Help Topics Covered in This Section

- Selecting a Payment Method

- Automated Clearing House (ACH): USD Cross Border / EUR International Payment

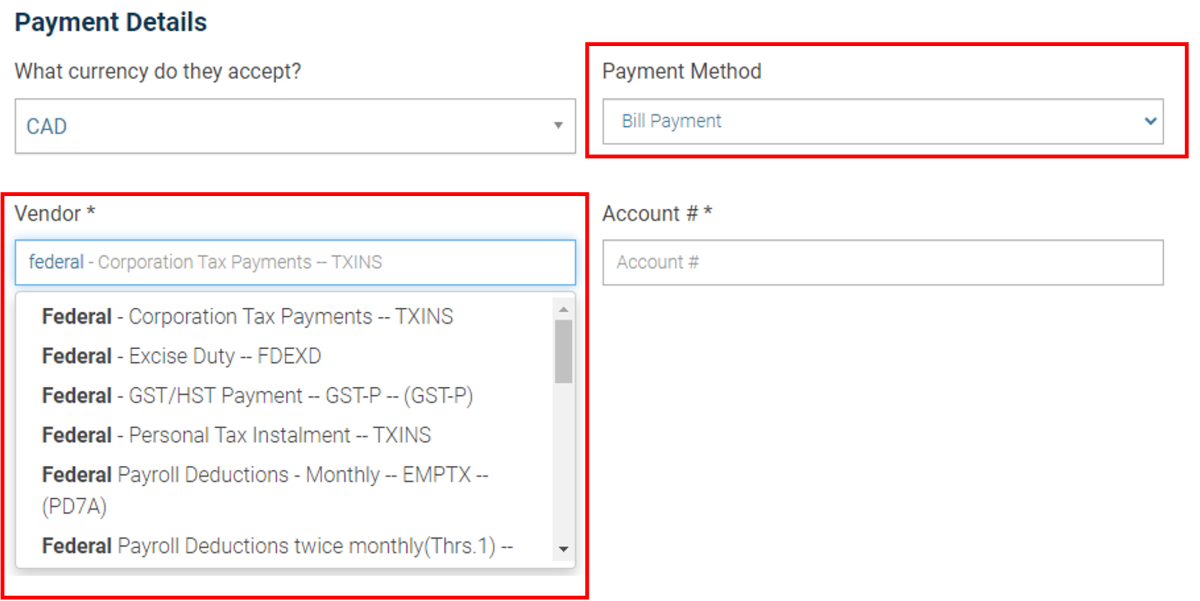

- Bill Payment

- Cheque

- CRA Payments (initiated via Bill Payment)

- Electronic Funds Transfer (EFT) / Direct Deposit

- Interac e-Transfer for Business

- RBC Pay & Transfers

- Virtual Credit Card

- Wire Transfer (Canada, US) and International Wire Transfer

Selecting a Payment Method

RBC PayEdge allows you to pay your suppliers using multiple payment methods. The type of payment method you select will typically be dependent on the following:

- Supplier preference

- Destination

- Cost

- Settlement timeline

- Supplier details you were provided

To view the settlement times and pricing for all payment methods, please download and refer to the RBC PayEdge Help Guide (PDF).

Automated Clearing House (ACH): USD Cross Border / EUR International Payment

Best Suited For:

Paying low dollar amounts to international suppliers (United States or EUR Zone).

Features:

- Lower cost than traditional international payment methods, with slower settlement times.

- Limit of $10,000 local currency per payment.

Information Required:

Note: You must first add ‘Wire Transfer’ as the payment method (including Wire Payment Details) for any suppliers you wish to pay using ACH. You will later add the account details for the ACH (USD Cross Border or EUR International Payment).

