RBC Chequing Account Offer

Open an Eligible RBC Chequing Account

and Get the New Apple Watchlegal bug 1

Plus, get Apple Music and Apple Fitness+ at no cost for 3 months with your new Apple Watch*,legal bug 2

Offer Ends June 1, 2026. Qualifying Criteria and other Conditions Apply.

Offer Ends June 1, 2026. Qualifying Criteria and other Conditions Apply.

* New subscribers only. After 3 months, subscription automatically renews until cancelled.

Two Great Chequing Accounts to Choose from

Enjoy a range of features and benefits, plus take advantage of our new bank account offer.

How to get your

new Apple Watch

Open an eligible RBC bank accountlegal bug 1 by June 1, 2026

Set up and complete two of the following by August 10, 2026:

- Your payroll or pension as a direct deposit

- Two pre-authorized monthly payments

- Two eligible bill payments to a service provider

Other terms and conditions apply.

RBC was awarded Best Bank in Canada and North America for 2025 by Global Finance.

RBC Digital Banking Security Guarantee

Trust your money is safe.

Your account is CDIC-insured for up to $100,000 and protected against unauthorized transactions with our Security Guarantee.13

RBC Right Account Guarantee

We will refund up to 3 months of account fees if you are not satisfied with your new account.12

RBC Digital Banking Security Guarantee

Trust your money is safe.

Your account is CDIC-insured for up to $100,000 and protected against unauthorized transactions with our Security Guarantee.13

RBC Right Account Guarantee

We will refund up to 3 months of account fees if you are not satisfied with your new account.12

Plus get Apple Music and Apple Fitness+ at no cost for 3 months with your new Apple Watchlegal bug *,legal bug 2

Enjoy over 100M songs and thousands of workouts

How Do I Redeem This?

To redeem the offer for Apple Watch, connect or pair your eligible device to an iPhone running the latest version of iOS.

After setting up or pairing your new Apple Watch, open the Apple Music and/or Apple Fitness app on an iPhone.

The offer should be presented immediately after launching the app. If not, go to the Home tab where it will appear.

Tap "Accept Now.”

Unlock More From Your Everyday Banking

With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account.

legal disclaimer 14

Only at RBC.

Avion Rewards

Your RBC Bank Account unlocks offers for cash back, savings and Avion points from over 2000 brands.

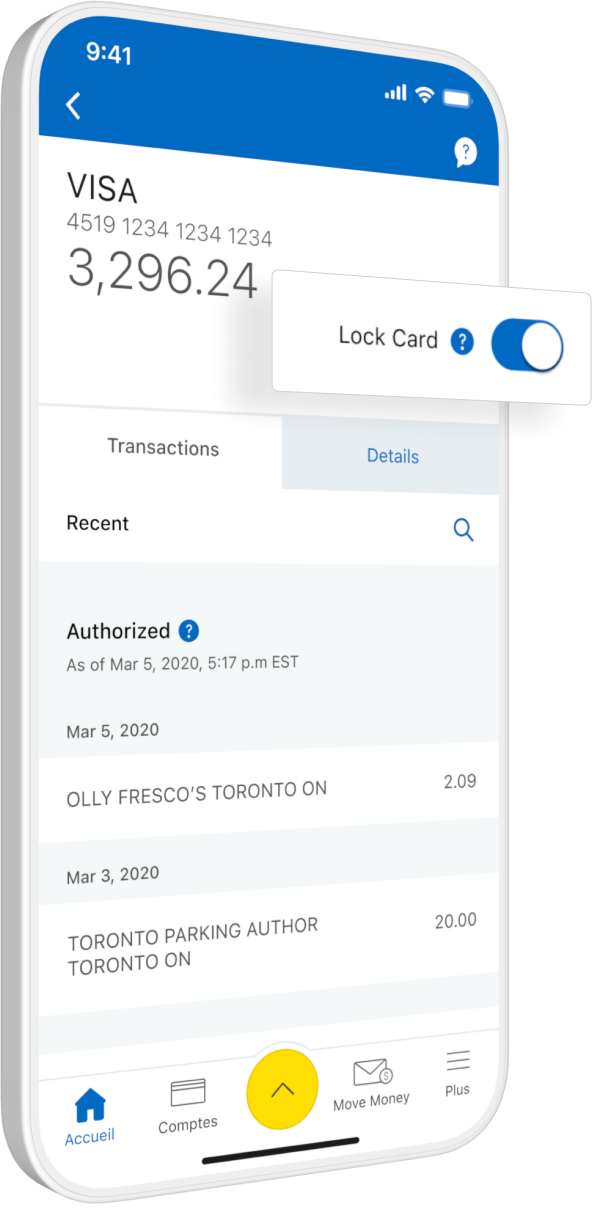

Card Lock

Easily lock a misplaced debit or credit card in the RBC Mobile legal disclaimer 16 app. Unlock it just as fast.

