RBC No Monthly Fee Account Offer

How to Get No Monthly Fee Banking for a Year

Open the RBC Day to Day Banking account by March 31, 2026, and enjoy no monthly fee for 1 yearLegal Disclaimer1!

The Essentials

RBC Day to Day Banking account

12 Free Debits

of any kind per month,

$1.25 each thereafter

Unlimited InteracLegal Disclaimer‡ e-transfersLegal Disclaimer2,Legal Disclaimer3,

Public TransitLegal Disclaimer4, and Virtual

Visa DebitLegal Disclaimer5 transitions

Save 3¢/LLegal Disclaimer6

on gas at Petro-Canada

No minimum

balance

needed to get the

no monthly fee offerLegal Disclaimer1

12 Free Debits

of any kind per month, $1.25 each thereafter

Unlimited Interac Legal Disclaimer‡ e-transfers Legal Disclaimer2,Legal Disclaimer3,

Public TransitLegal Disclaimer4, and Virtual

Visa DebitLegal Disclaimer5 transitions

Save 3¢/L Legal Disclaimer6

on gas at Petro-Canada

No minimum

balance

needed to get the

no monthly fee offer

Legal Disclaimer1

No monthly fee for a year. After that, $4/monthLegal Disclaimer7,Legal Disclaimer8 or less with the Legal Disclaimer9

How to Get

15,000 Avion Points

Open the RBC Day to Day Banking account by March 31, 2026Legal Disclaimer1, and enjoy no monthly fee for a year

Enrol your new Day to Day Banking account into the at the same time you open the account

Set up and complete two of the following qualifying criteria by June 9, 2026, and you could get 15,000 Avion points!

- Your payroll or pension as a direct deposit

- Two pre-authorized monthly payments

- Two bill payments to a service provider

Other terms and conditions apply

Already collecting Avion points? Combine them with the points from this offer to boost your balance and redeem for more.

The Value Program is an exciting way for RBC clients with an eligible personal bank account to get more rewards and more savings. When you enrol an eligible RBC bank account in the Value Program, you can:

- Earn Avion points when you make debit purchases in-store or online using your enrolled account.legal bug 1

- Save on monthly fees when you also have 2 or more additional eligible RBC product categories, and complete at least 2 out of 3 regular account activities (a pre-authorized payment, direct deposit or eligible bill payment) with your enrolled account each month.legal bug 2

The best part? There is no additional cost to enrol in the Value Program.

RBC was awarded Best Bank in Canada and North America for 2025 by Global Finance.

RBC Right Account Guarantee

We will refund up to 3 months of account fees if you are not satisfied with your new account.10

RBC Digital Banking Security Guarantee

Trust your money is safe. Your account is CDIC-insured for up to $100,000 and protected against unauthorized transactions with our Security Guarantee.17

RBC Right Account Guarantee

We will refund up to 3 months of account fees if you are not satisfied with your new account.10

RBC Digital Banking Security Guarantee

Trust your money is safe. Your account is CDIC-insured for up to $100,000 and protected against unauthorized transactions with our Security Guarantee.17

Unlock More From Your Everyday Banking

With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account.

legal disclaimer 11

Only at RBC.

Avion Rewards

Your RBC Bank Account unlocks offers for cash back, savings and Avion points from over 2000 brands.