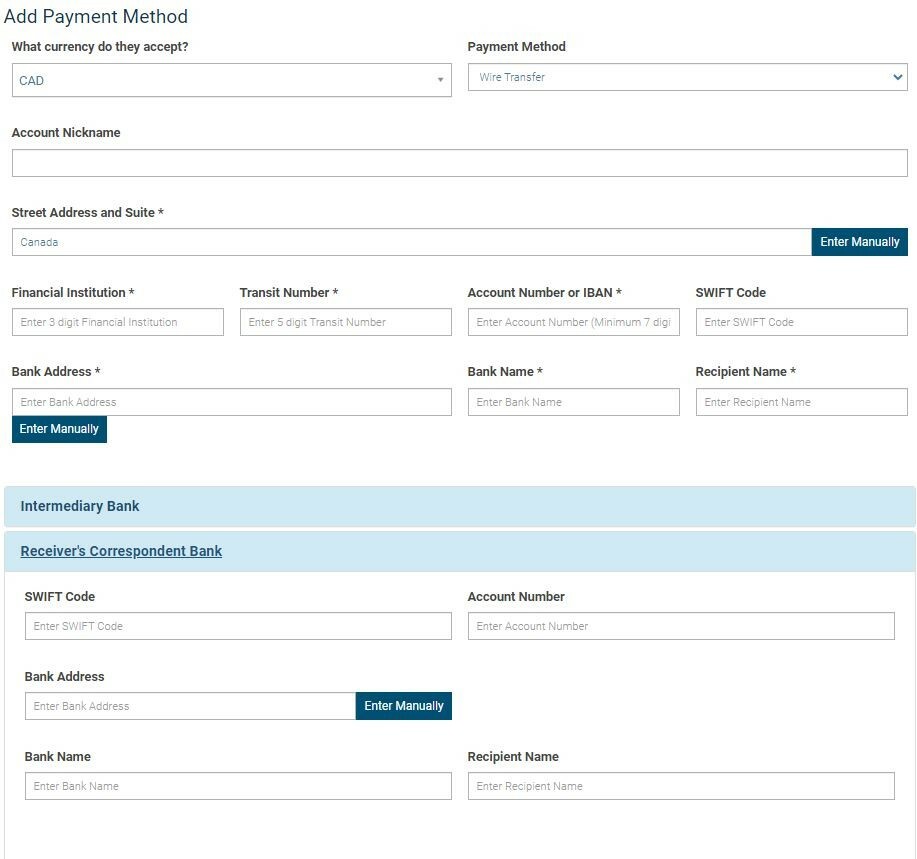

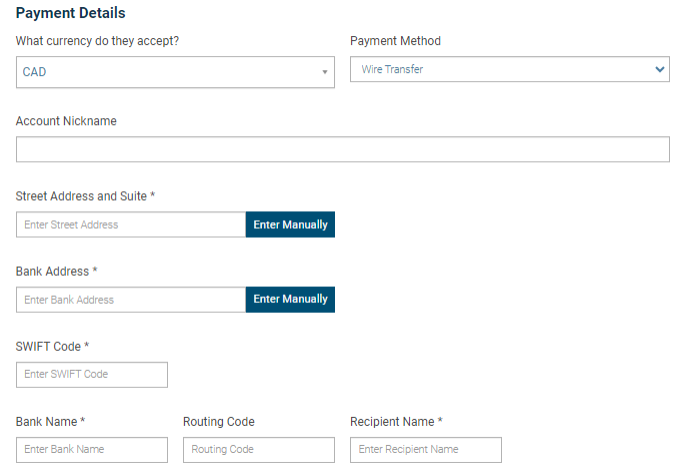

Wire Payment Details Required:

- Supplier Address and Recipient Name.

- Supplier Account Details: financial institution, transit number, account number or IBAN.

- Supplier’s Bank Details: SWIFT Code, Bank Address, Bank Name.

