Offer available February 3, 2026- June 1, 2026 (“Promotional Period”)

This offer is available to any Eligible Student Client without a Personal Banking Account with Royal Bank of Canada at the beginning of the Promotional Period or in the three-year period before the start of the Promotional Period, and who otherwise complies with the Terms of the Promotional offer. The Bonus Offer is $100 with an Eligible Personal Banking Account.

To qualify for the $100 you must open your first new Eligible Personal Banking Account by 9:00 PM EST on June 1, 2026 and complete two of the following Qualifying Criteria by 9:00 PM EST on August 10, 2026 using your Eligible Personal Banking Account:

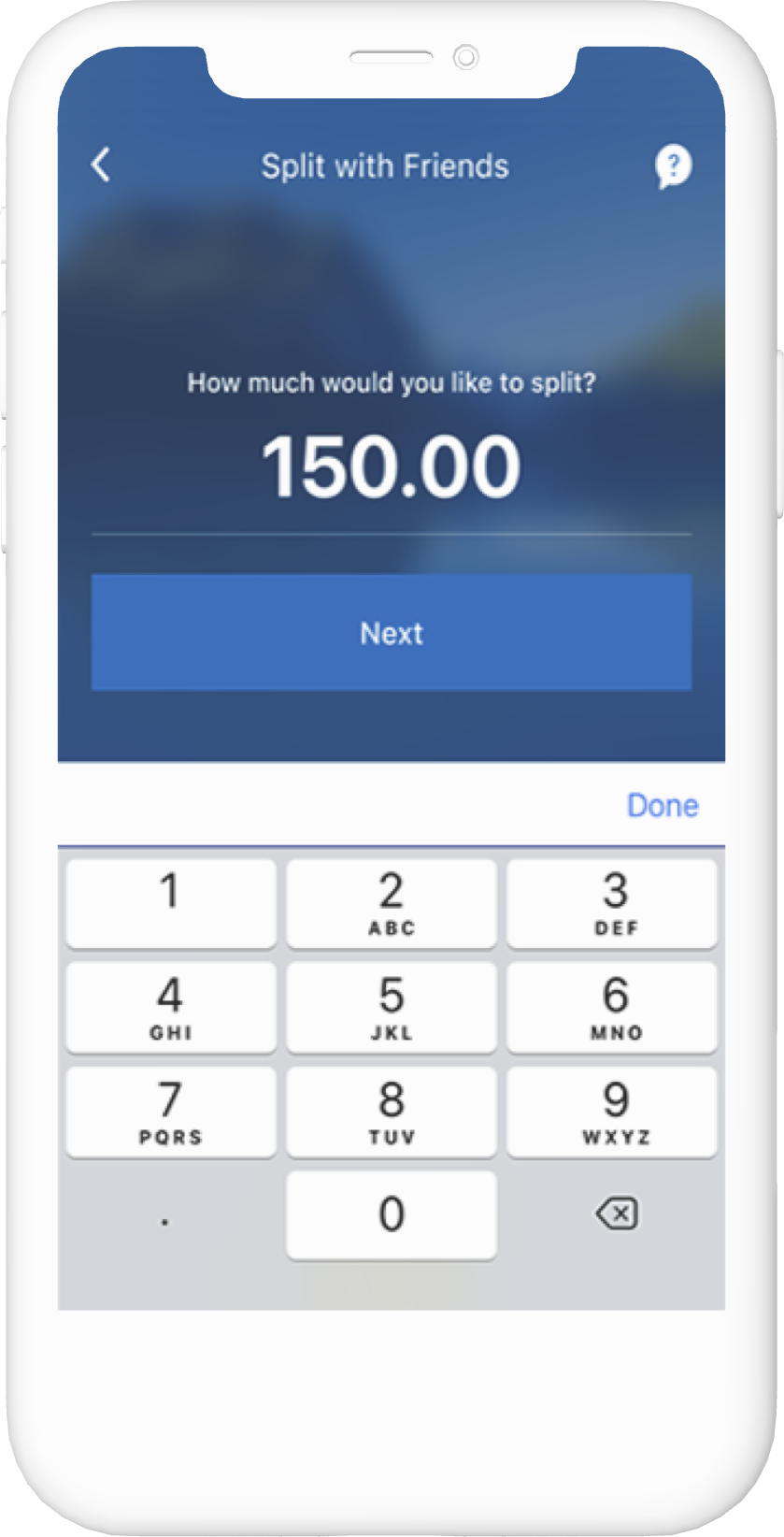

i. Register your Eligible Personal Banking Account for Interac Autodeposit and send or receive one (1) e-Transfer using RBC Online Banking or the RBC Mobile app.

ii. Request and obtain an RBC Virtual Visa Debit card and make at least one (1) Qualifying Debit Transaction (as defined in the Note section below) with your Eligible Personal Banking Account.

iii. Transfer the full amount of your automated and recurring payroll direct deposit to your new Eligible Personal Banking Account. For greater certainty, this means that you will not qualify if you split your payroll deposit from one employer between your new Eligible Personal Banking Account and any other account. We reserve the right to determine what is considered payroll and whether any payroll deposit has been split. The first payment of each PAP must be debited and must clear from your new Eligible Personal Banking Account by 9:00 PM Eastern Time August 10, 2026.

iv. Set up one (1) pre-authorized monthly payment (“PAP”) – such as a pre-authorized eligible bill payment to a service provider (i.e. utility bill, gym membership) or pre-authorized payment to an RBC mortgage, loan, Royal Credit Line, or contribution to your RBC investment account – from your new Eligible Personal Banking Account. PLEASE NOTE: Any bill payments (pre-authorized or otherwise) made using a Virtual Visa Debit will not qualify. The first payment of each PAP must be debited and must clear from your new Eligible Personal Banking Account by 9:00 PM Eastern Time August 10, 2026.

v. Make one (1) eligible bill payment to a service provider from your new Eligible Personal Banking Account. PLEASE NOTE: To qualify, the eligible bill payment must be completed through the RBC Mobile app or RBC Online Banking. Excludes any bill payment made in-person at an RBC Royal Bank branch with an RBC Advisor, and any bill payment made to an RBC credit card account, and any bill payment made using RBC Virtual Visa Debit. The eligible bill payment must be debited and must clear from your new Eligible Personal Banking Account by 9:00 PM Eastern Time August 10, 2026.

NOTE: Qualifying Debit Transactions are defined as Bill Payments or purchase transaction using any of the following: your RBC Client Card, an RBC Virtual Visa Debit card associated with your Eligible Personal Banking Account, Interac Flash, Apple Pay, Google Pay, Samsung Pay Transactions carried out at an RBC Royal Bank branch or through the RBC Royal Bank ATM network, and bank fee transactions, are not included as qualifying transactions.

NOTE: You must be at least 14 years of age to obtain an RBC Virtual Visa Debit card. As such, option ii. (above) is only available to individuals who meet this minimum age requirement; if you are below the age of 14 and participate in this Promotional Offer, you must select one of the other eligible transaction types described.

The $100 cash component of the Promotional Offer will be deposited into your Eligible Personal Banking Account within 4 to 10 weeks of completing the Qualifying Criteria, if applicable. Royal Bank of Canada may follow up with Eligible Student Clients to remind them to complete the Qualifying Criteria.

This offer may not be combined or used in conjunction with any other Personal Banking Account offers. Royal Bank of Canada reserves the right to withdraw this offer at any time without notice, even after acceptance by you. For full details including defined terms visit rbc.com/offerterms100.