Protect Your Family’s Lifestyle

Your home is where your family will live and grow, today and tomorrow. By protecting your mortgage balance with insurance, it can help cover your payments in the event of a critical illness, disability or death.

The Protected Mortgage Difference

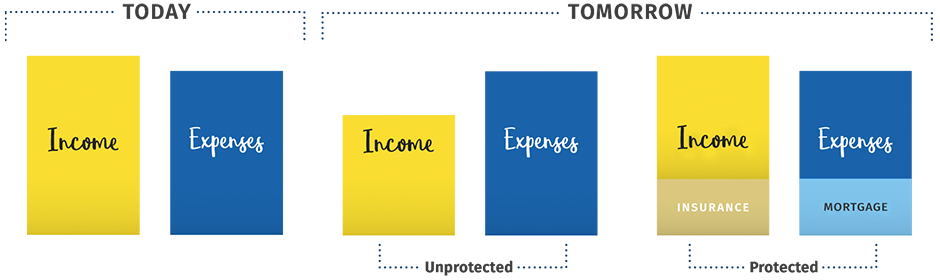

By having insurance that's dedicated to your mortgage, any additional income, such as employer's benefits, are preserved to take care of your family's other expenses.

Your mortgage fits neatly within your finances.

But what if you got sick or hurt and were suddenly unable to work?

A protected mortgage means your payments could be made for you.

Benefits at a Glance

For help protecting your family’s lifestyle, choose HomeProtector Insurance for your RBC Royal Bank mortgage.

- Customizable: Choose life insurance only — or add critical illness or disability insurance for more comprehensive protection. See how it works

- Affordable & Convenient: Premiums are locked in based on your age and mortgage balance when you apply and added to your regular mortgage payments.

- Easy to Apply: In most cases, acceptance is automatic. See eligibility requirements

- Builds on Existing Coverage: Receive benefits on top of other coverage you may have, such as through your employer.

Let Us Help You Get Started

RBC Royal Bank HomeProtector Insurance

Options at A Glance:

- Life insurance pays off or reduces your mortgage balance (up to $750,000) if you pass away.

- Life insurance also covers prepayment charges, any overdrawn property tax account balance and any “cash back option” penalty amounts you owe, if you pass away.

- Critical illness insurance pays a lump sum to your mortgage balance (up to $300,000) if you are diagnosed with a life-altering critical illness.

- Disability insurance maintains your mortgage payments (up to $3,000 per month, for up to 24 months) if you are disabled and unable to work due to an illness or an injury.

Note: Life Insurance is part of all coverage plans. You cannot be insured for both critical illness and disability insurance at the same time on the same mortgage.

Eligibility Requirements for RBC Royal Bank HomeProtector Insurance

To apply for HomeProtector life insurance, you must be:

- The individual borrower, co-borrower or guarantor of an RBC Royal Bank mortgage

- Age 18-65 on the date you apply

- A Canadian resident living in Canada at least six months of the year

To apply for HomeProtector disability insurance, you must also:

- Have HomeProtector life insurance coverage

- Be actively working on the date of your application 1

To apply for HomeProtector critical illness insurance, you must also:

- Have HomeProtector life insurance coverage

- Be under age 56 on the date you apply

Note: You cannot be insured for both critical illness and disability insurance at the same time on the same mortgage.

1) You must be actively working in full-time employment, self-employment or seasonal employment. Full-time employment

means actively working in Canada at least 20 hours a week on average (based on the 28 days immediately prior

to the application date). Actively at work does not include leaves of absence such as, but not limited to, sick

leaves.

Apply Online

Sign in to RBC Online Banking.

Review the application information.

Follow the steps outlined to apply.