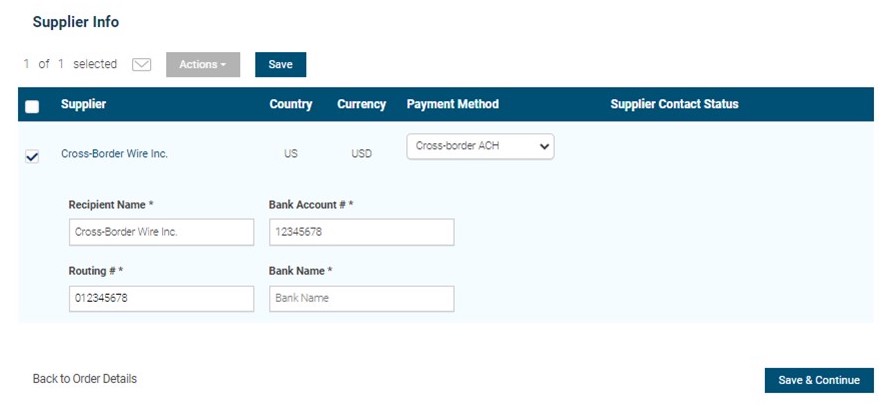

ACH Details Required:

- Supplier Name

- Bank Account #

- Routing #

- Bank Name

Note: You must first add ‘Wire Transfer’ as the payment method (including Wire Payment Details) for any suppliers you wish to pay using Cross Border ACH. You will later add the account details for the Cross Border ACH.

How does this work?