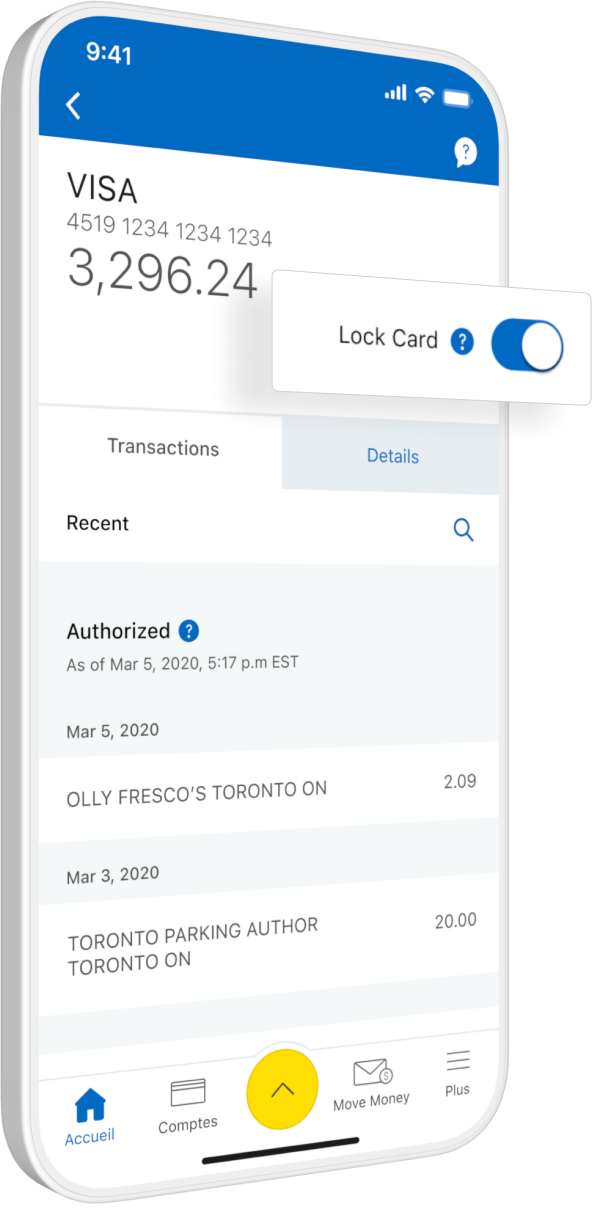

Card Lock

Easily lock a misplaced debit or credit card in the RBC Mobile legal disclaimer 12 app. Unlock it just as fast.

Split with Friends

A fast and simple way to manage shared expenses with your social circle.legal disclaimer 13

Unlock More From Your Everyday Banking

With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account.

legal disclaimer 11

Only at RBC.

Avion

Rewards

Your RBC Bank Account unlocks offers for cash back, savings and Avion points from over 2000

brands.

Card Lock

Easily lock a misplaced debit or credit card in the RBC Mobile legal disclaimer 12 app. Unlock it just as fast.

Split with Friends

A fast and simple way to manage shared expenses with your social circle.legal disclaimer 13

Top Questions

About This Bank Account Offer

Please go to rbc.com/nofeeterms.

The RBC Day to Day Banking account isn’t normally a no-monthly-fee account, but with this limited time offer you pay no monthly fee for 12 monthsLegal Disclaimer 1. Keep in mind, other bank fees may apply, such as overdraft fees, bank draft fees and cheque fees, depending on how you use your account.

No – this offer does not affect any of the service fees related to the operation of any of our personal deposit accounts, credit card accounts and business banking accounts, which continue to apply.

You can qualify for the offer by:

- Opening a new Day to Day Banking Account, as a primary owner between January 14, 2026 and March 31, 2026 at 9:00 PM EST

- Enrolling your eligible personal Banking Account into the Value Program at the same time you open the account

- Completing two of the following Qualifying Criteria from your new account by June 9, 2026 at 9:00 PM EST, which are:

- 1 automated and recurring payroll or pension direct deposit or,

- St up and complete 2 pre-authorized payments, or

- Set up and complete 2 eligible bill payments to a service provider (i.e. utility bill, cable, etc.) through Online or Mobile Banking

The offer is available to Canadian residents who:

- Have never had a Personal Banking Account (chequing account) with RBC nor qualified for any of our offers related to opening a Personal Banking Account at any time during the Promotional Period or in the five-year period before the start of the Promotional Period.

- Have attained the age of majority as defined in their province of residence prior to March 31, 2026.

See the full rbc.com/nofeeterms for details.

There are a few ways you can open a personal bank account at RBC. To take advantage of this offer, however, you must open your account online, through RBC Online Banking or in the RBC Mobile app12.

If you want to open your account another way (and not receive this offer), you can:

- Visit a branch

- Call 1-800-769-2511 (lines are open 24/7)

Please contact your branch or our Advice Centre at 1-800-769-2511 no later than July 24, 2025 if you have not received your monthly fee waiver. Any notice received after this date will not be accepted and you will be deemed not to have qualified for this Promotional Offer.

If you see a monthly fee charge on your first statement, please don’t worry. You’ll be credited on your next month’s statement.

No. Only one offer is available per client, no matter how many eligible accounts you may open during the offer period.

If you switch from the RBC Day to Day Banking Account to another personal banking account during the offer period, the monthly fee for the new Day to Day Banking Account will not be waived and the monthly fee for the new personal banking account will apply from the day of the switch forward.

No. This offer is only for clients who have never had a Personal Banking Account nor qualified for any of our offers related to opening a Personal Banking Account at any time during the Promotional Period or in the five year period before the start of the Promotional Period. Account switches do not qualify for this offer.

