Introduction

Learn how to read your monthly statement so you can get the most from your RBC credit card.

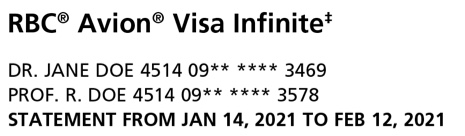

Credit Card Statement

*Photos are for illustrative purposes and actual statements may vary*

Statement Details

Statement Basics

The top of your monthly statement includes your card type, the names and linked cards of everyone authorized (co-applicants and authorized users) on the account, and the dates of your credit card statement period.

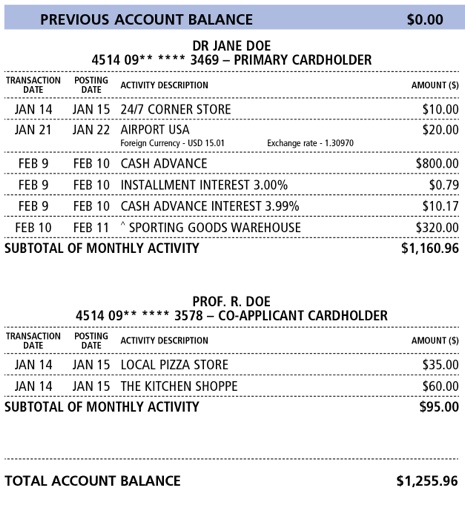

Credit Card Transactions & Activity Description

You’ll find a list of every transaction that took place during your credit card statement period here. Each transaction will include the transaction date (when the amount was debited or credited to your account), a posting date (when the transaction was processed), a description of the transaction, and the amount of the transaction. If the transaction was in a foreign currency, the foreign currency, amount and exchange rate will also be shown. Any negative amount represents a payment you have made, refund given, or a credit that has been applied to your account.

Transactions are separated by each credit card number under the account, making it easy to see the statement period activity for everyone authorized on the account.

Purchases that were installed as part of an Installment Plan during the statement period are identified by a ^ symbol in front of the activity description. You can find out more about installment plans in the “Installment Plan Summary" section below.

Carefully review your transactions each month. If you don’t recognize one or would like to report fraud, you can find the details right here.

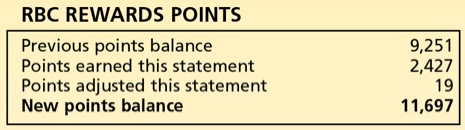

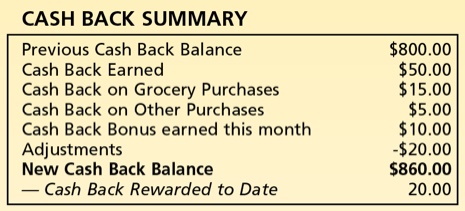

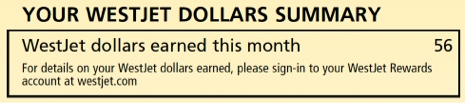

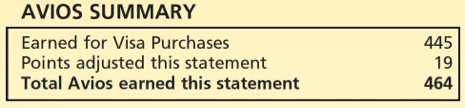

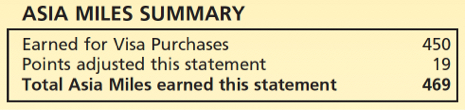

Rewards Summary Box

If your credit card offers Avion points, cash back, WestJet dollars or British Airways Avios, you’ll see your monthly activity and updated balance of your rewards program here. For Avion points, you can also view view a transaction level view of your points in the Avion Rewards app or by logging into Avion Rewards.

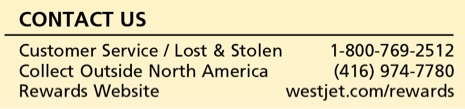

Contact Us

Have a question about your account? Here you’ll find phone numbers for reaching customer service or reporting a lost or stolen card. Remember, you can also report a lost or stolen card in Online Banking or in the RBC Mobile app.

This section also includes the URL of your My Credit Card Page for your card, where you’ll find account documentation and other useful resources.

