A Chequing account with everyday benefits

With RBC Vantage, you can enjoy additional benefits at no extra cost and with no minimum balance required when you open an eligible RBC bank account.

Unlimited Debit Transactions

Unlimited Debit Transactions

Use your account as often as you want! With unlimited debit transactions in Canada, you can buy, send, withdraw and transfer without having to keep track of your transactions.

Need to use your card at a non-RBC ATM? No problem!

Need to use your card at a non-RBC ATM? No problem!

Get unlimited withdrawals at non-RBC ATMs across Canada.legal disclaimer 6

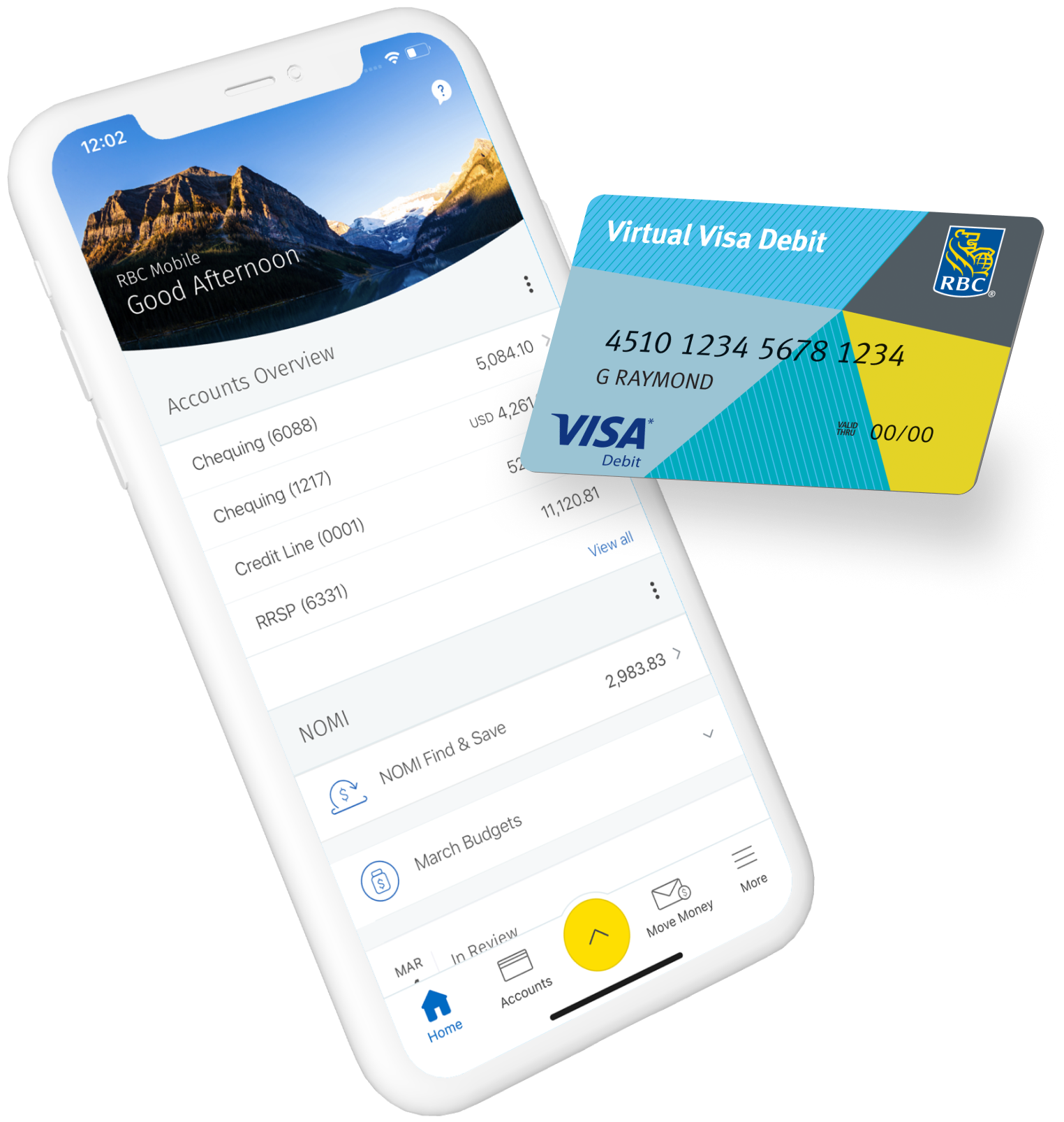

Virtual Visa Debitlegal disclaimer 7

Virtual Visa Debitlegal disclaimer 7

Spend online safely using a Virtual Visa Debit card.

