Receive Payments from Customers and Others

Make It Easy for Customers, Vendors, Suppliers and Others to Pay You

Whether you need to accept payments online or in person, we can help you simplify your collections process and get paid sooner.

Make It Easy for Customers, Vendors, Suppliers and Others to Pay You

Whether you need to accept payments online or in person, we can help you simplify your collections process and get paid sooner.

Collect Faster with the Right Accounts Receivable Solutions

- Eliminate trips to the branch with a wide range of electronic payment solutions.

- Quickly access funds by having payments automatically deposited to your RBC business account.

- Improve customer service by making it simple and secure for customers to pay you.

What Type of Payments Do You Need to Accept?

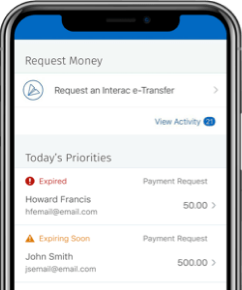

Easily Request Money Using Interac e-Transfer‡,1

Request up to $10,000 from each customer per day with Interac e-Transfer through RBC Online Banking for Business. You can provide a payment due date and an invoice number to keep track of payments. It’s fast, safe and secure!

Ideal for:

- Tracking payments electronically

- Requesting money on the go

- Using electronic invoicing

Instantly Receive Money with Interac e-Transfer Autodeposit2

Have payments automatically deposited into your business account. Simply register your email address or Canadian mobile number along with the account where you want the funds deposited.

Ideal for:

- Receiving electronic payments automatically

- Keeping banking details private

- Collecting receivables quickly and securely

Register online for Interac e-Transfer Autodeposit:

Request Payments from Multiple Clients in Bulk

Easily request multiple payments in a single file upload, without needing your customer’s banking information, using RBC Interac e-Transfer Bulk Request Money. It’s a secure and cost-efficient way to request payments.

Ideal for:

- Receiving payments electronically

- Sending up to 10,000 individual requests at a time

- Simplifying invoice reconciliation

Contact your RBC Account Manager(opens modal window) to learn more

Become a Payee Within Your Clients’ Online Banking

Get enrolled as an approved payee at RBC and other financial institutions so your clients can select your company and pay you through their online banking. Payments are directly deposited into your business account.

Ideal for:

- Receiving recurring payments from a large number of customers

- Accepting payments via any online banking or ATM platform

Contact your RBC Account Manager(opens modal window) to learn more

Accept Payments In Store, Online or On the Go

Easily accept debit and credit card payments online, at a physical location, curbside or on the road with Payment Solutions by Moneris‡. Funds are available in your business account the next day—seven days a week, 365 days a year.

Ideal for:

- Accepting debit and credit card payments

- Businesses needing a scalable payment solution

Collect Recurring, Fixed or Variable Receivables

Automatically collect regular, fixed or variable receivables from your Canadian and U.S. customers electronically with pre-authorized debit (ACH).

Ideal for:

- Collecting service fees, subscription fees, condo fees, etc. from existing customers and payees

- Quickly identifying insufficient fund payments

Contact your RBC Account Manager(opens modal window) to learn more

Deposit Multiple Cheques with Cheque-Pro®

Make unlimited deposits of up to 250 items to your Canadian and U.S. dollar business accounts. Receive same-day credit for deposits made before 10pm ET and access payment information online, as well as digital images of your cheques—without ever having to leave your office.

Ideal for:

- Businesses depositing 25+ cheques per month

- Businesses with more than one office making deposits, or not located near a branch

Contact your RBC Account Manager(opens modal window) to learn more

Receive and Process a High Volume of Paper Cheques

Reduce time processing paper cheques and invoices with a PO Box system that amalgamates, collects, opens, images, processes and provides same-day access to payments and invoices.

Ideal for:

- Mid-sized to large businesses looking to reduce time processing high paper cheque/invoice volume

- Receiving paper cheque payments from long distances

- Easily keeping track of remittance information

Available through Premium Online Banking - RBC Express.

Let Your Customers Pay Over Time

Drive sales, grow average order value and increase overall conversions with PayPlan by RBC.3 It integrates with your e-commerce platform to give customers the option to pay for items over time with the terms that work for them.Ideal for:

- Offering flexible financing terms for your shoppers

- Giving customers a way to pay for costly items over time

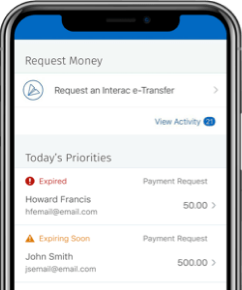

Easily Request Money Using Interac e-Transfer‡,1

Request up to $10,000 from each customer per day with Interac e-Transfer through RBC Online Banking for Business. You can provide a payment due date and an invoice number to keep track of payments. It’s fast, safe and secure!

Ideal for:

- Tracking payments electronically

- Requesting money on the go

- Using electronic invoicing

Instantly Receive Money with Interac e-Transfer Autodeposit2

Have payments automatically deposited into your business account. Simply register your email address or Canadian mobile number along with the account where you want the funds deposited.