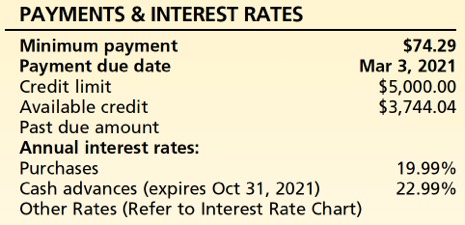

Payments & Interest Rates

If you are looking for information on payments, your credit limit and interest rates charged on purchases and cash advances, you’ll want to look in this section.

The minimum payment is the minimum amount that you must pay by the payment due date to keep your account in good standing. (Tip: You can set up an automated payment so you’ll never need to worry about missing a payment or making your payment on time.)

Your credit limit is the maximum amount that you and any co-applicant and/or authorized users, taken together, can charge to your account to cover purchases, cash advances, interest and fees. Your available credit is calculated by subtracting the amount you currently owe, plus the amount of any purchases that have been authorized but not yet posted to your account, from your credit limit.

If you didn’t make the minimum payment in the previous statement period, the unpaid balance will be shown here as the past due amount.

Finally, you’ll see your annual interest rates for your card. For additional information on all of the interest rates currently in effect on your account, refer to the interest rate chart and installment plan summary that appear on your statement and are outlined in further sections below.

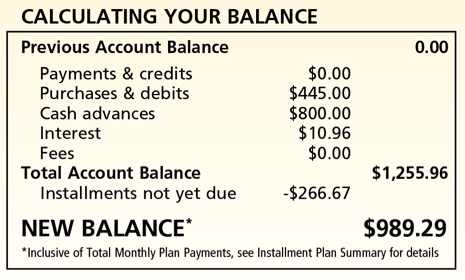

Calculating Your Balance

Your total account balance is calculated here by taking your previous account balance and deducting any payments or credits posted to your account by your statement date, then adding any new purchases, debits, cash advances, interest, and fees that accumulated during the statement period.

If you have any active installment plans, your new balance includes any monthly installment plan payments due that statement period. The remaining installment plan payments not yet due are deducted from your total account balance to come up with your new balance.

If you don’t have any installment plans, then your total account balance and your new balance will be the same amount. If you have an RBC RateAdvantage Visa you will not see a reference to total account balance, only to new balance, since installment plans are not available on this credit card type.

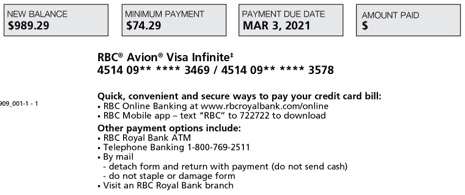

Your Remittance Slip

This section includes your new balance, minimum payment required, and the due date of your payment.

This section also indicates the various ways you can make a payment to your credit card. Your payment will be applied immediately when you pay your credit card balance via Online Banking, the RBC Mobile app, or by calling cards customer service. You can detach the remittance slip from your statement and include it when making your payment by mail or at a branch. Please allow sufficient time for payments to reach us by the payment due date.

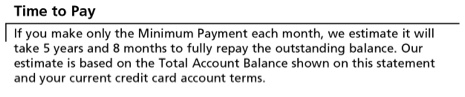

Time to Pay

This section shows you how long it would take to pay off your total account balance by making only the monthly minimum payment at the current account terms, and is intended for illustration purposes only.

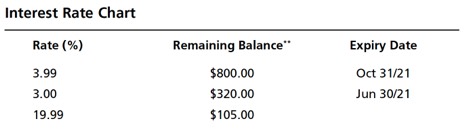

Interest Rate Chart

This chart lists the interest rates, remaining balances, and expiry dates currently in effect on your account.

Interest rates are used to calculate the amount you’re charged for borrowing on your credit card. You can avoid paying interest on new purchases (not converted to an installment plan) and fees by paying the new balance in full by the due date on your credit card statement. For cash advances, interest is charged as soon as the cash advance has been processed.

If you are benefitting from any special offers, such as a promotional interest rate on balance transfers or on an installment plan, the related interest rate will show up in this chart. If you have a balance transfer with a promotional interest rate, it will appear with the promotional interest rate displayed.

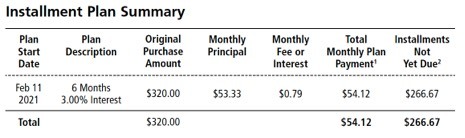

Installment Plan Summary

This section will only appear if you have active installment plans.