Need to use your card at a non-RBC ATM? No problem!

Get unlimited withdrawals at non-RBC ATMs across Canada.legal disclaimer 6

Virtual Visa Debitlegal disclaimer 7

Spend online safely using a Virtual Visa Debit card.

Security Guarantee

Trust your money is safe. Your account is CDIC-insured for up to $100,000 and protected against unauthorized transactions with our Security Guarantee.legal disclaimer 8

More Account Features

Avion Pointslegal disclaimer 9

Earn a minimum of 1 point per $10 spent

Once eligible account is enrolled in the Value Program

International Money Transfers

Pay no fee for U.S. and international money transferslegal disclaimer 33

Non-sufficient funds (NSF) Fee Rebate

1 NSF fee rebated every calendar yearlegal disclaimer 10

Personalized Cheques

Fees Apply

Bank Drafts

$9.95 each

Overdraft Protectionlegal disclaimer 11

$5/monthlegal disclaimer 39, plus overdraft interest (if used)

eStatements or Monthly Paper Statements

FREE

Not sure which chequing account is right for you?

Help Me Choose The Best Chequing Account For Me

Help Me Choose The Best Chequing Account For Me

Answer a few questions and we’ll suggest the chequing accounts that best match your needs.

Compare Chequing Account Features

Compare Chequing Account Features

See our range of accounts and compare the features that are important to you.

Speak to an Advisor

Speak to an Advisor

Book a virtual appointment with an advisor: 1-800-769-2561 (Open 24/7).

RBC High Interest eSavings

Earn 4.60% interest for 3 monthslegal disclaimer 12,legal disclaimer 13 when you open your first RBC High Interest eSavings account.

- No minimum deposit required

- Earn high interest on every dollarlegal disclaimer 14

- Unlimited transfers to your other RBC accountslegal disclaimer 15

RBC Advantage Banking account for students

With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account.legal disclaimer19

Only at RBC.

FREE Interaclegal bug ‡

e-Transfer transactionslegal bug 3,legal bug 4

Send money through Online Banking or the RBC Mobile app, quickly and securely.

No RBC Fee to use other

banks’ ATMs in Canadalegal bug 6

Need some cash quick and you're not near an RBC ATM? Students pay no RBC fee to use another bank’s ATM in Canada.

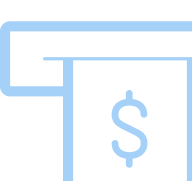

Get the app

that gets you

RBC Mobile Student Editionlegal bug 20 gives you access to the features that students use the most.

RBC Offers

Offers from the brands you love

Load available offers to your eligible RBC debit card and get rewarded with personalized offers from popular brands.legal bug 21

Vantage Snapshot

Keep track of the benefits you get with an eligible RBC bank account using the RBC Mobile app.legal bug 20

RBC Advantage Banking account for students

With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account legal disclaimer 19 . Only at RBC.

FREE Interaclegal bug ‡

e-Transfer transactionslegal bug 3,legal bug 4

Send money through Online Banking or the RBC Mobile app, quickly and securely.

No RBC Fee to use other banks’ ATMs in Canadalegal bug 6

Need some cash quick and you're not near an RBC ATM? Students pay no RBC fee to use another bank’s ATM in Canada.

Get the app

that gets you

RBC Mobile Student Editionlegal bug 20 gives you access to the features that students use the most.

RBC Offers

Offers from the brands you love

Load available offers to your eligible RBC debit card and get rewarded with personalized offers from popular brands.legal bug 21

Vantage Snapshot

Keep track of the benefits you get with an eligible RBC bank account using the RBC Mobile app.legal bug 20

Top Bank Account Questions

Top Bank Account Questions

To open an RBC Advantage Banking account for students, you need to be at least age 13 (14 in Quebec), meet our requirements for a full-time student and provide proof of ID when you apply—for example, a valid driver’s licence or passport.

