Saving & Planning

Saving & Planning

When it comes to saving for retirement, a Registered Retirement Savings Plan (RRSP) is a popular choice for most Canadians. A Tax-Free Savings Account (TFSA) can also be used to save for retirement, but it gives you the flexibility to save for short-term goals, too.

Here are a few ways the RRSP and TFSA stack up:

- Your savings in an RRSP grow tax-deferred while your savings in a TFSA grow tax-free.

- RRSP contributions are tax-deductible, helping you to pay less tax in your earning years. TFSA contributions are not tax-deductible.

- You have to earn an income to put money in an RRSP. With a TFSA, you can contribute even if you aren’t working and earning.

- You can’t keep saving in your RRSP after age 71—a TFSA lets you make contributions for life.

- Withdrawals from a TFSA are never taxed. Withdrawals from an RRSP are taxed the year you withdraw the money.

To compare more features and benefits, see TFSA vs RRSP vs eSavings

Avoiding emotional investing, following proven principles and adjusting your plan for the right reasons can help you reach your goals.

- Negative headlines and market volatility can make it tempting to change a well-designed investment plan. While selling off your portfolio may make you feel better, this decision could mean lost opportunity and not achieving your long-term investment goals.

- Stay on track with these five principles of successful investing:

- Invest early

- Invest regularly

- Invest enough

- Diversify

- Have a plan

- Adjust Your Plan as Needed

Your investment plan should be dynamic, not static. Here are three “levers” that can be adjusted over the years to meet your changing needs.

- - Lever 1: How Much You Invest

Concerned about not having enough money to meet your goals? Consider adjusting how much you contribute on a regular basis. Even a small increase can have a significant impact long-term. - - Lever 2: How Long You Invest

You can extend or shorten your investing time horizon based on your needs. For example, postpone retirement or re-enter the workforce if you want more time to build your wealth. - Lever 3: How Much Risk You Have

This lever should be shifted carefully as your risk profile is core to your investment plan. The best way to do this is to review your portfolio regularly with your RBC Financial Planner.

- - Lever 1: How Much You Invest

The opportunity to reach your retirement goal faster! With a regular, pre-authorized contribution plan, you can save automatically without even thinking about it.

- You don’t need much to get started (as little as $25 per week)

- Set one up for your Registered Retirement Savings Plan (RRSP), Tax-Free Savings Account (TFSA) or other registered account

- Contribute weekly, bi-weekly, monthly—you choose

- Contributions are automatically debited from your RBC chequing or savings account

- Invest in mutual funds, GICs and saving deposits

Try the RRSP calculator now to see how putting money regularly in an RRSP can grow your retirement savings.

Ready to invest? Get started now.

Your retirement will be as unique as you are. Travel, sports, hobbies … no one will combine these and other activities the same way you will. Your retirement plan should be just as unique.

After all, no one has the exact same retirement benefit plans, tax considerations and priorities as you. That’s why you need a personalized approach to provide steady income when your regular paycheque stops.

Working with an RBC Financial Planner is one of the easiest ways to get started with your retirement plan. In addition, you can use resources like the ones below to help guide your conversation:

First of all, know that you’re not alone. Many people approaching retirement do not feel prepared or know how much money they need to retire comfortably. Even if you've been saving for years, it's only natural to wonder if you’ll have enough to enjoy the retirement you want.

A great resource that can help you is MyAdvisor at RBC. MyAdvisor is a secure, one-of-a-kind online service that combines interactive planning tools and advice from a live advisor to help you be better prepared for retirement. It’s exclusive to RBC, easy to use and available to you at no extra cost!

Read more about MyAdvisor.

MyAdvisor is a secure, one-of-a-kind online service that combines interactive planning tools and advice from a live advisor to help you be better prepared for retirement. It’s exclusive to RBC clients, easy to use and available to you at no extra cost.

- See what you have with more certainty. MyAdvisor show’s you how you’re doing with powerful visuals and forecasts of your goals, net worth and cash flow.

- Link outside accounts for a complete picture. Have savings and investments outside of RBC? MyAdvisor lets you quickly link them for an up-to-date look at your money.

