Designed Specifically for Cross-Border Canadians

Finding the idea of banking and getting credit in the U.S. stressful? We’re with you. We make cross-border banking easy and secure.

- Easy access to cash with over 50,000 no-fee ATMs5 in all 50 states

- Use your Canadian credit history, address and ID to apply

- Manage your money anywhere, anytime through mobile, online and telephone banking

How we make cross-border banking easy

The Only U.S.-Based Bank Designed Specifically for Cross-Border Canadians

Finding the idea of banking and getting credit in the U.S. stressful? We’re with you. We make cross-border banking easy and secure.

- Easy access to cash with over 50,000 no-fee ATMs5 in all 50 states

- Use your Canadian credit history, address and ID to apply

- Manage your money anywhere, anytime through mobile, online and telephone banking

How we make cross-border banking easy

Apply Online in Just 5 Minutes

It's easy and quick. You can start your no-obligation application online right now. It usually takes less than 5 minutes and you can even open your U.S. bank account immediately.

Apply by October 31, 2026 and enjoy no-annual-fee cross-border banking for 1 year1.