Tips to Help You Save for a Child’s Post-Secondary Education

Students starting university in 2032 can expect a 4-year education to cost about $115,315.1 While that’s a big number, don’t be discouraged.

Check out our top savings tips based on when your child will be starting school:

My Child Will Start School in:

How much are you willing to cover?

If you feel overwhelmed by the thought of saving enough for your child to get a 4-year degree—remember, you don’t have to foot the entire bill.

- Let your child have some “skin in the game” through student loans or by working and saving. This could cover 25-50% of the costs and help your child gain valuable work experience.

- Look into grants, scholarships or bursaries your child is eligible for.

- Explore co-op or internship programs that allow students to earn money and work experience while they study.

Open an RESP now.

Open a Registered Education Savings Plan (RESP) as early as possible, even if you have to start small. Here’s why:

- Your money will have more time to grow—tax-free. And, because it is sheltered from tax, it could grow faster.

- The government will match 20% on the first $2,500 you contribute annually to an RESP ($500 maximum per year) through the Canada Education Savings Grant (CESG). Check out RESP grants and bonds.

Turn saving into a habit.

Put your savings on auto-pilot and grow your money faster by setting up regular (weekly, monthly, etc.), automatic contributions into your child’s RESP.

- You decide how much to save and how often—weekly, bi-weekly, monthly—it’s up to you

- Contributions are automatically debited from your bank account (at RBC or another financial institution)

- You can change how much you want to save, how often you contribute, and stop or pause your contributions at any time

Tip: Set your automatic contributions to coincide with every paycheque.

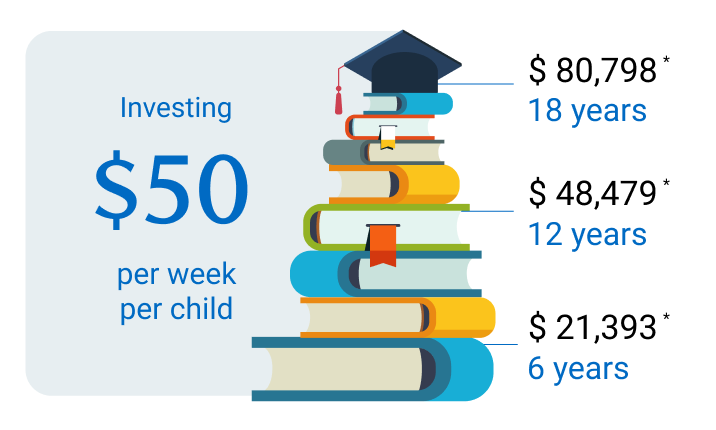

Putting just $50 per week in an RESP adds up quickly:

Calculations are for illustrative purposes only and are not intended to reflect future values or returns on investment from any mutual fund investment. Based on 6.26% average annualized and includes Canada Education Savings Grant (CESG) payments.

Make saving a team effort.

Instead of another toy, suggest that family and friends give RBC RESP Gift Cheques on birthdays and other special occasions.

Yes, a child can have multiple RESPs. However, the lifetime limit on total contributions for one beneficiary is $50,000. This limit applies to the total contributions made by all subscribers to all plans in the name of the beneficiary. So, if you contribute to an RESP for your child, and their grandparents also contribute to another RESP for them, you will need to coordinate contributions so you don’t exceed $50,000. (Over-contributions are subject to a penalty of 1% per month.) It’s worth noting that you can contribute to an RESP for up to 31 years and the plan can remain open for a maximum of 35 years.

A Family RESP lets you name one or more beneficiaries and earmark payments based on what works best for your family.

- Each beneficiary has to be related to you (the RESP subscriber) by blood or adoption, and can include a child, grandchild, step-child or sibling.

- Funds in the RESP do not have to be shared equally among beneficiaries, giving you more flexibility when it comes to making withdrawals.

Get started—and stay on track—with free tools.