- Receive personalized advice. Meet with a live advisor through video chat, by phone or in person to review your retirement plan, talk strategy or to simply ask a question.

- Make changes to your retirement savings plan at any time. Want to see a recommendation from your advisor or make a change to your plan? Simply log in to your MyAdvisor dashboard.

- Stay on track toward your goal with email alerts. Progress alerts let you know whether you need to adjust the amount you are saving in order to reach your retirement goal.

- Get started in a few simple, hassle-free steps. In minutes, you’ll have an idea of where you stand, see recommendations to help you grow your savings, and be able to book a one-on-one with an advisor.

Read more about MyAdvisor.

Most retirement publications tend to assume a reader is part of a couple—or plans to get married one day. If you’re a single woman planning for retirement, the right advice can be harder to find. Here’s an overview of some challenges you are likely to face and how you can overcome them:

- Saving enough money for retirement: Since you don’t have the economic benefit of a second person’s income to help fund your retirement savings, it’s especially important that you are saving every dollar you can and taking advantage of tax-smart plans and strategies. A great resource is an RBC Financial Planner, who can show you how to make the most of your savings and investments.

- Plan ahead for the long-term: According to Statistics Canada, in 2017, the life expectancy for Canadians was projected to be 79 years for men and 83 years for women. Because women tend to live longer, you may want to plan for extra years in retirement and take steps now to make sure your retirement income will last as long as you need it to. An RBC Financial Planner can help you create a comprehensive financial plan that addresses longevity and other key risks in retirement.

Planning for your future healthcare: As a single person, it’s very important to plan now for future healthcare needs in retirement, including a long-term care type of situation. Setting up critical illness and/or disability insurance (if you are still working) will help protect you financially in the event of a serious illness or injury. Long-term care insurance can also help protect you if you require in-home care down the road or need to move into a retirement residence or nursing home. An RBC Insurance Advisor can help answer your insurance questions. See Planning for Health Changes in Retirement.

Your housing options for retirement: Do you want to live on your own or perhaps become a snowbird when you retire? Make sure your retirement savings will support that lifestyle. Or, will you need to consider co-housing or shared living arrangements if you’re concerned about having enough money? An RBC Financial Planner can help you estimate the budget you’ll need to enjoy the lifestyle you want and suggest adjustments to your retirement plan as needed.

A Tax-Free Savings Account (TFSA) is a great way to invest for tax-free income when you're no longer able to save in a Registered Retirement Savings Plan (RRSP).

- You don't need to earn any income to contribute and you don't have to stop adding to it at a certain age.

- Unlike RRIF withdrawals, TFSA withdrawals are tax-free. If you have non-registered accounts, you may be able to move some of these funds into a TFSA and reduce your taxable income (however, there may be tax consequences – for more information about those, you can speak with a qualified tax advisor).

- Income you earn in your TFSA and withdrawals from it do not affect your eligibility for government benefits, including Old Age Security and the Guaranteed Income Supplement, or tax credits such as the Age Credit.

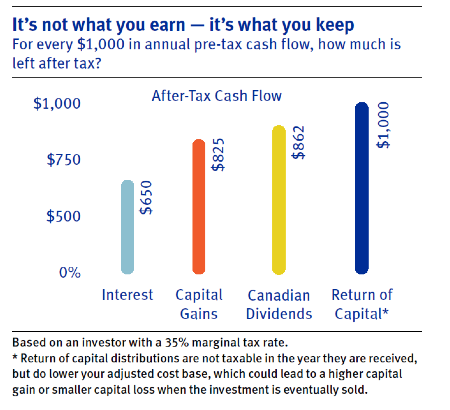

Taxes are an important part of income planning in retirement. That’s because you may be getting more of your income from personal savings and distributions from your investments, which can be taxed at different rates. This can have a big impact on the after-tax dollars that you have to spend in retirement.

The chart below shows the after-tax cash flow from different kinds of distributions.

With careful planning, you may be able to reduce or delay paying tax on income from your personal savings. Ask an RBC Financial Planner to create a retirement income plan that gives you the income you need in the most tax-efficient way possible.

