Timing your Registered Retirement Income Fund (RRIF) conversion is very important as this decision can impact the amount of taxes you pay and your government benefits.

You must convert your Registered Retirement Savings Plan (RRSP) to a RRIF or an annuity—or cash it out (not typically recommended)—by December 31 of the year you turn 71. You can also make the switch before then if you need the income.

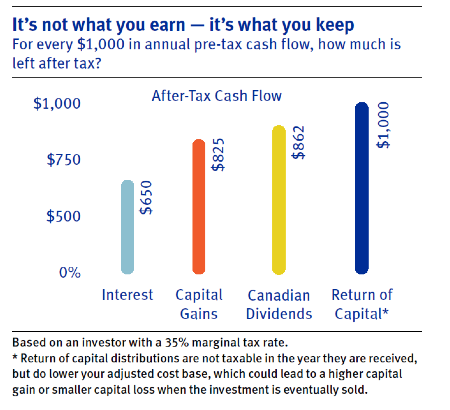

Since RRIF payments are considered taxable income in the year you take the money out, these amounts are added to your “other income” for tax purposes. Once you convert to a RRIF, you have to withdraw a minimum amount each year and that money will be taxed. Your withdrawals can also reduce certain government benefits such as Old Age Security (OAS).

For help knowing when to convert your RRSP, talk to an RBC Financial Planner. He or she can help you understand your options and suggest strategies to help you make the most of your income.