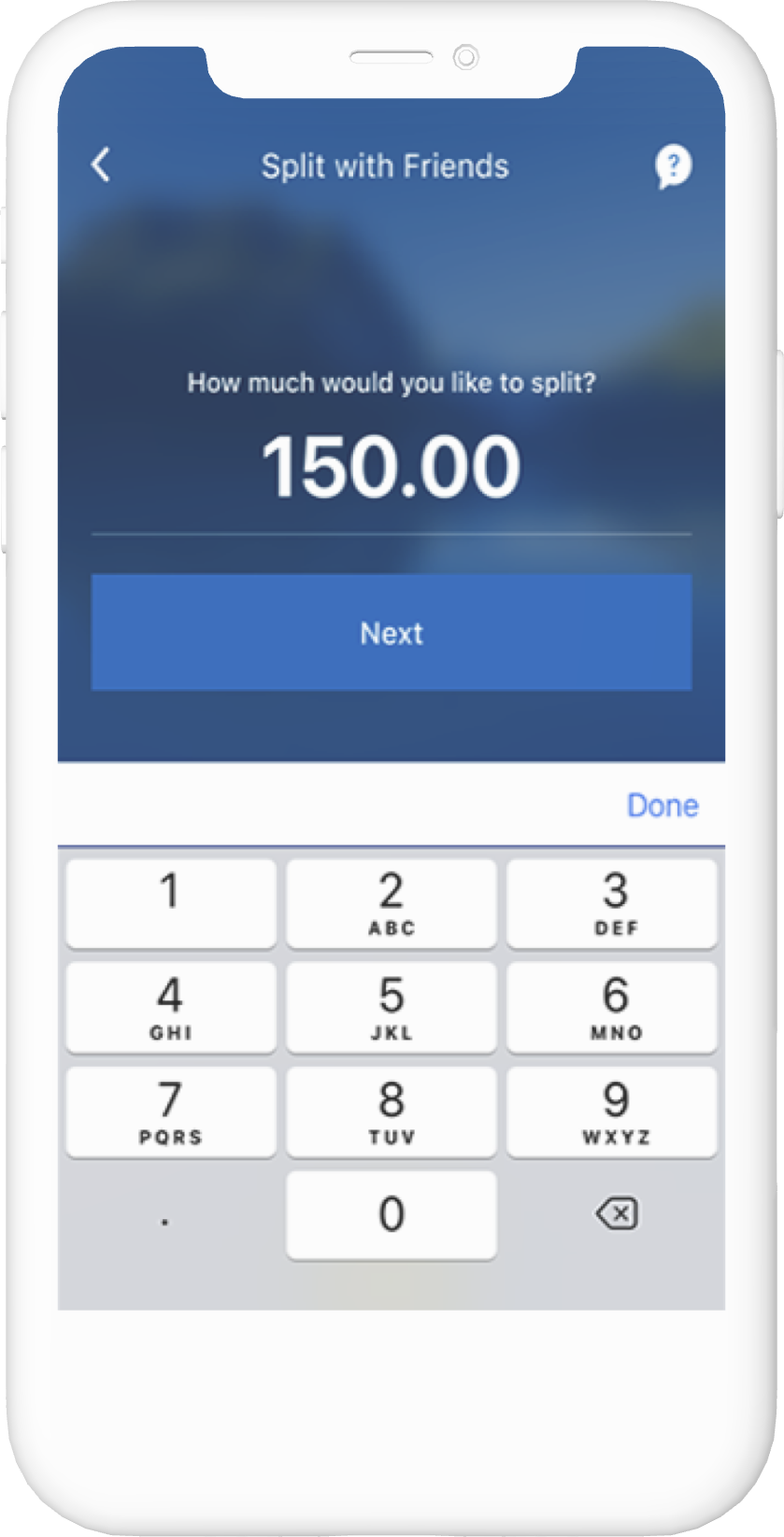

Split with Friends

A fast and simple way to manage shared expenses with your social circle.legal disclaimer 17

Unlock More From Your Everyday Banking

With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account.

legal disclaimer 14

Only at RBC.

