Performance Matters

Reaching your investment goals doesn’t happen by accident.

Discover how expertise, advice and tools can help make a big difference in building your wealth over time.

How Expertise Helps Performance

When your car needs service, you want a trusted and experienced mechanic—someone who will fine-tune your vehicle so that it performs well, no matter the road conditions. The same goes for your money. You want to know that your investments are being managed to weather downturns and capitalize on opportunities.

WHY RBC?

A Proven Track Record of Performance

At RBC, you can invest in portfolios that are built with funds from the award-winning team1 at RBC Global Asset Management (GAM). For example, see how our RBC Select Balanced Portfolio has performed against its industry peer group2:

Source: RBC GAM, Morningstar. Data from February 1, 2003 to January 31, 2023. RBC Select Balanced Portfolio Series A returns for 1-yr: -12.33%, 3-yr: 2.79%, 5-yr: 3.82%, 10-yr: 6.08%. Canada Fund Global Neutral Balanced category average return for 1-yr: -10.72% (1,542 funds), 3-yr: 2.25% (1,326 funds), 5-yr: 3.45% (1,048 funds), 10-yr: 5.35% (497 funds)

Decades of investment expertise

Benefit from RBC’s 150 years of experience serving Canadians, including RBC GAM’s 63-year history of managing money. RBC GAM brings together expertise from:

350+

Investment professionals

18

Investment teams

4

Specialty research and development teams

Actively-managed Portfolio Solutions

Choose from a wide range of portfolios that are actively monitored and rebalanced to capitalize on short-term opportunities and help weather market volatility.

How Advice Helps Performance

Whether you’re just starting out or getting ready to retire, having a professional in your corner can be priceless. Studies show that Canadian investors who work with an advisor have almost 4 times the financial assets of investors who don’t work with an advisor over a 15-year period4:

Source: The Gamma Factor and the Value of Financial Advice, Claude Montmarquette, Natalie Viennot-Briot, 2016.

WHY RBC?

Personalized Advice on Your Terms

Investing doesn't have to be one-size-fits-all. At RBC, you can get customized advice in-person or online, depending on how you choose to invest. The level of advice you get and how involved you want to be is up to you

Help reach your goals with the right investments

Receive recommendations based on your unique goals and appetite for risk.

Enjoy the freedom to invest how you want

Work one-on-one with an advisor, invest online with access to advice—or both.

Plan for the big (and little) things in life

Get guidance on other financial matters, including your retirement, estate, taxes and more.

Choose how you connect with an advisor

Meet with your advisor over video chat (using MyAdvisor(Open in new window)), by phone or in person—it’s your choice.

How Tools Help Performance

Just as you need specific tools and materials to build a house with a sturdy foundation, you may need certain tools to help create a strong investment portfolio. Whether you want to research investments, place a trade or see where you stand, the right tools for you can help provide the insights you need to invest wisely and achieve better results.

WHY RBC?

Tools for Self-Directed Investors

Trading tools to help you spot your next investing idea

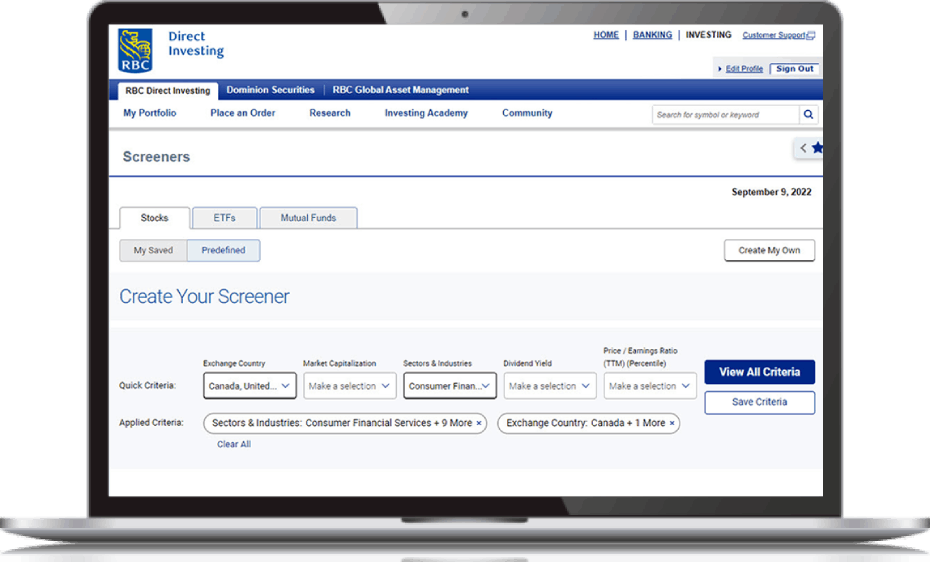

As a DIY investor, you know the importance of making the right investment picks. At RBC Direct Investing(Open in new window), you have access to stock and ETF screeners and up-to-date market research so you can make informed decisions. You can also track securities with customizable watchlists and test your ideas in a Practice Account.

