Two Great Chequing Accounts to Choose from

Enjoy a range of features and benefits, plus take advantage of our new bank account offer.

Most Popular

RBC Signature

No Limit Banking account

Monthly Fee4

$16.95

Includes:

Unlimited tap, swipe and debit transactions in Canada

Save up to $48 on eligible credit card annual fee3

3 non-RBC ATM fees waived/month

$2 each thereafter2

Most Exclusive

RBC VIP Banking account

Monthly Fee4

$30.00

Includes:

Unlimited tap, swipe and debit transactions worldwide

Save up to $120 on eligible credit card annual fee8

Everyday Benefits Included with RBC Canadian Chequing Accounts

No minimum balance

There’s no balance requirement to enjoy account benefits

Earn Avion points12 on everyday purchases

Get rewarded for purchases you would make anyway

Save 3¢/L on gas at Petro-Canada13

Simply link your debit card to your Petro-Points card

RBC Right Account Guarantee

We will refund up to 3 months of account fees if you are not satisfied with your new account.14

How to get your new iPad

Open an eligible RBC bank account1 by November 3, 2025

Set up and complete two of the following qualifying criteria within 90 days of opening the Eligible Personal Banking Account:

Your payroll or pension as a direct deposit

Two pre-authorized monthly payments (PAPs)

Two bill payments to a service provider

Other terms and conditions apply.

Get iPad Pro or MacBook Air

Contribute $50,000 in new funds across eligible RBC investment accounts to upgrade to an iPad Pro M4 or MacBook Air M4.

Conditions apply.

How to upgrade to an iPad Pro or MacBook Airlegal bug 1

You have an exciting opportunity to upgrade your new eligible bank account offer. Here’s how:

Complete all the requirements to get the new iPad, outlined above

Make qualifying contributions of at least C$50,000 into any Eligible Investments Account (shown below) within 90 days of opening the Eligible Personal Banking Account

Maintain the minimum Qualifying Net Contributions required under the Investments Promotional Offer until 365 days after opening the Eligible Personal Banking Account.

Other terms and conditions apply.

Eligible Investment Accounts* include:

- Tax-Free Savings Accounts (TFSAs)

- Registered Retirement Savings Accounts (RRSPs)

- Registered Education Savings Plans (RESPs)

- First Home Savings Accounts (FHSAs)

- Non-Registered Investment Accounts

- And more. See terms and conditions for full listing of eligible accounts

* All contributions into qualifying accounts are eligible except Redeemable GICs and Non-Redeemable GICs with a term of less than 1 year.

Unlock More From Your Everyday Banking

With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account.

legal disclaimer 15

Only at RBC.

Avion Rewards

Your RBC Bank Account unlocks offers for cash back, savings and Avion points from over 2000 brands.

