Bank Your Way

With RBC, you can choose a way of banking that’s most convenient and comfortable for you.

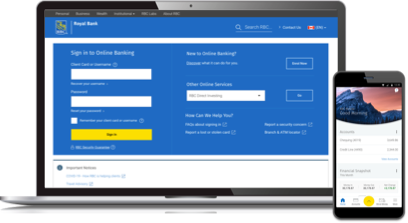

Online and Mobile Banking

Easily take care of day-to-day banking online from the comfort and security of your home.

Our tutorials can help you find everything you need to get started with RBC Online Banking and the RBC Mobile app.

Get started by selecting the activity you’d like to try:

ATM, Branch and Telephone Banking

Speak with an Advisor or visit an ATM with access to the largest combined branch and ATM network in Canada and 24-hour telephone banking.legal bug4

- Get in-person advice and information at a branch. Find a branch near you

- Withdraw cash, deposit cheques, pay bills and more at any of our ATMs.legal bug1 Find an ATM near you

- Transfer money, check your balances and more through 24/7 telephone banking

Accessibility

RBC is committed to ensuring you have accessible ways to bank as well as learn about the products and services offered.

Every RBC branch location has at least one dedicated wheelchair accessible ATM that meets and exceeds the Canadian Standards Association (CSA) standards.

Clients who are accompanied by a service animal may access all RBC premises that are normally accessible to clients.

We offer voice guidance enabled banking machines and printed materials in a number of formats including large type, e-text and Braille. Our websites are also developed to be easily accessible and screen reader friendly.

Clients can take advantage of our Teletypewriter (TTY) services, which use teletype devices with written text. Our TTY lines are available in English and French, and are as responsive as our regular phone lines. Just call us at 1-800-661-1275 — we'll be glad to help you.

Protect Your Money

Understand how to protect your money, personal information, and how to report suspicious financial activity.

Fraud and Financial Abuse

Financial abuse against seniors can take many forms, such as theft, fraud, and even dishonesty by friends or family members. Learn about the signs to watch out for, common examples of fraud and financial abuse, and how to protect yourself.

Protecting Yourself Online

Now more than ever, day-to-day life is conducted online from connecting with family, checking in with a doctor and doing your banking. The shift to digital has its benefits and at RBC, we believe working together with our clients is the best way to safeguard against financial fraud. Get tips on how to protect your personal information, get up to speed on the latest online scams, and understand how RBC keeps you safe.

Plan For the Future

You’ve worked hard for your money —so it’s important to keep as much of it as possible for both your future and your loved ones. Discover how you can continue to grow, protect and preserve your assets for yourself and future generations.

Retirement Planning Hub

From managing your cash flow to reducing your taxes in retirement, the RBC Retirement Planning Hub provides a wealth of information to help you save, plan and enjoy your retirement regardless of what stage you’re in.

Where are you with your retirement planning?

Wills and Estate Planning

Estate planning is just as important as planning for your retirement. Smart wills and estate planning can maximize the assets passed on to your loved ones and ensure your wishes are carried out efficiently.

Power of Attorney and Joint Banking

Power of Attorney

A Power of Attorney for property (POA) gives someone you trust the power to make financial decisions on your behalf—if and when it’s necessary. A POA can assist with your banking needs should you be unable to do so yourself.

With a joint bank account, you and the joint owner(s) share equal access and responsibility for all transactions made through the account.

Learn More about POA & Joint BankingHealth and Wellness Offers

As an RBC client, you also have access to special offers and support for your health and wellbeing.

Get 50 Be Well points for every $1 spent on eligible purchases at Rexalllegal bug 5

Earn and redeem Be Well points faster for your favourite health and wellness essentials. Simply scan your Be Well card when checking out at Rexall and pay with a linked RBC card.

Special Offer for RBC Clients: Save 20% When You Create a Will with Epilogue

Protect your loved ones with a legally-binding Will. Epilogue makes it convenient, easy and affordable to create a custom Will online.

Connect With an Advisor Today

RBC Advisors can help guide your financial journey—from taking care of your everyday banking needs to planning for the future.

Call 1 866 416-3611

Call Us

| Description | Phone Number |

|---|---|

| Everyday Banking | |

| Banking Accounts Client Cards Lines of Credit and Loans Mortgages |

1-800-769-2511 TTY: 1-800-661-1275 |

| Credit Cards Business Clients |

1-800-769-2512 TTY: 1-800-769-2518 |

| Business Banking | 1-800-769-2520 |

| Online Banking Mobile Banking |

1-800-769-2555 |

| Investments | |

| RRSPs, RESPs, TFSAs Mutual Funds & GICs |

1-800-463-3863 |

| RBC Direct Investing™ | 1-800-769-2560 |

| RBC Dominion Securities | 1-888-820-8006 |

| Insurance | |

|

Home Protector® Insurance LoanProtector® Insurance |

1-800-769-2523 |

|

BalanceProtector®

Insurance (optional protection for RBC Credit Cards) |

1-888-896-2766 |

| Business Loan Insurance Plan | 1-800-769-2523 |

| Travel HealthProtector® | 1-866-625-3508 |