TFSA Calculator

See How Much You Could Save in a Tax-Free Savings Account

See How Much You Could Save in a Tax-Free Savings Account

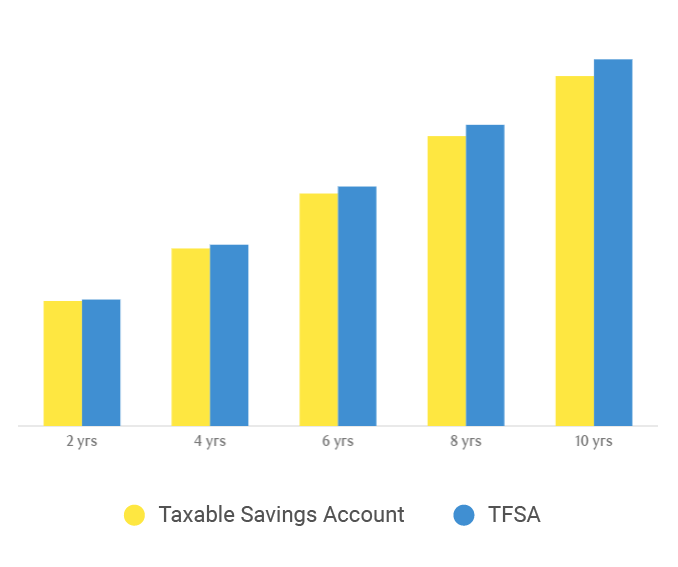

Use this calculator to understand how much more you could save in a TFSA compared to a regular savings account where earnings are taxable.

Select a province

Enter an income amount between $0 - $500,000

Enter your starting amount between

$0 -

Your TFSA lifetime contribution limit is .

Enter contribution amount greater than 0.

Your TFSA lifetime contribution limit is .

Enter interest rate between 1% to 10%

Enter value between 1 - 50

Your Results

Total saved in TFSA after 10 years

- -

That is - - more than you would have saved in a savings account where earnings are taxable

Complete the fields to see how your money can grow in a TFSA, and the tax dollars you could save.

Taxable Savings Account

TFSA

Take a look at your results

Watch your personalized video to understand how your money could grow faster in a TFSA compared to a savings account where earnings are taxable, and get insight on how to save even more.

Open your TFSA today

Start saving to meet your goals faster

Already have a TFSA?

Contribute to your TFSA to grow your money faster.

Assumptions

Taxes are based on the annual income entered with no additional deductions or earnings. This tool assumes the client was 18 years or older in 2009, otherwise the contribution limit will be lower. Annual income assumes this is your taxable income before taxes and deductions. Your annual income is used to estimate your combined federal/provincial marginal tax rate for the purpose of this calculator. Tax-free and taxable investment results are approximations and do not reflect actual returns. This tool assumes a marginal tax rate based on the annual income you provided and an average rate of all Canadian provinces. This tool uses the federal, provincial and territorial tax rates for 2021 obtained from Canada Revenue Agency's website (https://www.canada.ca/en/revenue-agency/services/tax/individuals/frequently-asked-questions-individuals/canadian-income-tax-rates-individuals-current-previous-years.html). This tool assumes a marginal federal and provincial tax rate based on the input of annual income, without consideration of surtaxes, low income tax reduction, and common non-refundable tax credits such as the basic personal amount. The starting contribution amount is assumed to be contributed in the beginning of the year. Regular periodic contributions are assumed to be made at the end of each period. This tool assumes interest from your investments are taxable at the end of the year.

Legal

These results are general estimates only and (i) are based on the accuracy and completeness of the data you have entered, (ii) are based on assumptions that are believed to be reasonable, and (iii) are for informational purposes only and should not be relied on for advice. Actual results may vary, perhaps to a large degree. You should consult your professional advisor before taking any action. Royal Bank of Canada does not make any express or implied warranties or representations with respect to any information or results in connection with this calculator tool. Royal Bank of Canada will not be liable for any losses or damages arising from any errors or omissions in any information or results, or any action or decision made by you in reliance on any information or results in connection with this calculator tool.