Here you’ll find some of the details of your original purchase that you converted to an installment plan, including the amount of the purchase, length of the plan, any applicable annual interest rate or monthly fee , the installment payment due this month, and how much you have left to pay. After the first payment, each monthly installment payment includes both interest or monthly fee (if applicable) and the installment plan principal. (Installment plan interest or monthly fee for the first and second month will be included in your second monthly payment).

Credit Card Statement Definitions

Select a Category by Letter

Annual Fee

Your annual fee (if any) for the primary card and for each additional card shown in the “Statement Basics" section, is charged on the first day of the month following your account opening (whether or not the credit card is activated) then annually on the first day of that same month.

Available Credit

The amount available to spend on your credit card, less all authorized and posted transactions.

We calculate your available credit by deducting from your credit limit the outstanding balance on your credit card account including cash advances, installments not yet due, and any purchases we have authorized but not yet posted to your account. As you make new cash advances, purchases or incur new fees or interest on your account, the amount of available credit for you to use will decrease. As you make payments or receive credits, your available credit will increase.

Balance Transfer

You can use the available credit on your RBC credit card to pay the balance of a non-RBC credit card, or to pay any bill. You can also transfer funds from your available credit to your RBC banking account.

A balance transfer is treated the same way as a cash advance. The cash advance interest rate is charged starting on the day when the balance transfer has been processed on your account, until you have paid off the full amount of the balance transfer.

From time to time, you may be eligible to receive a promotional interest rate offer on balance transfers completed via Online Banking or the RBC Mobile app. The offer details will be provided to you upon eligibility. A promotional rate fee of up to 3% is charged on balance transfers that are charged a promotional interest rate. Otherwise, balance transfer transactions are subject to the $3.50 cash advance fee.

RBC BalanceProtector Max Insurance

For more information about your RBC BalanceProtector Max insurance, please see your Certificate of Insurance or call Assurant at 1-888-896-2766

Cash Advance

The following types of transactions are treated as cash advances:

- When you make a cash withdrawal from your credit card at an RBC branch or ATM, or at any other financial institution’s branch or ATM.

- When you make a balance transfer by transferring all or part of a balance you owe elsewhere to your credit card, through our mobile banking, online banking service or by calling our cards customer service.

- When you make bill payments from your account (excluding pre-authorized charges that you set up with a merchant) or transfer funds from your account to another RBC Royal Bank account, at one of our branches or ATMs, or through our Online Banking, the RBC Mobile App, or telephone banking service.

- When you make cash-like transactions, which are transactions similar to cash. This includes money orders, wire transfers, travellers’ cheques and gaming transactions (including betting, off-track betting, race track wagers, casino gaming chips, and lottery tickets).

Interest is always charged from the day the cash advance has been processed to your account.

Cash Advance Fee

When you make a cash advance transaction, a $3.50 case advance fee for each transaction will be charged to your account unless the transaction is a balance transfer made at a promotional interest rate, or otherwise stated:

- Cash withdrawals from your account at one of our branches or ATMs, or at any other financial institution’s ATM, in Canada.

- Bill payments from your account (excluding preauthorized charges that you set up with a merchant) or when you transfer funds from your account to another RBC Royal Bank account at one of our branches or ATMs, or through our online banking or telephone banking service.

- When you make a balance transfer at the standard cash advance rate.

- When you make cash-like transactions, in Canada. (See cash advance for more on “cash-like" transactions).

Credit Limit

This is the maximum amount you and any co-applicant and/or authorized user, taken together, can charge to your account for purchases, cash advances, interest and fees. As the charges on your account increase, the amount of available credit for all of you to use will decrease. We calculate how much credit you have available by deducting from your credit limit the amount you owe including the amount of any purchases we have authorized but not yet posted to your account.

Installment Plan

You can convert eligible purchases into installment plans, which allow you to pay off that purchase in monthly installment payments over a set number of months pursuant to agreed upon terms.

Installment Plan Description

This states the one-time fee, monthly fee and/or interest associated with your Installment Plan, as well as the number of months to pay.

Installment Plan Monthly Fee and/or Interest

This is a monthly cost associated with your installment plan purchase. The fee and/or interest are added to your monthly principal as part of your Installment Plan Terms and Conditions.

