See What’s Possible with MyAdvisor

Looking for an easier way to manage your money and save for the future? Try MyAdvisor, a free digital advice platform that’s available exclusively to RBC clients'. You’ll get a personalized savings plan, helpful tips, real-time visuals and forecasts to help you stay on top of your money and reach your goals.

3 Ways MyAdvisor Can Help You

Get a clear view of your money and know where you stand

Being able to achieve your financial goals, first starts with knowing where you are today.

- View all your money in one spot and get a more complete picture of your finances by linking your banking, savings, investment and loan accounts—even ones outside RBC with one log-in. Linking is easy and no money is transferred.

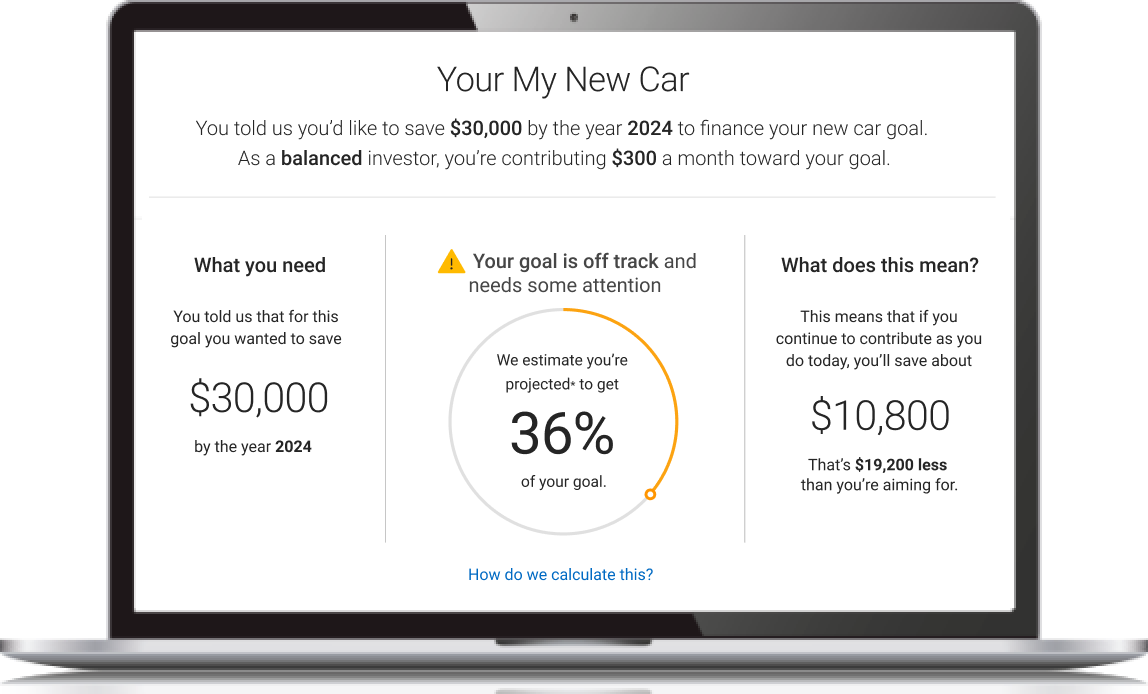

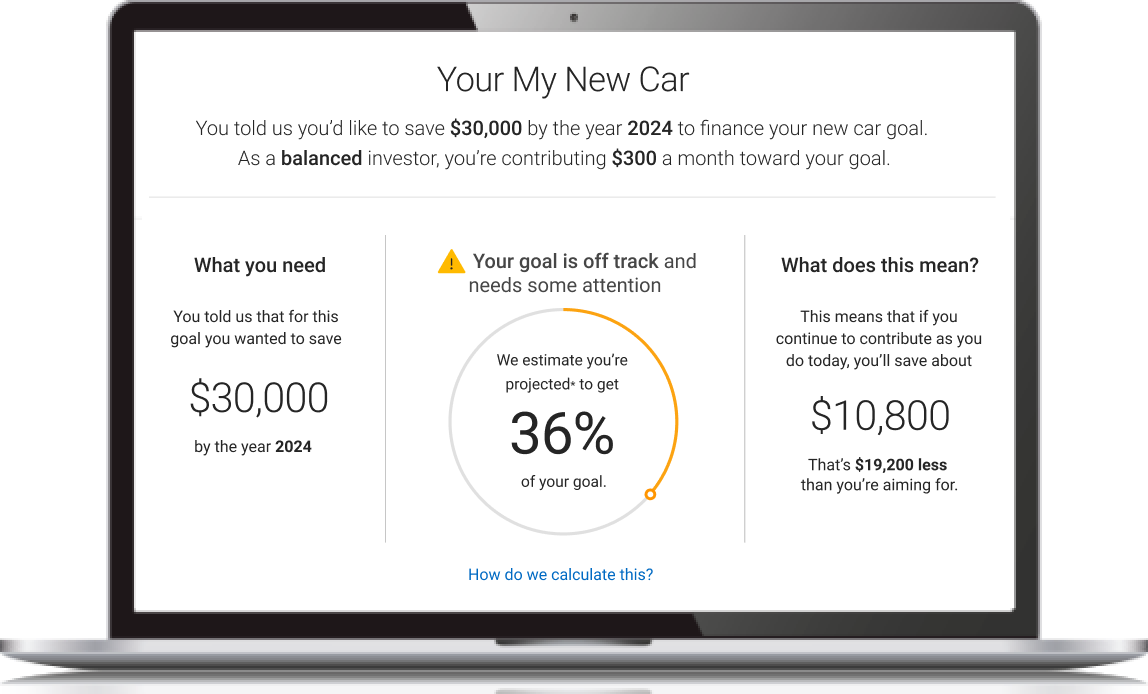

- Get real-time visuals of your progress to help you stay on track towards your goals.

