Invest today and take a step toward tomorrow.

Whether it’s the keys to your first home or more freedom in retirement, take the first step towards the future you want. Start investing today and get closer to your goals with the right support and a track record you can feel good about.

Invest more. Earn more.

The more you invest, the more Avion points you earn.

Earn 1 Avion point for every $2 dollars invested—up

to 500,000 Avion points!

Read More

Earn 1 point for every $2 dollars contributed—up to 500,000 points ($10,000 in value).legal disclaimer †

To get points, contribute at least C$5,000 into your first eligible RBC Royal Bank and/or RBC Direct Investing account(s). (Transfers can be from your personal RBC bank account or another ).

As an Avion Rewards member, you can redeem Avion points for:

- Flights, hotels and car rentals

- Cash contributions to your RBC Direct Investing account(s)—or to pay for trade commissionslegal disclaimer 16

- Gift cards and merchandise from thousands of brands

- And more…

Offer ends March 31, 2026. Conditions apply.

Get support tailored to you

You decide how you want to invest. Connect with an advisor for one-on-one advice or use advanced tools to trade stocks and ETFs on your own.legal disclaimer 10

RBC Royal Bank/Royal Mutual Funds Inc.

Performance matters

When it comes to achieving your short and long term goals, performance and advice matter.

Invest more. Earn more.

The more you invest, the more Avion points you earn.

Earn 1 Avion point for every $2 dollars invested—up

to 500,000 Avion points!

Read More

Earn 1 point for every $2 dollars contributed—up to 500,000 points ($10,000 in value).legal disclaimer †

To get points, contribute at least C$5,000 into your first eligible RBC Royal Bank and/or RBC Direct Investing account(s). (Transfers can be from your personal RBC bank account or another ).

As an Avion Rewards member, you can redeem Avion points for:

- Flights, hotels and car rentals

- Cash contributions to your RBC Direct Investing account(s)—or to pay for trade commissionslegal disclaimer 16

- Gift cards and merchandise from thousands of brands

- And more…

Offer ends March 31, 2026. Conditions apply.

Get support tailored to you

You decide how you want to invest. Connect with an advisor for one-on-one advice or use advanced tools to trade stocks and ETFs on your own.legal disclaimer 10

RBC Royal Bank/Royal Mutual Funds Inc.

Performance matters

When it comes to achieving your short and long term goals, performance and advice matter.

3 steps to get this offer

- Step 1 Open one or more , by March 31, 2026.

-

Step 2

Contribute or transfer-in funds in within one or more eligible accounts by May 29, 2026 and maintain until February 28, 2027.

Ways to contribute:

- Make lump sum contributions of at least $5,000, or

- Set up and process pre-authorized contributions (PACs) of $500+ per month

- Or do a combination of both

Transfers can be from your personal RBC bank account or another .

- Step 3 Be an Avion Rewards member by May 29, 2026 (if you're not already a member). It’s free and easy to join.

We’ll deposit your Avion points into your Avion Rewards account in four payments. Each payment will be made within eight weeks after: May 31, 2026; August 31, 2026; November 30, 2026; and February 28, 2027.

Earn 1 Avion point for every $2 dollars invested, plus get 12,500 bonus points — up to 500,000 Avion points!

| Qualifying Net Contributions (CAD): | Avion points you will receive: | Equivalent Value (CAD): |

|---|---|---|

| $5,000 (minimum) | 15,000 | $350 (round-trip flight for a quick getaway) |

| $45,000 | 35,000 | $750 (round-trip flight to explore North America) |

| $105,000 | 65,000 | $1,300 (round-trip flight to visit Europe) |

| $975,000 | 500,000 | $10,000 (5 round-trip flights to see the world) |

You can also redeem points for hotels, car rentals, gift cards, merchandise, cash contributions to an RBC Direct Investing account, to pay for trade commissionslegal disclaimer 16 and more!

Conditions apply. See full offer terms and conditions.

Ready to invest for your tomorrow?

Invest with advice when you need it or call your own shots—whatever’s right for you.

Get personalized advice

RBC Royal Bank/Royal Mutual Funds Inc.

Feel more confident about your investments—and your future—with personalized advice from an advisor. Meet over video chatlegal disclaimer 1, by phone or in person.