To be considered a full-time student, you must attend a primary or secondary school or be enrolled in a program at the post-secondary level at a college, university or other educational institution (whether in Canada or not). If you are a post-secondary student, you must take at least 60% of the usual course load for the program in which you are enrolled in any particular semester. Proof of enrollment may be requested at our discretion.

Yes, international students living in Canada can open a bank account in Canada. At RBC, you can open an RBC Advantage Banking account for students if you meet our definition of a full-time student and reside in Canada at the time you open the account. Learn more about opening a bank account as an international student.

To be considered a full-time student, you must attend a primary or secondary school or be enrolled in a program at the post-secondary level at a college, university or other educational institution (whether in Canada or not). If you are a post-secondary student, you must take at least 60% of the usual course load for the program in which you are enrolled in any particular semester. Proof of enrollment may be requested at our discretion.

When you have an RBC bank account, you can request a Virtual Visa Debit card, which you can use to make safe, online purchases using the money in your primary chequing account.legal disclaimer 29 No credit card needed!

Your credit score is a number that indicates your ability to borrow and repay money. A high credit score can help you qualify for loans, credit cards and/or higher credit limits when you apply for them. Learn more about how students can build a good credit score.

A great place to begin is to understand the benefits of a Tax-Free Savings Account (TFSA) and a Registered Retirement Savings Plan (RRSP). These are popular investment accounts that give you the opportunity to grow your money faster than you could in a traditional savings account. Check out these 4 things to know about TFSAs and RRSPs.

In some cases, yes. You can apply to open an RBC Advantage Banking account for students online if you meet our definition of a full-time student and you are:

- 18 years of age or the age of majority in your province

Note: Ages 13+ (or 14+ in Quebec) can apply to open an account using the RBC Mobilelegal disclaimer 20 app.

- Opening a sole account in your own name

- Living in Canada

If you are opening an account on behalf of a full-time student, please visit a branch to open an account.

To be considered a full-time student, you must attend a primary or secondary school or be enrolled in a program at the post-secondary level at a college, university or other educational institution (whether in Canada or not). If you are a post-secondary student, you must take at least 60% of the usual course load for the program in which you are enrolled in any particular semester. Proof of enrollment may be requested at our discretion.

Full-time studentslegal disclaimer 2, including students as young as age 13 (14 in Quebec), can open an RBC Advantage Banking account for studentslegal disclaimer 31 and enjoy unlimited debits in Canada and other great benefits for no monthly fee.

Send an Interac‡ e-Transferlegal disclaimer 3,legal disclaimer 4 without ever needing to log in to the RBC Mobilelegal disclaimer 30 app! Simply enable Siri in the app and you'll be able to quickly and easily send money.

Going away to school or thinking of staying local? There are several factors that can impact how much a college, university or other post-secondary education might cost you. Use the RBC Student Budget Calculator to get an estimate of how much money you might need.

Upon the graduation date you provided when you opened your RBC Advantage Banking account for students, your monthly fee waiver for full-time students will expire and you’ll be charged the monthly fee for the RBC Advantage Banking account. However, you may be able to qualify for a monthly fee rebate through the Value Program and could pay as little as $0 per month for your account.legal disclaimer27

Offer available February 3, 2026- June 1, 2026 (“Promotional Period”)

This offer is available to any Eligible Student Client without a Personal Banking Account with Royal Bank of Canada at the beginning of the Promotional Period or in the three-year period before the start of the Promotional Period, and who otherwise complies with the Terms of the Promotional offer. The Bonus Offer is $100 with an Eligible Personal Banking Account. To qualify for the $100 you must open your first new Eligible Personal Banking Account by 9:00 PM EST on June 1, 2026 and complete two of the following Qualifying Criteria by 9:00 PM EST on August 10, 2026 using your Eligible Personal Banking Account:

i. Register your Eligible Personal Banking Account for Interac Autodeposit and send or receive one (1) e-Transfer using RBC Online Banking or the RBC Mobile app.

ii. Request and obtain an RBC Virtual Visa Debit card and make at least one (1) Qualifying Debit Transaction (as defined in the Note section below) with your Eligible Personal Banking Account.