After your 12 months of this offer, the Day to Day Banking account comes with a $ 4 monthly feeLegal Disclaimer 9. However, if you qualify for the RBC Value Program and enroll in it, your monthly fee will be rebated, meaning you will pay $0 monthly fee for this account. To qualify for the rebate under the Value Program you must:

- Have two other RBC products, such as a personal credit card, personal investment, residential mortgage or small business account

- Complete at least 2 out of 3 regular account activities, such as pre-authorized payment, direct deposit or eligible bill paymentLegal Disclaimer 10

RBC is one of Canada’s largest banks (as measured by market capitalization) and most trusted brands. We’re a proud member of Canada Deposit Insurance Corporation (CDIC) and offer a range of bank accounts, credit cards, loans, mortgages, investments and more to fit your needs.

Learn more about RBC.A chequing account is meant for your everyday transactions, such as withdrawing cash from an ATM, paying a bill, depositing a pay cheque, and paying for groceries. It has the advantage of providing easy access to your money.

RBC Vantage is the way we describe all of the powerful benefits you can get just by having an eligible RBC bank account. There is no additional cost to enjoy these benefits—and you don’t need a minimum balance.

Here are just a few ways you can take advantage of these benefits:

- Earn Avion points with an eligible bank account by enrolling your account in the Value Program and making debit purchases in-store or online using your enrolled account.Legal Disclaimer 4

- Save on monthly fee when you enrol your account in the Value Program, have 2 or more additional eligible RBC product categories, and complete at least 2 out of 3 regular account activities (a pre-authorized payment, direct deposit or bill payment) with your enrolled account each month.Legal Disclaimer 10

- Save 3¢/L on gas at Petro-Canada with every fill-up using your linked RBC card.Legal Disclaimer 16

- Load available offers to your eligible RBC debit card and start getting rewarded with offers from popular brands.Legal Disclaimer 11

If you are opening a new account, you can enrol it in the Value Program at the same time you open the account. If you open an account online, simply enrol in the Value Program when you are invited to do so.

If you already have an eligible bank account, an RBC advisor can enrol your account in the Value Program for you. Please book an appointment, call 1-800-769-2511 or visit a branch.

Avion Rewards gives you the opportunity to earn Avion points in many ways and the flexibility to redeem them for nearly endless options—travel the world, buy merchandise and gift cards from some of your favourite brands, pay down bills, invest in your future and much more.

There are several ways to earn points. For example, you can earn points when you make debit purchases with an eligible RBC bank accountLegal Disclaimer 2 that is enrolled in the Value Program or when you make purchases with an Avion Rewards credit card.

Avion Rewards also gives you access to discounts, bonus points, special offers and savings you’ll only find at Canada’s largest bank-owned loyalty program.

Learn more about Avion Rewards.Other Resources

Are you a Newcomer to Canada?

Are you a Newcomer to Canada?

Enjoy no-monthly-fee banking for a yearLegal Disclaimer 15 with the RBC Newcomer Advantage

Are you a full-time StudentLegal Disclaimer 16?

Are you a full-time StudentLegal Disclaimer 16?

Enjoy special student offers, including no-monthly-fee banking on an RBC Advantage Banking account for students

Need More Help?

(Open 24/7)

- be a resident of Canada and the age of majority by March 31, 2026;

- do not have an existing Personal Banking Account with us;

- never had a Personal Banking Account with us, nor qualified for any of our offers related to opening a Personal Banking Account at any time during the Promotional Period or in the five year period before the start of the Promotional Period; and

- have a valid deliverable email address associated with your client profile with us by March 31, 2026.

To qualify for the Bonus Offer (15,000 Avion Points), in addition to the Promotional Offer, you must:

- complete the qualifications listed above for the Promotional Offer and

-

complete at least two of the following by 9:00 PM Eastern Time on June 9, 2026 for the 15,000 Avion points bonus:

- set up two Pre-Authorized Monthly Payments the Eligible Personal Banking Account;

- one automated and recurring payroll or pension direct deposit to the Eligible Personal Banking Account;

- two eligible bill payments to a service provider from the Eligible Personal Banking Account. RBC has the right to determine what is considered payroll.

There is a limit of 999 free Interacavis de responsabilité ‡ e-Transfer Transactions per Month per Account; for every Interacavis de responsabilité ‡ e-Transfer Transaction over the limit, you will be charged $1.