- Build a diversified portfolio to manage risk and volatility

- Choose from a wide range of GICs and mutual fundslegal disclaimer +

- Talk through financial matters that are on your mind

Trade and Invest Your Way

RBC Direct Investing

Buy and sell stocks, ETFs, mutual funds, GICs and more on a powerful platform that has the tools and research you need to feel equipped and empowered.

- Invest in select ETFs commission-free—including crypto ETFslegal disclaimer 10

- Invest in all mutual funds commission-freelegal disclaimer 11

- Pay no maintenance fees

Get up to $10,000 in value†

Open your first eligible account and invest $5,000 or more.

Offer ends March 31, 2026. Qualifying criteria and other Conditions apply*.

GoSmart accounts are not eligible for the offer.

This type of GIC is held as a non-registered account, which means any interest the GIC earns must be added to your taxable income. If you want to hold GICs in a tax-advantaged registered account (such as a TFSA) instead, please change your selection above to open your account first.

This type of mutual fund is held as a non-registered account, which means any investment income the fund earns must be added to your taxable income. If you want to hold mutual funds in a tax-advantaged registered account (such as a TFSA) instead, please change your selection above to open your account first.

RBC Royal Bank

Invest With Advice When You Need It

RBC Royal Bank

Invest With Advice When You Need It

RBC Royal Bank

Invest With Advice When You Need It

RBC Direct Investing

Trade and Invest Yourself

Feel confident with a company that Canadians have trusted for over 150 years.

Accounts & Products to Help Grow Your Money

Registered investment accounts like the TFSA, RRSP and FHSA offer tax advantages to help grow your money. You can hold a variety of investments (such as GICs and mutual funds) in both registered and non-registered accounts.

Tax-Free Savings Account (TFSA)

Registered Retirement Savings Plan (RRSP)

First Home Savings Account (FHSA)

Keep Your Savings Safe and Secure

If you’re looking for a risk-free option with a steady rate of return, consider a GIC or savings account. You can hold a GIC in your registered accounts (TFSA, RRSP, etc.) or as a non-registered investment.

Guaranteed Investment Certificates (GICs)

RBC High Interest eSavings Account

Invest for Growth, Income and More

Choose from a wide range of investment products, including:

Exchange-Traded Funds (ETFs)

With RBC Direct Investing & RBC InvestEase

Invest in a fund that holds a variety of investments and trades like a stock.Tips and Advice to Help You Reach Your Goals

Explore our “how to” guides for tips on saving for the things that matter to you.

Smart Tools to Help You Plan and Save

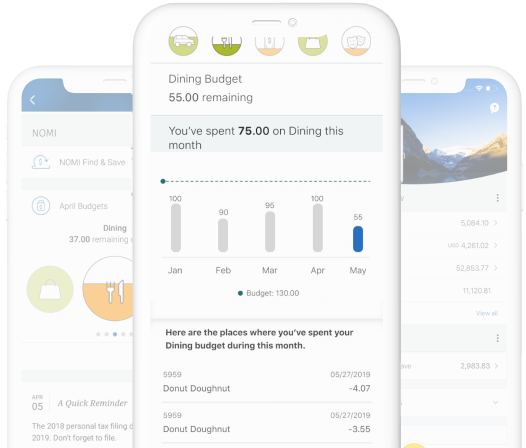

Save on AutoPilot

Put your savings on autopilot.

Grow your investments faster by setting up regular (weekly, monthly, etc.) contributions into your investment account. Simply choose how much you want to save automatically—and how often.

Save Extra Dollars

Start saving for any goal—quickly and easily!

NOMI Find & Save is a digital savings account that looks at your spending, finds extra dollars in your cash flow that it thinks you won’t miss and automatically moves them to savings. Turn on NOMI Find & Save in the RBC Mobilelegal disclaimer 7 app.

Other Ways to Invest with RBC®

Work with a Dedicated Financial Planner

RBC Financial Planning

- Develop a personalized comprehensive financial plan based on your unique goals with an accredited professional

- Get strategies on building wealth, retirement planning, estate and tax planning

Get Custom Advice from a Dedicated Wealth Advisor

RBC Wealth Management

- Customize your investment portfolio and wealth plan with a dedicated wealth advisor

- Access top-tier investment insights and award-winning research

Your Top Questions Answered

- Not currently hold one of the as of December 1, 2025 (previous eligible accounts that were closed prior to the start of the qualifying period do not impact your eligibility)

- Open one or more between December 1, 2025 and March 31, 2026

- Be a Canadian resident and at least the age of majority in your province/territory when you open your eligible account(s)

- Be an Avion Rewards member by May 29, 2026 (if you're not already a member). It’s free and easy to join.

