More Ways We Protect Your Money

2-Step Verification for Sign-in

You'll be notified any time you (or someone else) logs into your account, giving you the peace of mind that your accounts and information are safe.

Protect Yourself From Fraud

Beware of fraudsters who may contact you pretending to be RBC employees.

RBC will never call, text, or email you to ask you for personal information like your account number, PIN, verification code, or password.

Authentication Methods

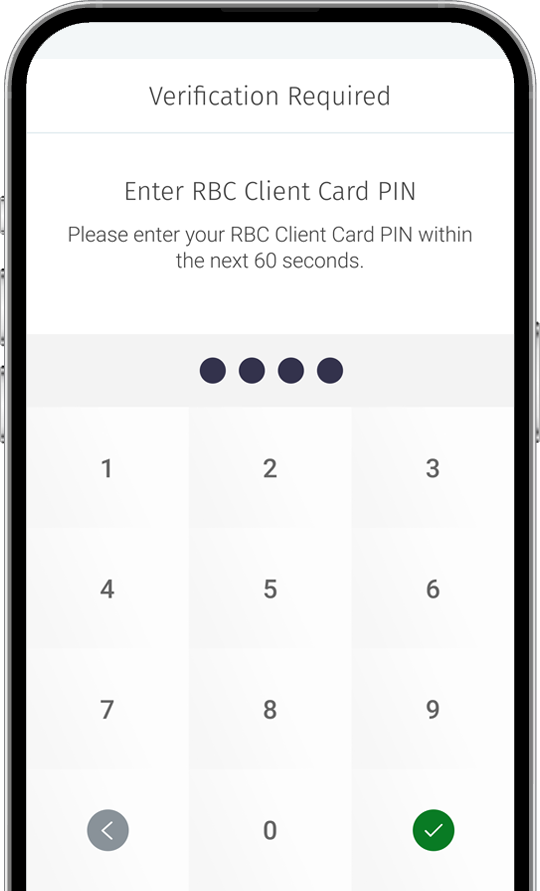

Client Card + PIN

Tap your Client Card on your mobile device, then enter your PIN. You might have to confirm your identity using biometrics.

You’ll need:

- The latest version of the RBC Mobile app.

- Your RBC Client Card.

- Your trusted device, if you’re using Online Banking.

Tip: Ensure your push notifications are turned on in your mobile device settings

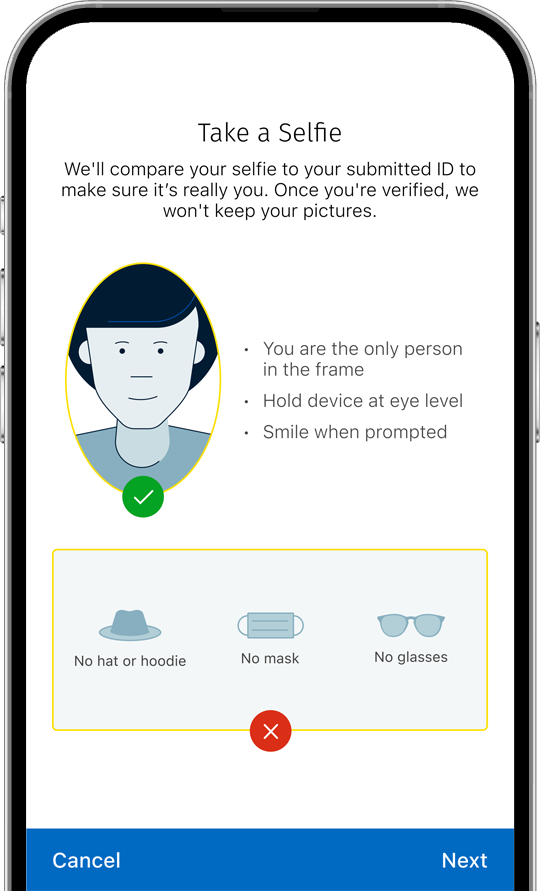

ID Verification

Scan the QR code with your mobile device’s camera, upload a photo of your government-issued ID and take a selfie.

You’ll need:

- The latest version of the RBC Mobile app.

- A small government-issued ID card such as a valid driver’s license, photo ID card or passport.

- Your mobile device, if you’re using Online Banking.

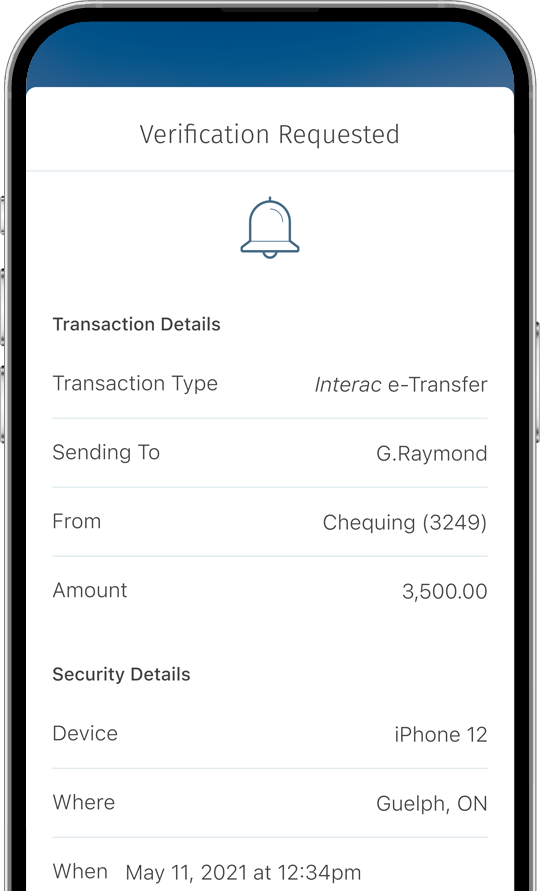

Push Notification

You’ll receive a notification on your trusted device asking you to allow the transaction. You may be asked to enter your PIN.

