legal disclaimer 1)

To take advantage of this offer, you must be a resident of Canada and age of majority by June 1, 2026 and you must not have an existing Personal Banking Account with Royal Bank of Canada or any of its deposit taking subsidiaries at the beginning of the “Promotional Period” on January 14, 2026, or in the prior five year period, and otherwise comply with the terms of the offer. You will be eligible to receive a complimentary Apple Watch (Apple Watch Series 11 GPS, Rubber band, 42 mm or 46 mm case in your choice of Jet Black Aluminum with Black Sport Band, Space Grey Aluminum with Black Sport Band, Rose Gold Aluminum with Light Blush Sport Band or Silver Aluminum with Purple Fog Sport Band, Model Numbers included in the full

Terms and Conditions), when you open your first new Eligible Personal Banking Account of either an RBC Signature No Limit Banking

® account (monthly fee of $16.95) or RBC VIP Banking

® account (monthly fee of $30) by 9PM EST June 1, 2026 and complete two of the following ”Qualifying Criteria” by 9PM EST August 10, 2026: set up two pre-authorized payments from the Eligible Personal Banking Account; and/or one automated and recurring payroll or pension direct deposit to the Eligible Personal Banking Account, and/or two eligible bill payments to a service provider from the Eligible Personal Banking Account. RBC has the right to determine what is considered payroll. This offer may not be combined or used in conjunction with any other Personal Banking Account offers unless otherwise indicated. Royal Bank of Canada reserves the right to withdraw this offer at any time without notice, even after acceptance by you. Other conditions apply. For full details including defined terms visit

rbc.com/watchterms.

Royal Bank of Canada may withdraw or amend this Offer at any time without notice. For full details including defined terms visit

rbc.com/watchterms.

legal disclaimer 4)

As a sole or joint owner of an RBC Signature No Limit Banking (SNL) account and the primary cardholder of one of the eligible credit cards listed below, the annual fee of that eligible credit card will be fully or partially rebated (depending on the credit card you choose), every year, as long as your eligible card remains in good standing and you remain an SNL account owner. Additional cardholders (co-applicants and authorized users) do not qualify for the annual fee rebate, even if they are also owners of an SNL account. Only one credit card annual fee rebate per SNL account is allowed, which means that if you own a joint SNL account and each co-owner is also the primary cardholder of an eligible credit card, only the primary owner of the SNL account will be entitled to the credit card annual fee rebate. Other conditions and restrictions apply. Rebates that apply to eligible credit cards are: 1) $48 rebate (annual fee fully rebated) for: RBC ION+ Visa card, 2) $39 rebate (annual fee fully rebated) for: Signature® RBC Rewards Visa and WestJet RBC Mastercard cards, or 3) $35 rebate (annual fee partially rebated) for: RBC Avion Visa Infinite, RBC Avion Visa Infinite Privilege, RBC Avion Visa Platinum, RBC Rewards Visa Preferred, RBC US Dollar Visa Gold, RBC British Airways Visa Infinite and WestJet RBC World Elite Mastercard cards. If you already have an SNL account, the rebate will be applied at the time you open your eligible credit card account. If you open your SNL account after you have opened your eligible credit card account, the rebate will be applied at your next annual renewal and won't be applied retroactively. Other conditions and restrictions may apply. Royal Bank of Canada reserves the right to withdraw this offer at any time, even after acceptance by you.

legal disclaimer 5)

The standard Monthly Fee for the RBC Signature No Limit Banking account is $16.95; however, you may be eligible to receive a partial rebate on your account's standard Monthly Fee if you meet the criteria applicable to rebates or discounts we offer, as described herein, and in the document entitled

Personal Deposit Accounts Disclosures and Agreements.

legal disclaimer 7)

An ATM operator surcharge (also called convenience fee) may be charged by other ATM operators. The convenience fee is not a Royal Bank fee. It is added directly to the amount of your cash withdrawal. All clients who use non-RBC ATMs may be charged a convenience fee regardless of the type of Account they hold.

legal disclaimer 8)

To be eligible, you must be 24 and under or a full-time student with an Advantage Banking Account. To be considered a full time student you must attend a primary or secondary school, OR be enrolled in a program at the post secondary level at a college, university or other educational institution (whether in Canada or not). If you are a post-secondary student you must take at least 60% of the usual course load for the program in which you are enrolled in any particular semester. Proof of enrollment may be requested at our discretion.