- May 31, 2026

- August 31, 2026

- November 30, 2026

- February 28, 2027

| Qualifying Net Contributions (CAD): | Avion points you will receive: | Equivalent Value (CAD): |

|---|---|---|

| $5,000 (minimum) | 15,000 | $350 (round-trip flight for a quick getaway) |

| $45,000 | 35,000 | $750 (round-trip flight to explore North America) |

| $105,000 | 65,000 | $1,300 (round-trip flight to visit Europe) |

| $975,000 | 500,000 | $10,000 (5 round-trip flights to see the world) |

You must be a member of the Avion Rewards program (Avion Elite or Avion Premium membership level) before May 29, 2026 to receive the Avion points. It’s free and easy to join.

To learn more about Avion Rewards and the value of your points, visit the Avion Rewards site.

In general, you can:

- Make lump sum contributions that equal to at least $5,000, or

- Set up and process pre-authorized contributions (PACs) of $500+ per month, or

- Do a combination of both

For example, if you open an eligible account through RBC Royal Bank (an RBC TFSA or RRSP, for instance), you may contribute $2,500 into savings deposits and $2,500 into a 2-year term GIC, and your total of these investments would meet the qualifying criteria.

Alternatively, you can also set up pre-authorized contributions in RBC mutual funds (distributed by Royal Mutual Funds Inc.).

If you open an eligible account through RBC Direct Investing (an RBC Direct Investing TFSA or RRSP, for instance), you can make cash deposits and purchase securities listed on a U.S. or Canadian exchange, including:

- Stocks and Options

- Exchange-Traded Funds (ETFs)

- Mutual Funds

- Guaranteed Investment Certificates (GICs)

- Bonds

- And more …

- If you are already a member, you’ll be directed to your home page to see your points balance.

- If you are not already a member, your sign in attempt will activate your account.

- Become an RBC client by opening an eligible product.

- Sign in to Avion Rewards using your RBC Online Banking login to activate your membership. (You can become a Premium or Elite member depending on what account or card you have.)

There are 2 ways you can open an account:

1. Through RBC Direct Investing

- Call your own shots with our low-cost online trading and investing service

- Hold stocks, bonds, exchange-traded funds (ETFs) and more in your FHSA

- Make informed investment decisions using expert research and other resources like free real-time streaming quotes8

2. Through RBC InvestEase

- Our pros will pick, buy and manage the investments in your FHSA for you

- We match you to a low-cost, expertly constructed portfolio of exchange-traded funds (ETFs)legal disclaimer 9 based on your answers to a few simple questions

- Track your progress online anytime and speak to a Portfolio Advisor if you have questions or need advice

You can open a new TFSA:

Online (for existing RBC clients):

- Through RBC Online Banking

- Through the RBC Mobile app

Not enrolled in RBC Online Banking? Enrol Now

With help from an RBC advisor:

- Call 1-855-845-8413

- Visit a branch*

*We recommend booking an appointment ahead of time by calling us at 1-855-543-0464.

You can open an RRSP through RBC Royal Bank, RBC Direct Investing and/or RBC InvestEase:

RBC Royal Bank:

Ideal if you want to invest with access to advice when you need it:

- Meet with an advisor by phone, online (video chat), or in person for personalized advice or help getting started

- Hold GICs, mutual funds+ and savings deposits

- View and manage your investments in RBC Online Banking or the RBC Mobile app

To open an RRSP:

Existing RBC Online Banking Client:

Non-Client or Not Enrolled in RBC Online Banking:

Call 1-877-511-1016 (Toll-Free)

Visit a BranchRBC Direct Investing:

Ideal if you want to trade and invest on your own:

- Call your own shots with our low-cost online trading and investing service

- Hold stocks, bonds, exchange-traded funds (ETFs) and more in your RRSP

- Make informed investment decisions using expert research and other resources like free real-time streaming quotes

RBC InvestEase:

Ideal if you want to invest without the work:

- Get a low-cost, diversified portfolio of exchange-traded funds (ETFs) based on your answers to some simple questions online

- Relax while our dedicated team of Portfolio Advisors buy and manage the investments in your RRSP for you

- Track your progress online anytime and speak to a Portfolio Advisor if you have questions or need advice

You can buy GICs:

- Through RBC Online Banking if you have an RBC Royal Bank chequing or savings account, or an existing GIC.