Avion

Rewards

Your RBC Bank Account unlocks offers for cash back, savings and Avion points from over 2000

brands.

Card Lock

Easily lock a misplaced debit or credit card in the RBC Mobile legal disclaimer 16 app. Unlock it just as fast.

Split with Friends

A fast and simple way to manage shared expenses with your social circle.legal disclaimer 17

Top Questions About Our New Bank Account Offer

Please go to rbc.com/watchterms

Not necessarily. You can be an existing RBC client and qualify for this offer, as long as you:

- do not have an existing Personal Banking Account with RBC

- never had a Personal Banking Account with RBC, nor qualified for any of our offers related to opening an account in the last five years

1) Open a new RBC Signature No Limit Banking account or RBC VIP Banking account by June 1, 2026

2) Set up and complete two of the following by August 10, 2026

- Your payroll or pension as a direct deposit

- Two (2) pre-authorized monthly payments (PAPs)

- Two (2) eligible bill payments to a service provider

NOTE:

- The Qualifying Criteria you performed to get the Apple Watch Reward (such as recurring payroll/pension deposit, bill payment or pre-authorized monthly payment) must remain in effect until after June 1, 2027.

- Once you qualify, to order your Apple Watch you must have a valid deliverable email address where you will receive a message containing a secure link that will permit you to visit a secure online store where you can select your Apple Watch and confirm an address for delivery, as well as any other shipping details

The offer is available to Canadian residents who:

- have never had a Personal Banking Account (chequing account) with RBC nor qualified for any of our offers related to opening a Personal Banking Account at any time during the Promotional Period or in the five year period before the start of the Promotional Period.

- have attained the age of majority as defined in their province of residence prior to June 1, 2026.

NOTE: If you are not age of majority when you open your new account but will turn the age of majority before June 1, 2026 once you complete the criteria, you will receive the link to order your Apple Watch after your birthday.

Other terms and conditions apply. See the full Terms and Conditions for details.

Starting February 9, 2026, we will notify you – by way of an email sent to the email address you have provided to us – when you have fulfilled the Qualifying Criteria and qualified for the Promotional Offer. This message will be sent at any time up to twenty business days after we have determined that all Qualifying Criteria have been completed by you. The email message will contain a secure link that will permit you to visit a secure online store where you can select your Reward and confirm an address for delivery, as well as any other shipping details

Your Eligible Personal Banking Account must remain open and in good standing, and the Qualifying Criteria you performed to receive the Reward (for example, setting up payroll/pension deposit or pre-authorized payments) must remain in effect until at least June 1, 2027.

You will be able to select the Apple Watch Series 11 GPS, Sport band, 42 mm or 46 mm case in your choice of:

- Jet Black Aluminum Case with Black Sport Band - S/M or M/L

- Grey Aluminum Case with Black Sport Band - S/M or M/L

- Rose Gold Aluminum Case with Light Blush Sport Band - S/M or M/L

- Silver Aluminum Case with Purple Fog Sport Band - S/M or M/L

Colours and band types are subject to availability. Please see the Terms and Conditions for additional details.

Need More Help?

Book an Appointment

Book a virtual appointment with an advisor:

1-800-769-2561 (Open 24/7)Royal Bank of Canada may withdraw or amend this Offer at any time without notice. For full details including defined terms visit rbc.com/watchterms.

New subscribers only. $10.99/month after trial. Offer is available for new Apple Music subscribers with a new eligible device for a limited time only. Offer redemption for eligible audio devices requires connecting or pairing to an Apple device running the latest iOS or iPadOS. Offer redemption for Apple Watch requires connecting or pairing to an iPhone running the latest iOS. Offer good for three months after eligible device activation. Only one offer per Apple Account, regardless of the number of eligible devices you purchase. Plan automatically renews until cancelled. Restrictions and other terms apply.

Apple Fitness+:

A subscription is required for Apple Fitness+.