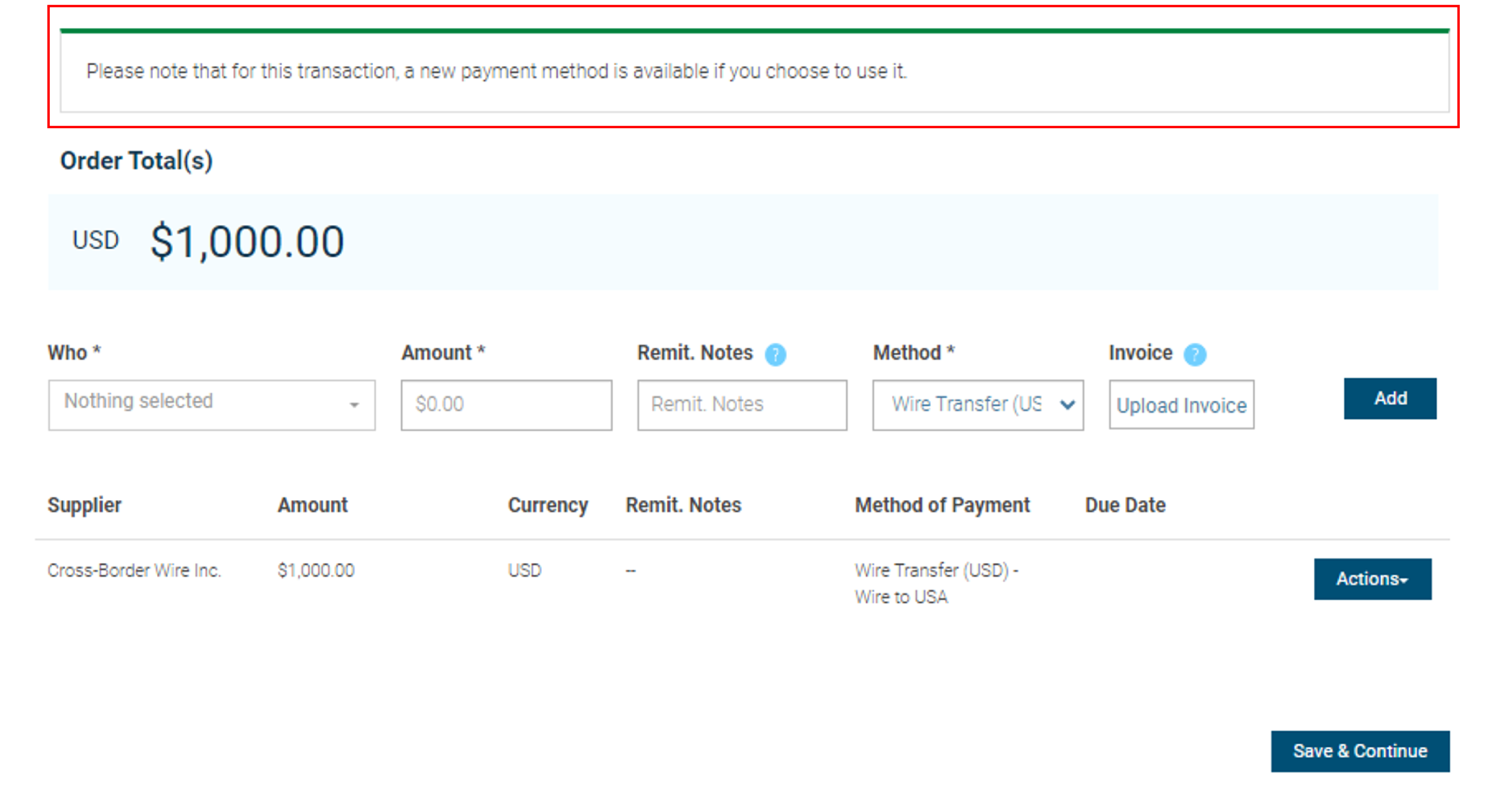

1.

When making a payment to an international supplier, if it meets the criteria to be eligible for USD Cross Border ACH or EUR International Payment (based on $ size and destination) the platform will prompt you with this option.

2.

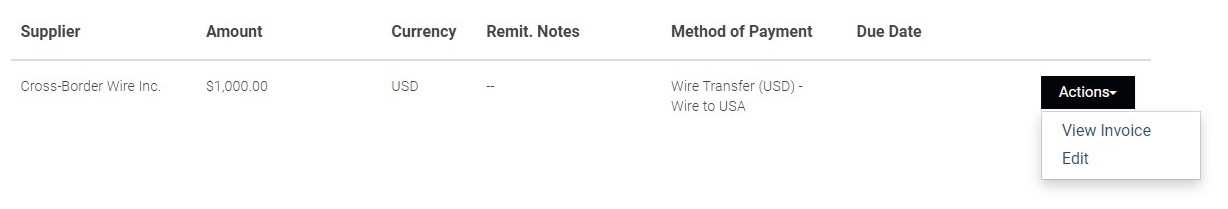

To unlock this new payment function click ‘Actions’ > ‘Edit’

3.

Under Method of Payment select Cross-border ACH (USD) for USD or International Payment for EUR. Click ‘Save’.

As a one-time activity, you will be required to confirm the supplier account information for the ACH payment. Going forward this information will be saved, and you can select ACH as a method of payment for any eligible payments.

Bill Payment

Best Suited For:

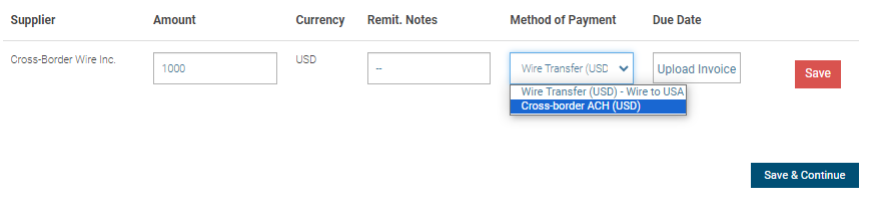

- Paying a bill directly to a domestic service provider (e.g. utilities or telecommunications).

Features:

- Low cost and standard settlement times.

- No dollar limit.

Information Required:

- The supplier’s business name (must be found in the dropdown) and the account details from the bill that you are paying.

