Online and Mobile Banking for Businesses of All Sizes

Online and Mobile Banking for Businesses of All Sizes

Whether you’re operating a sole proprietorship or managing a large commercial business, RBC’s online banking platforms can help you take care of business from anywhere. Explore the option that best fits your business needs:

Single-user, single-entity businesses

RBC Online Banking for Business

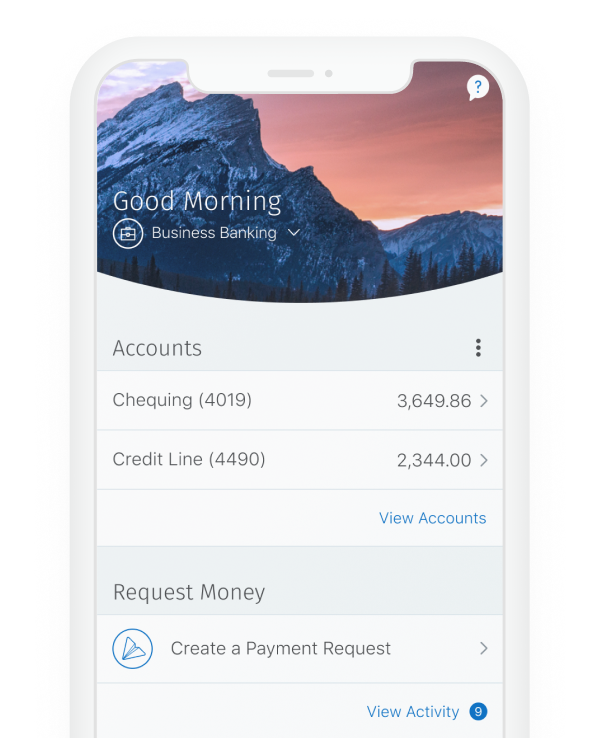

RBC Online Banking for Business

RBC Online Banking for Business and the RBC Mobile1 app are for businesses with a single digital banking user requiring domestic currencies and standard payment solutions.