Apple Fitness+ requires iPhone 8 or later with iOS 16.1 or later, or Apple Watch Series 3 or later with watchOS 7.2 or later paired with an iPhone 6s or later with iOS 14.3 or later.

Offer available to new subscribers who purchase an eligible device after September 7, 2022. $12.99/month after trial. Only one offer per Apple Account and only one offer per family if you’re part of a Family Sharing group, regardless of the number of devices you or your family purchases. This offer is not available if you or any of your family members have previously subscribed to Apple Fitness+. Offer good for three months after eligible device activation. Plan automatically renews until cancelled. Restrictions and other terms apply.

- transactions that occur after you notify us that you believe that any of your Passwords may have become known by someone, or that you noticed unusual, suspicious or fraudulent activity on any of your Accounts;

- transactions where it can be shown that you have been a victim of fraud, theft or have been coerced by trickery, force or intimidation, so long as you report the incident to us immediately and cooperate and assist us fully in any investigation;

- transactions resulting from negligent conduct by us, our employees or Third-Party Service Providers;

- Interac‡ Online Payment transactions resulting from negligent conduct by any Third Party participating in Interac‡ Online Payment; and

- any failure, error, malfunction, or technical problem of our system or equipment or that of any Third-Party Service Provider or any Third Party participating in Interac‡ Online Payment.

- you do not comply with any of your obligations under this Agreement or you do not comply with any instructions we may provide to you in connection with Digital Banking or Mobile Payments;

- you engage in any fraudulent, criminal or dishonest acts related to Digital Banking or Mobile Payments;

- you access Digital Banking or Mobile Payments via a Device that you know or reasonably should know contains software that has the ability to reveal or otherwise compromise any of your Passwords, Personal Verification Questions or an e-Transfer Question and Answer;

- you carry out the transaction, including if the transaction is a result of any mistake, error, omission, inaccuracy or other inadequacy of, or contained in any data or information that you give to us;

- you share any of your Passwords or Personal Verification Questions; or

- you consent to, contribute to or authorize a transaction in any way.

Other Features Included in this Account

| Avion Pointslegal bug 1 | Enrol your account in the Value Program to get a minimum of 1 Avion point for every $10 you spend in-store and online using your enrolled account. |

| Interaclegal bug ‡ e-transferslegal bug 2,legal bug 3 | FREE |

| International Money Transfers | Pay no fee for U.S. and international money transferslegal bug 4 |

| Cross Border Debits | 5 cross-border debits per month, $1 each thereafterlegal bug 5 |

| Online, Mobile and Telephone Banking | FREE |

| eStatements | FREE |

| Monthly Paper Statements | $2.25 without cheque image, $2.50 with cheque image |

| Personalized Chequeslegal bug 8 | 1 book of cheques FREE, afterwards Fees Apply |

| Bank Draftslegal bug 9 | 6 FREE/year, $9.95 each thereafter |

| Right Account Guarantee® | If you’re not completely satisfied within the first 4 months, we’ll refund your monthly fees for up to 3 monthslegal bug 10. |

Optional Services

| Using a PLUS System ATM in Canada or the U.S.legal bug 11,legal bug 12 | $3 each |

| Using a PLUS System ATM Outside Canada or the U.S. | $5 each |

Other Features Included in this Account

| Avion Pointslegal bug 1 | Enrol your account in the Value Program to get a minimum of 1 Avion point for every $10 you spend in-store and online using your enrolled account. |

| Interaclegal bug ‡ e-transferslegal bug 2,legal bug 3 | FREE |

| International Money Transfers | Pay no fee for U.S. and international money transferslegal bug 4 |

| RBC ATMs | No RBC fee to use ATMs worldwidelegal bug 5,legal bug 6,legal bug 7 |

| Online, Mobile and Telephone Banking | FREE |

| eStatements or Monthly Paper Statements | FREE |

| Cross-Border Debitslegal bug 8,legal bug 9,legal bug 10 | FREE |

| Safe Deposit Boxlegal bug 11 | Up to $60/year discount on regular fees |

| Personalized Chequeslegal bug 13 | FREE, with RBC VIP Style |

| Bank Draftslegal bug 14 | 12 FREE/year, $9.95 each thereafter |

| Right Account Guarantee® | If you’re not completely satisfied within the first 4 months, we’ll refund your monthly fees for up to 3 months.legal bug 15 |