Ideal for:

- Receiving electronic payments automatically

- Keeping banking details private

- Collecting receivables quickly and securely

Register online for Interac e-Transfer Autodeposit:

Request Payments from Multiple Clients in Bulk

Easily request multiple payments in a single file upload, without needing your customer’s banking information, using RBC Interac e-Transfer Bulk Request Money. It’s a secure and cost-efficient way to request payments.

Ideal for:

- Receiving payments electronically

- Sending up to 10,000 individual requests at a time

- Simplifying invoice reconciliation

Register online for Interac e-Transfer Autodeposit:

Contact your RBC Account Manager(opens modal window) to learn more

Become a Payee Within Your Clients’ Online Banking

Get enrolled as an approved payee at RBC and other financial institutions so your clients can select your company and pay you through their online banking. Payments are directly deposited into your business account.

Ideal for:

- Receiving recurring payments from a large number of customers

- Accepting payments via any online banking or ATM platform

Contact your RBC Account Manager(opens modal window) to learn more

Accept Payments In Store, Online or On the Go

Easily accept debit and credit card payments online, at a physical location, curbside or on the road with Payment Solutions by Moneris‡. Funds are available in your business account the next day—seven days a week, 365 days a year.

Ideal for:

- Accepting debit and credit card payments

- Businesses needing a scalable payment solution

Collect Recurring, Fixed or Variable Receivables

Automatically collect regular, fixed or variable receivables from your Canadian and U.S. customers electronically with pre-authorized debit (ACH).

Ideal for:

- Collecting service fees, subscription fees, condo fees, etc. from existing customers and payees

- Quickly identifying insufficient fund payments

Contact your RBC Account Manager(opens modal window) to learn more

Accept Payments In Store, Online or On the Go

Easily accept debit and credit card payments online, at a physical location, curbside or on the road with Payment Solutions by Moneris‡. Funds are available in your business account the next day—seven days a week, 365 days a year.

Ideal for:

- Accepting debit and credit card payments

- Businesses needing a scalable payment solution

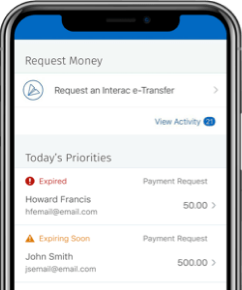

Easily Request Money Using Interac e-Transfer‡, 1

Request up to $10,000 from each customer per day with Interac e-Transfer through RBC Online Banking for Business. You can provide a payment due date and an invoice number to keep track of payments. It’s fast, safe and secure!

Ideal for:

- Tracking payments electronically

- Requesting money on the go

- Using electronic invoicing

Accept Payments In Store, Online or On the Go

Easily accept debit and credit card payments online, at a physical location, curbside or on the road with Payment Solutions by Moneris‡. Funds are available in your business account the next day—seven days a week, 365 days a year.

Ideal for:

- Accepting debit and credit card payments

- Businesses needing a scalable payment solution

Let Your Customers Pay Over Time

Drive sales, grow average order value and increase overall conversions with PayPlan by RBC.3 It integrates with your e-commerce platform to give customers the option to pay for items over time with the terms that work for them.Ideal for:

- Offering flexible financing terms for your shoppers

- Giving customers a way to pay for costly items over time

Deposit Multiple Cheques with Cheque-Pro®

Make unlimited deposits of up to 250 items to your Canadian and U.S. dollar business accounts. Receive same-day credit for deposits made before 10pm ET and access payment information online, as well as digital images of your cheques—without ever having to leave your office.

Ideal for:

- Businesses depositing 25+ cheques per month

- Businesses with more than one office making deposits, or not located near a branch

Contact your RBC Account Manager(opens modal window) to learn more

Receive and Process a High Volume of Paper Cheques

Reduce time processing paper cheques and invoices with a PO Box system that amalgamates, collects, opens, images, processes and provides same-day access to payments and invoices.

Ideal for:

- Mid-sized to large businesses looking to reduce time processing high paper cheque/invoice volume

- Receiving paper cheque payments from long distances

- Easily keeping track of remittance information

Available through Premium Online Banking - RBC Express.

FAQs

Accounts receivable is money owed to a business by clients or customers for products or services that have been provided and invoiced.

A pre-authorized payment is a convenient, automatic way for your customers to pay you electronically. As an RBC business client, you can automatically collect recurring, fixed or variable receivables from your customers through pre-authorized debit.

To receive funds from an Interac e-Transfer for business transaction, clients can conveniently have payments deposited directly into their business accounts using Autodeposit. You can accept payments once you get a notification via email or phone.

As an RBC business client, you can accept debit and credit card payments online, in store or on the go with Moneris‡. Set up is easy, fast and secure and you’ll have access to the funds in your RBC business account by the next day, 365 days a year.

Learn more about Moneris.Become a payee at RBC and other financial institutions through the RBC Corporate Creditor Payment Service. You’ll need to provide some details about your business in order to get enrolled.

Contact your RBC Account Manager(opens modal window) to learn more

Ready to Get Started?

How many employees do you have?

View Legal DisclaimersHide Legal Disclaimers