Learn More

Enterprise-level online business banking2

RBC Express Online Banking

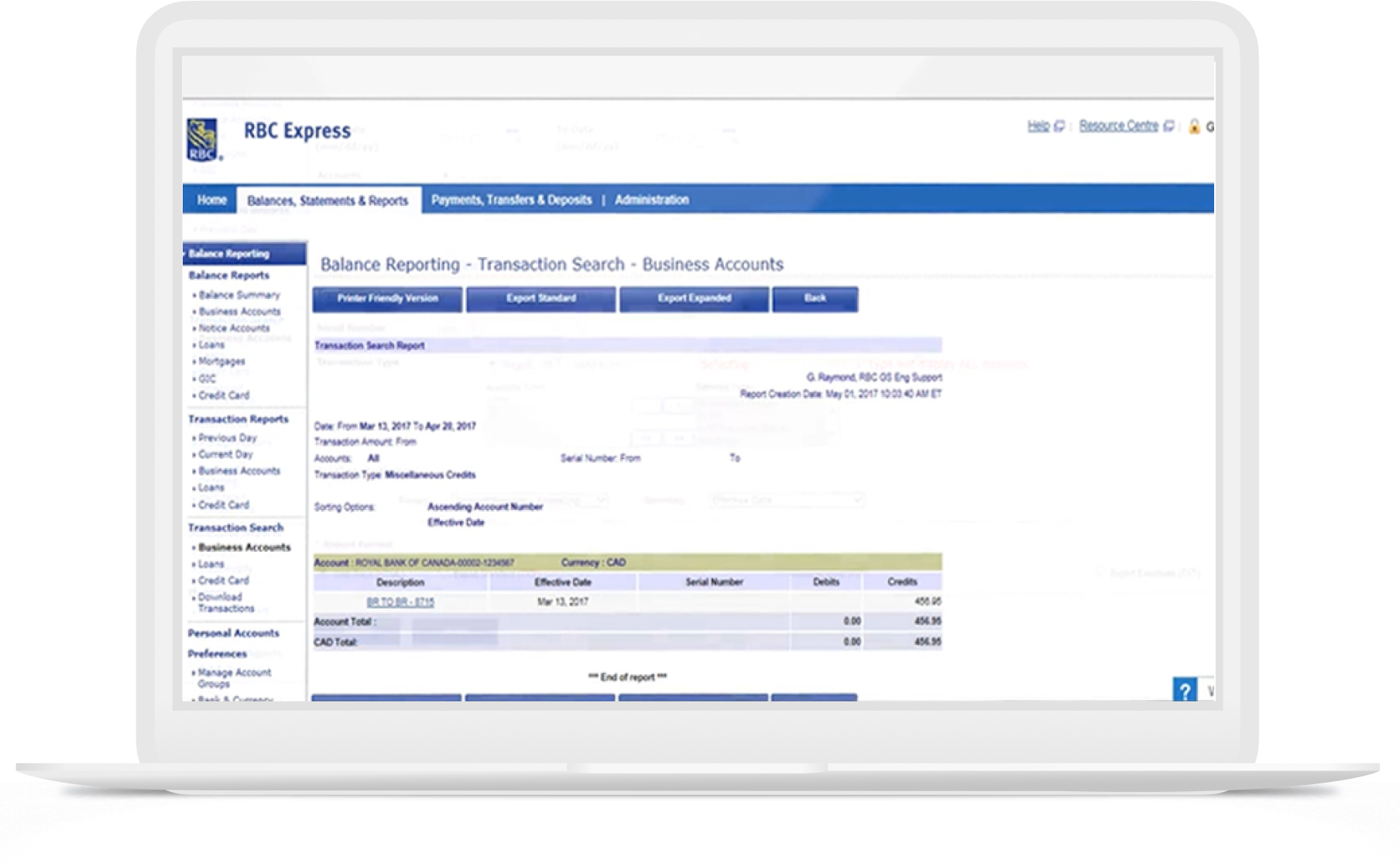

RBC Express Online Banking

RBC Express is an enterprise-level platform for businesses with multiple digital banking users requiring domestic and/or international currencies and higher-value payment solutions.

Learn More

Compare RBC Online Banking for Business and RBC Express Online Banking

Note: Fees apply for certain services.

| Table Heading | RBC Online Banking for Business | RBC Express Banking (and Connected Platforms) |

|---|---|---|

| Maximum Number of Users | 1 | Unlimited |

| Manage Banking for More Than One Entity |

|

|

| Access Your Company’s Banking 24/7 |

|

|

| Bank on the Go with a Mobile app |

|

|

| View and Manage Accounts in Canadian and U.S. Currencies |

|

|

| Access Information on Operating Accounts Located Outside of Canada, in Local or International Currencies |

|

|

| Make and Receive Payments in Local and International Currencies |

|

|

| Manage Foreign Exchange |

|

|

| Bill Payments and Account Transfers |

|

|

| Direct Deposits for Employees, Vendors and Suppliers |

|

|

| Send Domestic and International Wire Payments |

|

|

| Tax Payments and Filing |

|

|

| ACH Payments (Electronic Funds Transfer) |

|

|

| Bulk Payment Files (manual upload or host-to-host) |

|

|

| Interac e-Transfer for Business | Up to $2,000 | Up to $25,000 (via RBC PayEdge) |

| Email/SMS Money Transfers |

|

|

| Interac e-Transfer Autodeposit |

|

|

| Deposit Cheques from Anywhere |

|

|

| Multiple Cheque Deposit |

|

|

| High Volume Paper Cheque Management Service - Lockbox Receivables Service |

|

|

| Cheque Fraud Prevention Tools |

|

|

| Collect Membership Fees or Recurring Payments |

|

|

| Reconcile Payments and Accounts Receivables |

|

|

| Balance Reporting |

|

|

| Chargeback Reporting |

|

|

| Incoming Wires Reporting |

|

|

| Fee Details (for Reporting and Monitoring) | Not applicable | Monthly Fees Starting at $03 |

| Manage Business GICs |

|

|

| Manage Your Credit Online |

|

|

| View Loan Balances |

|

|

Access to other connected RBC platforms that are purpose-built to support more complex banking needs, such as:

|

||

Not an RBC Business Client Yet?

Our dedicated specialists will work with you to provide the financial advice and solutions that best suit your business.

Call our 24/7 Business Helpline

Compare Your Options

| Services | Online Banking for Business | Premium Online Banking for Business with RBC Express |

|---|---|---|

| 24/7 Account Access |  |

|

| Mobile App (bank on the GO) |  |

|

| Pay Bills, Transfer Funds, File and Pay Taxes |  |

|

| Pay Employees & Vendors through direct deposit |  |

|

| Mobile Cheque Deposit |  |

– |

| Manage banking for more than 1 entity | – |  |

| Multiple Cheque Deposit | – |  |

| High Volume Paper Cheque Management Service | – |  |

| Cheque Fraud Prevention Tools | – |  |

| Unique Users | 1 | Unlimited |

| Banking on the Go Using a Mobile Device |  |

|

| Email/SMS Money Transfers |  |

|

| View and Manage Accounts in Canadian and U.S. Currencies |  |

|

| Access Information on Operating Accounts Located Outside of Canada, in Local or International Currencies | – |  |

| Making and Receive Payments in Local and International Currencies | – |  |

| Manage Foreign Exchange | – |  |

| Send Domestic and International Wires Up to $10,000 Per Day |  |

– |

| Send Domestic and International Wires With Preferred Foreign Exchange Rates & No Daily Limit | – |  |

| Collect Membership Fees or Recurring Payments | – |  |

| Cost Per Month | Free | Starts at $0 |