iii. Transfer the full amount of your automated and recurring payroll direct deposit to your new Eligible Personal Banking Account. For greater certainty, this means that you will not qualify if you split your payroll deposit from one employer between your new Eligible Personal Banking Account and any other account. We reserve the right to determine what is considered payroll and whether any payroll deposit has been split. The first payment of each PAP must be debited and must clear from your new Eligible Personal Banking Account by 9:00 PM Eastern Time August 10, 2026.

iv. Set up one (1) pre-authorized monthly payment (“PAP”) – such as a pre-authorized eligible bill payment to a service provider (i.e. utility bill, gym membership) or pre-authorized payment to an RBC mortgage, loan, Royal Credit Line, or contribution to your RBC investment account – from your new Eligible Personal Banking Account. PLEASE NOTE: Any bill payments (pre-authorized or otherwise) made using a Virtual Visa Debit will not qualify. The first payment of each PAP must be debited and must clear from your new Eligible Personal Banking Account by 9:00 PM Eastern Time August 10, 2026.

v. Make one (1) eligible bill payment to a service provider from your new Eligible Personal Banking Account. PLEASE NOTE: To qualify, the eligible bill payment must be completed through the RBC Mobile app or RBC Online Banking. Excludes any bill payment made in-person at an RBC Royal Bank branch with an RBC Advisor, and any bill payment made to an RBC credit card account, and any bill payment made using RBC Virtual Visa Debit. The eligible bill payment must be debited and must clear from your new Eligible Personal Banking Account by 9:00 PM Eastern Time August 10, 2026.

NOTE: Qualifying Debit Transactions are defined as Bill Payments or purchase transaction using any of the following: your RBC Client Card, an RBC Virtual Visa Debit card associated with your Eligible Personal Banking Account, Interac Flash, Apple Pay, Google Pay, Samsung Pay Transactions carried out at an RBC Royal Bank branch or through the RBC Royal Bank ATM network, and bank fee transactions, are not included as qualifying transactions.

NOTE: You must be at least 14 years of age to obtain an RBC Virtual Visa Debit card. As such, option ii. (above) is only available to individuals who meet this minimum age requirement; if you are below the age of 14 and participate in this Promotional Offer, you must select one of the other eligible transaction types described.

The $100 cash component of the Promotional Offer will be deposited into your Eligible Personal Banking Account within 4 to 10 weeks of completing the Qualifying Criteria, if applicable. Royal Bank of Canada may follow up with Eligible Student Clients to remind them to complete the Qualifying Criteria.

This offer may not be combined or used in conjunction with any other Personal Banking Account offers. Royal Bank of Canada reserves the right to withdraw this offer at any time without notice, even after acceptance by you. For full details including defined terms visit rbc.com/offerterms100.

- transactions that occur after you notify us that you believe that any of your Passwords may have become known by someone, or that you noticed unusual, suspicious or fraudulent activity on any of your Accounts;

- transactions where it can be shown that you have been a victim of fraud, theft or have been coerced by trickery, force or intimidation, so long as you report the incident to us immediately and cooperate and assist us fully in any investigation;

- transactions resulting from negligent conduct by us, our employees or Third-Party Service Providers;

- Interac‡ Online Payment transactions resulting from negligent conduct by any Third Party participating in Interac‡ Online Payment; and

- any failure, error, malfunction, or technical problem of our system or equipment or that of any Third-Party Service Provider or any Third Party participating in Interac‡ Online Payment.

- you do not comply with any of your obligations under this Agreement or you do not comply with any instructions we may provide to you in connection with Digital Banking or Mobile Payments;

- you engage in any fraudulent, criminal or dishonest acts related to Digital Banking or Mobile Payments;

- you access Digital Banking or Mobile Payments via a Device that you know or reasonably should know contains software that has the ability to reveal or otherwise compromise any of your Passwords, Personal Verification Questions or an e-Transfer Question and Answer;

- you carry out the transaction, including if the transaction is a result of any mistake, error, omission, inaccuracy or other inadequacy of, or contained in any data or information that you give to us;

- you share any of your Passwords or Personal Verification Questions; or

- you consent to, contribute to or authorize a transaction in any way.

To get $50 worth of gift cards/certificates, you will need a total of 7,000 Avion points. Minimum redemption of 1,400 Avion points for most $10 gift cards/certificates. Some exceptions apply. Point redemption values may fluctuate. For general redemption terms, conditions and restrictions that apply to the Avion Rewards program, as well as for current point redemption values, please visit https://www.avionrewards.com/terms-and-conditions.html or call 1-800-769-2512.

