Benefits of an RESP

Open an RESP for no charge and pay no annual administration fees at RBC Royal Bank.

-

Tax Sheltered Growth

Earnings within an RESP are not taxed. When the funds are taken out for education, withdrawals are taxed in the student’s hands, often resulting in little or no tax.

-

Get Government Contributions

Grow your savings faster with the Canada Education Savings Grant (CESG)1, Canada Learning Bond (CLB)2, and other government incentives. See RESP Grants and Bonds.

-

Built-In Flexibility

If the child doesn’t pursue post-secondary education, you may be able to choose a new beneficiary. Or, if he or she wants to travel first, you have 35 years to use the funds.

How to Grow Your RESP Savings Faster

Invest Regularly

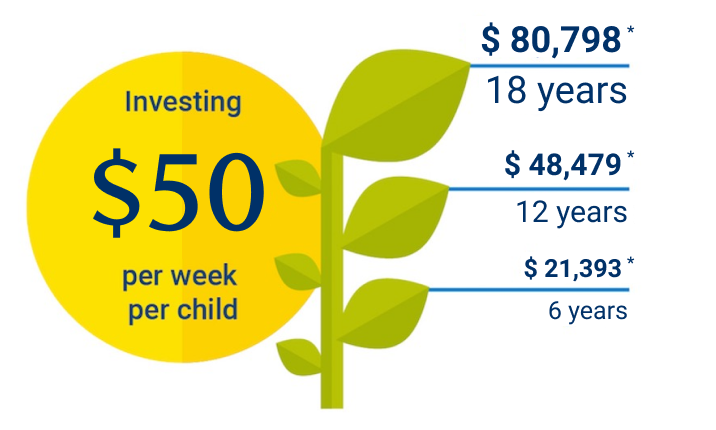

See how contributing $50 per week in an RESP adds up quickly when supplemented by the federal and provincial incentives.

Automate Your Savings

With a regular, pre-authorized contribution plan you save without even thinking about it!

- Start with as little as $50 per week

- Contribute weekly, bi-weekly, monthly—you choose

- Set it and forget it—contributions are automatically debited from your bank account (change, pause or stop at any time)

Make the Most of Your RESP Options

"Did you know, there's more than one kind of RESP?”

- Justin, RBC Branch ManagerFees, Contribution Rules, & More

Looking for more? Download Your Guide to Saving for a Child's Post-Secondary Education

RESP FAQs

Explore top RESP questions.

There is a service fee of $150.00 for the transfer of property from an RESP to a company that is not a subsidiary of Royal Bank of Canada. This fee is subject to change. In the event this fee changes or new fees are introduced, RBC will notify clients by mail or electronically at least 30 days before the effective date of the change.

There is no charge to open an RESP with RBC Royal Bank.

You can contribute any amount to an RESP, subject to a lifetime limit of $50,000 per beneficiary. You can contribute to an RESP for up to 31 years, and the plan can remain open for a maximum of 35 years.

Yes! An RBC RESP Gift Cheque can be used to invest in a child’s future. RESP Gift Cheques can be deposited into new or existing RBC RESP accounts.

Once an RESP beneficiary is enrolled in a qualifying post-secondary education or training program, the accumulated income, grants and bonds within the RESP can be paid out to the student as an Educational Assistance Payment (EAP) at the discretion of the subscriber (person who opened the RESP).

An RESP beneficiary must claim all Educational Assistance Payments (EAPs)—as income on his or her tax return in the year that they are received. Usually, this results in little or no tax since students tend to be in the lowest tax bracket and can claim tax credits for the personal amount and education-related expenses. Contributions can be withdrawn tax-free.

An RBC RESP can hold a variety of investments, including Guaranteed Investment Certificates (GICs), mutual funds, portfolio solutions and savings deposits. You can also hold stocks and bonds through RBC Direct Investing™ and RBC Dominion Securities

You can contribute to an existing RESP online through RBC Online Banking or the RBC Mobile app(opens new window) if you have an RBC Royal Bank chequing or savings account:

- Sign in to Online Banking(opens new window): Choose your RESP from the Accounts Summary page, click "Contributions" from the left menu, and follow the on-screen instructions.

- Sign in to the RBC Mobile app(opens new window): Tap ‘Move Money’, select ‘Transfer Between my Accounts’, select your eligible RBC Royal Bank RESP investment and follow the on-screen instructions.

Ready to Invest?

Open or contribute to an RESP today!

View Legal DisclaimersHide Legal Disclaimers

Please consult your advisor and read the Fund Facts if you are considering purchasing mutual funds before investing. There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Mutual fund securities are not guaranteed or covered by the Canada Deposit Insurance Corporation or by another government deposit insurer. For funds other than money market funds, unit values change frequently. For money market funds, there can be no assurances that a fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in a fund will be returned to you. Past performance may not be repeated. Royal Mutual Funds Inc. is licensed as a financial services firm in the province of Quebec.

Financial planning services and investment advice are provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.