Cheque

Best Suited For:

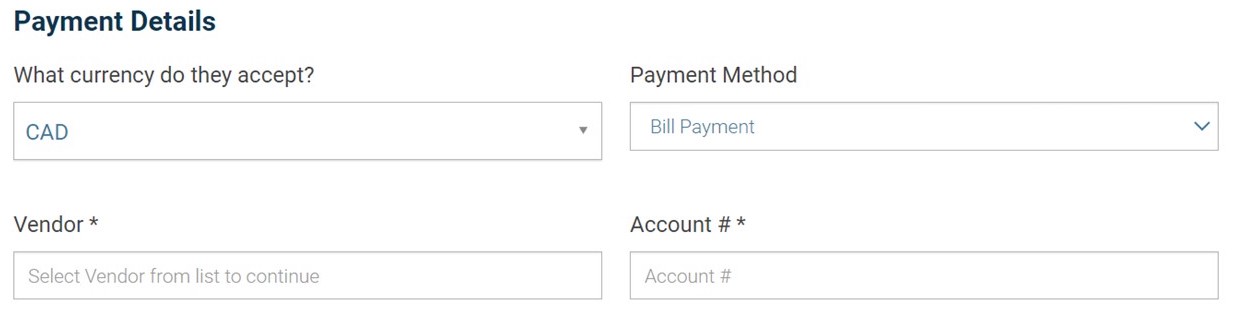

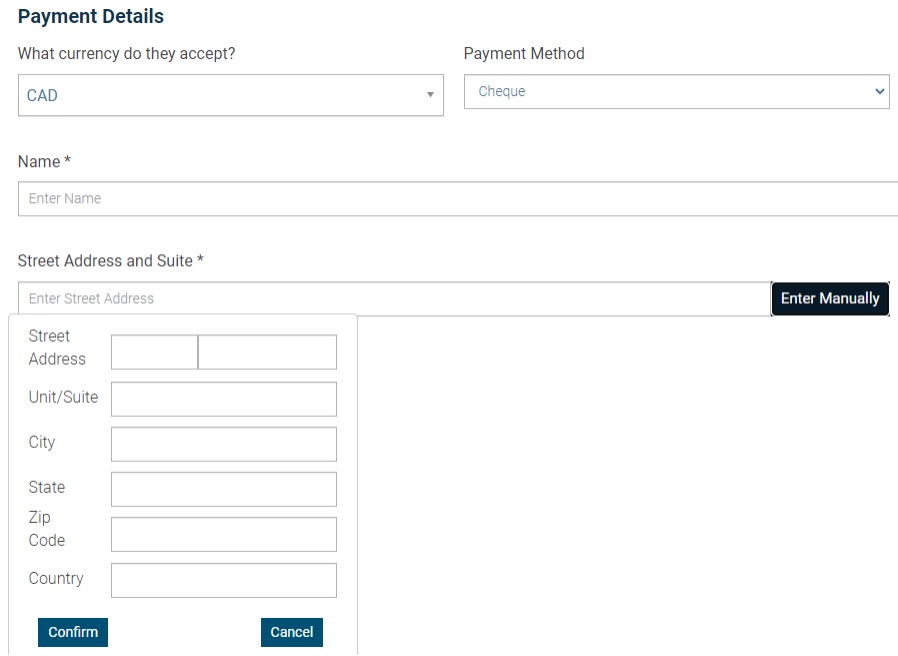

- Paying domestic suppliers who require a physical cheque.

Features:

- Relatively low cost, slower settlement time.

- No dollar limit.

- RBC PayEdge will issue and mail the cheque to suppliers on your behalf.

Information Required:

- Supplier Name and Business Address.

How does this work?

When a cheque payment is approved, the amount is withdrawn from the selected funding account.

The payment is issued on an RBC PayEdge cheque, with the sender’s name appearing on the memo line at the bottom of the cheque as well as in the remittance notes.

Once the cheque has been deposited and cleared by the recipient, RBC PayEdge will send you a notification informing you that the payment has been completed.

CRA Payments (initiated via Bill Payment)

Best Suited For:

- Submitting Federal and Provincial taxes for your business.

- The most common remittances include: Corporate Tax Payments, GST/HST Remittance and Payroll Deductions.