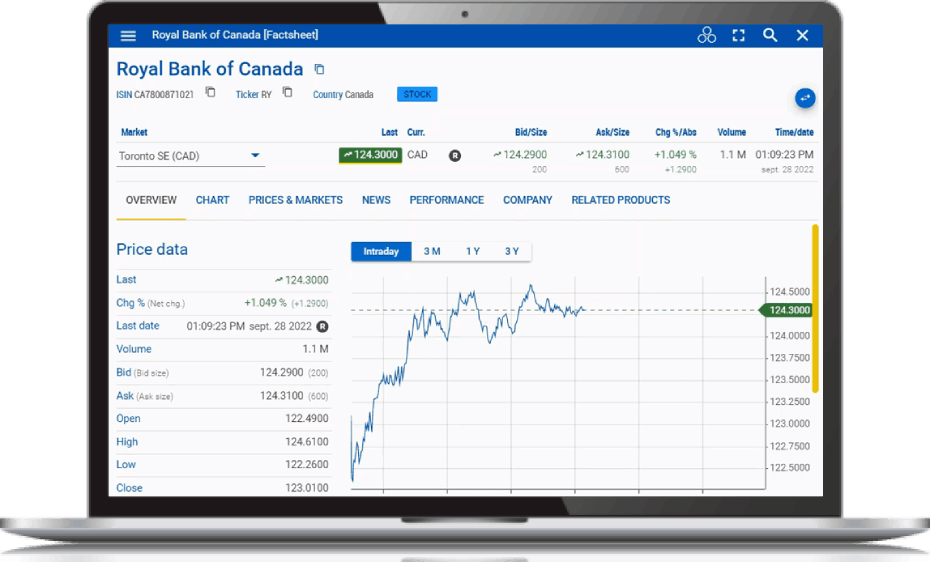

Free, real-time streaming quotes6 to make decisions in the moment

There are times when you need to make quick trading decisions to get the results you want. That’s why RBC Direct Investing(Open in new window) gives you free, real-time streaming quotes for stocks and ETFs6 plus an extra line of sight with Level 2 quotes7—so you never miss an opportunity.

Three powerful trading platforms

When you’re ready to act, you need to be able to quickly place trades and monitor your investments when and how you want. At RBC Direct Investing(Open in new window), you can confidently invest though the RBC Mobile app8, the secure online investing site and the trading dashboard. The choice is yours.