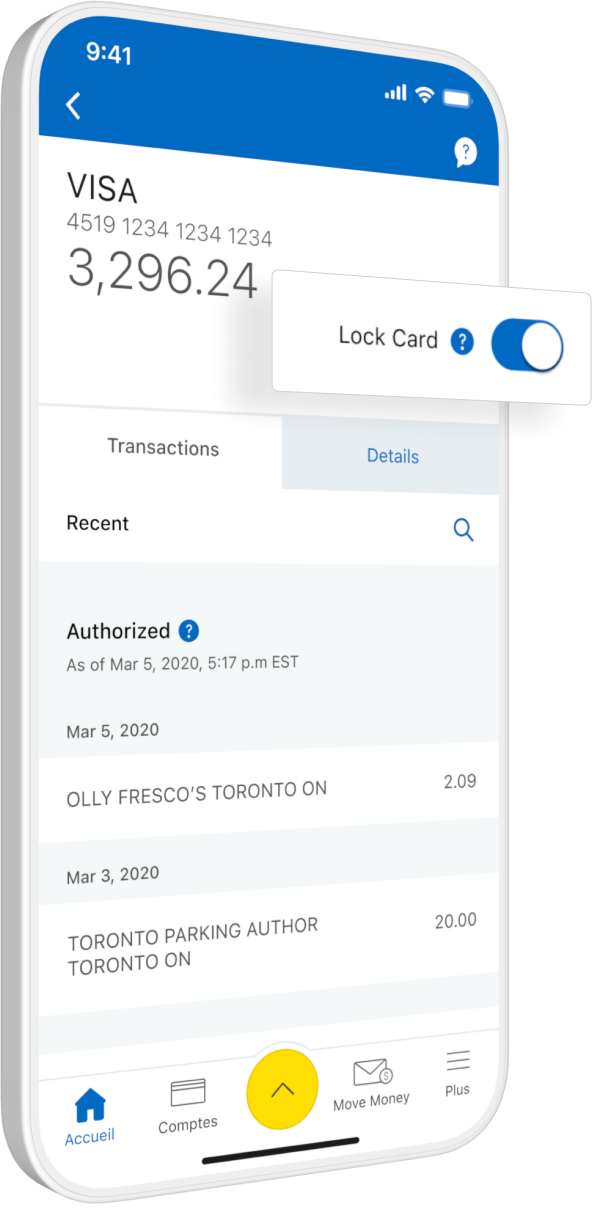

Card Lock

Easily lock a misplaced debit or credit card in the RBC Mobile legal disclaimer 16 app. Unlock it just as fast.