Features:

- Low cost, standard settlement time.

- No dollar limit.

Information Required:

- Name of the agency being paid.

- Information required will be dependent on the type of CRA payment you are making. You will be prompted for details based on the Vendor selected.

Note: CRA payments are initiated as Bill Payments, and the recipient must be found in the Vendor Dropdown. The three most common payment types are automatically available on each new client profile; any additional taxes payable must be added to the client profile by the RBC PayEdge Support Team. Please reach out directly at 1-833-945-4292 for assistance.

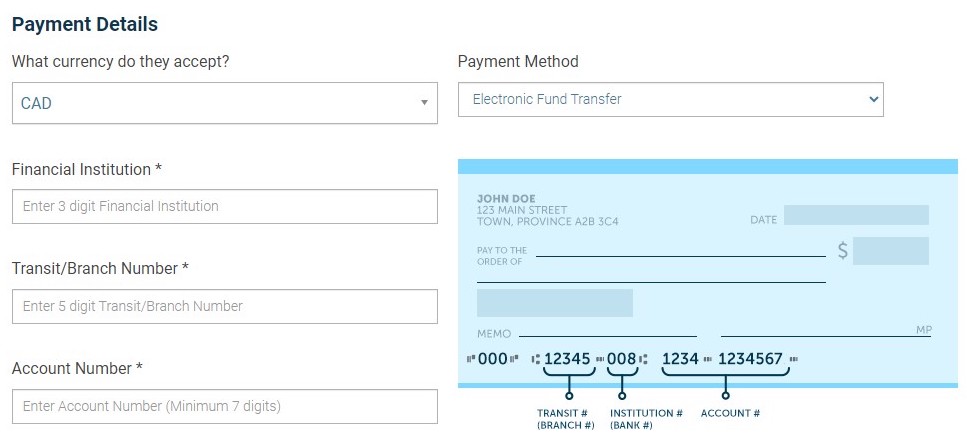

Electronic Funds Transfer (EFT) / Direct Deposit

Best Suited For:

- Paying domestic suppliers when you have their bank account details.

Features:

- Low cost and standard settlement times.

- No dollar limit.

Information Required:

- Supplier’s bank account details (transit, institution, and account numbers).

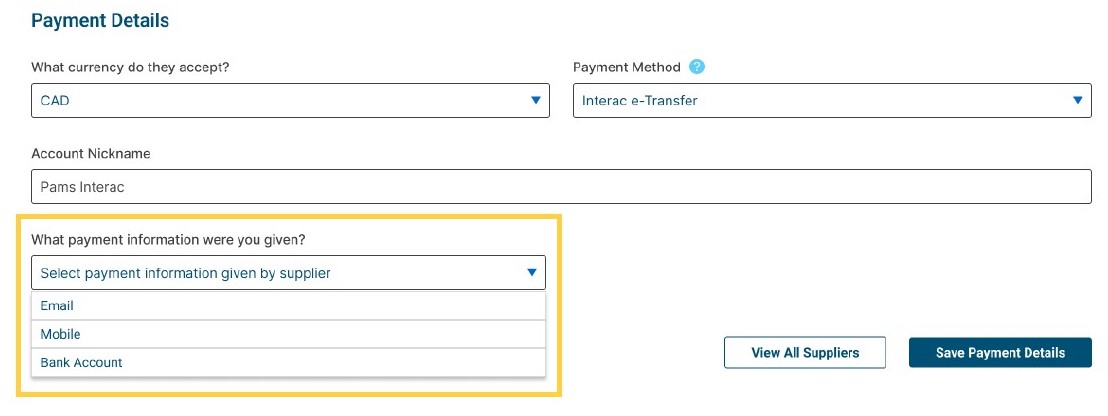

Interac e-Transfer for Business

Best Suited For:

- Paying domestic suppliers using flexible routing options.

Features:

- Low cost, expedited settlement times.

- Limit of CAD $25,000 per payment.