- Or if you have questions, we encourage you to use our online booking tool to schedule a time to speak with us by phone.

Get up to $10,000 in value†

Open your first eligible account and invest $5,000 or more.

Offer ends March 31, 2026. Qualifying criteria and other Conditions apply*.

GoSmart accounts are not eligible for the offer.

This type of GIC is held as a non-registered account, which means any interest the GIC earns must be added to your taxable income. If you want to hold GICs in a tax-advantaged registered account (such as a TFSA) instead, please change your selection above to open your account first.

This type of mutual fund is held as a non-registered account, which means any investment income the fund earns must be added to your taxable income. If you want to hold mutual funds in a tax-advantaged registered account (such as a TFSA) instead, please change your selection above to open your account first.

RBC Royal Bank

Invest With Advice When You Need It

RBC Royal Bank

Invest With Advice When You Need It

RBC Royal Bank

Invest With Advice When You Need It

RBC Direct Investing

Trade and Invest Yourself

Feel confident with a company that Canadians have trusted for over 150 years.

GoSmart is a service offered by RBC Direct Investing Inc. RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate entities which are affiliated. RBC Direct Investing Inc. is a wholly owned subsidiary of Royal Bank of Canada and is a Member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund. Royal Bank of Canada and certain of its issuers are related to RBC Direct Investing Inc. RBC Direct Investing Inc. does not provide investment advice or recommendations regarding the purchase or sale of any securities. Investors are responsible for their own investment decisions. RBC Direct Investing is a business name used by RBC Direct Investing Inc. ® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. Used under licence. © Royal Bank of Canada 2026.

RBC InvestEase Inc. is registered as a restricted portfolio manager in all provinces and territories of Canada and provides access to model portfolios consisting of RBC iShares ETFs. Each model portfolio holds up to 100% of RBC iShares ETFs. RBC iShares ETFs are comprised of RBC ETFs managed by RBC Global Asset Management Inc. (RBC GAM) and iShares ETFs managed by BlackRock Canada Limited (BlackRock Canada). RBC GAM and BlackRock Canada entered into a strategic alliance to bring together their respective ETF products under the RBC iShares brand, and to offer a unified distribution support and service model for RBC iShares ETFs. RBC InvestEase Inc. uses the business name RBC InvestEase.

Investment advice is provided, and Mutual Funds are sold, by RMFI. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Please read the Fund Facts/prospectus before investing. Mutual fund securities are not insured by the Canada Deposit Insurance Corporation. For funds other than money market funds, unit values change frequently. For money market funds, there can be no assurances that a fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in a fund will be returned to you. Past performance may not be repeated. RMFI is licensed as a financial services firm in the province of Quebec.

Royal Bank of Canada and RMFI shall not be liable for any losses or damages arising from any errors or omissions in information contained in this calculator.

RBC Financial Planning is a business name used by Royal Mutual Funds Inc. (RMFI). Financial planning services are provided by RMFI.

All Avion Rewards members with the exception of Personal ION Accounts, Avion Rewards Core Product Accounts and Avion Select members may redeem Points for an RBC Travel Reward at the rate of 100 Points per $1.00 CAD to pay for all or part of your booking, including associated taxes and fees. A minimum of 1,000 Points must be redeemed. A service charge and other conditions may apply.

If you have a Personal ION Account or an Avion Rewards Core Product Account, you may redeem your Points for an RBC Travel Reward at the rate of 100 Points per $0.58 CAD to pay for all or part of your booking, including associated taxes and fees. A minimum of 2,500 Points must be redeemed. A service charge and other conditions may apply. Please refer to the Avion Rewards Terms and Conditions for a list of eligible products and respective travel redemption rates.

Redemption rates vary depending on redemption category. For general redemption terms, conditions and restrictions that apply to the Avion Rewards program, please visit avionrewards.com or call 1-800 ROYAL 1-2 (1-800-769-2512).

-

You must be "Eligible Client", who:

-

Is a resident of Canada and of the age of majority in the province or territory in which they reside as of the date the Eligible Investment Account is opened; and

-

Is a new investment client for:

-

Royal Bank of Canada ('RBC') or Royal Mutual Funds Inc. ('RMFI') and opens a new Eligible Investment Account with either RBC or RMFI within the Qualifying Period. A new investment client to RBC or RMFI is a person who does not hold a personal investment account with RBC or RMFI before the first day of the Qualifying Period.

