Sustainable Finance Solutions

Banking for tomorrow

We’re creating more ways to help you manage your personal finances and work toward your goals, while helping you learn more about the ways you can reduce your impact on the environment.

Choose an area to explore today

Savings & Investments

Consider a socially responsible portfolio that balances positive change and performance

Travel & Commuting

Lower the emissions of your journeys and learn about electric car ownership

Home

Improve your home’s energy efficiency and reduce its carbon emissions

Banking for tomorrow

We’re creating more ways to help you manage your personal finances and work toward your goals, while helping you learn more about the ways you can reduce your impact on the environment.

Choose an area to explore today

Savings & Investments

Consider a socially responsible portfolio that balances positive change and performance

Home

Improve your home’s energy efficiency and reduce its carbon emissions

Helping to shape the future of our planet together

As global temperatures rise, the effects of climate change are felt by everybody. Shifts in our climate threaten to disrupt communities, natural spaces, the economy, and industries across Canada.

While climate change is a challenge we all face, there are solutions we can work towards. We recognize the need for action to collectively reduce our greenhouse gas emissions, which will contribute towards positive environmental change.

Learn MoreSavings & Investments

Investing in the future

Make progress towards your financial goals and feel confident in how your investments impact people and the planet.

What is ESG investing?

What is ESG investing?

ESG investing involves investments that meet environmental, social, and governance standards, which is one way you can help ensure your values are aligned with your financial goals.

-

Environmental — Includes a company’s actions around climate change, carbon emissions, air and water pollution, biodiversity and natural resource management.

-

Social — Considers a company’s relationships with its employees, customers and communities.

-

Governance — Considers how a company is governed: the company’s board structure and independence, executive compensation, shareholder rights, any lobbying activities and political contributions, and overall tax strategy and accounting standards.

What Investors Need to Know About Net Zero

Find out what net zero really means and how it can impact your personal investments.

Understanding ESG Investing: 9 Terms to Know

The numbers are in: 79 per cent of Canadians are considering investing in companies that are committed to ESG values.

Invest with greater purpose

Invest with greater purpose

Discover investing options with RBC.

Learn more about ESG investingTravel & Commuting

Reduce the greenhouse gas emissions of each mile

From the daily commute to a well-earned vacation, travel is a necessary part of our everyday lives. Find helpful advice to reduce the environmental impact of the trips you make, and guides to electric vehicle ownership.

Transport makes up around 1/3 of the average Canadian's carbon footprint

It accounts for 24% of total national emissions.

Transport makes up around 1/3 of the average Canadian's carbon footprint

It accounts for 24% of total national emissions.

Everything you need to know about owning an electric vehicle

Everything you need to know about owning an electric vehicle

We’re here to help answer any questions you might have about buying and owning an EV.

Learn more about EVsThe 2024 Guide to Buying an Electric Bike

Now’s a great time to buy an electric bike. The quality of available models is only going up, and they’re a great choice for the environment.

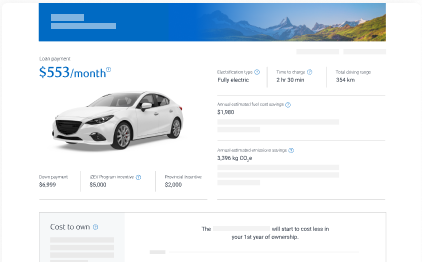

Electric car cost calculator

Calculate the cost to buy and own an EV, and find out how much money you could save.

Calculate nowHome

Energy-efficient home improvements

Making your home more energy-efficient doesn’t only benefit the environment — it can help save on energy bills, too. There are many ways to improve your household energy use, whether you rent or own your home.

Energy use in the average Canadian home

+

Around 65% of energy is used to heat and cool our homes

-

Tip:

Keep your home temperate by

setting your thermostat to

around 20°C during the day, and 16°C at night

+

Appliances, like fridges and dishwashers, use approx. 14% of household energy

-

Tip:

When it’s time, consider

installing ENERGY STAR-certified

appliances to use energy more efficiently

+

Heating water uses 17% of our home energy

-

Tip:

Your water heater can be

reduced to 49°C and still produce

enough hot water for your household needs

+

Just over 3% of our home’s energy is spent on lighting

-

Tip:

An LED or ENERGY STAR light

bulb uses 90% less energy than

a standard bulb, lasts 15x longer, and saves ~$55 in electricity

costs

in its lifetime

What is a Green Home and How Does it Reduce Emissions?

The energy we use at home doesn’t just impact on our utility bills: It may also negatively impact the environment.

A Renter’s Guide to Making Your Home More Energy-Efficient

As a renter there are still many affordable, achievable changes you can make to use less energy.

Your guide to saving energy at home

Learn how to make your home more energy-efficient and reduce greenhouse gas emissions.

Learn About Home Energy-EfficiencyA change you can make today

Switch to electronic statements and documents

Save paper and get your statements through RBC Online Banking and the RBC Mobile app.

Switch nowOur climate strategy

The RBC Climate Blueprint

Our strategy is to support our clients across sectors in the transition, while focusing first on the areas that we believe present the greatest opportunities and risks.1 We will continue to measure and track our progress and evolve our strategy to be responsive to the needs of our clients and communities.

For more details, including scope and definitions, please refer to RBC’s Climate Blueprint

Ideas for People and PlanetTM

Our Purpose Framework – Ideas for People and Planet™ – identifies our three ambitions which can help address these challenges and where we believe we can have a meaningful impact: support the transition to a net-zero economy, equip people with skills for a thriving future and drive more inclusive opportunities for prosperity.

Visit the SiteNavigating Canada’s journey to net-zero

The RBC Climate Action Institute brings together economists, policy analysts, and business strategists to help research and advance ideas that can contribute to Canada’s climate progress.

Visit the Climate Action InstituteThe RBC Climate Library

Environmental ideas for the planet and your wallet

Read more (Opens in new window)