Interacavis de responsabilité ‡ e-Transfer Transactions expire 30 days after they are sent and cannot be claimed by the recipient after this time. You have 15 days after the Interacavis de responsabilité ‡ e-Transfer Transaction is sent to cancel without charge. A $5 Interacavis de responsabilité ‡ e-Transfer Transaction Reclaim Fee is charged when a recipient does not accept it before it expires and the sender does not cancel the transaction before the 15-day cancellation period.

For Chequing Accounts only, Third Party Payments debits will not count toward the number of included Debit Transactions per Month.

For RBC Day to Day Banking Account only, Point of Sale Purchases made at public transit authority merchants classified by Interac’s “Merchant Category Code” (MCC) as “Local and Suburban Commuter Passenger Transportation, including ferries” will not count towards the number of included Debit Transactions per Month. All other debits, including those Point of Sale Purchases for which the merchant may offer public transit services but is not categorized under Interac’s “Local and Suburban Commuter Passenger Transportation, including ferries” MCC, will count towards the number of included Debit Transactions and will result in an Excess Debit Transaction Fee if you go over the number of included debits per Month.

When you use RBC Virtual Visa Debit for a transaction in a currency other than Canadian dollars, we will convert the transaction amount into Canadian dollars at an exchange rate that is 2.5% over a benchmark rate Royal Bank of Canada pays on the date of the conversion. If the merchant gives you a credit voucher or refund for a transaction in a foreign currency, the debit and the subsequent credit will not exactly balance because of exchange rate and currency fluctuations.

To participate in this offer, you must have an RBC debit or credit card which is issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”). RBC business clients will only be able to link up to two (2) business credit cards and one business debit card to a Petro-Points card. You must be enrolled in RBC Online Banking or the RBC Mobile app in order to link your RBC Card to your Petro-Points card. Card linking may take up to 2 business days to process before savings and bonus points can be applied to purchases. A linked RBC Card means an RBC Card linked to a Petro-Points Account. Your linked RBC Card acts as your Petro-Points card. You will automatically earn Petro-Points when you pay for qualifying purchases with your linked RBC Card at Petro-Canada locations and you do not need to swipe your Petro-Points card before you pay. You can redeem your Petro-Points at Petro-Canada using your linked RBC Card. Each time you use your linked RBC Card to purchase any grade of gasoline, or diesel, at a Petro-Canada location, you will save three cents ($0.03) per litre at the time of the transaction.

The Monthly Fee is charged on the last day of the Month of your Account’s monthly cycle. If the last day is a non-Business Day, the fee is charged the previous Business Day. However, if the last day of your Account’s Monthly Cycle is a non-Business Day and falls at the beginning of the calendar month, then the Monthly Fee is collected the next Business Day.

Offered as part of the Commitment on Low-Cost and No-Cost Accounts from the Financial Consumer Agency of Canada (FCAC).

The standard Monthly Fee for the RBC Day to Day Banking account is $4; however, you may be eligible to receive a full rebate on your account's standard Monthly Fee if you meet the criteria applicable to rebates or discounts we offer, as described herein, and in the document entitled “Personal Deposit Accounts Disclosures and Agreements”.

Eligible accounts include: RBC VIP Banking, RBC Signature No Limit Banking, RBC Advantage Banking, RBC Day to Day Banking account. You must close the account and apply for the refund or switch to another account within 4 months of account opening or upgrade. Offer limited to one account opening or upgrade per customer per calendar year. Offer may be withdrawn at any time without notice.

The following RBC bank accounts are eligible for the Value Program: RBC Day to Day Banking, RBC Advantage Banking (includes RBC Advantage Banking for students), RBC Signature No Limit Banking, RBC VIP Banking, RBC No Limit Banking (discontinued), RBC Student Banking (discontinued), RBC No Limit Banking for Students (discontinued), RBC Day to Day Savings, RBC Enhanced Savings and RBC High Interest eSavings.

RBC Mobile is operated by Royal Bank of Canada, RBC Direct Investing Inc. and RBC Dominion Securities Inc.

You can send up to 25 requests at a time up to $10,000 each to anyone banking in Canada with Request Money in the RBC Mobile app. Limits for fulfilling Request Money transactions vary by financial institution and recipient. Contact your recipient to ensure your request can be fulfilled. Any unfulfilled money request will expire after 30 calendar days.