See how the money decisions you make today may affect you down the line

Together, we can explore what’s possible for you and your money – you’ve got questions and we’ve got answers.

- Tell us what you’re saving for and MyAdvisor will create a personalized plan with insights and tips on how to improve cash flow and savings across all your accounts.

- Try out different scenarios to see how extra cash or a new expense could impact your finances.

- Grow your savings faster by setting up pre-authorized contributions. Life changes—and your savings plan can, too.

Access your personalized plan from the comfort of your own home

In an ever changing world, we know that it’s important for you to have the ability to take control, when you need it.

- Through digital access, you can adjust your plan, review your goals and monitor your progress any time.

- Advisors are here to help if you need it. Connect by video chat, phone or in person. Ask any questions you might have—no financial question is off limits.

Get a clear view of your money and know where you stand

Being able to achieve your financial goals, first starts with knowing where you are today.

- View all your money in one spot and get a more complete picture of your finances by linking your banking, savings, investment and loan accounts—even ones outside RBC with one log-in. Linking is easy and no money is transferred.

- Get real-time visuals of your progress to help you stay on track towards your goals.

See how the money decisions you make today may affect you down the line

Together, we can explore what’s possible for you and your money – you’ve got questions and we’ve got answers.

- Tell us what you’re saving for and MyAdvisor will create a personalized plan with insights and tips on how to improve cash flow and savings across all your accounts.

- Try out different scenarios to see how extra cash or a new expense could impact your finances.

- Grow your savings faster by setting up pre-authorized contributions. Life changes—and your savings plan can, too.

Access your personalized plan from the comfort of your own home

In an ever changing world, we know that it’s important for you to have the ability to take control, when you need it.

- Through digital access, you can adjust your plan, review your goals and monitor your progress any time.

- Advisors are here to help if you need it. Connect by video chat, phone or in person. Ask any questions you might have—no financial question is off limits.

Discover What MyAdvisor Can Do for You

Get a personalized plan from MyAdvisor in just a few minutes. We will guide you through a series of simple questions. Here’s how to get started:

Sign in to RBC Online Banking.

Not yet enrolled? Enroll now.

Choose the goal(s) you want to save for and link your RBC accounts and you could also link accounts outside RBC so you can get a more complete view of your money in MyAdvisor.

Tell us a few details about your income and expenses.

Answer a few questions about your investing knowledge and risk tolerance.

That’s all you need to do to access the MyAdvisor dashboard where you can see your goal(s), net worth, cash flow and recommendations!

Get Started Today

Sign in to RBC Online Banking and click "MyAdvisor: your custom financial picture" on your Investments Accounts Summary and we’ll help guide you through your first goal in a few minutes.

Try MyAdvisorFAQs

Yes, MyAdvisor is available exclusively to RBC clients. You will need to have an RBC product—such as a chequing or savings account, an investment, etc. to activate your personalized plan.

If you are not an RBC client but want to use MyAdvisor, we can help you get started. The first step is to book an appointment at a branch near you or call us at 1-800-463-3863 to help find the services that are right for you.

Not at all! MyAdvisor is designed to make the process of monitoring and reaching your goals very simple. You just need to share some information about yourself, your finances and your goals.

We will help you understand the numbers—how much money you have and what you need to be saving—to help you reach your goals.

Get a personalized plan with MyAdvisor—it only takes a few minutes! We will guide you through a series of simple questions. Here’s an overview:

- Sign in to RBC Online Banking.

Not yet enrolled? Enrol Now. - Choose the goal(s) you want to save for and the RBC accounts you want to see in MyAdvisor so we can give you a more accurate view of your money

- Tell us a few details about your income and expenses

- Answer a few questions about your investing thoughts and preferences

And you’re done! You now have access to the MyAdvisor dashboard where you can adjust your plan, review your goals and monitor your progress any time.

Absolutely! Getting started is easy, but if you prefer having an Advisor walk you through the steps, you can book an appointment at a branch near you or you get started over the phone by calling 1-800-463-3863.

There is no additional cost to use MyAdvisor. Some investments you hold may have certain fees and expenses (such as mutual funds), but there is no extra fee to use MyAdvisor.

Your RBC accounts will automatically connect to MyAdvisor and adding accounts outside RBC is a snap. You can add chequing and savings accounts, registered plans (such as RRSPs and TFSAs), non-registered investments, mortgage balances, loans and other accounts outside RBC.

Just link your non-RBC accounts (linking is easy and no transactions are initiated) or manually add account information to get a more complete view of your money.

Think of MyAdvisor as another member of your financial team. You will have easy access to MyAdvisor to track and forecast your progress. You can also connect and work with an advisor for guidance and recommendations whenever you need to at no additional cost.

View Legal DisclaimersHide Legal Disclaimers

Financial planning services and investment advice are provided by Royal Mutual Funds Inc. (RMFI). Investment advice provided by RMFI may be delivered through the MyAdvisor platform. RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.