(i) “Grocery Stores and Supermarkets” (MCC 5411), “Eating Places and Restaurants” (MCC 5812), “Drinking Places (Alcoholic Beverages) – Bars, Taverns, Nightclubs, Cocktail Lounges, and Discotheques” (MCC 5813), “Fast Food Restaurants” (MCC 5814), “are “Grocery, Dining, and Food Delivery Purchases”. Government liquor agencies and package stores that sell beer, wine, and liquor do not qualify as part of the “Drinking Places (Alcoholic Beverages) – Bars, Taverns, Nightclubs, Cocktail Lounges, and Discotheques” MCC;

(ii) “Service Stations (With or without Ancillary Services)” (MCC 5541), “Automated Fuel Dispensers” (MCC 5542), “Taxicabs and Limousines” (MCC 4121), “Local and Suburban Commuter Passenger Transportation, Including Ferries” (MCC 4111), “Electric Vehicle Charging” (MCC 5552) are “Rides, Gas & Electric Vehicle Charging Purchases”. Non-commuter passenger railway purchases and non-commuter bus line purchases do not qualify as part of “Rides, Gas & Electric Vehicle Charging Purchases”.

(iii) “Digital Goods Media – Books, Movies, Music” (MCC 5815), “Digital Goods – Games” (MCC 5816), “Digital Goods – Applications (Excludes Games)” (MCC 5817), “Digital Goods – Large Digital Goods Merchants” (MCC 5818), “Cable, Satellite and Other Pay Television/Radio/Streaming Services” (MCC 4899) are “Streaming, Digital Gaming & Subscriptions Purchases”. The “Digital Goods – Games” MCC does not include games of chance and gambling.

You will earn 1 Avion point for every $1.00 on all other purchases (including pre-authorized bill payments) you make on your RBC ION+ Visa credit card.

Even though some merchants may sell Grocery, Dining, Food Delivery, Rides, Gas, Electric Vehicle Charging, Streaming, Digital Gaming & Subscriptions merchandise, purchases made at these locations may not necessarily qualify as Eligible MCCs if the merchant is not classified as such by Visa. Also, you may make a purchase at a merchant that is not classified as an Eligible MCC but is located on the premises of a merchant that is classified as an Eligible MCC, in which case your purchase would not qualify as an Eligible MCC. We cannot guarantee that any merchant, operating in whole or in part as a Grocery, Dining, Food Delivery, Rides, Gas, Electric Vehicle Charging, Streaming, and Digital Gaming & Subscriptions merchant is classified as an Eligible MCC and in no event will we be liable or responsible for any claims with respect to a Grocery, Dining, Food Delivery, Rides, Gas, Electric Vehicle Charging, Streaming, and Digital Gaming & Subscriptions Purchase made at a merchant that is not classified as an Eligible MCC. Avion points are earned on net purchases only; they are not earned on cash advances (balance transfers, cash-like transactions and bill payments that are not pre-authorized charges that you set up with a merchant), interest charges or fees, and credits for returns and adjustments will reduce or cancel the points earned by the amounts originally charged.

Student Edition is intended for clients under the age of 22. RBC Online Banking is operated by Royal Bank of Canada.

Eligibility criteria for an Offer: (a) is determined by RBC, (b) may vary depending on the offer, and (c) may be based on the client’s preferences and account status. Eligible clients will refer to the terms and conditions applicable to each specific Offer for more details.

For Chequing Accounts only, Third Party Payments debits will not count toward the number of included Debit Transactions per Month.

For RBC Day to Day Banking Account only, Point of Sale Purchases made at public transit authority merchants classified by Interac’s “Merchant Category Code” (MCC) as “Local and Suburban Commuter Passenger Transportation, including ferries” will not count towards the number of included Debit Transactions per Month. All other debits, including those Point of Sale Purchases for which the merchant may offer public transit services but is not categorized under Interac’s “Local and Suburban Commuter Passenger Transportation, including ferries” MCC, will count towards the number of included Debit Transactions and will result in an Excess Debit Transaction Fee if you go over the number of included debits per Month.