By enrolling an eligible RBC personal bank account into the RBC Value Program, holding eligible additional RBC products (“Product Categories”, as more particularly described below), and completing certain activities from your enrolled account each month (as more particularly described below), you may be entitled to receive a partial or full rebate of your enrolled account’s standard Monthly Fee. Eligible Product Categories include RBC personal credit cards, personal investments, residential mortgages, and linked small business relationships. Multiple products in a single Product Category will be considered one Product Category. In addition to having eligible Product Categories, you must also perform any two (2) or more of the following specified account activities in the previous calendar month to or from your enrolled account: a monthly direct deposit, a monthly pre-authorized payment, or an eligible bill payment made at minimum once per month. An eligible bill payment means a bill payment completed through either RBC Online Banking, the RBC Mobile app, using an RBC ATM, or using Telephone Banking Services, and excludes any bill payment made: (i) in-person at an RBC Royal Bank branch with an RBC Advisor, (ii) to an RBC credit card account, or (iii) using an RBC Virtual Visa Debit ® associated with your Enrolled Account. Conditions apply. For complete details, please see the Value Program Terms & Conditions.

Offered as part of the Commitment on Low-Cost and No-Cost Accounts from the Financial Consumer Agency of Canada (FCAC)

To be considered a full-time student, you must attend a primary or secondary school OR be enrolled in a program at the post-secondary level at a college, university or other educational institution (whether in Canada or not). If you are a post-secondary student, you must take at least 60% of the usual course load for the program in which you are enrolled in any particular semester. Proof of enrollment may be requested at our discretion.

Our guarantee to you: We will reimburse you for monetary losses to your Account(s) resulting directly from the following unauthorized transactions on your Account(s) using Digital Banking or Mobile Payments (collectively, Unauthorized Transactions):

transactions that occur after you notify us that you believe that any of your Passwords may have become known by someone, or that you noticed unusual, suspicious or fraudulent activity on any of your Accounts;

transactions where it can be shown that you have been a victim of fraud, theft or have been coerced by trickery, force or intimidation, so long as you report the incident to us immediately and cooperate and assist us fully in any investigation;

transactions resulting from negligent conduct by us, our employees or Third-Party Service Providers;

Interac Online Payment transactions resulting from negligent conduct by any Third Party participating in Interac Online Payment; and

any failure, error, malfunction, or technical problem of our system or equipment or that of any Third-Party Service Provider or any Third Party participating in Interac Online Payment.

Your responsibilities: Despite the above, we are not responsible for and we will not reimburse you for losses to your Account(s) if:

you do not comply with any of your obligations under this Agreement or you do not comply with any instructions we may provide to you in connection with Digital Banking or Mobile Payments;

you engage in any fraudulent, criminal or dishonest acts related to Digital Banking or Mobile Payments;

you access Digital Banking or Mobile Payments via a Device that you know or reasonably should know contains software that has the ability to reveal or otherwise compromise any of your Passwords, Personal Verification Questions or an e-Transfer Question and Answer;

you carry out the transaction, including if the transaction is a result of any mistake, error, omission, inaccuracy or other inadequacy of, or contained in any data or information that you give to us;

you share any of your Passwords or Personal Verification Questions; or

you consent to, contribute to or authorize a transaction in any way.

Exceptional Losses: In no event, even if we are negligent, will we be liable for any loss of data, or any indirect, consequential, special, aggravated, punitive or exemplary damages, in whole or in part, (including any business interruption, loss of profits, data, information, opportunity, revenues, goodwill or any other commercial or economic loss), caused to you, regardless of the cause of action, even if we were advised of the possibility of such damages.

For full details regarding the protections and limitations of the RBC Digital Banking Security Guarantee, including your responsibilities in ensuring the safety and security of your transactions, please see your Electronic Access Agreement and your Client Card Agreement for personal banking clients, and the Master Client Agreement for business clients. This guarantee is given by Royal Bank of Canada in connection with its Online and Mobile Banking services. Formerly known as the RBC Online Banking Security Guarantee.

Available only to (i) Newcomers to Canada who arrived within the last 5 years and (ii) for non-credit card accounts with RBC. Must show proof of entry into Canada and provide supporting documents such as landing papers or permanent resident card. Other conditions apply. See branch for details. This offer may be withdrawn at any time and is subject to change without notice.

When you enrol your eligible RBC personal bank account into the RBC Value Program (“Enrolled Account”), you become eligible to earn Avion points within the Avion Rewards program when you make purchases from your Enrolled Account, and any such points earned will be deposited into the Avion Rewards account tied to your Enrolled Account. Purchases from your Enrolled Account refers to purchases using your RBC Client Card (i.e. debit card) to pay for items at a merchant or service provider with the amount electronically debited directly from your Enrolled Account or using your RBC Virtual Visa Debit for purchases online. Avion points and the Avion Rewards program are governed by the Avion Rewards Terms and Conditions. Paper copies are available upon request. For complete details on the Value Program, please see the Value Program Terms & Conditions.