- Ability to include key remittance data such as invoice details, sender messages, or other payment information.

Information Required:

- One of the following: Email address, Canadian mobile phone number, or account number (institution, transit, account number) for the recipient.

- Creation of a security question. This will not be used if recipient has Autodeposit enabled or if routed using a Bank Account.

- Remittance Notes may be added to the payment which can include a payment memo, invoice details (for up to 5 invoices) or an external link to an invoice.

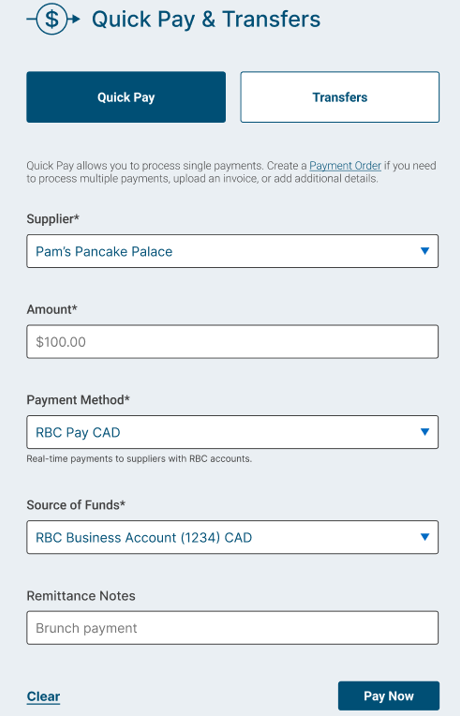

RBC Pay & Transfers

Best Suited For:

- Making real-time payments from your RBC Business Account or Virtual Wallet to a Supplier’s RBC Account.

- Making real-time transfers between your RBC Business Accounts within the same legal entity, including to your Virtual Wallet.

Features:

- Low cost, real-time payment processing.

- $25,000 limit per transaction.

- $10,000,000 limit per transaction for account transfers within the same legal entity.

Information Required:

- Supplier’s RBC bank account details (transit, institution – must be 003, and account numbers).

How does this work?

This feature is only available for eligible RBC Business Accounts and the Virtual Wallet when making a payment to another RBC account. At this time, RBC Pay can only be initiated using the Quick Pay & Transfers Function.

If a supplier is eligible to receive a payment using RBC Pay, you will have the option to add RBC Pay as a Payment Method to their supplier profile. No additional set up is required to transfer funds between RBC accounts within the same legal entity using the Transfers feature.

Virtual Credit Card

Best Suited For:

- Making a one-time credit card payment to a supplier who accepts credit card (cannot be used for recurring payments).

- This feature is only available for RBC Commercial Credit Card holders.

Features:

- No cost to process payment, standard settlement time.

- No dollar limit.

- Reduces fraud by generating a unique card number for each transaction.

Information Required:

- Your RBC Commercial Credit Card details. Refer to Add a credit card section for details on how to add a card as a funding source.

- Your supplier’s contact information and approval to accept this payment source.

How does this work?

RBC PayEdge will issue a single use 16-digit credit card number, with its own expiry date and CVV code that is tied to the RBC Commercial credit card you own.

When a payment is made, the supplier will receive a secure email with payment details so they can authenticate and accept the funds using their POS/ePOS to process the payment.

Once the payment is processed, or the 30 day time limit has elapsed, the virtual card number will expire.

Wire Transfer (Canada, US) and International Wire Transfer

Best Suited For:

- Paying domestic or international suppliers when finality of payment and/or delivery in foreign currency is required.

Features:

- Higher cost, standard settlement times (destination dependent).

- No dollar limit.

- Over 30 currencies supported.

Information Required:

- Supplier Address and Recipient Name.

- Supplier Account Details: financial institution, transit number, account number or IBAN (CLABE for payments to Mexico).

- Supplier’s Bank Details: SWIFT Code, Bank Address, Bank Name.

- [If Required] Intermediary or Correspondent Bank details.