Retirement Income

When you retire, your income could come from at least four different sources:

- Government benefits such as Old Age Security (OAS) and the Canada Pension Plan (CPP)/Quebec Pension Plan (QPP)

- Registered Retirement Savings Plans (RRSPs)/Registered Retirement Income Funds (RRIFs)

- Work pension plan(s)

- Other personal savings and investments you may have

For advice on making the most of your income in retirtement, check out the following resources:

Timing your Registered Retirement Income Fund (RRIF) conversion is very important as this decision can impact the amount of taxes you pay and your government benefits.

You must convert your Registered Retirement Savings Plan (RRSP) to a RRIF or an annuity—or cash it out (not typically recommended)—by December 31 of the year you turn 71. You can also make the switch before then if you need the income.

Since RRIF payments are considered taxable income in the year you take the money out, these amounts are added to your “other income” for tax purposes. Once you convert to a RRIF, you have to withdraw a minimum amount each year and that money will be taxed. Your withdrawals can also reduce certain government benefits such as Old Age Security (OAS).

For help knowing when to convert your RRSP, talk to an RBC Financial Planner. He or she can help you understand your options and suggest strategies to help you make the most of your income.

You must convert your Registered Retirement Savings Plan (RRSP) to an income option, such as a Registered Retirement Income Fund (RRIF) or annuity, by December 31 of the year in which you turn 71.

Here are some of the most important differences to be aware of:

| RRIFs |

A RRIF is like an extension of your RRSP and is used to withdraw income during your retirement.

|

| Annuities |

An annuity is a financial contract between you and an insurance company. You deposit a lump sum with the insurer and, in return, receive guaranteed payments of a pre-determined amount. When purchasing an annuity, you effectively transfer all of the risk of investing to the expertise of the insurer.

|

Need some help deciding what’s right for you with regards to your RRIF? Talk to an RBC Financial Planner.

Canada Pension Plan (CPP) or Quebec Pension Plan (QPP) benefits are designed to start when you're 65, but you can also take payments early or late (up to age 70), depending on your lifestyle and income needs in retirement. See this article for some key considerations on timing your payments: How Do I Know When to Take My CPP/QPP?

The amount of Old Age Security (OAS) you receive is based on how long you have lived in Canada after age 18 and may be partially or fully clawed back if you earn above a certain amount. If you are still employed or expecting significant income from other sources at this point in your life, you may want to postpone taking your OAS.

To make the most of all your sources of retirement income, talk to an RBC Financial Planner today.

Tax-Free Savings Account (TFSA) withdrawals are not included as income for tax purposes, which means they will not affect your eligibility for Federal income-tested government benefits and credits, such as Old Age Security.

Registered Retirement Income Fund (RRIF) withdrawals are considered taxable income in the year you take out the money, so they can impact your eligibility for Federal income-tested government benefits. To help avoid a reduction (called a clawback) of your benefits, it’s important to plan the timing and amount you need to withdraw.

An RBC Financial Planner is a great resource to help you plan your income and withdrawals in retirement.

Make the most of your work pension plan by understanding your plan and its benefits. Here are some questions you may want to ask your plan administrator or human resources department:

- Do I have a Defined Benefit (DB) or a Defined Contribution (DC) plan?

- Based on when I want to retire, how much pension income can I expect?

- Can I buy more pension credits now to increase my income during retirement?

- Is my pension indexed to keep up with the cost of living?

- What happens to my pension when I die?

- Are there survivor benefits? Are these survivor benefits reduced in any way?

- Will my pension income affect my government benefits?

For more information on pension plans, see:

Where Will My Retirement Income Come From?What Are My Pension Options When I Leave Work?

Health & Lifestyle

Retirement means different things to different people—and that could include you and your spouse. Rather than waiting until retirement is right around the corner, talk to your spouse about what he or she wants out of retirement now.

Our interactive Your Future by Design® tool can help you get started.

Your Future by Design is a discovery process that you can walk through online and with an RBC Financial Planner. By asking the right questions, we can help you and your spouse identify what will be most important to you in retirement. Try it out now!