Eligibility criteria for an offer: (a) is determined by RBC, (b) may vary depending on the offer, and (c) may be based on the client’s preferences and account status. Eligible clients will refer to the terms and conditions applicable to each specific offer for more details.

® / TM Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada.

avis de responsabilité ‡ All other trademarks are the property of their respective owner(s).

Other Features Included in this Account

| Avion PointsLegal Disclaimer 1 | Earn a minimum of 1 point per $10 spent

Once eligible account is enrolled in the Value Program |

| International Money Transfers | Pay no fee for U.S. and international money transfersLegal Disclaimer 2 |

| eStatements | FREE |

| Paper Statements | FREE without cheque image, $2.50/month with cheque image |

| Cross Border DebitsLegal Disclaimer 3 | $1 each |

| Overdraft ProtectionLegal Disclaimer 4 | $5/monthLegal Disclaimer 7, plus overdraft interest (if used) |

| Safe Deposit Box | Regular fees apply |

| Personalized Cheques | Fees apply |

| Bank drafts | $9.95 each |

| Using a PLUS System ATM in Canada or the U.S.Legal Disclaimer 5,Legal Disclaimer 6 | $3 each |

| Using a PLUS System ATM Outside Canada or the U.S.Legal Disclaimer 5,Legal Disclaimer 6 | $5 each |

Save with the Value Program Rebatelegal bug 1

Get more from your everyday banking when you enrol any of your eligible RBC bank accountslegal bug 4 in the Value Program. The more product categories you have, the more you earn and save.

Bank Account

RBC Signature No Limit Banking

$16.95/monthlegal bug 2

Your Savings and Rewards

Monthly Feelegal bug 2

$16.95

after rebate*, legal bug 1

*For each enrolled account, you must also complete at least 2 out of 3 regular account activities (pre-authorized payment, direct deposit or eligible bill payment) each month to receive the monthly fee rebate.

By enrolling an eligible RBC personal bank account into the RBC Value Program, holding eligible additional RBC products (“Product Categories”, as more particularly described below), and completing certain activities from your enrolled account each month (as more particularly described below), you may be entitled to receive a partial or full rebate of your enrolled account’s standard Monthly Fee. Eligible Product Categories include RBC personal credit cards, personal investments, residential mortgages, and linked small business relationships. Multiple products in a single Product Category will be considered one Product Category. In addition to having eligible Product Categories, you must also perform any two (2) or more of the following specified account activities in the previous calendar month to or from your enrolled account: a monthly direct deposit, a monthly pre-authorized payment, or an eligible bill payment made at minimum once per month. An eligible bill payment means a bill payment completed through either RBC Online Banking, the RBC Mobile app, using an RBC ATM, or using Telephone Banking Services, and excludes any bill payment made: (i) in-person at an RBC Royal Bank branch with an RBC Advisor, (ii) to an RBC credit card account, or (iii) using an RBC Virtual Visa Debit® associated with your Enrolled Account. Conditions apply. For complete details, please see the Value Program Terms & Conditions.

The Monthly Fee is charged on the last day of the Month of your Account’s monthly cycle. If the last day is a non-Business Day, the fee is charged the previous Business Day. However, if the last day of your Account’s Monthly Cycle is a non-Business Day and falls at the beginning of the calendar month, then the Monthly Fee is collected the next Business Day.

When you enrol your eligible RBC personal bank account into the RBC Value Program, you will be eligible to earn Avion points within the Avion Rewards Program as an Eligible Personal Banking Client, and any such points earned will be deposited into the Avion Rewards account tied to your enrolled account. Purchases from your account refers to using your RBC Client Card to pay for items at a merchant or service provider with the amount electronically debited directly from your enrolled account or using your RBC Virtual Visa Debit for purchases online. Avion points are governed by the Avion Rewards Terms and Conditions available on our website, or a copy may be provided to you by contacting us. For complete details on the Value Program, please see the Value Program Terms & Conditions.

The following RBC bank accounts are eligible for the Value Program: RBC Day to Day Banking, RBC Advantage Banking (includes RBC Advantage Banking for students), RBC Signature No Limit Banking, RBC VIP Banking, RBC No Limit Banking (discontinued), RBC Student Banking (discontinued), RBC No Limit Banking for Students (discontinued), RBC Day to Day Savings, RBC Enhanced Savings and RBC High Interest eSavings.