legal disclaimer 9)

Available only to newcomers to Canada who arrived within the previous 5 years of opening an RBC Advantage Banking account. Must show proof of date of entry into Canada and provide supporting documents, such as landing papers or permanent resident card. This offer may be withdrawn at any time and is subject to change without notice. Monthly fee will be waived for the first twelve months upon account opening of the RBC Advantage Banking account. Thereafter the monthly fee will be charged.

legal disclaimer 10)

By enrolling an eligible RBC personal bank account into the RBC Value Program, holding eligible additional RBC products (“Product Categories”, as more particularly described below), and completing certain activities from your enrolled account each month (as more particularly described below), you may be entitled to receive a partial or full rebate of your enrolled account’s standard Monthly Fee. Eligible Product Categories include RBC personal credit cards, personal investments, residential mortgages, and linked small business relationships. Multiple products in a single Product Category will be considered one Product Category. In addition to having eligible Product Categories, you must also perform any two (2) or more of the following specified account activities in the previous calendar month to or from your enrolled account: a monthly direct deposit, a monthly pre-authorized payment, or an eligible bill payment made at minimum once per month. An eligible bill payment means a bill payment completed through either RBC Online Banking, the RBC Mobile app, using an RBC ATM, or using Telephone Banking Services, and excludes any bill payment made: (i) in-person at an RBC Royal Bank branch with an RBC Advisor, (ii) to an RBC credit card account, or (iii) using an RBC Virtual Visa Debit

® associated with your Enrolled Account. Conditions apply. For complete details, please see the

Value Program Terms & Conditions.

legal disclaimer 11)

Subject to credit approval. As a sole or joint owner of an RBC VIP Banking (VIP) account and the primary cardholder of one of the eligible credit cards listed below, the annual fee of that eligible credit card will be fully or partially rebated (as indicated below), every year, as long as your credit card remains in good standing and you remain a VIP account owner. Additional cardholders’ annual fee is also fully or partially rebated (as indicated below), every year, as long as your eligible credit card remains in good standing and you remain a VIP account owner. Only one credit card annual fee rebate per VIP account is allowed, which means that if you own a joint VIP account and each co-owner is also the primary cardholder of an eligible credit card, only the primary owner of the VIP account will be entitled to the credit card annual fee rebate. Other conditions and restrictions apply. Rebates that apply to eligible credit cards are: (i) partial rebate of $120 for the primary cardholder and $50 for the co-applicant on the annual fee of an RBC Avion Visa Infinite Privilege card, and (ii) annual fee fully rebated for the primary cardholder and the additional cardholders (co-applicant and authorized users) on any of the following cards: RBC Avion Visa Infinite, RBC Avion Visa Platinum, RBC Rewards Visa Preferred, RBC U.S. Dollar Visa Gold, RBC British Airways Visa Infinite, RBC ION+ Visa, RBC Cash Back Preferred World Elite Mastercard and WestJet RBC World Elite Mastercard. If you already have a VIP account, the rebate will be applied at the time you open your eligible credit card account. If you open your VIP account after you have opened your eligible credit card account, the rebate will be applied at your next annual renewal and won't be applied retroactively. Other conditions and restrictions may apply. Royal Bank of Canada reserves the right to withdraw this offer at any time, even after acceptance by you.

legal disclaimer 12)

Eligible Canadian dollar Accounts: one of RBC Day to Day Banking, RBC Day to Day Savings or RBC Enhanced Savings. The RBC VIP Banking Account is known as your “VIP Operating Account.” Accounts linked to your VIP Operating Account are known as “VIP Companion Accounts.” All Accounts need to be in the same geographic location.

legal disclaimer 13)

On operating account only. $1 per cross border debit transaction on companion accounts. Not available on U.S. Personal Account. Foreign currency purchases paid by withdrawal from your Canadian dollar account are converted to Canadian dollars at an exchange rate 2.5% over the Interbank Spot Rate (as defined by

Interac‡ Corp.), effective at time of processing. Since exchange rates fluctuate, the rate applied will usually differ from the posted exchange rate at the time of your purchase.

legal disclaimer 14)

Overdraft Protection is an optional feature that may be added to your account. Monthly fee waived for VIP Banking & Signature No Limit Banking accounts. Subject to credit approval. Overdraft interest charge applies if used. If an account is overdrawn, a deposit is required to be made at least once each month, in an amount that will cover the monthly overdraft interest.

legal disclaimer 15)

Paper statements are free without cheque image, or $2.50 per month with cheque image.

legal disclaimer 16)

Eligible accounts include: RBC VIP Banking, RBC Signature No Limit Banking, RBC Advantage Banking, RBC Day to Day Banking account. You must close the account and apply for the refund or switch to another account within 4 months of account opening or upgrade. Offer limited to one account opening or upgrade per customer per calendar year. Offer may be withdrawn at any time without notice.

legal disclaimer 17)

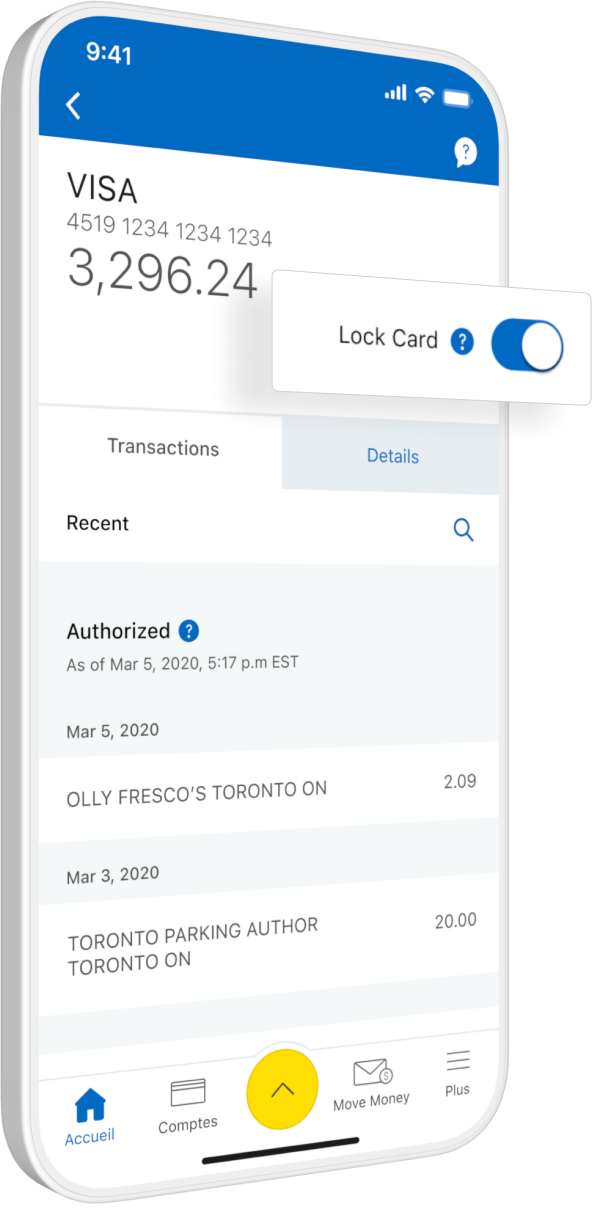

Our guarantee to you: We will reimburse you for monetary losses to your Account(s) resulting directly from the following unauthorized transactions on your Account(s) using Digital Banking or Mobile Payments (collectively,

Unauthorized Transactions):

- transactions that occur after you notify us that you believe that any of your Passwords may have become known by someone, or that you noticed unusual, suspicious or fraudulent activity on any of your Accounts;

- transactions where it can be shown that you have been a victim of fraud, theft or have been coerced by trickery, force or intimidation, so long as you report the incident to us immediately and cooperate and assist us fully in any investigation;

- transactions resulting from negligent conduct by us, our employees or Third-Party Service Providers;

- Interac‡ Online Payment transactions resulting from negligent conduct by any Third Party participating in Interac‡ Online Payment; and

- any failure, error, malfunction, or technical problem of our system or equipment or that of any Third-Party Service Provider or any Third Party participating in Interac‡ Online Payment.

Your responsibilities: Despite the above, we are not responsible for and we will not reimburse you for losses to your Account(s) if:

- you do not comply with any of your obligations under this Agreement or you do not comply with any instructions we may provide to you in connection with Digital Banking or Mobile Payments;

- you engage in any fraudulent, criminal or dishonest acts related to Digital Banking or Mobile Payments;

- you access Digital Banking or Mobile Payments via a Device that you know or reasonably should know contains software that has the ability to reveal or otherwise compromise any of your Passwords, Personal Verification Questions or an e-Transfer Question and Answer;

- you carry out the transaction, including if the transaction is a result of any mistake, error, omission, inaccuracy or other inadequacy of, or contained in any data or information that you give to us;

- you share any of your Passwords or Personal Verification Questions; or

- you consent to, contribute to or authorize a transaction in any way.

Exceptional Losses: In no event, even if we are negligent, will we be liable for any loss of data, or any indirect, consequential, special, aggravated, punitive or exemplary damages, in whole or in part, (including any business interruption, loss of profits, data, information, opportunity, revenues, goodwill or any other commercial or economic loss), caused to you, regardless of the cause of action, even if we were advised of the possibility of such damages.

For full details regarding the protections and limitations of the RBC Digital Banking Security Guarantee, including your responsibilities in ensuring the safety and security of your transactions, please see your

Electronic Access Agreement and your

Client Card Agreement for personal banking clients, and the

Master Client Agreement for business clients. This guarantee is given by Royal Bank of Canada in connection with its Online and Mobile Banking services. Formerly known as the RBC Online Banking Security Guarantee.

legal disclaimer 18)

The following RBC bank accounts are eligible for the Value Program: RBC Day to Day Banking, RBC Advantage Banking (includes RBC Advantage Banking for students), RBC Signature No Limit Banking, RBC VIP Banking, RBC No Limit Banking (discontinued), RBC Student Banking (discontinued), RBC No Limit Banking for Students (discontinued), RBC Day to Day Savings, RBC Enhanced Savings and RBC High Interest eSavings.

legal disclaimer 19)

When you enrol your eligible RBC personal bank account into the RBC Value Program, you will be eligible to earn Avion points within the Avion Rewards Program as an Eligible Personal Banking Client, and any such points earned will be deposited into the Avion Rewards account tied to your enrolled account. Purchases from your account refers to using your RBC Client Card to pay for items at a merchant or service provider with the amount electronically debited directly from your enrolled account or using your RBC Virtual Visa Debit for purchases online. Avion points are governed by the

Avion Rewards Terms and Conditions available on our website, or a copy may be provided to you by contacting us. For complete details on the Value Program, please see the

Value Program Terms & Conditions.

legal disclaimer 20)

To participate in this offer, you must have an RBC debit or credit card which is issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”). RBC business clients will only be able to link up to two (2) business credit cards and one business debit card to a Petro-Points card. You must be enrolled in RBC Online Banking or the RBC Mobile app in order to link your RBC Card to your Petro-Points card. Card linking may take up to 2 business days to process before savings and bonus points can be applied to purchases. A linked RBC Card means an RBC Card linked to a Petro-Points Account. Your linked RBC Card acts as your Petro-Points card. You will automatically earn Petro-Points when you pay for qualifying purchases with your linked RBC Card at Petro-Canada locations and you do not need to swipe your Petro-Points card before you pay. You can redeem your Petro-Points at Petro-Canada using your linked RBC Card. Each time you use your linked RBC Card to purchase any grade of gasoline, or diesel,litre at the time of the transaction.

legal disclaimer 21)

RBC Mobile is operated by Royal Bank of Canada, RBC Direct Investing Inc. and RBC Dominion Securities Inc.

legal disclaimer 22)

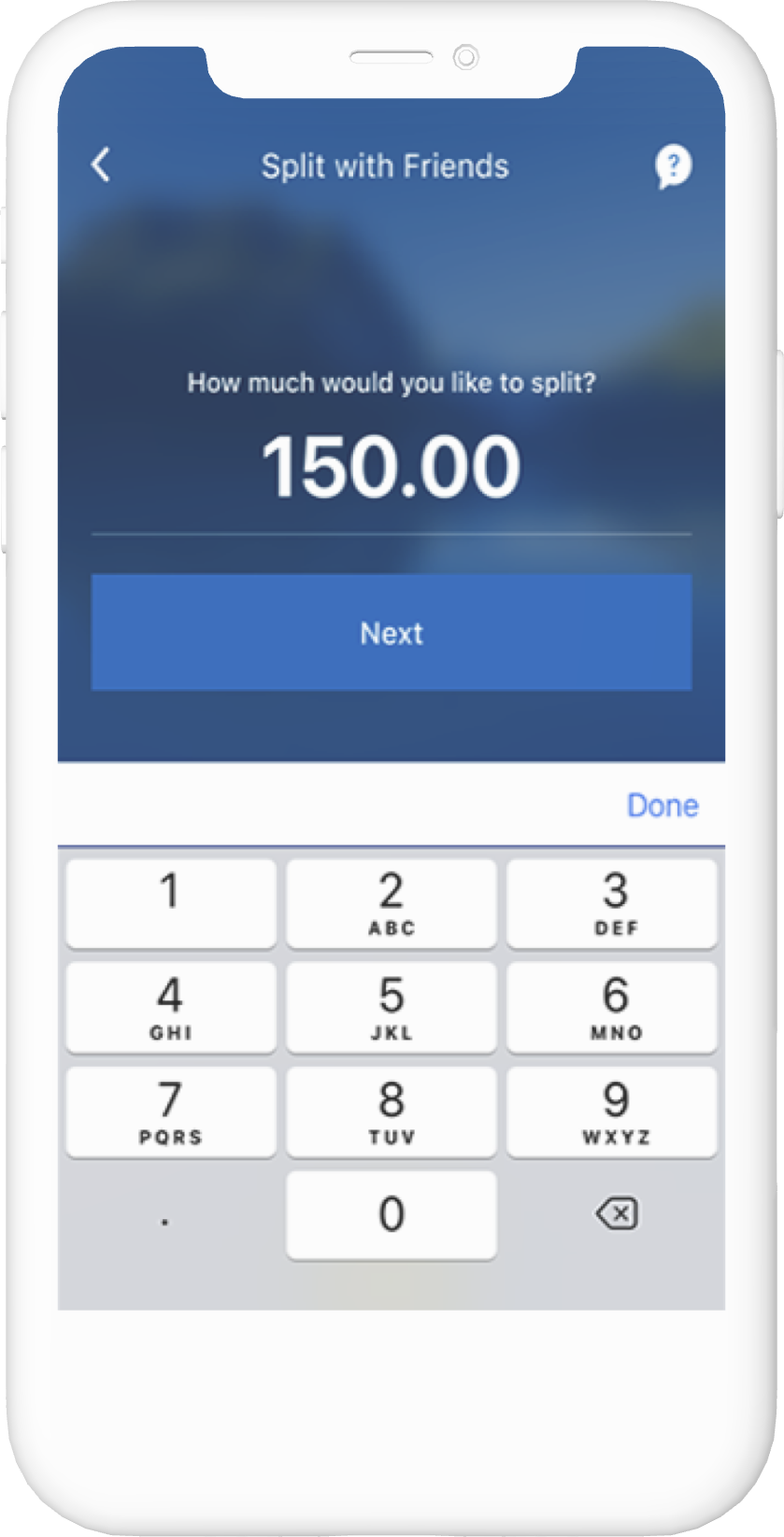

You can send up to 25 requests at a time up to $10,000 each to anyone banking in Canada with Request Money in the RBC Mobile app. Limits for fulfilling Request Money transactions vary by financial institution and recipient. Contact your recipient to ensure your request can be fulfilled. Any unfulfilled money request will expire after 30 calendar days.

legal disclaimer 23)

The Offers program is available to clients with an RBC Royal Bank (i) debit card tied to a personal or business chequing account, and/or (ii) personal or business credit card, other than an RBC Commercial Visa or RBC US Dollar Visa card.

Eligibility criteria for an Offer: (a) is determined by RBC, (b) may vary depending on the offer, and (c) may be based on the client’s preferences and account status. Eligible clients will refer to the terms and conditions applicable to each specific Offer for more details.

legal disclaimer 24)

The standard Monthly Fee for the RBC Day to Day Banking account is $4; however, you may be eligible to receive a full rebate on your account's standard Monthly Fee if you meet the criteria applicable to rebates or discounts we offer, as described herein, and in the document entitled “

Personal Deposit Accounts Disclosures and Agreements”.

legal disclaimer 25)

The standard Monthly Fee for the RBC Advantage Banking account is $12.95; however, you may be eligible to receive a full or partial rebate on your account's standard Monthly Fee if you meet the criteria applicable to rebates or discounts we offer, as described herein, and in the documents entitled “

Personal Deposit Accounts Disclosures and Agreements”.

legal disclaimer 26)

The standard Monthly Fee for the RBC VIP Banking account is $30; however, you may be eligible to receive a partial rebate on your account's standard Monthly Fee if you meet the criteria applicable to rebates or discounts we offer, as described herein, and in the document entitled “

Personal Deposit Accounts Disclosures and Agreements”.

legal disclaimer 27)

RBC Mobile is operated by Royal Bank of Canada, RBC Direct Investing Inc. and RBC Dominion Securities Inc. RBC Canada, and Avion Rewards are operated by Royal Bank of Canada.

legal disclaimer 28)

Unlimited FREE Interac e-Transfer transactions through the Interac e-Transfer service are available with all Canadian dollar personal bank accounts and are not counted in the monthly total of debits for accounts with a limited number of free debits. There is a limit of 999 free Interac e-Transfer Transactions per Month per Account; for every Interac e-Transfer Transaction over the limit, you will be charged $1. For all Canadian dollar savings accounts, transfers through the Interac e-Transfer service are $1 each, count as a Debit Transaction toward any free monthly total and carry an Excess Debit Transaction Fee, if applicable. The Interac e-Transfer service is not available with U.S. Dollar Accounts.

legal disclaimer 29)

The following debits will not count toward the number of included Debit

Transactions per Month: RBC Virtual Visa‡ Debits; Self-Serve electronic funds

transfers from your personal deposit account to another personal deposit account in your name; pre-authorized or self-service transfers made to any RBC credit card; payments to your RBC Royal Bank personal loan, Royal Credit Line®, RBC residential mortgage or RBC Homeline Plan®; contributions made to RBC investments/ investment accounts such as Guaranteed Investment Certificates (GICs), Registered Retirement Savings Plans (RRSPs), Registered Education Savings Plans (RESPs), Registered Disability Savings Plans (RDSPs), Tax-Free Savings Accounts (TFSAs), and Royal Mutual Funds. Unless otherwise specified herein, all other debits, including bill payments, will count towards the number of included Debit Transactions and will result in an Excess Debit Transaction Fee if you go over the number of included debits per Month. Notwithstanding the foregoing:

For Chequing Accounts only, Third Party Payments debits will not count toward

the number of included Debit Transactions per Month.

For RBC Day to Day Banking Account only, Point of Sale Purchases made at public transit authority merchants classified by Interac’s “Merchant Category Code” (MCC) as “Local and Suburban Commuter Passenger Transportation, including ferries” will not count towards the number of included Debit Transactions per Month. All other debits, including those Point of Sale Purchases for which the merchant may offer public transit services but is not categorized under Interac’s “Local and Suburban Commuter Passenger Transportation, including ferries” MCC, will count towards the number of included Debit Transactions and will result in an Excess Debit Transaction Fee if you go over the number of included debits per Month.

legal disclaimer 30)

When you use RBC Virtual Visa Debit for a transaction in a currency other than Canadian dollars, we will convert the transaction amount into Canadian dollars at an exchange rate that is 2.5% over a benchmark rate Royal Bank of Canada pays on the date of the conversion. If the merchant gives you a credit voucher or refund for a transaction in a foreign currency, the debit and the subsequent credit will not exactly balance because of exchange rate and currency fluctuations.

legal disclaimer 31)

If you are an owner of an Account that allows Companion Accounts, participation in the RBC’s Value Program, a discount on the annual fee for an RBC credit card or a discount on the annual rental fee of a safe deposit box, your holdings will be automatically linked if their owner(s) is (are) the same. However, in some instances your product holdings may need to be manually linked, and you will need to contact us to do so. Without limitation, this includes if your product holdings are held in different ownership, in different processing centers, or there are greater than two account owner(s) on your Account. If any one of your associated or linked RBC products is in joint ownership and the ownership of any of the linked products differ from one another, you acknowledge that the ownership of the other products may be disclosed to the other joint owners or co-owners.

legal disclaimer 32)

Offered as part of the Commitment on Low-Cost and No-Cost Accounts from the Financial Consumer Agency of Canada (FCAC).

legal disclaimer 34)

Offer available February 3, 2026- June 1, 2026 (“Promotional Period”)

This offer is available to any Eligible Student Client without a Personal Banking Account with Royal Bank of Canada at the beginning of the Promotional Period or in the three-year period before the start of the Promotional Period, and who otherwise complies with the Terms of the Promotional offer. The Bonus Offer is $100 with an Eligible Personal Banking Account.

To qualify for the $100 you must open your first new Eligible Personal Banking Account by 9:00 PM EST on June 1, 2026 and complete two of the following Qualifying Criteria by 9:00 PM EST on August 10, 2026 using your Eligible Personal Banking Account:

i. Register your Eligible Personal Banking Account for Interac Autodeposit and send or receive one (1) e-Transfer using RBC Online Banking or the RBC Mobile app.

ii. Request and obtain an RBC Virtual Visa Debit card and make at least one (1) Qualifying Debit Transaction (as defined in the Note section below) with your Eligible Personal Banking Account.

iii. Transfer the full amount of your automated and recurring payroll direct deposit to your new Eligible Personal Banking Account. For greater certainty, this means that you will not qualify if you split your payroll deposit from one employer between your new Eligible Personal Banking Account and any other account. We reserve the right to determine what is considered payroll and whether any payroll deposit has been split. The first payment of each PAP must be debited and must clear from your new Eligible Personal Banking Account by 9:00 PM Eastern Time August 10, 2026.

iv. Set up one (1) pre-authorized monthly payment (“PAP”) – such as a pre-authorized eligible bill payment to a service provider (i.e. utility bill, gym membership) or pre-authorized payment to an RBC mortgage, loan, Royal Credit Line, or contribution to your RBC investment account – from your new Eligible Personal Banking Account. PLEASE NOTE: Any bill payments (pre-authorized or otherwise) made using a Virtual Visa Debit will not qualify. The first payment of each PAP must be debited and must clear from your new Eligible Personal Banking Account by 9:00 PM Eastern Time August 10, 2026.

v. Make one (1) eligible bill payment to a service provider from your new Eligible Personal Banking Account. PLEASE NOTE: To qualify, the eligible bill payment must be completed through the RBC Mobile app or RBC Online Banking. Excludes any bill payment made in-person at an RBC Royal Bank branch with an RBC Advisor, and any bill payment made to an RBC credit card account, and any bill payment made using RBC Virtual Visa Debit. The eligible bill payment must be debited and must clear from your new Eligible Personal Banking Account by 9:00 PM Eastern Time August 10, 2026.

NOTE: Qualifying Debit Transactions are defined as Bill Payments or purchase transaction using any of the following: your RBC Client Card, an RBC Virtual Visa Debit card associated with your Eligible Personal Banking Account, Interac Flash, Apple Pay, Google Pay, Samsung Pay Transactions carried out at an RBC Royal Bank branch or through the RBC Royal Bank ATM network, and bank fee transactions, are not included as qualifying transactions.

NOTE: You must be at least 14 years of age to obtain an RBC Virtual Visa Debit card. As such, option ii. (above) is only available to individuals who meet this minimum age requirement; if you are below the age of 14 and participate in this Promotional Offer, you must select one of the other eligible transaction types described.

The $100 cash component of the Promotional Offer will be deposited into your Eligible Personal Banking Account within 4 to 10 weeks of completing the Qualifying Criteria, if applicable. Royal Bank of Canada may follow up with Eligible Student Clients to remind them to complete the Qualifying Criteria.

This offer may not be combined or used in conjunction with any other Personal Banking Account offers. Royal Bank of Canada reserves the right to withdraw this offer at any time without notice, even after acceptance by you. For full details including defined terms visit rbc.com/offerterms100.

legal disclaimer ® / ™

Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada.

legal disclaimer ‡

All other trademarks are the property of their respective owner(s).