For many Canadians, health—and the cost of health care—becomes a prominent concern at some point in retirement. Many expenses may not be fully covered by provincial health insurance, resulting in additional out-of-pocket expenses you hadn’t planned on. To prepare for potential future health costs, it’s a good idea to ensure a portion of your investments are liquid and can be easily converted to income when and if you need additional funds. You can also set up an emergency savings account that offers easy access to cash.

Creating a plan that looks after your interests if you were to become physically or mentally incapacitated is also important, which includes deciding who will manage your affairs if you cannot (such as a Power of Attorney or Mandate in Quebec).

Also looking at lifestyle decisions, such as knowing whether to down-size your home, can help you be better prepared.

Retirement is a time of change. Working with an RBC Financial Planner can help you live your best retirement while preparing for potential health changes down the road.

For more on this topic, see Planning for Health Changes in Retirement.

Knowing whether to down-size or sell your home is not always an easy decision. Before you decide, make sure you have a good reason and really think through the impact to your lifestyle, what you want out of retirement, and all the potential costs of selling and moving.

For more on this important topic, check out our Downsizing Case Study and Things to Think About Before Selling Your Home.

Moving to the U.S. for part of the year is more complicated than packing your summer clothes and getting on a plane. There are important considerations to becoming a snowbird, including what items to bring, how long you are allowed to stay before you need to start paying U.S. taxes and the potential for losing your provincial health insurance coverage.

To see what you need to know, check out our Five Tips for Soon-To-Be Snowbirds.

Thanks to better lifestyles and health care, people are living longer than ever. Today, a healthy 65-year-old has a good chance of living to 81. For a healthy couple, both age 65, there’s a strong possibility that at least one spouse will live past 90.

Of course, it’s impossible to know exactly how long any one person will live in retirement. But it’s certainly wise to plan for a long retirement. In most cases, you should plan for 30 years or more to cover a wide range of possibilities.

To help make sure your income will last as long as you need it to, contact an RBC Financial Planner today.

Estate Planning

Not at all! However, it is a common misconception that only the wealthy need estate planning. Without estate planning, there can be significant unnecessary costs to your estate and additional burdens for family members after you die. Just about everyone can benefit from creating an estate plan. Young or old, wealthy or middle class, an estate plan can reduce the taxes and expenses of your estate, simplify and speed up the passing of assets to your beneficiaries and make sure that your beneficiaries are protected.

For more information, see What is Estate Planning and Why Does It Matter?

If you're like many people, you may think that if you were to become mentally or physically incapacitated, your spouse or partner could simply act on your behalf. But this is not the case. Without a court order or a Power of Attorney, your family members could not manage your financial affairs.

A Power of Attorney (Mandate in Quebec) gives someone you trust the power to make decisions for you.

You can set up a Power of Attorney for financial decisions, as well as a Power of Attorney for health care (or Advance Health Care Directive), which gives the power to make decisions about your personal care or health care. It also allows you to list which medical measures you are okay with. Even in areas where a living Will cannot be enforced, a Power of Attorney is an effective way to make your wishes known.

To learn more about Power of Attorney and estate planning, see What is Estate Planning and Why Does It Matter?

An executor (liquidator in Quebec) is a person or trust company (such as RBC Estate and Trust Services) that administers and distributes your assets after your death. You can ask anyone you trust (a friend or family member, for example) to be your executor; however, they are not obligated to take on the role.

Here are some things to keep in mind when choosing one:

- An executor has many responsibilities, including making funeral arrangements, determining the value of your estate assets and liabilities, probating your Will if necessary, preparing and filing tax returns, paying your debts and ultimately distributing your assets.

- While it’s an honour to be an executor, many people find the duties demanding—particularly while they are grieving the loss of a loved one. Many also lack the time or ability to take on the tasks, especially if they live in another city, province or country.

- It is generally recommended that you name an executor who is one generation younger than you to ensure that they will be able to act on your behalf.

- Consider appointing an alternate executor should your executor be unwilling or unable to act.

- You may appoint more than one person to act as your executor. In general, executors must act jointly.

- Consider where your executor lives. If he or she lives in another province/territory or country, there may be negative tax consequences and it could be difficult for him or her to administer your estate.

For more information on estate planning and executors, see What is Estate Planning and Why Does It Matter?