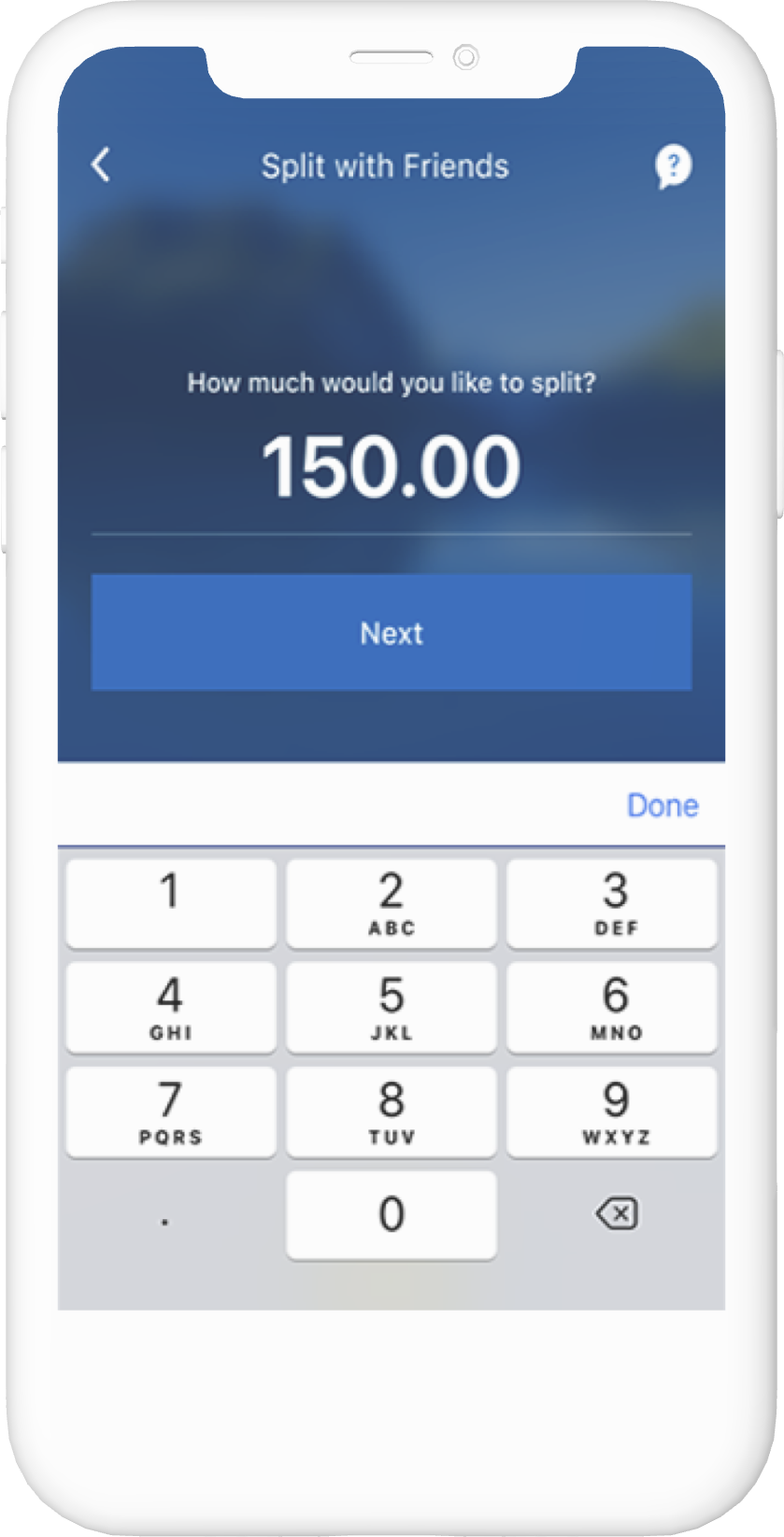

Split with Friends

A fast and simple way to manage shared expenses with your social circle.legal disclaimer 17

Unlock More From Your Everyday Banking

With RBC Vantage, you can unlock rewards, savings, insights and more with any eligible bank account.

legal disclaimer 15

Only at RBC.

Avion

Rewards

Your RBC Bank Account unlocks offers for cash back, savings and Avion points from over 2000

brands.

Card Lock

Easily lock a misplaced debit or credit card in the RBC Mobile legal disclaimer 16 app. Unlock it just as fast.

Split with Friends

A fast and simple way to manage shared expenses with your social circle.legal disclaimer 17

Top Questions About Bank Account Offers

Please go to rbc.com/ipadoffer

Yes, this offer is available to individuals who:

- Do not have an existing Personal Banking Account with RBC

- Never had a Personal Banking Account with RBC, nor qualified for any of our offers related to opening an account in the last five years

Here’s how to get the iPad offer:

1) Open an eligible RBC bank account by November 3, 2025

2) Set up and complete two of the following within 90 days of opening your account:

- Your payroll or pension as a direct deposit

- Two pre-authorized monthly payments (PAPs)

- Two bill payments to a service provider

To upgrade your offer to an iPad Pro or MacBook Air:

- Complete all the requirements to get the iPad offer, outlined above

- Contribute $50,000 net new funds across eligible RBC investment accounts

-

Eligible accounts include:

- Tax-Free Savings Accounts (TFSAs)

- Registered Retirement Savings Accounts (RRSPs)

- Registered Education Savings Plans (RESPs)

- First Home Savings Accounts (FHSAs)

- Non-Registered Investment Accounts

- And more. See terms and conditions for full listing of eligible accounts

* All contributions to the qualifying accounts are eligible except Redeemable GICs and Non-Redeemable GICs with a term of less than 1 year.

Other terms and conditions apply.

Shortly following the 90th day after opening the Eligible Personal Banking account, or after you complete the Personal Banking and Investments Qualifying Criteria (whichever is earlier), you will receive an email from RBC to the email address you have provided to us on account opening with a link to a secure website where you can select your device and confirm your shipment details. When selecting your device, the website will provide you with an estimated delivery time which will vary based on your selection.

Your Eligible Personal Banking Account must remain open and in good standing, and the Qualifying Criteria you performed to get the Apple iPad Reward (such as payroll/pension deposit, bill payment or pre-authorized payment) must remain in effect until at least November 3, 2026.

If you qualified for the upgrade to the iPad Pro or MacBook Air, you must also maintain the minimum $50,000 net contribution until 365 days after opening the Eligible Personal Banking Account.

Need More Help?

(Open 24/7)

Set up two pre-authorized payments from the Eligible Personal Banking Account; and/or one automated and recurring payroll or pension direct deposit to the Eligible Personal Banking Account, and/or two eligible bill payments to a service provider from the Eligible Personal Banking Account. RBC has the right to determine what is considered payroll.