Save with the Value Program Rebatelegal bug 1

Get more from your everyday banking when you enrol any of your eligible RBC bank accountslegal bug 4 in the Value Program. The more product categories you have, the more you earn and save.

Bank Account

RBC Advantage Banking

$12.95/monthlegal bug 2

Your Savings and Rewards

Monthly Feelegal bug 2

$12.95

after rebate*, legal bug 1

*For each enrolled account, you must also complete at least 2 out of 3 regular account activities (pre-authorized payment, direct deposit or eligible bill payment) each month to receive the monthly fee rebate.

By enrolling an eligible RBC personal bank account into the RBC Value Program, holding eligible additional RBC products (“Product Categories”, as more particularly described below), and completing certain activities from your enrolled account each month (as more particularly described below), you may be entitled to receive a partial or full rebate of your enrolled account’s standard Monthly Fee. Eligible Product Categories include RBC personal credit cards, personal investments, residential mortgages, and linked small business relationships. Multiple products in a single Product Category will be considered one Product Category. In addition to having eligible Product Categories, you must also perform any two (2) or more of the following specified account activities in the previous calendar month to or from your enrolled account: a monthly direct deposit, a monthly pre-authorized payment, or an eligible bill payment made at minimum once per month. An eligible bill payment means a bill payment completed through either RBC Online Banking, the RBC Mobile app, using an RBC ATM, or using Telephone Banking Services, and excludes any bill payment made: (i) in-person at an RBC Royal Bank branch with an RBC Advisor, (ii) to an RBC credit card account, or (iii) using an RBC Virtual Visa Debit® associated with your Enrolled Account. Conditions apply. For complete details, please see the Value Program Terms & Conditions.

The Monthly Fee is charged on the last day of the Month of your Account’s monthly cycle. If the last day is a non-Business Day, the fee is charged the previous Business Day. However, if the last day of your Account’s Monthly Cycle is a non-Business Day and falls at the beginning of the calendar month, then the Monthly Fee is collected the next Business Day.

When you enrol your eligible RBC personal bank account into the RBC Value Program, you will be eligible to earn Avion points within the Avion Rewards Program as an Eligible Personal Banking Client, and any such points earned will be deposited into the Avion Rewards account tied to your enrolled account. Purchases from your account refers to using your RBC Client Card to pay for items at a merchant or service provider with the amount electronically debited directly from your enrolled account or using your RBC Virtual Visa Debit for purchases online. Avion points are governed by the Avion Rewards Terms and Conditions available on our website, or a copy may be provided to you by contacting us. For complete details on the Value Program, please see the Value Program Terms & Conditions.

The following RBC bank accounts are eligible for the Value Program: RBC Day to Day Banking, RBC Advantage Banking (includes RBC Advantage Banking for students), RBC Signature No Limit Banking, RBC VIP Banking, RBC No Limit Banking (discontinued), RBC Student Banking (discontinued), RBC No Limit Banking for Students (discontinued), RBC Day to Day Savings, RBC Enhanced Savings and RBC High Interest eSavings.

Save with the Value Program Rebatelegal bug 1

Get more from your everyday banking when you enrol any of your eligible RBC bank accountslegal bug 4 in the Value Program. The more product categories you have, the more you earn and save.

Bank Account

RBC VIP Banking

$30/monthlegal bug 2

Your Savings and Rewards

Monthly Feelegal bug 2

$30

after rebate*, legal bug 1

*For each enrolled account, you must also complete at least 2 out of 3 regular account activities (pre-authorized payment, direct deposit or eligible bill payment) each month to receive the monthly fee rebate.

By enrolling an eligible RBC personal bank account into the RBC Value Program, holding eligible additional RBC products (“Product Categories”, as more particularly described below), and completing certain activities from your enrolled account each month (as more particularly described below), you may be entitled to receive a partial or full rebate of your enrolled account’s standard Monthly Fee. Eligible Product Categories include RBC personal credit cards, personal investments, residential mortgages, and linked small business relationships. Multiple products in a single Product Category will be considered one Product Category. In addition to having eligible Product Categories, you must also perform any two (2) or more of the following specified account activities in the previous calendar month to or from your enrolled account: a monthly direct deposit, a monthly pre-authorized payment, or an eligible bill payment made at minimum once per month. An eligible bill payment means a bill payment completed through either RBC Online Banking, the RBC Mobile app, using an RBC ATM, or using Telephone Banking Services, and excludes any bill payment made: (i) in-person at an RBC Royal Bank branch with an RBC Advisor, (ii) to an RBC credit card account, or (iii) using an RBC Virtual Visa Debit® associated with your Enrolled Account. Conditions apply. For complete details, please see the Value Program Terms & Conditions.

