Give the Gift of Knowledge with an RESP

One of the best ways to save for a child’s post-secondary education is through a Registered Education Savings Plan (RESP). Whether you want to save for your own children, your grandchildren, a niece, nephew, or family friend, an RESP offers flexibility, tax-deferred investment growth and direct government assistance to help you save for a child’s education.

- Interest income and investment growth earned within an RESP are not taxed as long as the funds remain in the plan.

- The Canada Education Savings Grant (CESG) matches 20% on the first $2,500 contributed annually to a maximum of $500 a year ($7,200 overall) for a child under the age of 18, plus possible catch-up grants.

- Some children may also be eligible for an additional amount on the CESG, based on family net income.

- Incentives are also available through the Canada Learning Bond (CLB), with an initial amount of $500 and additional annual entitlements of $100 per year, up to age 15.

Download Your FREE Guide

View our guide for information on your education savings options, including RESPs.

Key Benefits of an RBC RESP

- Tailored Advice. Your advisor will take the time to understand the goals for your child’s education and recommend the best investment strategy to meet those goals.

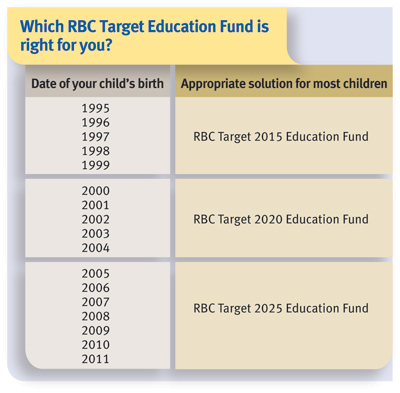

- Investment Choice. With an RBC RESP, you can invest in RBC Savings Deposits, RBC Guaranteed Investment Certificates (GICs) and RBC Funds, including RBC Target Education Funds.

- Easy to Contribute. Saving is quick and simple when you use the RBC RESP–Matic® plan to make regular, automatic contributions.

- Flexibility. An RBC RESP comes with built-in flexibility—for example, it’s easy to change beneficiaries if the original beneficiary does not pursue a post-secondary education.

- Cost Savings. There is no charge to open an RBC RESP and there are no annual administration fees.

Talk to an Advisor

Call or visit us today to open an RESP or to speak with an RBC advisor about the right investment strategy for your young scholar's future.

Please note: You will need the SIN and ID of a parent and the SIN of the child to open an RESP account.