If you’re an RBC client, you’ve also got access to free tools that can get you started with saving and help you stay on track:

- A quick way to start saving for a child’s education is with the help of NOMI Find & Save. It’s a digital savings account that learns your transaction patterns, finds extra dollars in your cash flow and automatically moves them to savings. Turn on NOMI Find & Save in the RBC Mobile app.

- MyAdvisor is a digital service that makes the heavy lifting of saving for a child’s education—and other goals—easier.

MyAdvisor is a digital service that combines interactive planning tools and advice from a live advisor to help you stay on top of your savings goals. It’s exclusive to RBC clients, easy to use and available to you at no extra cost.

- See what you have with more certainty. MyAdvisor shows you how you’re doing with powerful visuals and forecasts of your goals, net worth and cash flow.

- Link outside accounts for a complete picture. Have savings and investments outside of RBC? MyAdvisor lets you quickly link them for an up-to-date look at your money.

- Receive personalized advice. Meet with a live advisor through video chat, by phone or in person to review your savings plan, talk strategy or to simply ask a question.

- Stay on track toward your goal with email alerts. Progress alerts let you know whether you need to adjust the amount you are saving in order to reach your goal.

- Get started in a few simple, hassle-free steps. In minutes, you’ll have an idea of where you stand, see recommendations to help you grow your savings, and be able to book a one-on-one with an advisor.

Sign in to RBC Online Banking and try MyAdvisor today.

FAQs on Saving for a Child’s Education

With tuition fees and other expenses spiralling upward, it’s predicted that in 2032 a student’s annual average expenses including tuition fees, books, shelter, food and transportation will be $27,951.1

You can open a Registered Education Savings Plan (RESP) for any “beneficiary”—your child, grandchild, niece, nephew or family friend. Each beneficiary must be a Canadian resident and have a Social Insurance Number (SIN).

While you can contribute any amount to an RESP, there is a lifetime limit of $50,000 per beneficiary. Contributions are not tax-deductible (they won’t reduce your taxable income in the year you contribute); however, investment earnings grow tax-free. The Canadian government and some provinces and territories also offer grants, bonds and incentives to help build the savings even faster.

Within an RESP, you can hold Guaranteed Investment Certificates (GICs), mutual funds, exchange-traded funds (ETFs), savings deposits, stocks and bonds. (Your specific choices depend on where you invest.)

Once a student has enrolled in a qualifying post-secondary education or training program, the investment income, grants and bonds within the RESP can be paid out as Educational Assistance Payments (EAPs). The student must claim these as income in the year that they are taken out. Usually, this results in little or no tax since students tend to be in a very low tax bracket and can claim tax credits. Original contribution amounts to the RESP can be taken out tax-free.

The Registered Education Savings Plan (RESP) is a tax-sheltered plan that helps you save for a child’s post-secondary education. While contributions to the plan are not tax-deductible (these amounts won’t reduce your taxable income in the year you make the contributions), your investment earnings within the RESP grow tax-free.

When the child takes the money out for their education, the money withdrawn is taxed in the student’s hands, often resulting in little or no tax. Read more about RESP Rules and Contribution Limits.

In addition to the tax benefits of an RESP, government grants, bonds and incentives may also be available to help build the child’s education savings even faster.

Yes! You can use a Tax-Free Savings Account (TFSA) to save for anything, including your child’s post-secondary education.

Just keep in mind that amounts you contribute to a TFSA are not eligible for the Canada Education Savings Grant (CESG) or other government incentives. However, both earnings and withdrawals in your TFSA are tax-free. You can make withdrawals and pay your child’s school fees directly or give the money to your child.

You can also save for your child’s education in a high interest savings account. It gives you maximum control and flexibility, but any investment income you earn will be taxable in your hands in the year you earn it. This means you could miss out on the benefit of tax-deferred growth.

Want Help Deciding How to Invest? Let’s Connect.

Talk to an advisor for one-on-one investment advice, help making a plan and more.

Things our lawyers want you to knowThings our lawyers want you to know