AND/OR

-

RBC Direct Investing Inc. (RBC Direct Investing) and opens a new Eligible Investment Account with RBC Direct Investing within the Qualifying Period. A new investment client to RBC Direct Investing is a person who does not hold a personal investment account with RBC Direct Investing before the first day of the Qualifying Period; and

-

-

is an Avion Rewards member before May 29, 2026. For more information on eligibility visit https://www.avionrewards.com/eligibility.html

-

-

Open one or more new "Eligible Investment Account(s)" with RBC, RMFI or RBC Direct Investing between December 1, 2025, and March 31, 2026, inclusive (the "Qualifying Period"). Eligible Investment Accounts means any one of the following personal investment accounts:

For RBC & RMFI Inc. For RBC Direct Investing Inc. -

Tax Free Savings Account (TFSA)

-

Registered Retirement Savings Plan (RRSP)

-

Non-Registered Investment Account

-

Locked in Retirement Account (LIRA)

-

Life Income Fund (LIF) Account

-

Registered Education Savings Plan (RESP)

Retirement Income Fund (RIF)

-

Registered Disability Savings Plan (RDSP)

-

Tax Free Savings Account (TFSA)

-

Registered Retirement Savings Plan (RRSP)

-

First Home Savings Account (FHSA)

-

Non-Registered Investment Account/Margin Account

-

Locked in Retirement Account (LIRA)

-

Life Income Fund (LIF) Account

-

Registered Education Savings Plan (RESP)

Retirement Income Fund (RIF)

-

-

You must meet the "Qualifying Criteria":

-

You must transfer or deposit at least $5,000 in Net Qualifying Contributions (defined below) to your new Eligible Investment Account(s) considered collectively across RBC, RMFI and RBC Direct Investing though:

- One or more lump-sum contribution(s) before May 29, 2026 (inclusive) (the 'Contribution Deadline'); or

- A Pre-authorized Contribution (PAC) of at least $500 per month, with the first payment being processed before the Contribution Deadline, until February 28, 2027; or

- A combination of lump-sum contributions and PAC that amounts to at least $5,000 in Qualifying Net Contributions by February 28, 2027.

Qualifying Net Contributions means the total of all lump sum contributions collectively deposited or transferred into your Eligible Investment Account(s) by the Contribution Deadline, less any withdrawals from any Eligible Investment Account(s) on or before February 28, 2027. For PACs, the Qualifying Net Contributions will be the annualized amount of the PAC as of the Contribution Deadline. Contributions or transfers from non-RBC affiliated legal entities and RBC Personal Banking Accounts will qualify but contributions or transfers-in from other RBC-affiliated legal entities do not qualify (including but not limited to Royal Mutual Funds Inc., RBC Direct Investing Inc., RBC InvestEase Inc., RBC Dominion Securities Inc., RBC Dominion Securities Global Inc., Phillips, Hager & North Investment Services, RBC Phillips, Hager & North Investment Counsel Inc, Royal Trust Corporation of Canada and the Royal Trust Company). If your Qualifying Net Contributions fall below the minimum required under the Offer at any time on or before February 28, 2027, you will cease to qualify to receive Avion Points under the Offer.

-

For new Eligible Investment Accounts held at RBC and RMFI, your Qualifying Net Contributions may only be held in "Eligible Product(s)". Eligible Product(s) means RBC Registered Savings Deposit, RMFI distributed Mutual Funds or RBC Non-Redeemable Guaranteed Investment Certificate (GICs) with terms of 1 year or longer. Canadian and US dollar Mutual Funds and GICs that are transferred to RBC and RMFI will qualify as Qualifying Net Contributions where allowed. If you contribute to multiple Eligible Products during the Qualifying Period, all the contributions and/or transfers-in (net of withdrawals and/or transfers-out) will be added together to assess the qualification for the Offer.

-

Securities transferred in-kind to new Eligible Investment Accounts to RBC Direct Investing, will only count towards 'Qualifying Net Contributions' if the securities are listed on a US or Canadian exchange. Options and securities not listed on a Canadian or U.S marketplace will not qualify towards Qualifying Net Contributions.

-

-

Clients will receive four payments of Avion points. One Avion points payment will be made within eight weeks after May 31, 2026, August 31, 2026, November 30, 2026, and February 28, 2027, respectively, provided the Eligible Client continues to meet the Qualifying Criteria at the time of the payment.