Provided you fulfill the “Personal Banking Qualifying Criteria” and the “Investments Qualifying Criteria” below ” by 9PM EST time by the 90th day after opening the Eligible Personal Banking Account, you may elect to receive one of the following (Apple 13-inch MacBook Air: M4 chip with 10-core CPU and 8-core GPU, 16GB, 256GB SSD, Model # MC6T4C/A (Bleu ciel, Français); MC6T4LL/A (Sky Blue); MW0W3C/A (Argent, Français); MW0W3LL/A (Silver); MW0Y3C/A (Comète, Français); MW0Y3LL/A (Starlight); MW123C/A (Minuit, Français); MW123LL/A (Midnight) Or; (Apple 11-inch iPad Pro Wi-Fi 256GB with Standard Glass, Model # MVV83CL/A (Space Black); MVV93CL/A (Silver):

b. Transfer-in or deposit Qualifying Net Contributions of at least C$50,000 into any Eligible Investments Account, or collectively into any combination of Eligible Investments Accounts

c. Maintain the minimum Qualifying Net Contributions required under the Investments Promotional Offer until 365 days after completing the Investments Qualifying Criteria

This offer may not be combined or used in conjunction with any other Personal Banking Account offers unless otherwise indicated. Royal Bank of Canada reserves the right to withdraw this offer at any time without notice, even after acceptance by you. Other conditions apply. For full details including defined terms visit www.rbc.com/ipadoffer

Other Features Included in this Account

| Avion Pointslegal bug 1 | Enrol your account in the Value Program to get a minimum of 1 Avion point for every $10 you spend in-store and online using your enrolled account. |

| Interaclegal bug ‡ e-transferslegal bug 2,legal bug 3 | FREE |

| International Money Transfers | Pay no fee for U.S. and international money transferslegal bug 4 |

| Cross Border Debits | 5 cross-border debits per month, $1 each thereafterlegal bug 5 |

| Online, Mobile and Telephone Banking | FREE |

| eStatements | FREE |

| Monthly Paper Statements | $2.25 without cheque image, $2.50 with cheque image |

| Safe Deposit Boxlegal bug 6 | Up to $12/year discount on regular fees |

| Non-Sufficient Funds (NSF) Fee | 1 NSF fee rebated every calendar yearlegal bug 7 |

| Personalized Chequeslegal bug 8 | 1 book of cheques FREE, afterwards Fees Apply |

| Bank Draftslegal bug 9 | 6 FREE/year, $9.95 each thereafter |

| Right Account Guarantee® | If you’re not completely satisfied within the first 4 months, we’ll refund your monthly fees for up to 3 monthslegal bug 10. |

Optional Services

| Using a PLUS System ATM in Canada or the U.S.legal bug 11,legal bug 12 | $3 each |

| Using a PLUS System ATM Outside Canada or the U.S. | $5 each |

Other Features Included in this Account

| Avion Pointslegal bug 1 | Enrol your account in the Value Program to get a minimum of 1 Avion point for every $10 you spend in-store and online using your enrolled account. |

| Interaclegal bug ‡ e-transferslegal bug 2,legal bug 3 | FREE |

| International Money Transfers | Pay no fee for U.S. and international money transferslegal bug 4 |

| RBC ATMs | No RBC fee to use ATMs worldwidelegal bug 5,legal bug 6,legal bug 7 |

| Online, Mobile and Telephone Banking | FREE |

| eStatements or Monthly Paper Statements | FREE |

| Cross-Border Debitslegal bug 8,legal bug 9,legal bug 10 | FREE |

| Safe Deposit Boxlegal bug 11 | Up to $60/year discount on regular fees |

| Non-Sufficient Funds (NSF) Fee | 1 NSF fee rebated every calendar yearlegal bug 12 |

| Personalized Chequeslegal bug 13 | FREE, with RBC VIP Style |

| Bank Draftslegal bug 14 | 12 FREE/year, $9.95 each thereafter |

| Right Account Guarantee® | If you’re not completely satisfied within the first 4 months, we’ll refund your monthly fees for up to 3 months.legal bug 15 |