Installment Plan Monthly Principal

This is the amount of your original purchase amount to be repaid each month.

Installment Plan Original Purchase Amount

This is the total purchase amount that was converted to an installment plan.

Installment Plan Start Date

This refers to the date you converted your purchase into an installment plan.

Installment Plan Summary

The Installment Plan Summary chart shown on your monthly statement sets out the details of any installment plans you are participating in. This includes a brief description of your plan, the amount you must repay each month, and remaining installments not yet due.

Installment Plan Total Monthly Plan Payment

Total monthly plan payments are the amounts you must repay each month on your Installment Plan(s). Your total monthly plan payment is equal to your monthly principal plus your installment plan monthly fee and/or interest due that month.

Installments Not Yet Due

Installments not yet due is the amount of principal on your installment plan to be paid in future statement periods. This amount therefore does not include the monthly principal due on your most recent monthly statement. See your “Installment Plan Summary" for details.

Interest

Interest is the amount charged to you for borrowing money by the use of your credit card to pay for your purchases or to withdraw as a cash advance. If you do not pay your new balance in full by the due date, you will pay interest on the remaining unpaid amount. For some transactions, including cash advances and balance transfers, interest starts accruing the date the transaction takes place, and is always charged.

Interest-free Grace Period

The grace period is the number of days you have to pay off new purchases and fees before interest is charged. Interest-free grace periods are typically 21 days, but may vary. There is no interest-free period for cash advances (including cash-like transactions, and balance transfers).

Minimum Payment

The minimum payment is the minimum amount you are required to pay by your statement’s due date to ensure your account remains in good standing. Your minimum payment is normally made up of any interest + fees + total monthly plan payments (installments) + $10.

If you reside in Quebec, the minimum payment will normally be the total of any total monthly plan payments, plus a percentage of your remaining new balance (that is, the new balance excluding total monthly plan payments). If your account was opened on or after August 1, 2019, this percentage is 5%. If your account was opened prior to August 1, 2019, this percentage is 2.5% until July 31, 2021, thereafter increasing in increments of 0.5% annually, beginning August 1, 2021, until 5% is reached on August 1, 2025.

Monthly Principal

If you have an Installment Plan, it is the portion of the original purchase to be repaid each month.

New Balance

Your new balance is equal to your total account balance as of your statement date, minus any installments not yet due (if you have installment plans). If you do not have any installment plans, then your total account balance and your new balance will be the same amount. Your new balance is the amount you will need to pay by the payment due date in order avoid interest charges on new purchases and fees.

One-time fee

This is a fee that, if applicable, is charged when you set up your installment plan.

Other Fees

Some transactions on your credit card may be charged an associated fee (cash advance, overlimit, installment plan, etc.). Your fees will be included in your transaction summary, as well as totaled in your “Calculating Your Balance" section of your statement.

Over limit and Over limit fee

You are overlimit if your total account balance exceeds your credit limit at any time during your monthly statement period. Should you go over limit, an over limit fee will be charged to your account. This fee does not apply to the RBC Avion Visa Infinite Privilege or RBC Avion Visa Infinite Privilege for Private Banking accounts, nor does it apply if you reside in Quebec. We may, at any time, refuse to authorize transactions in excess of your credit limit and require you to immediately pay any balance which goes over your credit limit.

Past Due Amount

If the minimum payment from the previous statement is not fully paid by the due date and not received by the time we prepare your statement, the unpaid portion will show up as a past due amount in the “Payments & Interest Rates" section of your statement.

Payment Due Date

Your payment due date is the date when your minimum payment is due. To avoid interest charges on new purchases and fees (other than those purchases converted to an Installment Plan), you should pay your new balance in full each month. Due dates are at least 21 days after the end of the previous statement period.

Payments and Credits

Payments are the amount of money transferred to your credit card to pay off your credit card balance. Credits are processed when a transaction has been reversed on your account, for example a refund of a purchase previously made on the card. The credit values are subtracted from your total account balance.

Previous Account Balance

This is the same as the total account balance that appeared on your last credit card statement. If you have an installment plan, your account balance includes installments not yet due.

Purchases and Debits

These consist of purchases, fees, interest, pre-authorized payments, or other spend on your credit card and are added to your total account balance.

