RBC.com | Français |  | Contact Us | Site Map | Sign In

| Contact Us | Site Map | Sign In

[an error occurred while processing this directive]

Ways to Use Your Tax-Free Savings Account (TFSA)

Everyone has different reasons for saving and investing. But no matter what your goals are, you may be able to realize them sooner with a Tax-Free Savings Account.

Below are just a few of the ways you could use your TFSA. For strategies and advice specific to your own situation and goals, talk to an RBC® advisor.

- Reduce Your Taxes

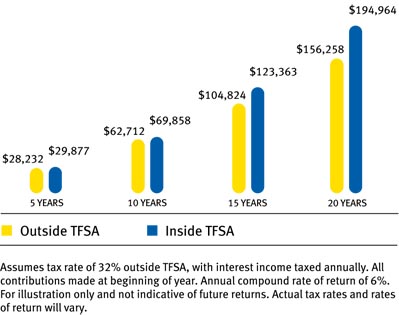

If you currently earn interest or other investment income in taxable accounts, consider moving those funds into a TFSA instead. The income you earn will be tax-free, helping your money grow faster (see chart below). - Save for a Specific Goal

You can withdraw funds from your TFSA whenever you want (depending on what you’ve invested in), to use for multiple purposes. This makes a TFSA ideal for both your short- and long-term investment goals. For example, you could save to purchase a new car, renovate your home, buy a new home, start a small business, take a vacation, build an emergency fund and more. - Save for Retirement

If you have maximized your Registered Retirement Savings Plan (RRSP) contribution room, use a TFSA to complement your RRSP. A TFSA gives you a second source of funds in retirement that you can withdraw at any time without tax consequences. You can also earn tax-free returns even if you don’t have the earned income required to make an RRSP contribution. And you can contribute at any age once you become an adult. - Save During Retirement

If you have a Registered Retirement Income Fund (RRIF), you are required to withdraw a minimum amount every year. If you don’t need all of your RRIF withdrawal or pension income to cover your living expenses, you can contribute the excess to a TFSA where your funds can enjoy tax-free compound growth. - Split Income with Your Spouse or Partner

You can give funds to your spouse or common-law partner, who can then use them to contribute to his or her own TFSA. This can help to equalize your future incomes and has the potential to lower your family's overall tax bill. Returns earned inside the account are not attributed back to you so there is no tax consequence to either you or your spouse while the funds remain within the TFSA. Just note that the money in your spouse's TFSA belongs to your spouse. - Maintain Eligibility for Government Programs

TFSA earnings and withdrawals are not included as income for tax purposes, so they don’t affect your eligibility for income-tested government benefits and tax credits like Old Age Security (OAS) or the Goods and Services Tax (GST) credit.

Tax-Free Savings can add up faster

The chart below shows how $5,000 contributed annually, earning 6% interest per year can grow within a TFSA vs. outside of a TFSA.

Start Investing Today!

An RBC advisor will work with you to develop an investment plan specifically tailored to your goals.

your TFSA |

RBC® advisor at your local branch. |

Information about the Tax-Free Savings Account is based on what is currently available from the Canadian government and can be subject to change.