Tools for Those Who Want Advice

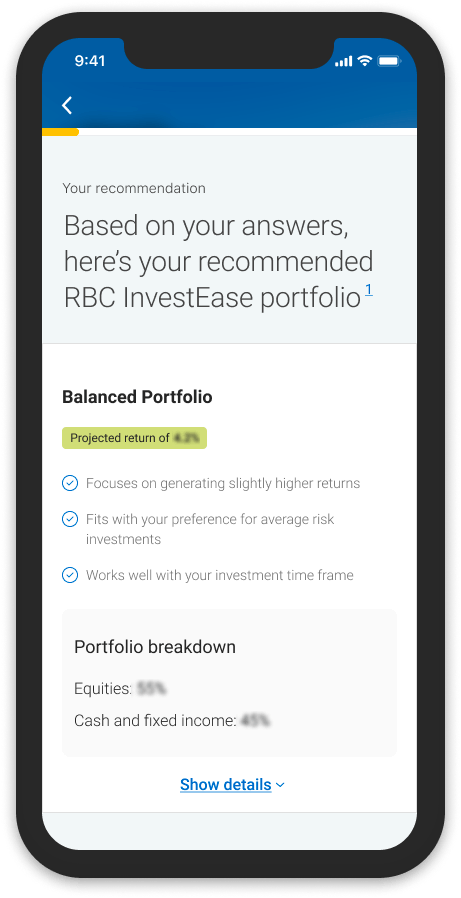

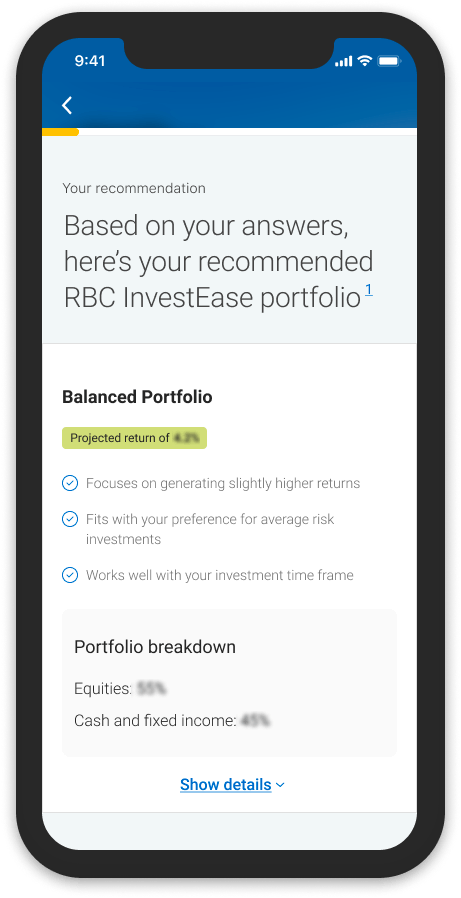

Professionally-built investment portfolios online

Answer some simple questions at RBC InvestEase(Open in new window) to get matched in minutes to a portfolio of low-cost ETFs that’s professionally built and managed for you. Track your progress, view your portfolio performance, access market commentary and even chat with a Portfolio Advisor to feel confident about your future.

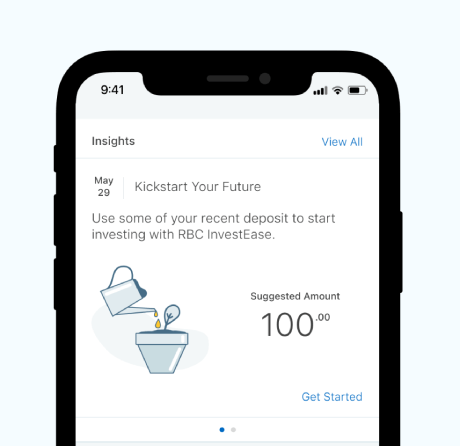

AI-driven insights to help put your money to work

Available on the RBC Mobile app, NOMI Insights for RBC InvestEase(Open in new window) lets you know when you have spare cash you might want to invest. Take action on these insights with just a few clicks and instantly get more of your money working for you.

Tools for All RBC Investors

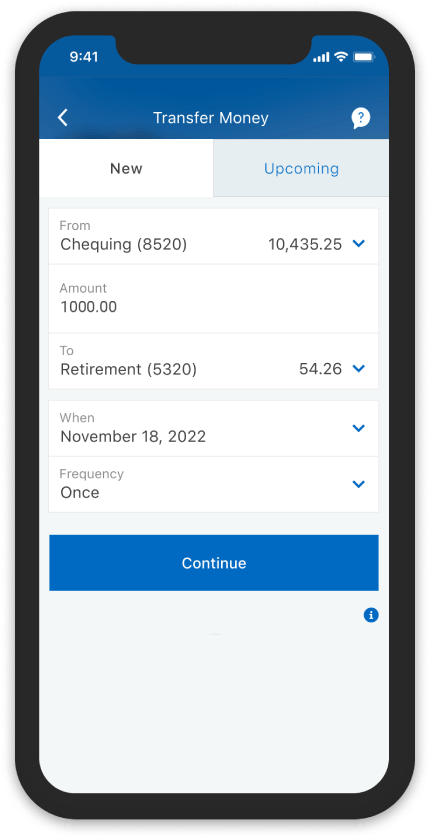

Instant transfers so you can act fast when it counts

When you want to invest, you shouldn’t have to wait on your money to play catch up. Instantly move money between your RBC banking and investing accounts. No extra steps. No limit. And no wait time.