-

This offer is only available to the primary account holder of a joint account, and is only available once per Eligible Client.

-

This Offer may be modified, restricted, withdrawn or extended at any time without notice at the sole discretion of RBC Direct Investing, RBC & RMFI and is subject to the full terms and conditions of the Offer.

i. Any GoSmart account opened as a TFSA, RRSP or FHSA with RBC Direct Investing is excluded, and does not qualify as an 'Eligible Investment Account' under the Offer.

MyAdvisor is an online platform from RBC where you can view your financial information including visual representations (charts and graphs) of your retirement readiness, net worth, cash flow, and financial goal tracking. You can also see how varying your current approach can affect your savings and goals. The MyAdvisor platform also enables you to book an appointment with an RBC advisor and to meet with your advisor using video chat or phone to open new accounts, including investment accounts, and get advice on meeting your financial goals. Investment advice provided by RMFI may be delivered through the MyAdvisor platform.

Investment Accounts Eligible for This Offer

The following RBC investment accountslegal disclaimer * are eligible for this offer:

| RBC Royal Bank/Royal Mutual Funds Inc. | RBC Direct Investing | |

|

Tax-Free Savings Account (TFSA)

Invest for any goal—tax-freelegal disclaimer 2,legal disclaimer 3. Pay no taxes on any investment earnings and withdraw your money at any time for any reasonlegal disclaimer 12. |

RBC Royal Bank/Royal Mutual Funds Inc. eligible for

TFSA

|

RBC Direct Investing eligible for TFSA

|

|

Registered Retirement Savings Plan (RRSP)

Invest for retirement and defer taxes on your investment earningslegal disclaimer 3,legal disclaimer 4. Contributionslegal disclaimer 13 are tax-deductible and could help lower your taxable income. Contribute by March 2, 2026, for 2025 deductions. |

RBC Royal Bank/Royal Mutual Funds Inc. eligible for

RRSP

|

RBC Direct Investing eligible for RRSP

|

|

First Home Savings Account (FHSA)

Invest for your first home. Contributionslegal disclaimer 3 are tax-deductible and could help lower your taxable income. |

RBC Royal Bank/Royal Mutual Funds Inc. not eligible for FHSA |

RBC Direct Investing eligible for FHSA

|

|

Registered Education Savings Plan (RESP)

Invest for a child’s post-secondary education with tax-deferred investment growth and direct government assistancelegal disclaimer 14. |

RBC Royal Bank/Royal Mutual Funds Inc. eligible for

RESP

|

RBC Direct Investing eligible for RESP

|

|

Non-Registered Investment Account

Invest in an account that lets you access your money when you need it. |

RBC Royal Bank/Royal Mutual Funds Inc. eligible for

Non-Registered Investment Account

|

RBC Direct Investing eligible for Non-Registered

Investment Account

|

|

Non-Registered Margin Account

Access additional buying power by leveraging the value of your margin-eligible securitieslegal disclaimer 15. |

RBC Royal Bank/Royal Mutual Funds Inc. not eligible for Margin Account |

RBC Direct Investing eligible for Margin Account

|

Any GoSmart account opened as a TFSA, RRSP or FHSA with RBC Direct Investing is excluded, and does not qualify as an 'Eligible Investment Account' under the Offer.

Investment Products Eligible for This Offer

The following investment products are eligible for this offer:

| RBC Royal Bank/Royal Mutual Funds Inc. |

*May be purchased through pre-authorized contributions. |

|---|---|

| RBC Direct Investing |

|

Contributions and Transfers Eligible for This Offer

Contributions or transfers from your personal RBC bank account or a non-RBC-affiliated financial institution will qualify for this offer.

Contributions or transfers from other RBC-affiliated financial institutions will not qualify for this offer. This includes, but is not limited to, Royal Mutual Funds Inc.; RBC Direct Investing Inc.; RBC InvestEase Inc.; RBC Dominion Securities Inc.; RBC Dominion Securities Global Inc.; Phillips, Hager & North Investment Funds Ltd. ; RBC Phillips, Hager & North Investment Counsel Inc.; Royal Trust Corporation of Canada; and the Royal Trust Company.

Registered Retirement Savings Plan (RRSP) lets you defer the

taxes you pay on investment income until you withdraw that money in

retirement.

Registered Retirement Savings Plan (RRSP) lets you defer the

taxes you pay on investment income until you withdraw that money in

retirement.