The Monthly Fee is charged on the last day of the Month of your Account’s monthly cycle. If the last day is a non-Business Day, the fee is charged the previous Business Day. However, if the last day of your Account’s Monthly Cycle is a non-Business Day and falls at the beginning of the calendar month, then the Monthly Fee is collected the next Business Day.

When you enrol your eligible RBC personal bank account into the RBC Value Program, you will be eligible to earn Avion points within the Avion Rewards Program as an Eligible Personal Banking Client, and any such points earned will be deposited into the Avion Rewards account tied to your enrolled account. Purchases from your account refers to using your RBC Client Card to pay for items at a merchant or service provider with the amount electronically debited directly from your enrolled account or using your RBC Virtual Visa Debit for purchases online. Avion points are governed by the Avion Rewards Terms and Conditions available on our website, or a copy may be provided to you by contacting us. For complete details on the Value Program, please see the Value Program Terms & Conditions.

The following RBC bank accounts are eligible for the Value Program: RBC Day to Day Banking, RBC Advantage Banking (includes RBC Advantage Banking for students), RBC Signature No Limit Banking, RBC VIP Banking, RBC No Limit Banking (discontinued), RBC Student Banking (discontinued), RBC No Limit Banking for Students (discontinued), RBC Day to Day Savings, RBC Enhanced Savings and RBC High Interest eSavings.

Save with the Value Program Rebatelegal bug 1

Get more from your everyday banking when you enrol any of your eligible RBC bank accountslegal bug 4 in the Value Program. The more product categories you have, the more you earn and save.

Bank Account

RBC Day to Day Banking

$4/monthlegal bug 2

Your Savings and Rewards

Monthly Feelegal bug 2

$4

after rebate*, legal bug 1

*For each enrolled account, you must also complete at least 2 out of 3 regular account activities (pre-authorized payment, direct deposit or eligible bill payment) each month to receive the monthly fee rebate.

By enrolling an eligible RBC personal bank account into the RBC Value Program, holding eligible additional RBC products (“Product Categories”, as more particularly described below), and completing certain activities from your enrolled account each month (as more particularly described below), you may be entitled to receive a partial or full rebate of your enrolled account’s standard Monthly Fee. Eligible Product Categories include RBC personal credit cards, personal investments, residential mortgages, and linked small business relationships. Multiple products in a single Product Category will be considered one Product Category. In addition to having eligible Product Categories, you must also perform any two (2) or more of the following specified account activities in the previous calendar month to or from your enrolled account: a monthly direct deposit, a monthly pre-authorized payment, or an eligible bill payment made at minimum once per month. An eligible bill payment means a bill payment completed through either RBC Online Banking, the RBC Mobile app, using an RBC ATM, or using Telephone Banking Services, and excludes any bill payment made: (i) in-person at an RBC Royal Bank branch with an RBC Advisor, (ii) to an RBC credit card account, or (iii) using an RBC Virtual Visa Debit® associated with your Enrolled Account. Conditions apply. For complete details, please see the Value Program Terms & Conditions.

The Monthly Fee is charged on the last day of the Month of your Account’s monthly cycle. If the last day is a non-Business Day, the fee is charged the previous Business Day. However, if the last day of your Account’s Monthly Cycle is a non-Business Day and falls at the beginning of the calendar month, then the Monthly Fee is collected the next Business Day.

When you enrol your eligible RBC personal bank account into the RBC Value Program, you will be eligible to earn Avion points within the Avion Rewards Program as an Eligible Personal Banking Client, and any such points earned will be deposited into the Avion Rewards account tied to your enrolled account. Purchases from your account refers to using your RBC Client Card to pay for items at a merchant or service provider with the amount electronically debited directly from your enrolled account or using your RBC Virtual Visa Debit for purchases online. Avion points are governed by the Avion Rewards Terms and Conditions available on our website, or a copy may be provided to you by contacting us. For complete details on the Value Program, please see the Value Program Terms & Conditions.

The following RBC bank accounts are eligible for the Value Program: RBC Day to Day Banking, RBC Advantage Banking (includes RBC Advantage Banking for students), RBC Signature No Limit Banking, RBC VIP Banking, RBC No Limit Banking (discontinued), RBC Student Banking (discontinued), RBC No Limit Banking for Students (discontinued), RBC Day to Day Savings, RBC Enhanced Savings and RBC High Interest eSavings.