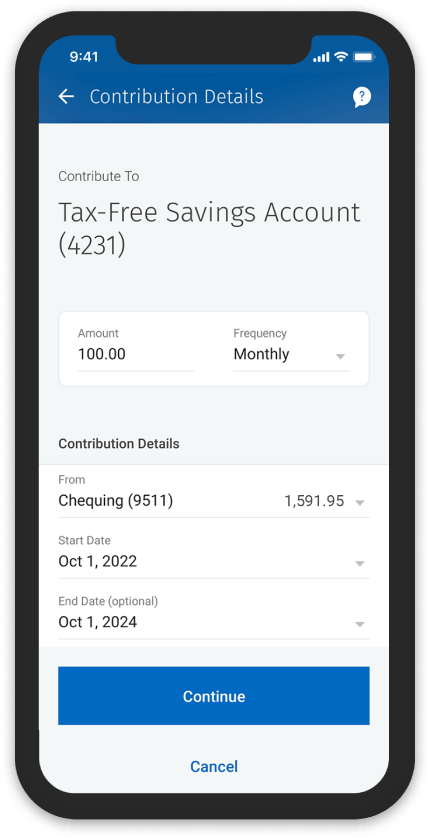

Automatic deposits to help build your wealth faster

Take advantage of market fluctuations and the power of compounding returns. With pre-authorized contributions, you don’t have to worry about timing your investments. This can reduce your cost of investing over the long term, help smooth out returns over time and position your portfolio for growth.

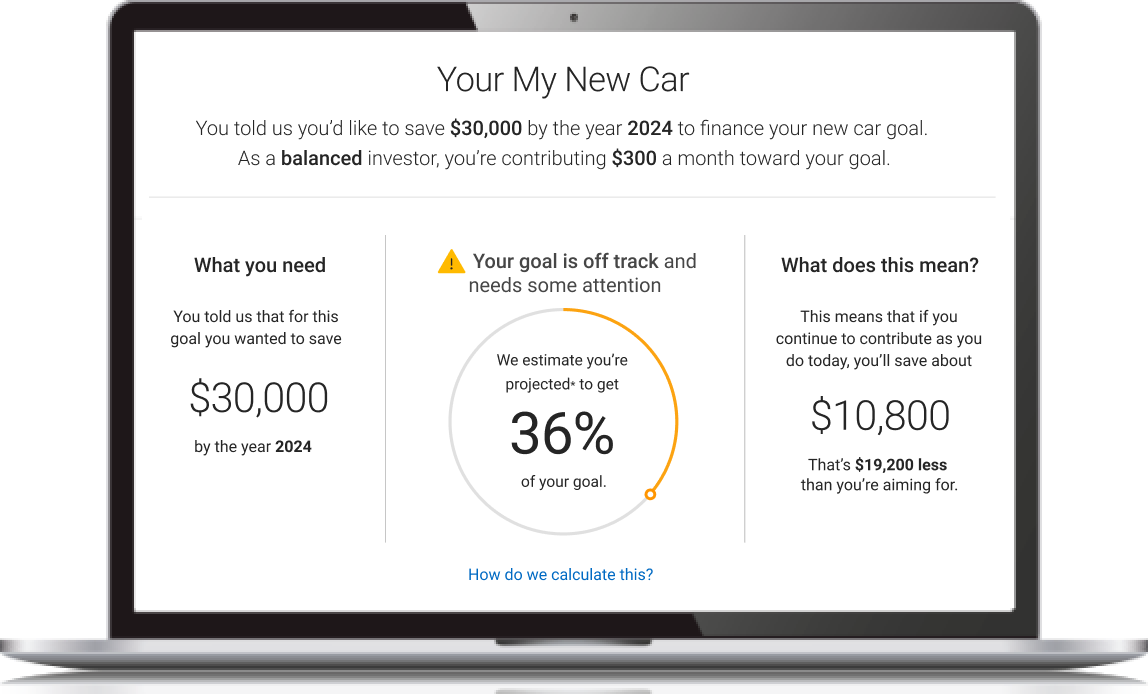

MyAdvisor—get a clear view of your money and more

Reaching your goals starts with knowing where you stand. MyAdvisor(Open in new window), a free digital advice platform exclusive to RBC clients, lets you link your banking, investment and loan accounts—even ones outside RBC—under one log-in. You can also get a personalized savings plan and forecasts to see what’s possible.

Invest without Compromise

Help build your wealth with the right combination of expertise, advice and tools.

Connect With Us

Speak with an RBC advisor to learn more about investing with us: