Check Out What's New

Vantage Snapshot

Get a clear picture of the value you get with an eligible RBC bank account. See your monthly fee savings, rebates, Avion Points balance and more—all in one spot.

Credit Score

You can now check your credit score and your credit report in the app. Get actionable tips and advice on how to improve, protect and maintain your score.

Contribute to Your Existing Investments

View and make contributions to your TFSA, RRSP, RESP and other eligible investment accounts in the RBC Mobile app.

Check Out Whats New!

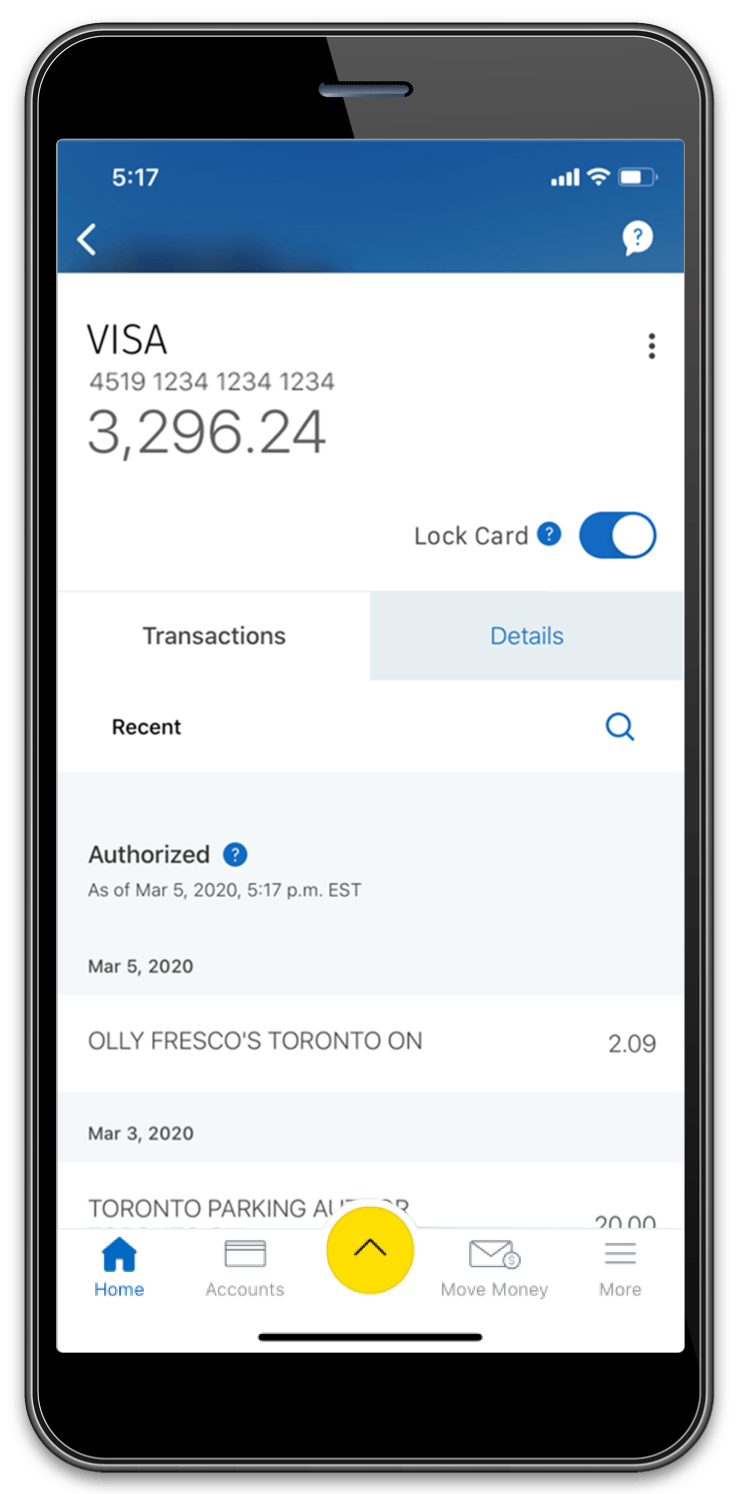

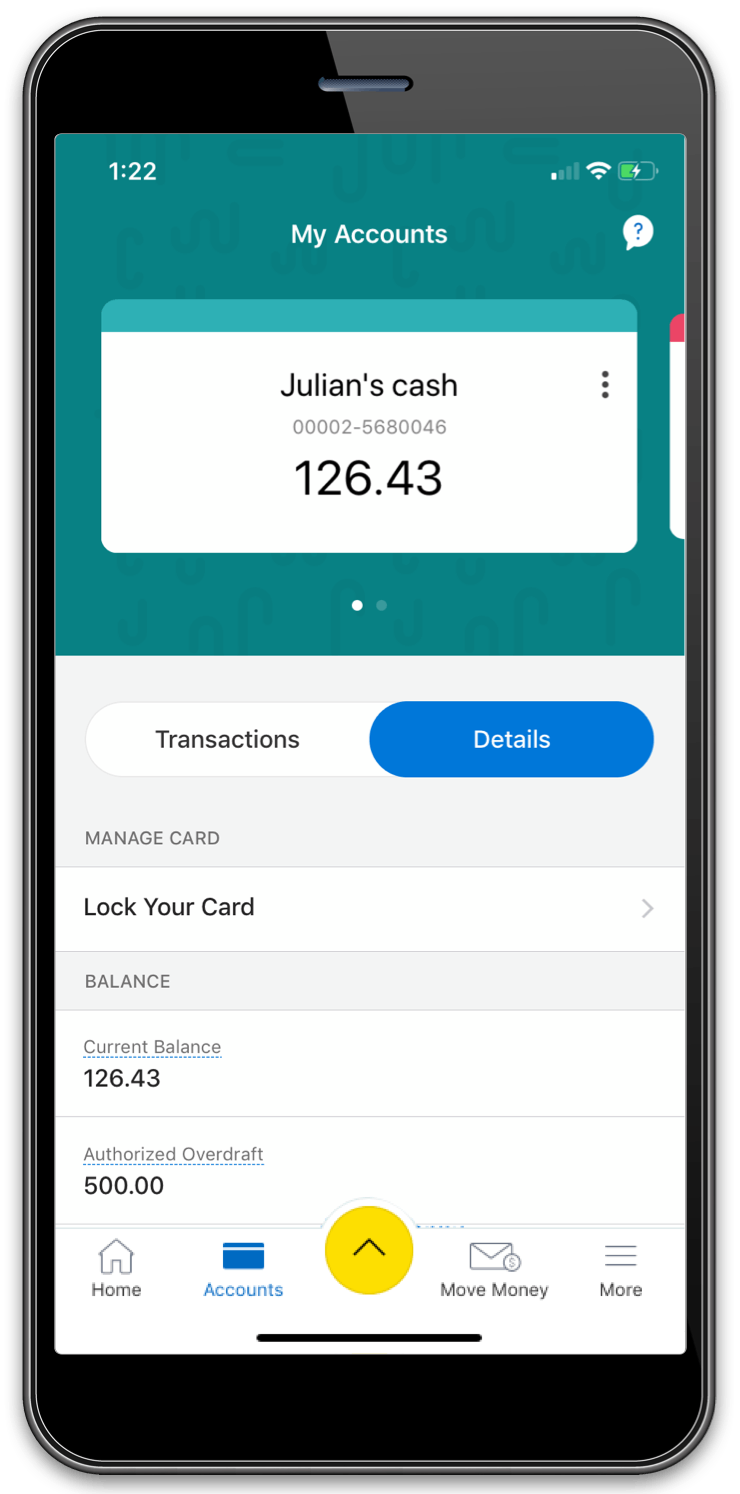

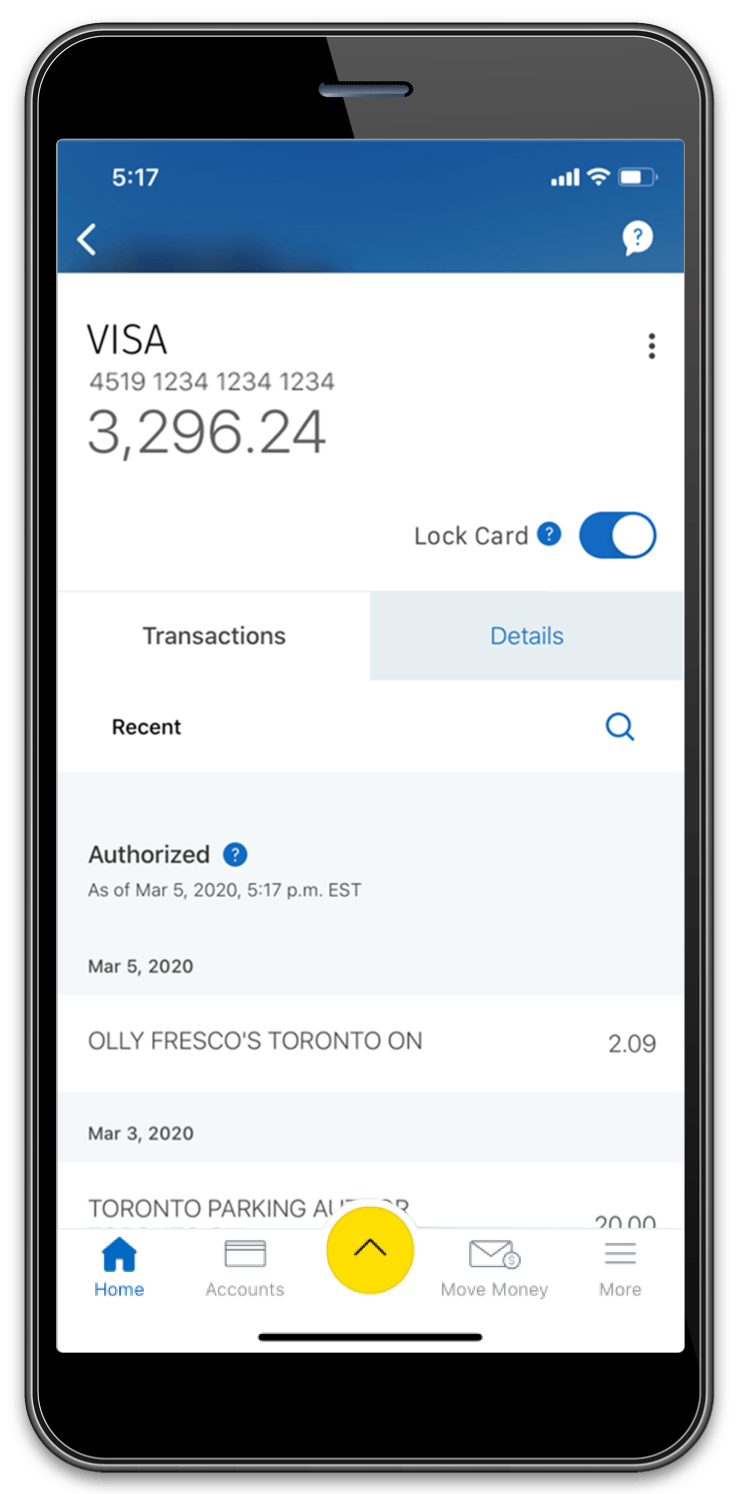

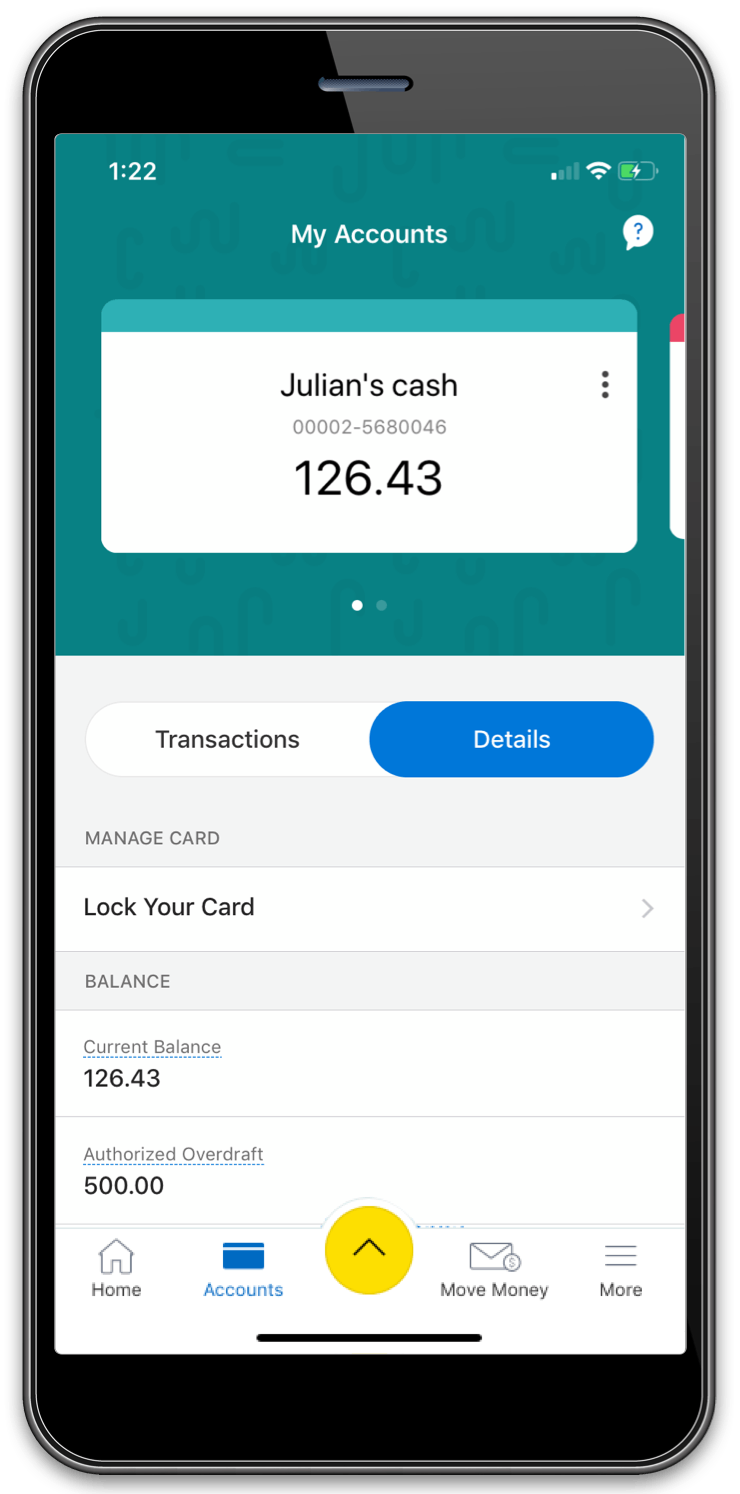

Card Lock

Misplaced your client card or credit card? Now you can lock your card directly from your phone using the RBC Mobile app. Unlocking it is just as easy.

Learn MoreSplit with Friends

A fast and simple way to manage shared finances with your social circle.

Learn MoreContribute to Your Existing Investments

View and make contributions to your TFSA, RRSP, RESP and other eligible investment accounts in the RBC Mobile app.

Contribute nowFeatures You’ll Love

Personal Banking

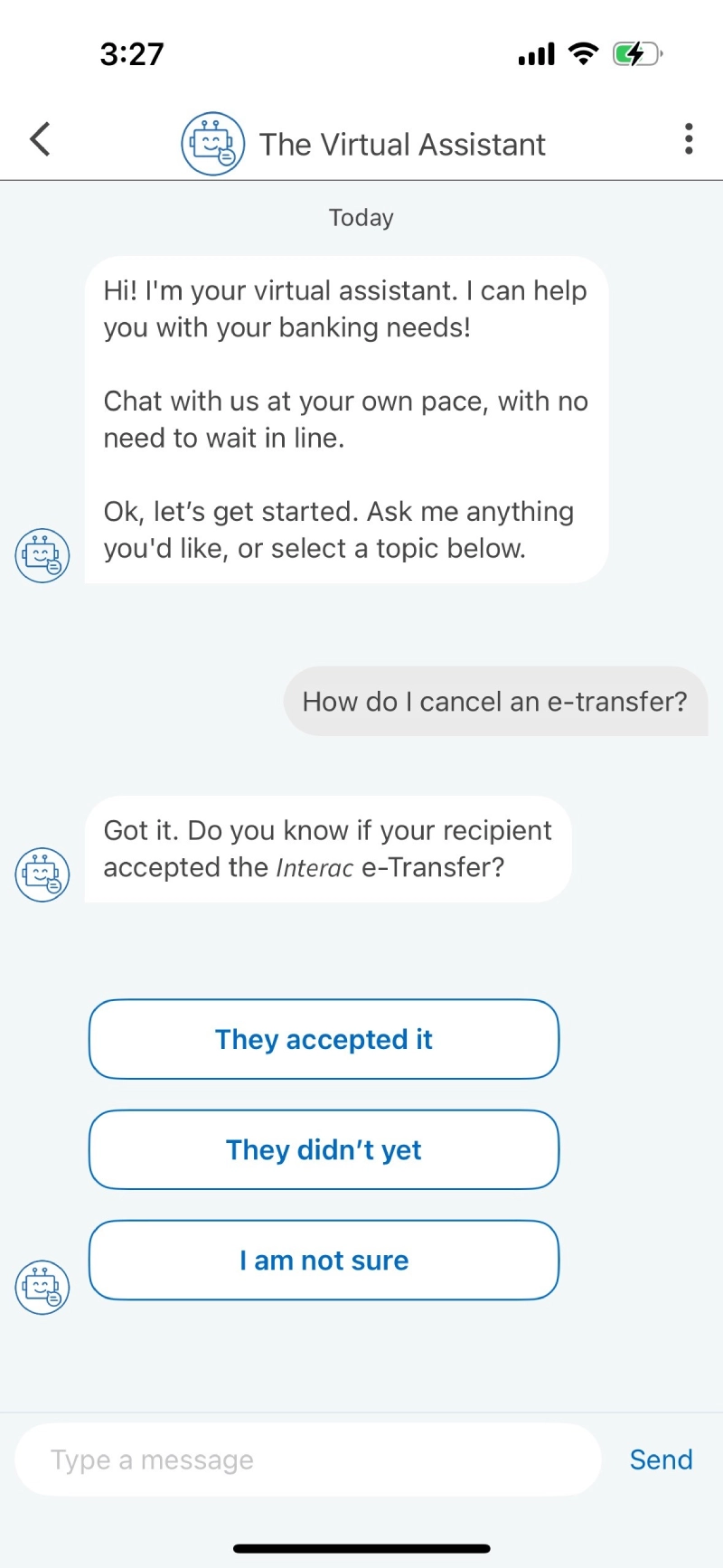

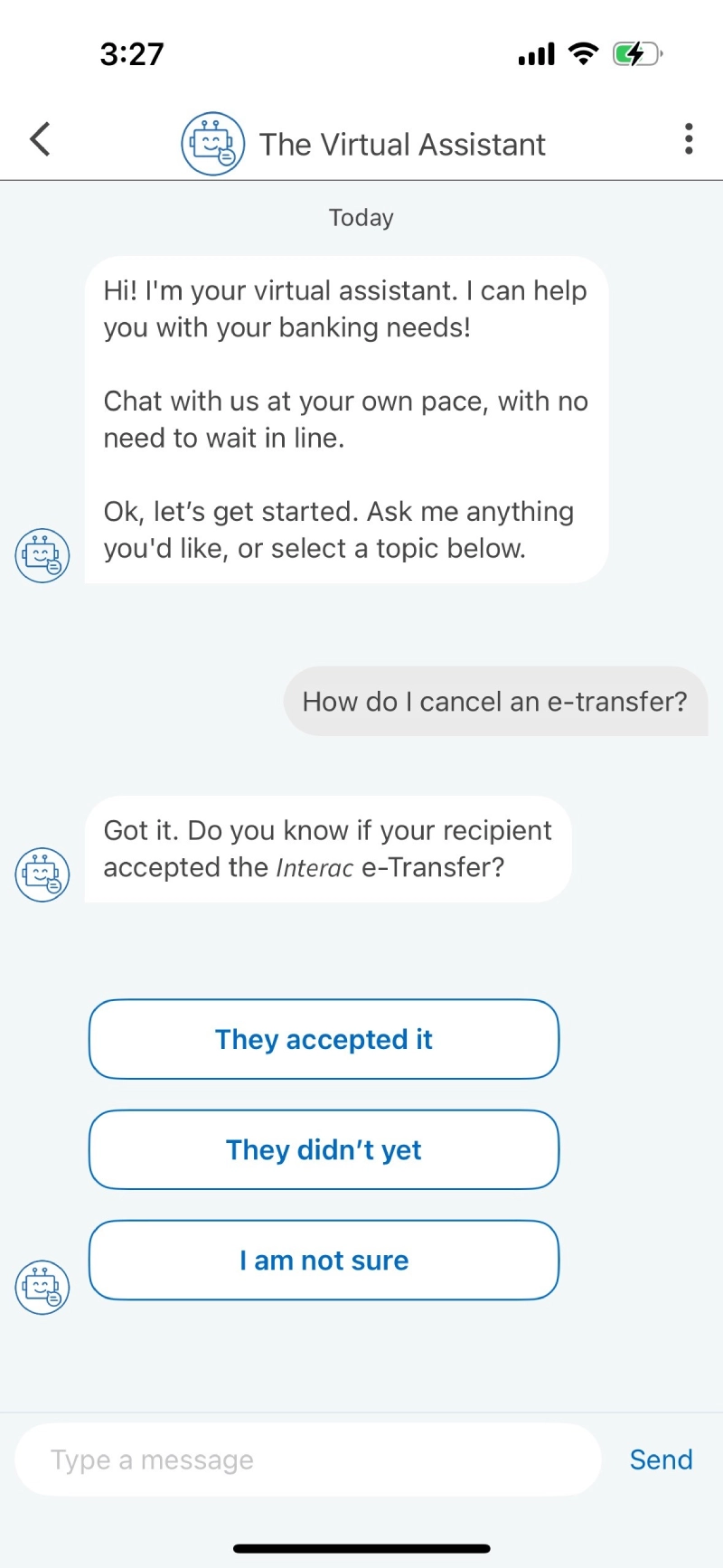

Personalized Support

Your virtual assistant helps you find quick answers or connects you with the right advisor.

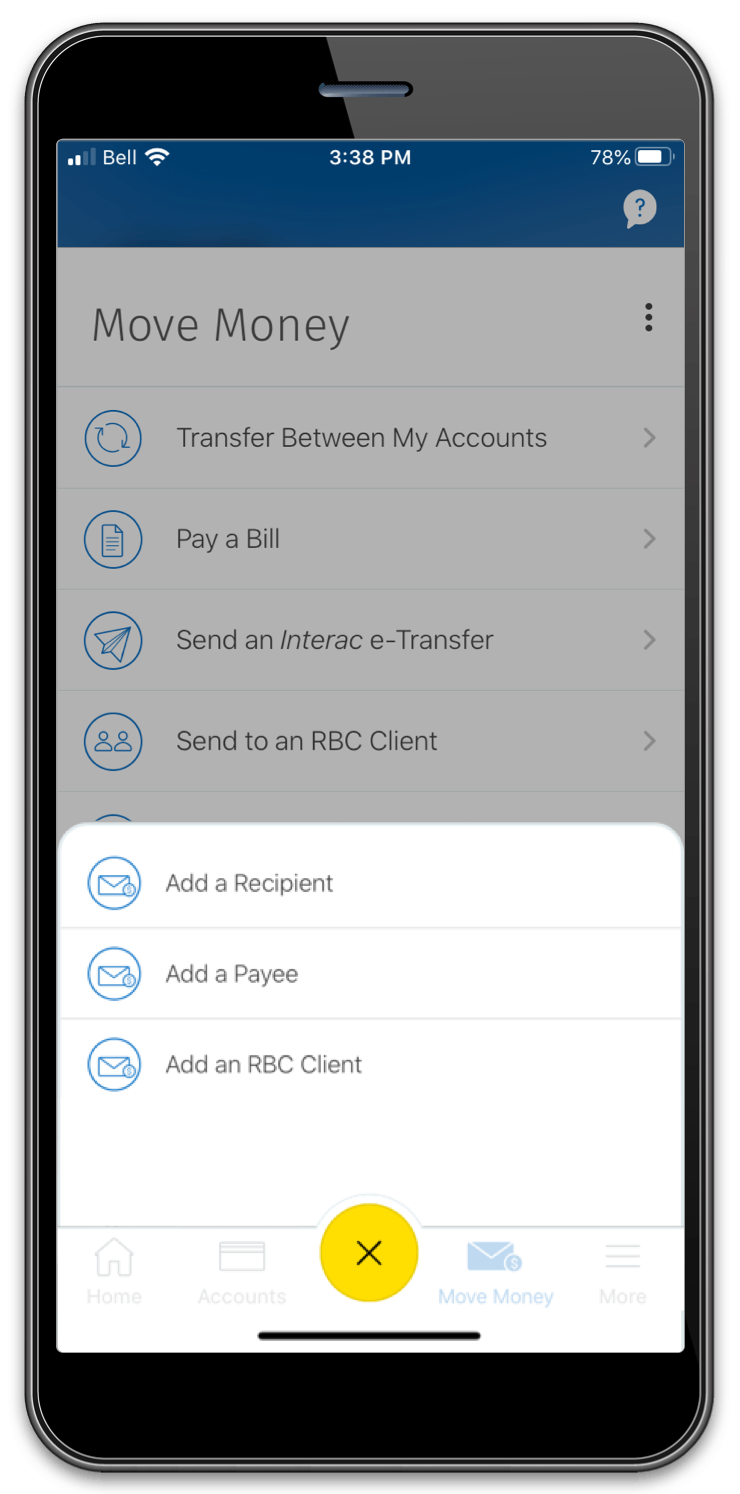

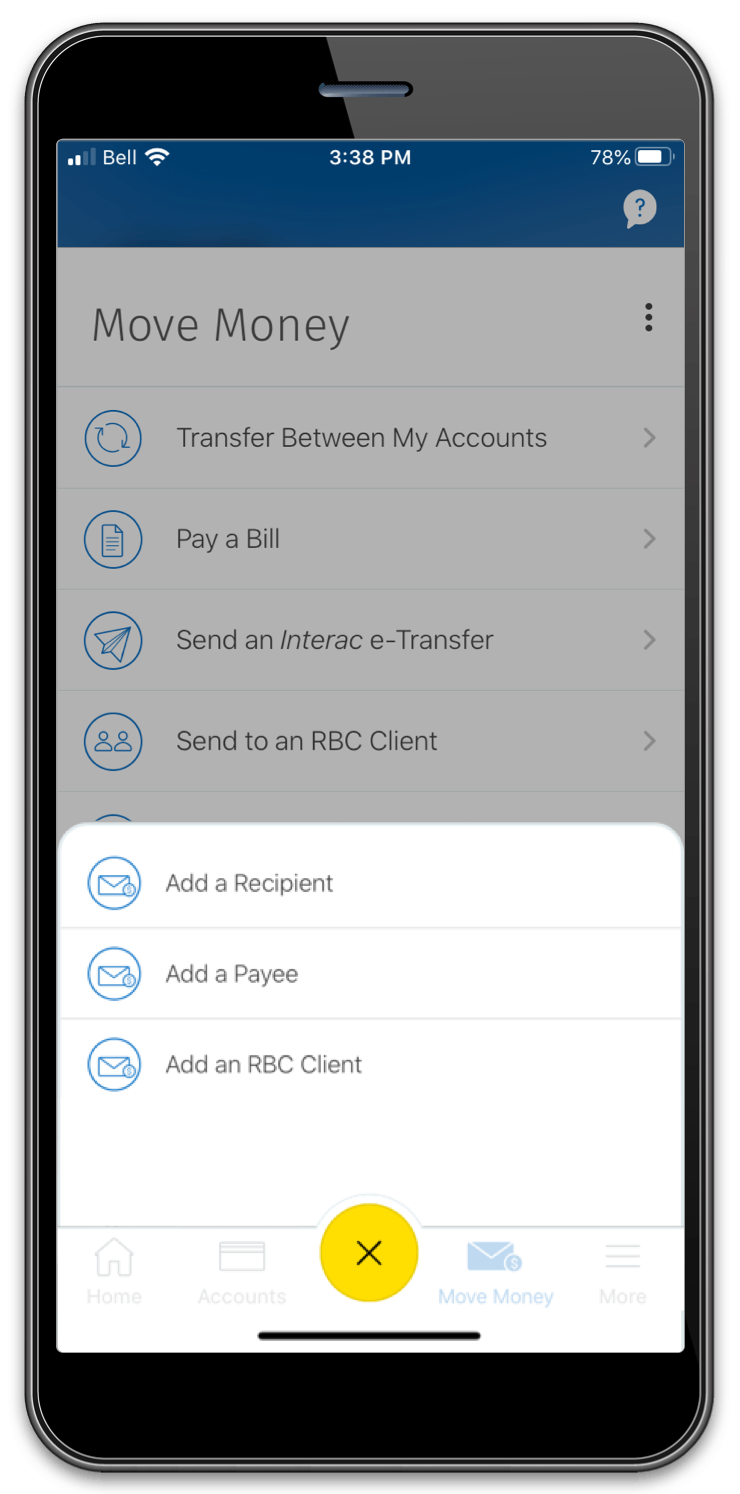

Move Money With Ease

Quick acess to the most important tasks on every page at your fingertips.

Be in Control of Your Cards

Misplaced your Client Card or RBC credit card? You can instantly lock or unlock your card right in the app.

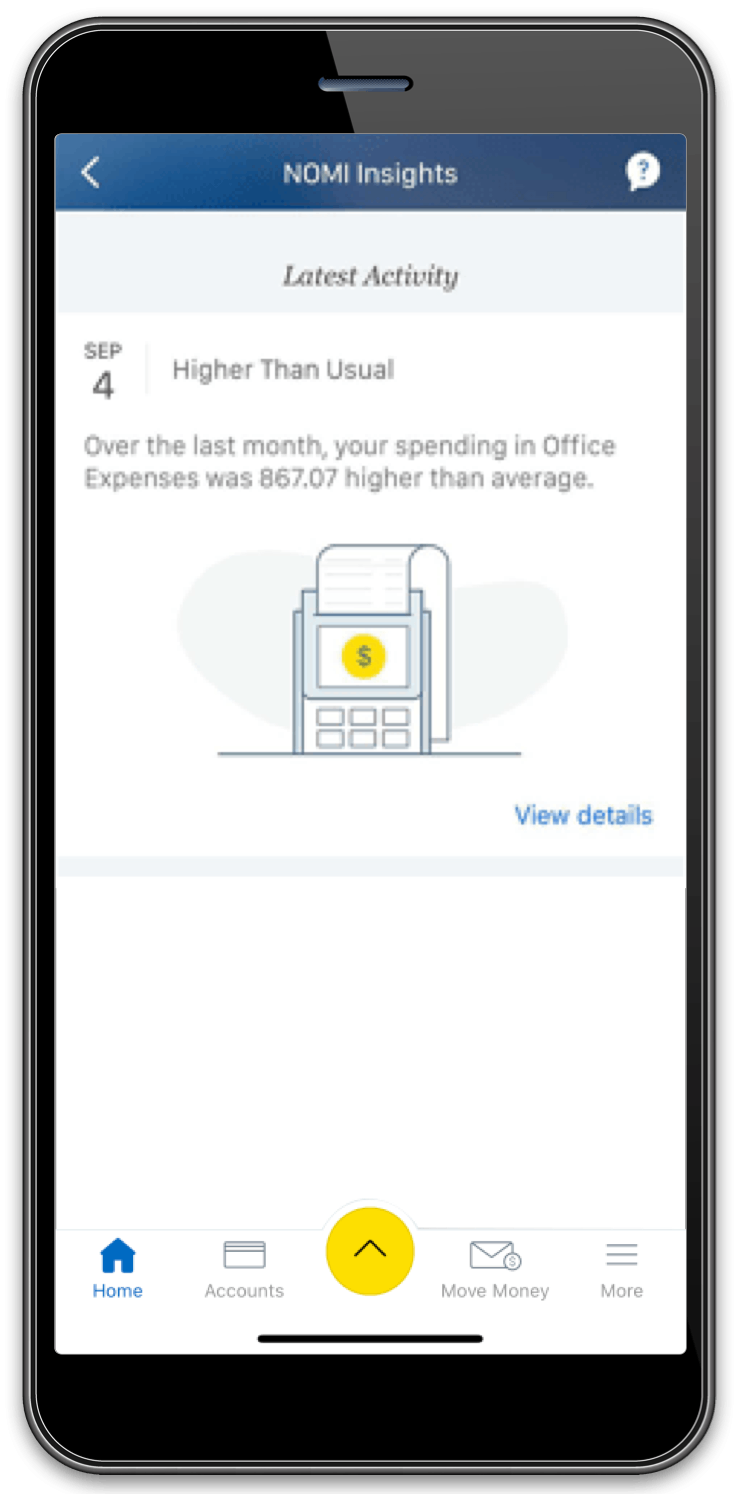

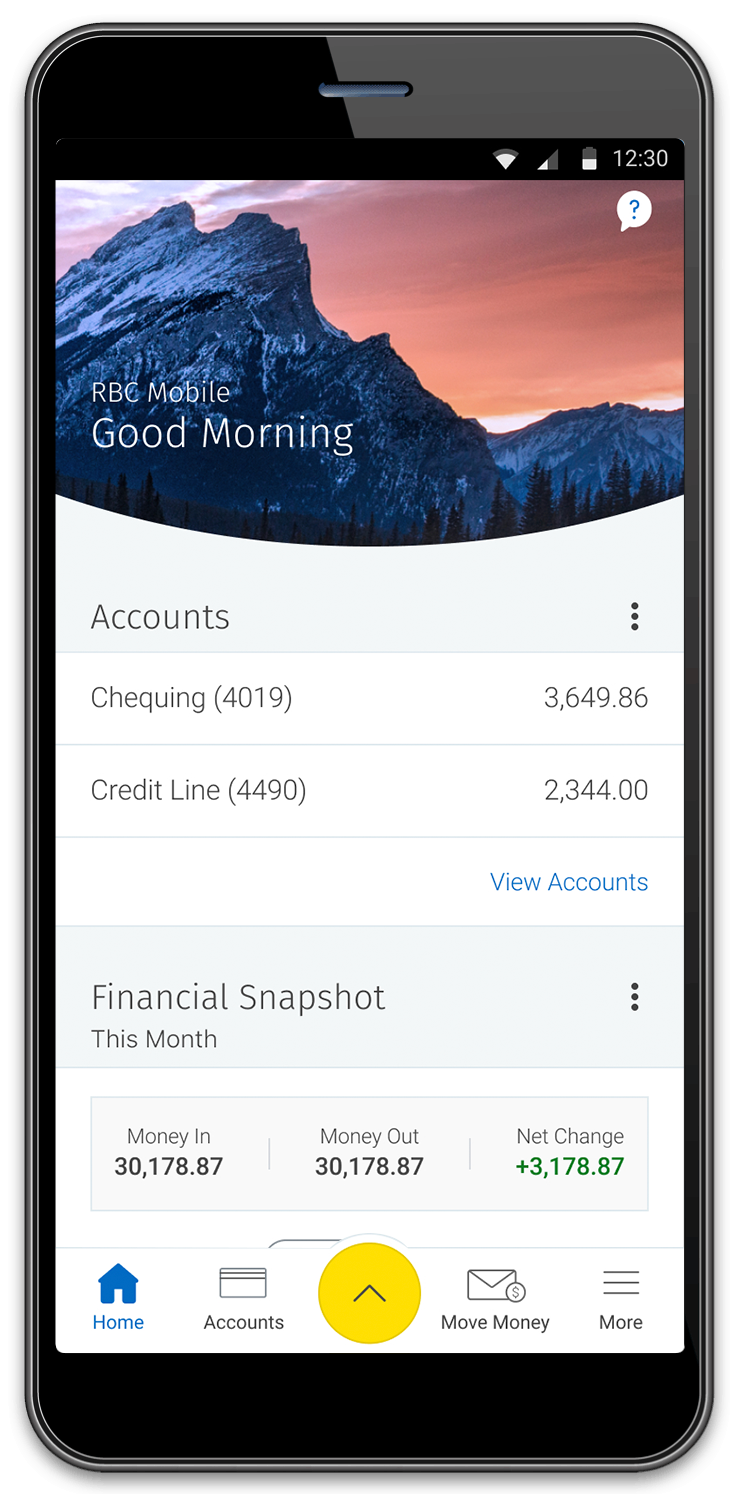

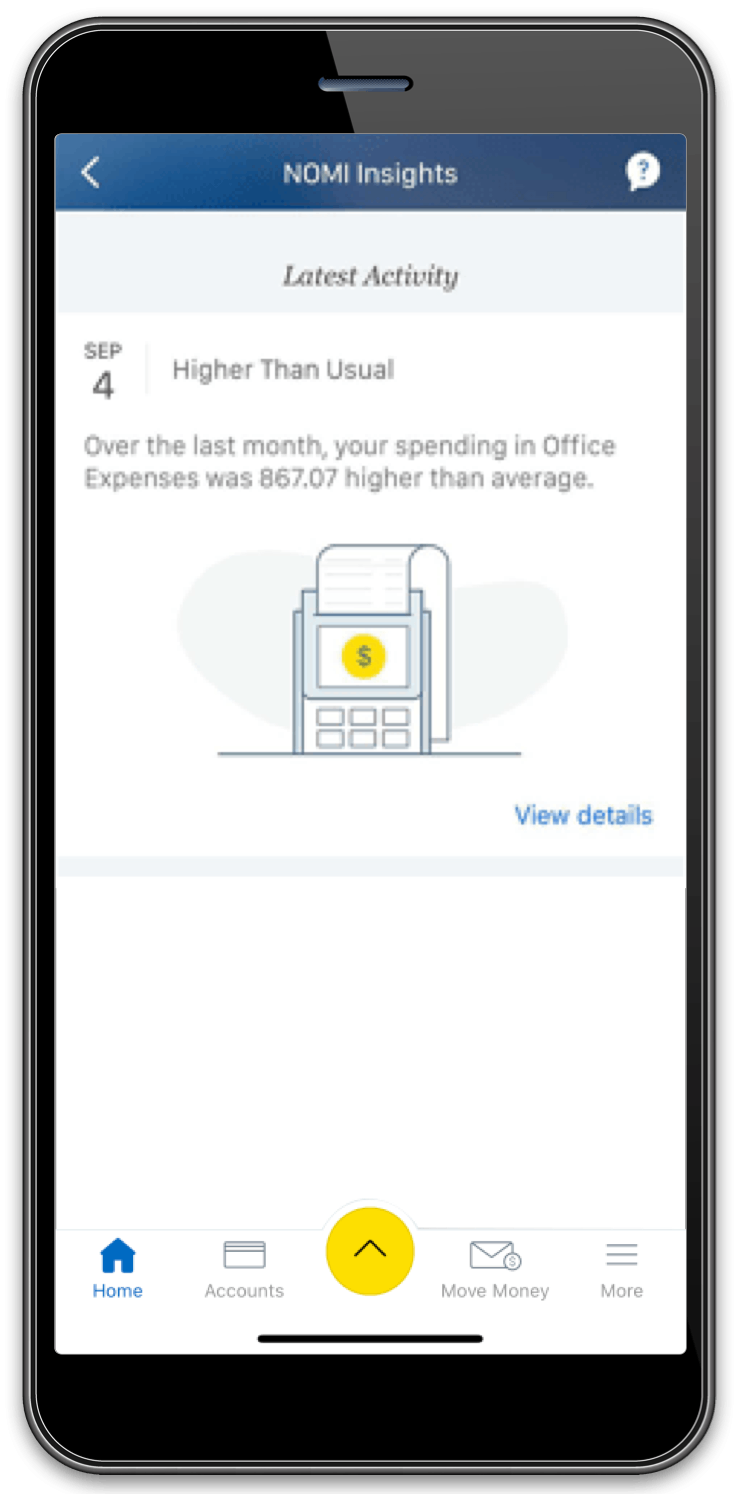

Stay on Top of Your Finances with NOMI

NOMI gives you insights based on your cash flow, helps you save, and keeps you updated so you can make better financial decisions.

Explore NOMI

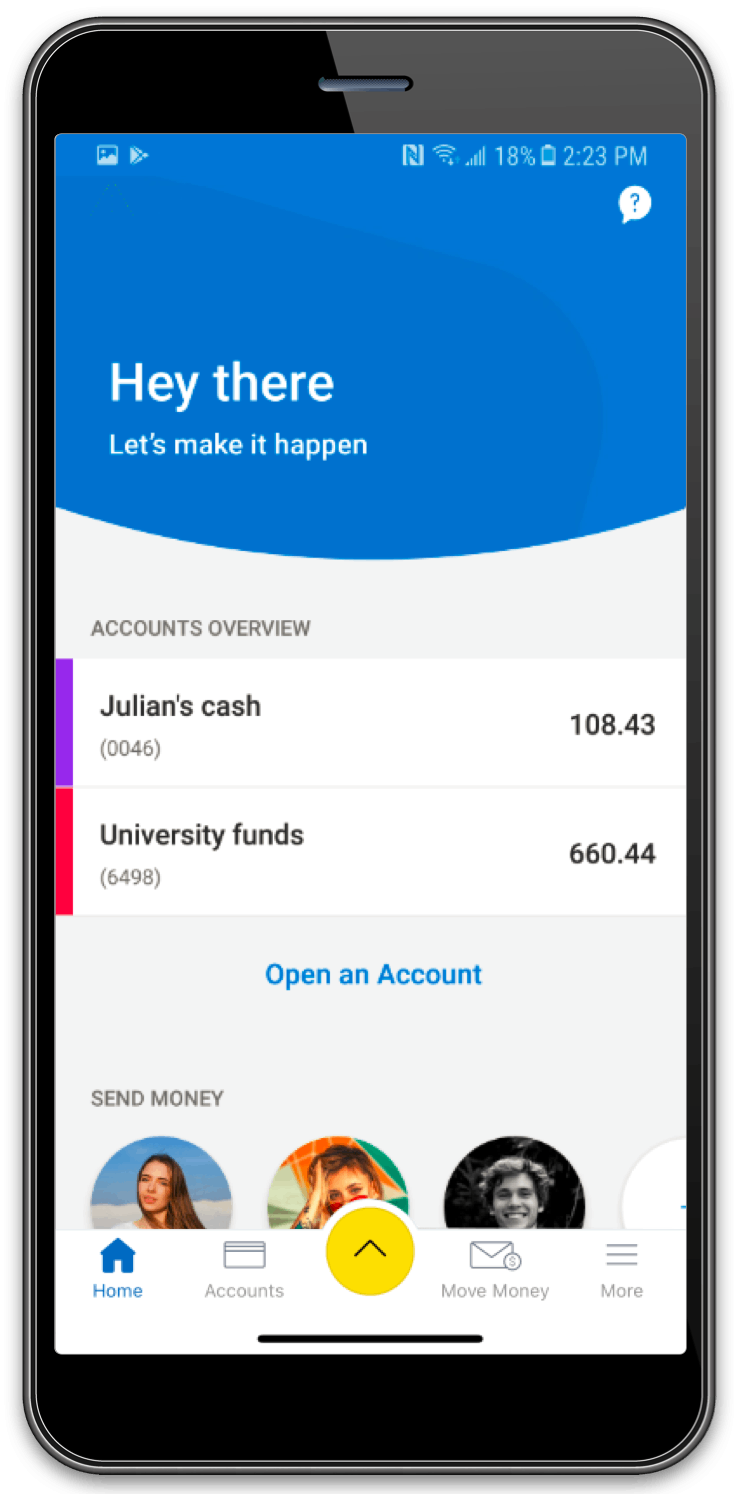

RBC Mobile Student Edition

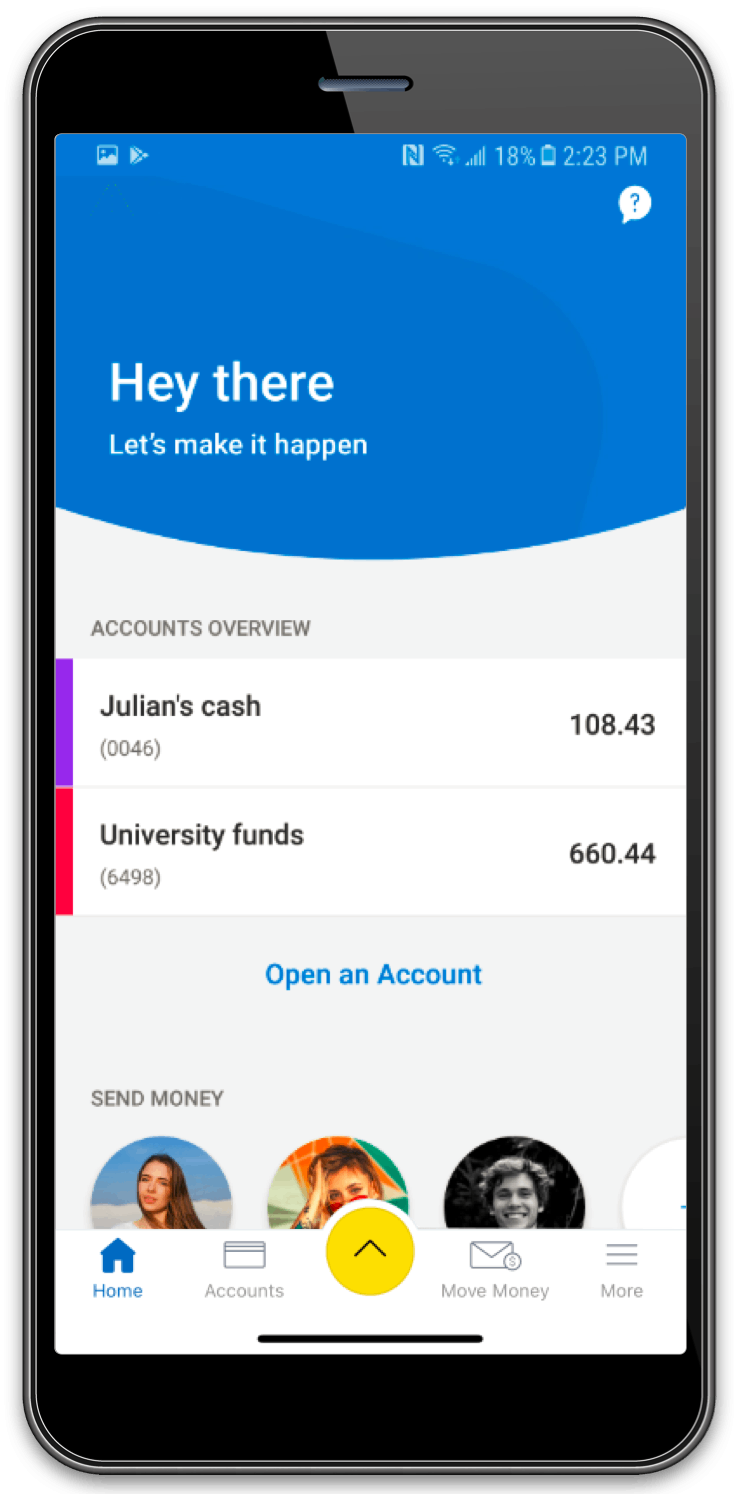

It Gets How You Like to Spend Your Money

Quickly send money to friends and family – Interac e-Transfer is right at your fingertips.

It Gets How You Want to Make it Your Own

Add personality with photos for contacts, a splash of colour and nicknames for accounts.

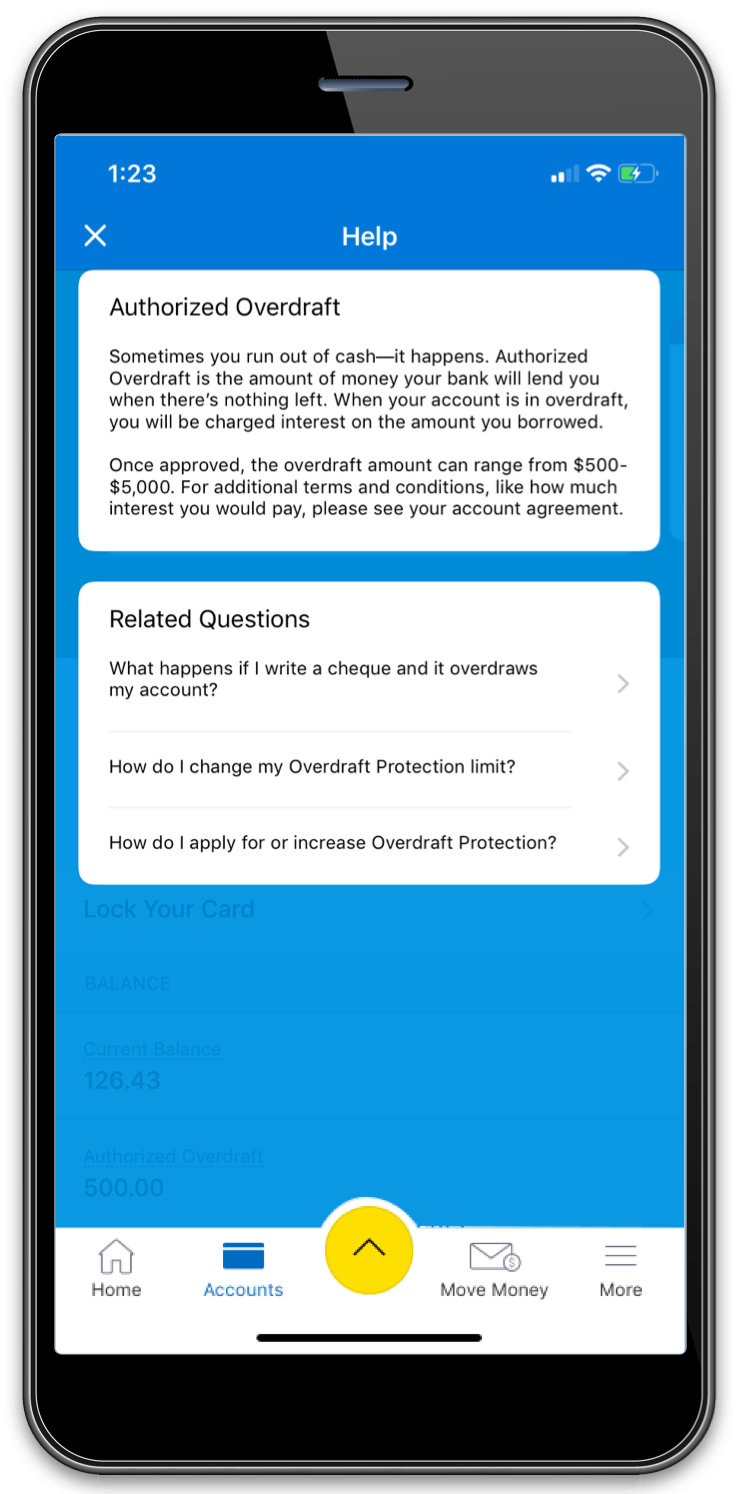

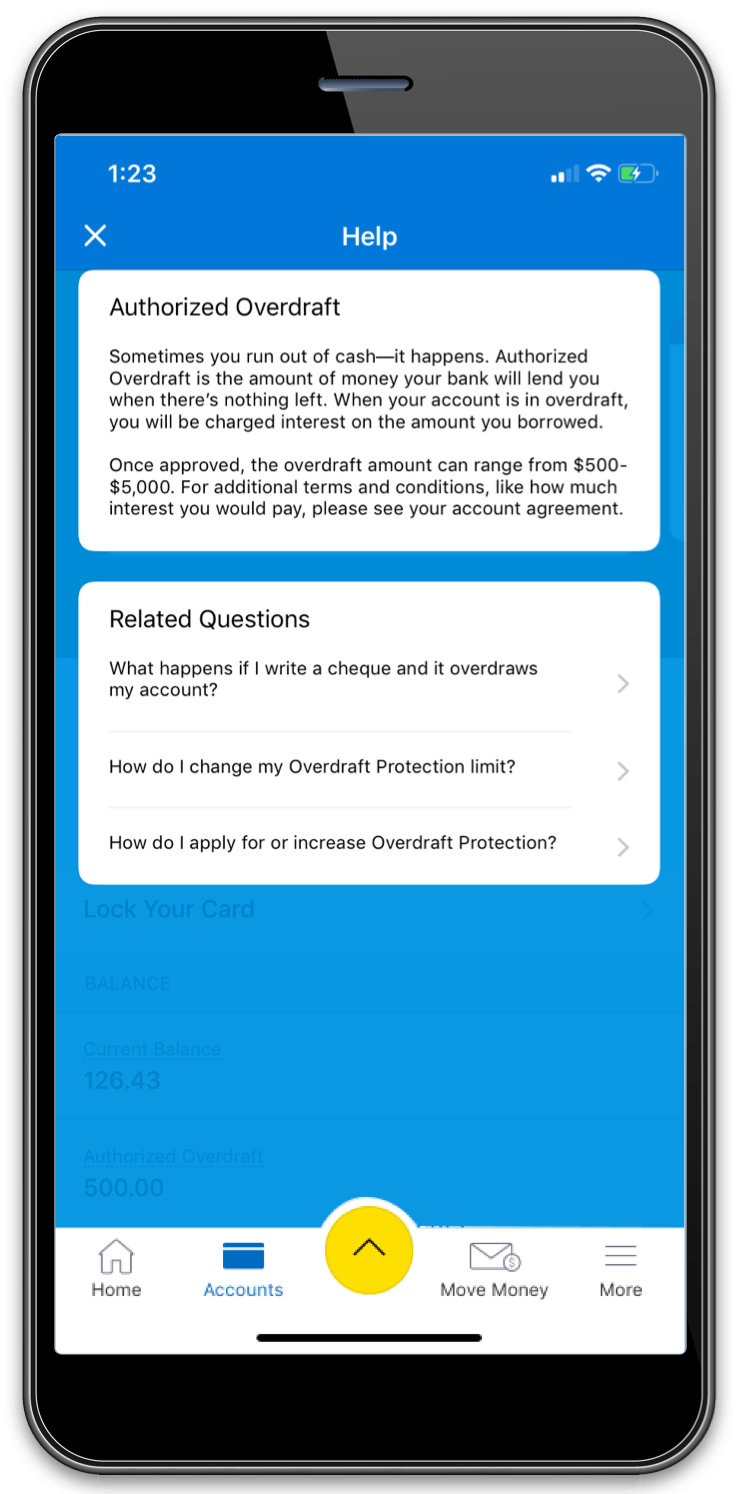

It Gets That Bank Terms Sometimes Need Explaining

Not sure what that banking term means? Tap it to get the definition.

Your Business Financial Picture At-a-Glance

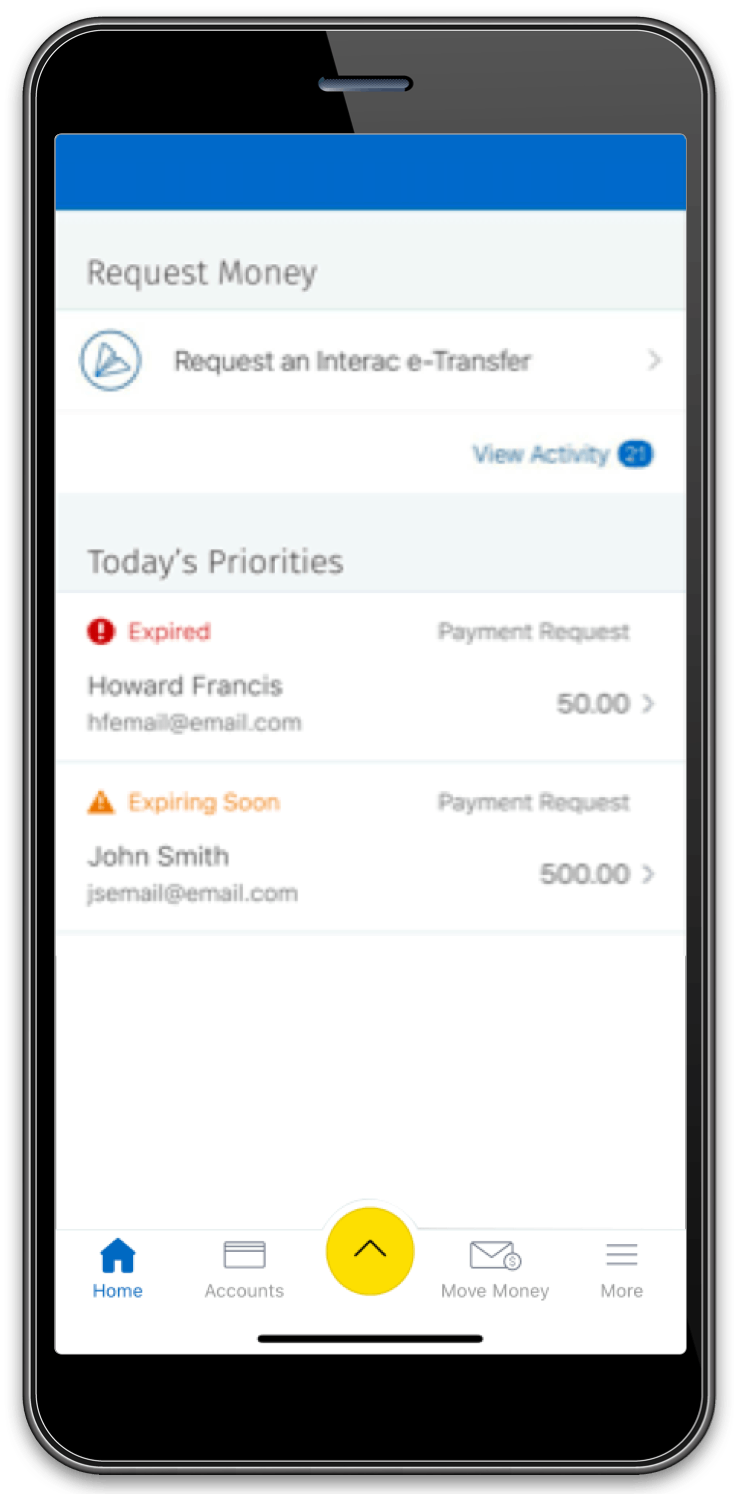

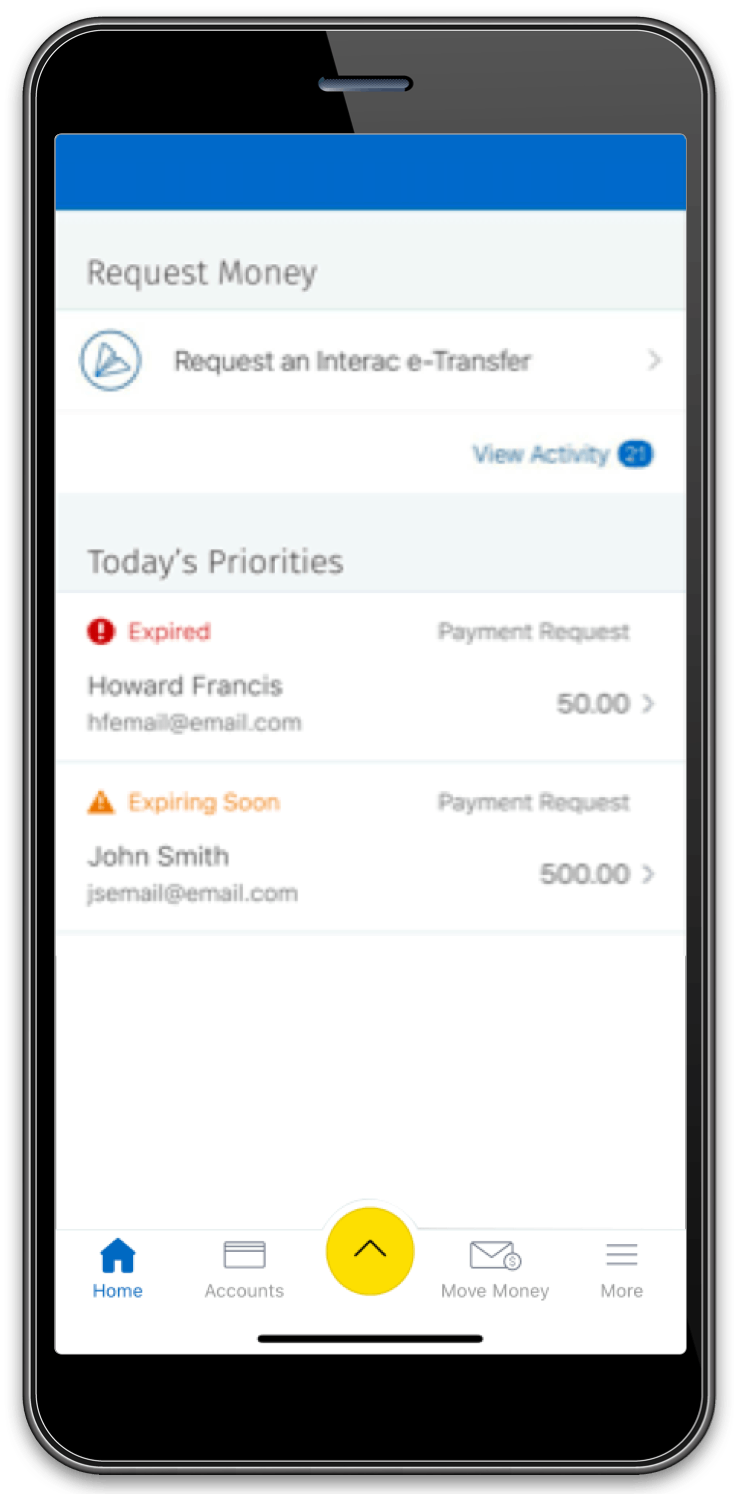

Getting Paid is Easier

Instantly request payments from your customers and receive real-time notifications on outstanding payments.

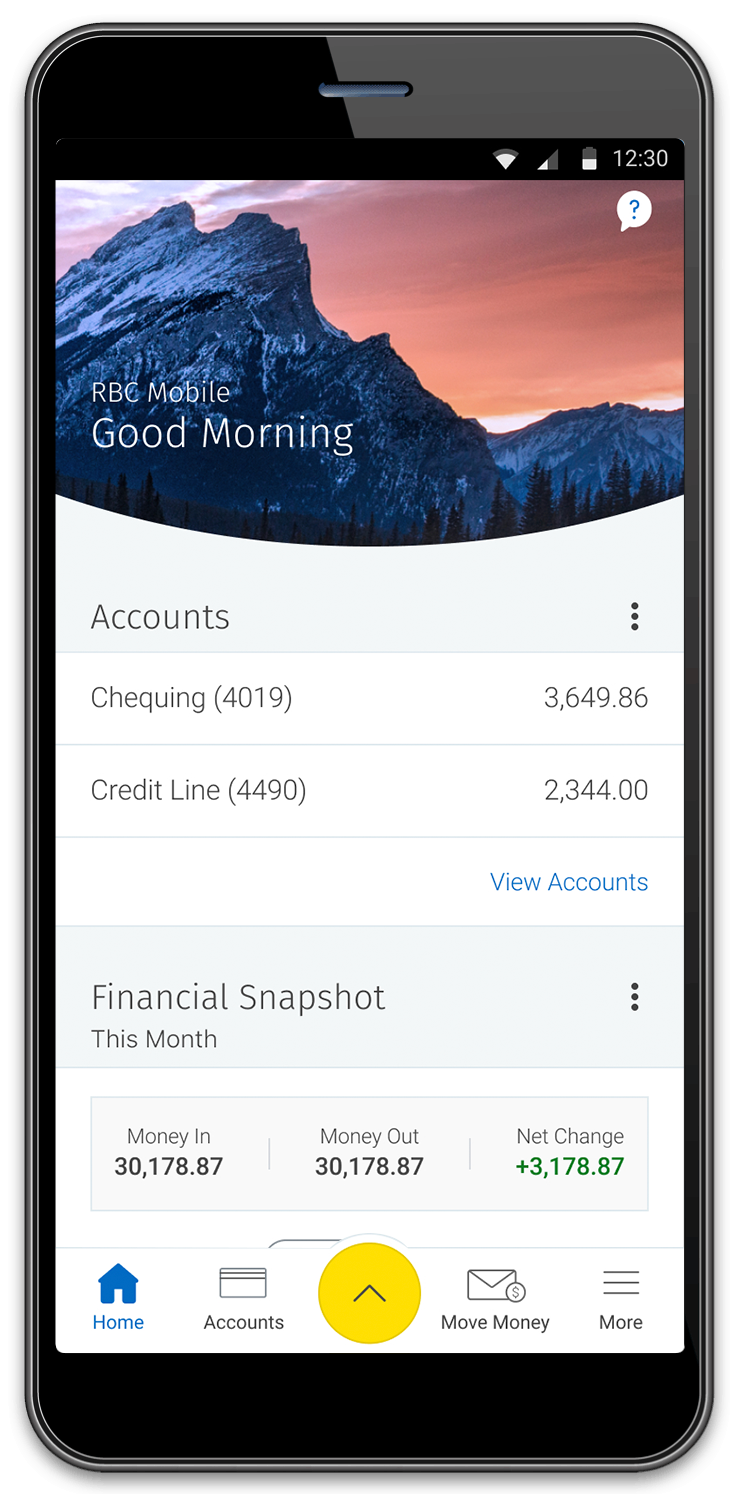

Stay on Top of your Cash Flow

Get a snapshot of the money going in and out of your accounts allowing you to make spending decisions with confidence.

See How your Business is Performing

NOMI helps you take control of your day-to-day finances by keeping track of your spending, telling you when your bills are higher or lower than usual, and providing a cash flow summary.

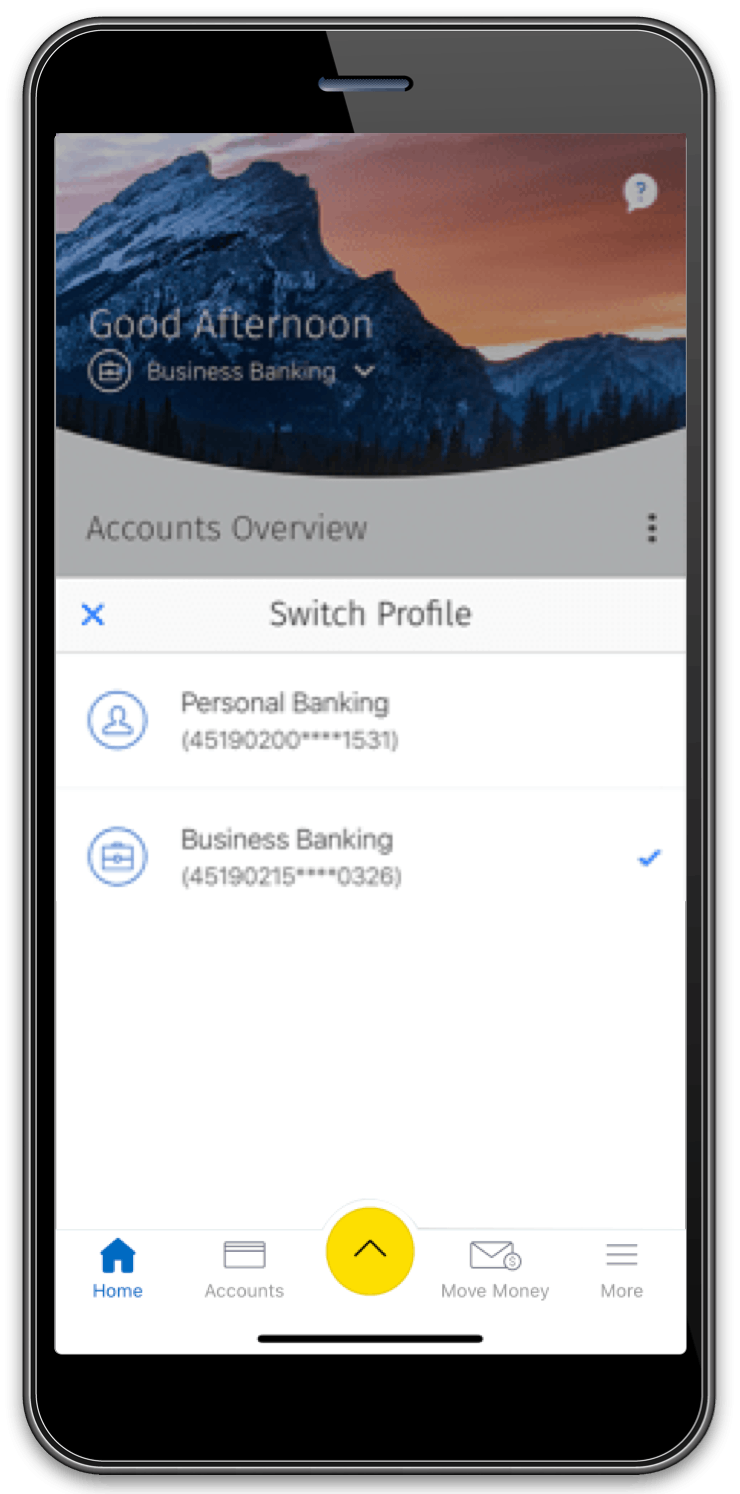

Manage Your Financial Picture

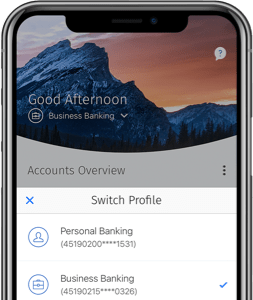

Easily toggle between your business and personal RBC bank accounts within the same app.

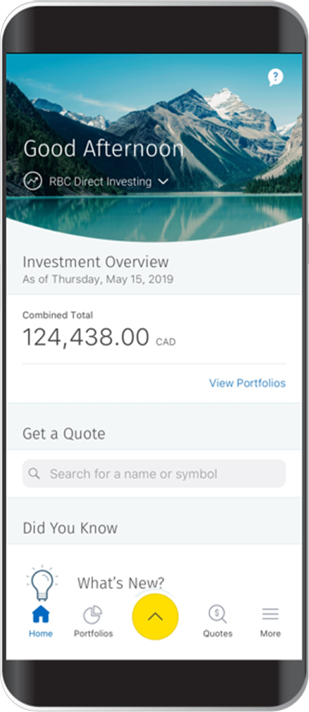

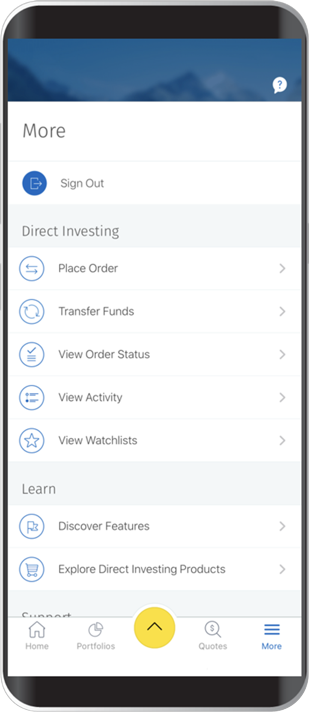

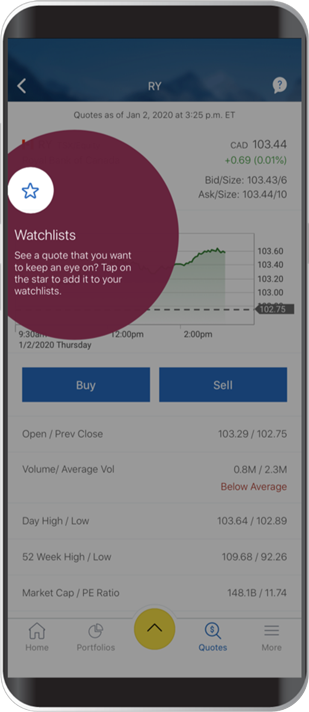

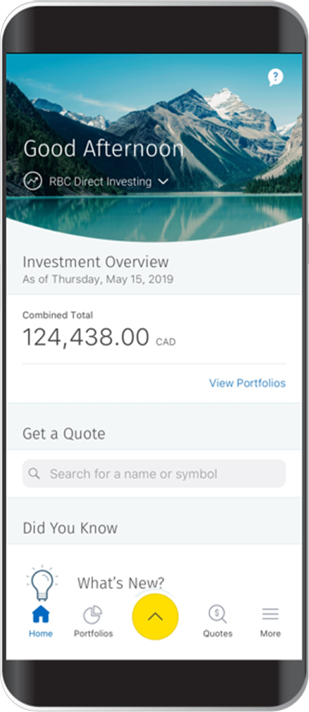

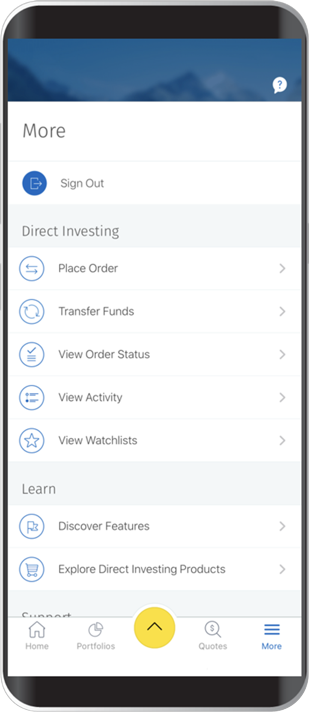

The New and Improved Trading Experience You Deserve

The updated RBC Direct Investing Mobile experience on the RBC Mobile1 app makes it a breeze to evaluate, monitor and take action on your trading strategy.

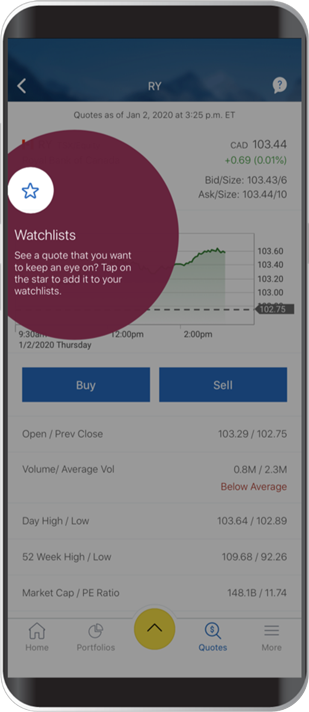

Evaluate Effortlessly

Stay in touch with the markets, look up a stock quote, get the latest information or monitor and add to your watchlist.

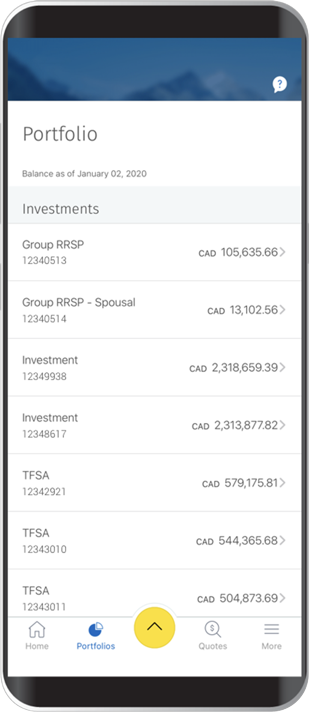

Quickly Monitor Your Investments

Use the improved Homepage as a launch pad to see all your investments, switch between accounts and manage your watchlists.

Act Fast Without Any Hassle

The updated RBC Mobile app gives you the power to take action from every screen, and seamlessly jump to key tasks like trading.

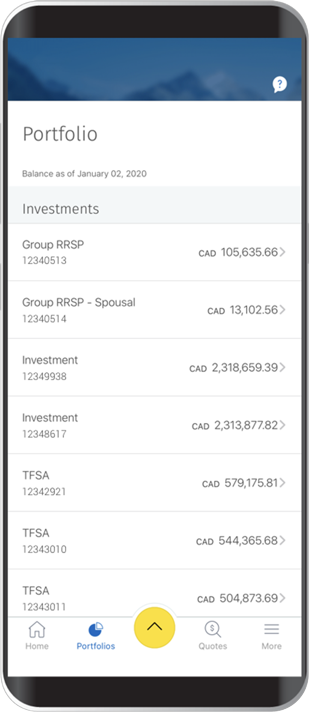

Track Your Progress

See how your investments are performing, drill down into account activity and make adjustments as soon as you need to with Portfolio view.

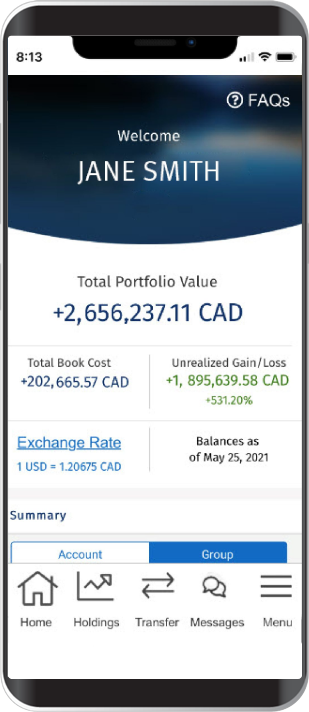

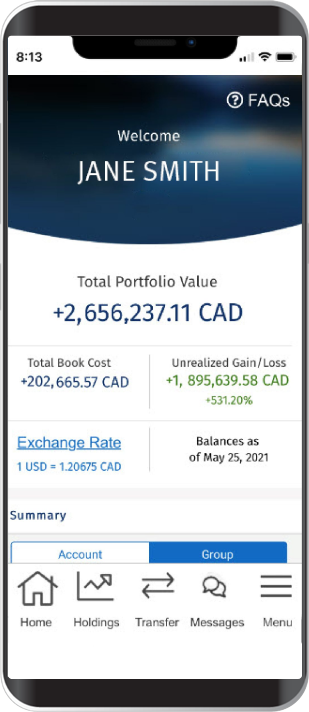

Stay Connected With Your Wealth

The RBC Wealth Management experience on the RBC Mobile app1 is easy to use with all the same great features you can find on your RBC Wealth Management Online website today – only optimized for a smaller screen.

Stay connected and protected

Confidently access your accounts and stay informed on the progress you are making towards your financial goals with a secure mobile experience designed specifically for RBC Dominion Securities, RBC PH&N Investment Counsel and RBC Royal Trust clients.

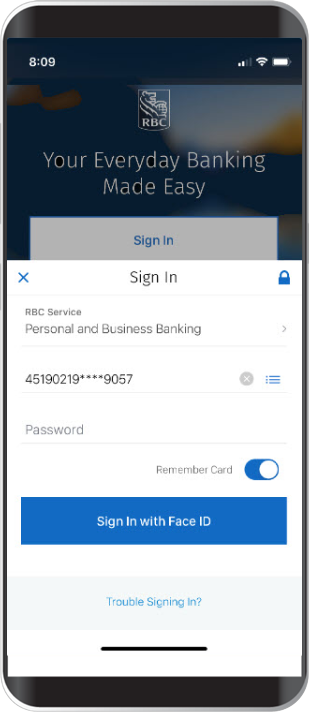

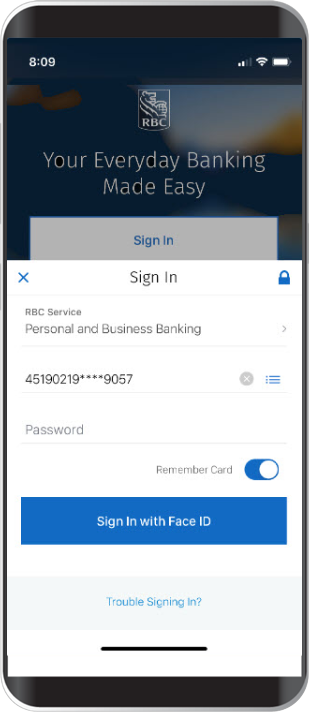

Sign in effortlessly

If you’ve connected your RBC Royal Bank banking and RBC Wealth Management investment accounts, signing in is both safe and easy. Simply sign in using the same user name and password as you do for your RBC Wealth Management Online website today. Plus, make signing into the RBC Mobile app even easier when you set up biometrics, like Touch ID, Face ID or fingerprint authentication, in the app.

Manage your wealth and your finances

Quickly toggle between your various RBC Royal Bank and RBC Wealth Management accounts in real time during regular business hours, share important information with two-way secure messaging and safely transfer funds.

Features You'll Love

Personal Banking

Personalized Support

Your virtual assistant helps you find quick answers or connects you with the right advisor.

Move Money With Ease

Quick acess to the most important tasks on every page at your fingertips.

Be in Control of Your Cards

Misplaced your Client Card or RBC credit card? You can instantly lock or unlock your card right in the app.

Stay on Top of Your Finances with NOMI

NOMI gives you insights based on your cash flow, helps you save, and keeps you updated so you can make better financial decisions.

Explore NOMIRBC Mobile Student Edition

It Gets How You Like to Spend Your Money

Quick acess to the most important tasks on every page at your fingertips.

It Gets How You Want to Make it Your Own

Add personality with photos for contacts, a splash of colour and nicknames for accounts.

It Gets That Bank Terms Sometimes Need Explaining

Not sure what that banking term means? Tap it to get the definition.NNot sure what that banking term means? Tap it to get the definition.

Your Business Financial Picture At-a-Glance

Getting Paid is Easier

Instantly request payments from your customers and receive real-time notifications on outstanding payments.

Stay on Top of your Cash Flow

Get a snapshot of the money going in and out of your accounts allowing you to make spending decisions with confidence.

See How your Business is Performing

NOMI helps you take control of your day-to-day finances by keeping track of your spending, telling you when your bills are higher or lower than usual, and providing a cash flow summary.

Manage Your Financial Picture

Easily toggle between your business and personal RBC bank accounts within the same app.

The New and Improved Trading Experience You Deserve

The updated RBC Direct Investing Mobile experience on the RBC Mobile1 app makes it a breeze to evaluate, monitor and take action on your trading strategy.

Evaluate Effortlessly

Stay in touch with the markets, look up a stock quote, get the latest information or monitor and add to your watchlist.

Quickly Monitor Your Investments

Use the improved Homepage as a launch pad to see all your investments, switch between accounts and manage your watchlists.

Act Fast Without Any Hassle

The updated RBC Mobile app gives you the power to take action from every screen, and seamlessly jump to key tasks like trading.

Track Your Progress

See how your investments are performing, drill down into account activity and make adjustments as soon as you need to with Portfolio view.

Stay Connected With Your Wealth

The RBC Wealth Management experience on the RBC Mobile app1 is easy to use with all the same great features you can find on your RBC Wealth Management Online website today – only optimized for a smaller screen.

Stay connected and protected

Confidently access your accounts and stay informed on the progress you are making towards your financial goals with a secure mobile experience designed specifically for RBC Dominion Securities, RBC PH&N Investment Counsel and RBC Royal Trust clients.

Sign in effortlessly

If you’ve connected your RBC Royal Bank banking and RBC Wealth Management investment accounts, signing in is both safe and easy. Simply sign in using the same user name and password as you do for your RBC Wealth Management Online website today. Plus, make signing into the RBC Mobile app even easier when you set up biometrics, like Touch ID, Face ID or fingerprint authentication, in the app.

Manage your wealth and your finances

Quickly toggle between your various RBC Royal Bank and RBC Wealth Management accounts in real time during regular business hours, share important information with two-way secure messaging and safely transfer funds.

More Great Features & Services

View Up-to-Date Balances Instantly

-

Receive Alerts About Your Account Activity and Upcoming Offers

Learn more about Alerts -

View up to 7 Year’s Worth of Statements

-

Check Your Transactions in Real Time

View Your Daily Transaction Limits

-

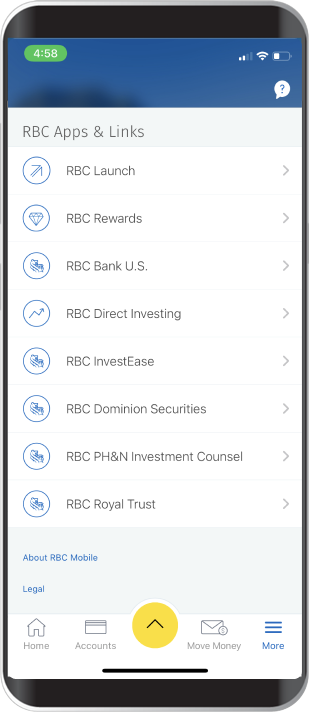

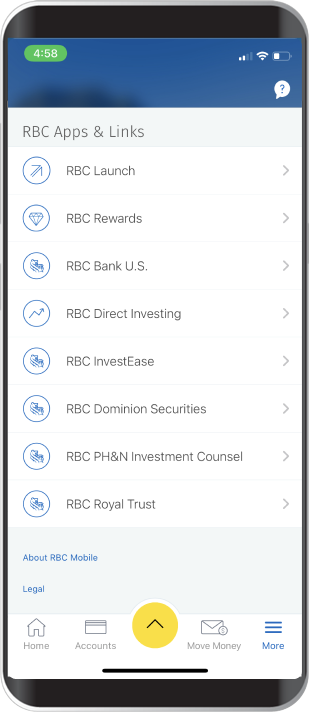

Get Quick Access to Other RBC Apps and Sites

-

Mobile Bill Pay

Snap a photo. Pay your bills. Use the RBC Mobile app to add a payee simply by taking a photo, and pay your bills.

Learn more

-

Easily Transfer Funds Between Your Accounts

-

Send or Request an Interac e-Transfer for Free3, 4

Learn More -

Send Money to Almost Anywhere in the World

International Money Transfers Transfer Money Cross-Border

Pay Current and Future Bills

Deposit a Cheque by Taking a Photo

-

Send Money Using Voice Command

Discover Siri for RBC Mobile Send Money to Another RBC Client

-

Customize Your View and Account Names

Open a New Account or Credit Card

-

Schedule a Call or Book an Appointment

Sign In Using Biometrics

-

View Your Account Balances Without Signing In

-

Link your RBC Personal Banking, Business Banking or Direct Investing profiles

Find an RBC Branch or ATM

-

Register for Interac e-Transfer Autodeposit

Link to Your Petro-Points Card

-

Update Your Address and Contact Details

Android

- Supports RBC Mobile app Android version 4.38 or later.

- Compatible with Android phones operating on OS 10 or later.

- Android Tablets are not supported.

iPhone, iPad and iPod Touch

-

Supports RBC Mobile app iOS version 6.38 or later.

Requires iOS 16.4+ or later.

-

Siri for RBC Mobile requires iOS 16.4+.

-

Widget for Account Preview no longer compatible on iOS 18+.

The RBC Mobile app is supported on Android and iOS in the following countries:

- Canada

- United States

- United Kingdom

-

European Union:

- Austria

- Belgium

- Bulgaria

- Croatia

- Republic of Cyprus

- Czech Republic

- Denmark

- Estonia

- Finland

- France

- Germany

- Greece

- Hungary

- Ireland

- Italy

- Latvia

- Lithuania

- Luxembourg

- Malta

- Netherlands

- Poland

- Portugal

- Romania

- Slovakia

- Slovenia

- Spain

- Sweden

- China

- India

- Philippines

- Hong Kong

- Singapore

- Malaysia

- UAE

- Taiwan

- Australia

- New Zealand

Security Guarantee

We’ll fully reimburse you for any unauthorized transactions2 made through the RBC Mobile app.

Learn More

RBC Online Banking is provided by Royal Bank of Canada. RBC Mobile is operated by Royal Bank of Canada, RBC Direct Investing Inc. and RBC Dominion Securities Inc. RBC Canada, RBC Wallet, Avion Rewards and RBC eGift are operated by Royal Bank of Canada.

For a definition of an unauthorized transaction and for full details regarding the protections and limitations of the RBC Digital Banking Security Guarantee, please see your Electronic Access Agreement and your Client Card Agreement for personal banking clients, and the Master Client Agreement for business clients. This guarantee is given by Royal Bank of Canada in connection with its Online and Mobile Banking services. Cardholders are not liable for losses resulting from circumstances beyond their control provided they have taken reasonable precautions to protect their Client Card and PIN (if applicable) as set out in the Client Card Agreement. Formerly known as the RBC Online Banking Security Guarantee.

There is a limit of 999 free Interac e-Transfer Transactions per Month per Account; for every Interac e-Transfer Transaction over the limit, you will be charged $1.00.

Interac-Transfer Transactions expire 30 days after they are sent and cannot be claimed by the recipient after this time. You have 15 days after the Interac e-Transfer Transaction is sent to cancel without charge. A $5.00 Interac e-Transfer Transaction Reclaim Fee is charged when a recipient does not accept it before it expires and the sender does not cancel the transaction before the 15-day cancellation period.