Remittance Slip

Making a credit card payment in a branch or sending a payment by mail? Be sure to detach your remittance slip from your statement and include it with the payment to ensure your account is properly credited.

Statement Period

Each monthly statement covers activity on your account from the day after your previous statement was prepared to the last day of the statement period (your statement date).

Total Account Balance

Your total account balance is made up of your previous account balance, plus all new purchases and debits, cash advances, interest, and fees shown on your statement, minus the amount of any payments and credits which have been posted to your account by your statement date. If you have an Installment Plan(s), your total account balance also includes installments not yet due.

Statement FAQs

The Minimum Payment is the minimum amount you are required to pay by your statement’s due date to ensure your account remains in good standing.

You can make a payment through any of the methods below:

- Through RBC Online Banking

- Through the RBC Mobile app

- With automated payments (so you’ll never need to worry about making your payment on time)

- In person at an RBC Royal Bank branch

- At an RBC Royal Bank ATM that processes payments

- By calling 1-800-769-2512

- By mail

- At the branch of another financial institution

Make sure to allow sufficient time for payments to reach us by the payment due date.

Your annual interest rate can be found on the first page of your statement in the “Payments & Interest Rates Section" for both purchases and cash advances. Promotional or other interest rates can be found on the “Interest Rate Chart" on your statement.

Your credit limit is the maximum amount that you and any co-applicants and/or authorized users, taken together, can charge to your account to cover purchases, cash advances, interest and fees. As the charges on your credit card increases or decreases, the amount of credit available will go up and down.

The transaction date is the date on which the activity was debited or credited from your available credit. If it was a purchase, it was the date in which you made the purchase at a merchant.

The posting date is the date when the transaction was processed on your account.

There are 3 ways to request a change to the credit limit on your card:

- Sign into RBC Online Banking and select your RBC credit card. On the right side of the page, select change credit limit and follow the instructions.

- Give us a call at 1-800-769-2512

- Visit your local RBC Royal Bank branch

Your payment due date can be found on your monthly statement in the “Payments & Interest Rates" section, or on the account details page within RBC Online Banking or the RBC Mobile app. Your payment due date is at least 21 days after your previous statement end date, but if your payment due date falls on a weekend or a holiday, we will move the payment due date to the next business day.

If you suspect fraud, you should call us right away at 1-800-769-2512. You can also temporarily lock your card through the RBC Mobile app or RBC Online Banking.

Your statement is available on Mobile or Online Banking.

Online Banking

- Log into RBC Online Banking

- From the Banking tab, go to the applicable credit card

- Go to the Statement/Documents link

Mobile App

- Log into the RBC Mobile app

- From the Banking tab, go to the applicable credit card

- Go to the Details tab

- Go to the View Statements link

Switching from paper statements to electronic statements – or eStatements – is easy and convenient. eStatements look the same as paper statements and offer you even more value, convenience and security with benefits such as anytime/anywhere access and secure 7-year statement archivingLegal disclaimer double dagger ††.

Learn more about eStatements.

Your monthly statement includes a summary of all loyalty program activity from the current statement period in the “Rewards Summary" section. Information in this box will include your previous loyalty program balance, and “points" or “cashback" earned in the statement period, any redemptions, as well as your balance as of the end of the statement period.

For Avion points, you can see your point accumulation broken down by transaction by logging into Avion Rewards and reviewing your Point Activity or in the Avion Rewards app.

If you’ve loaded an offer to your debit or credit card, once you make your qualifying purchase, your cash savings offer will automatically appear as a credit on your credit card account statement or deposit on your bank account statement in as fast as 2 business days. Your bonus points offer will be deposited to your Avion Rewards account in as fast as 2 business days.

Please refer to the offer details for the exact amount of time it will take to receive your bonus points.

On the “Credit Card Transactions" section of your statement there will be separate lines for each interest amount charged to your account. For example, if you were charged interest for cash advances and purchases, you will see two separate lines with the corresponding interest rate, and the dollar amount charged. Interest is charged at the end of the statement period.

Changing your statement date can be done by giving us a call at 1-800-769-2512.

If your dispute is with the merchant, please contact the store or merchant directly to resolve the issue.

If you suspect that your RBC Royal Bank credit card has been used without your knowledge or consent, please call customer service immediately at 1-800-769-2512 and an advisor will help you.