You’ll need:

- The latest version of the RBC Mobile app.

- Your trusted device, if you’re using Online Banking.

Tip: Ensure your push notifications are turned on in your mobile device settings

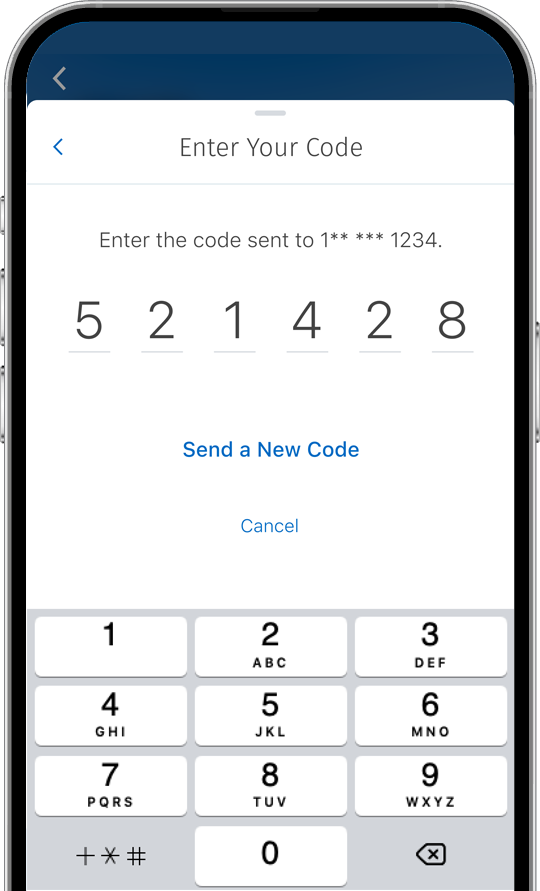

One Time Passcode

Choose between getting a text message on your mobile device or a phone call to a landline to present a one-time verification code.

You'll need:

- An up-to-date phone number in your RBC Profile.

- Your trusted device, if you’re using Online Banking.

- A Canadian or U.S. phone number.

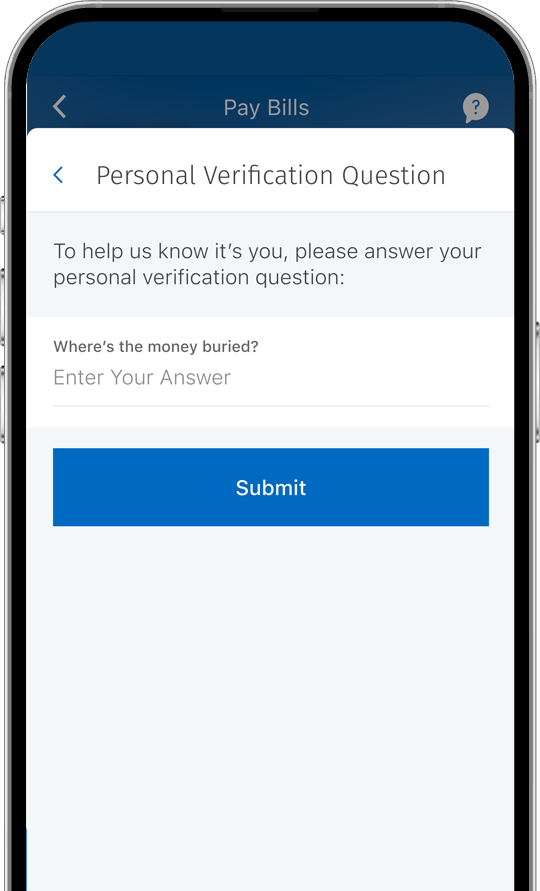

Personal Verification Questions

You’ll be asked to answer one of the personal verification questions you set for your account.

Frequently Asked Questions

2-Step Verification provides an extra layer of security to your Online and Mobile banking experience. Every time you log into your account, after entering your username and password, you will receive a notification on a trusted device asking you to allow the login. We may also ask you to verify your identity to complete certain banking operations, like sending an Interac e-Transfer.

This ensures that even if someone has your username and password, only you will be able to access your banking information and carry out transactions.

A trusted device is the device you will get a notification on whenever we ask you to verify your identity with 2-Step Verification. It can be any personal mobile device (smartphone or tablet).

You can only set up one trusted device for 2-Step Verification, so it should be one that you own and use often. Public or shared devices, like a family tablet, should not be used as a trusted device.

Once you have chosen your trusted device, ensure that you have the most recent version of the RBC Mobile app installed on it.

You will need a personal mobile device for 2-Step Verification. This can be either a mobile phone or a tablet.

If you don't have access to your trusted device, you can use the ID verification method to authenticate your identity and access your account. Please note that you need a smartphone or tablet to complete the ID verification process, but it doesn't have to be your trusted device.

If we notice any suspicious activity in your account, you may be asked to confirm your identity even if you have chosen to turn off 2-Step Verification. We do this to better protect your money online.

We'll only send push notifications to your trusted device, so make sure you’re checking that device. Also, check that your device has the latest version of the RBC Mobile app and that your push notifications are turned on in your device's settings.

If your Client Card is lost or stolen, you should lock it first and then report it as lost or stolen so we can send you a new one. Even if your card is locked, you can still bank online and complete the 2-Step Verification process with a government-issued ID.

If your Client Card PIN is locked, you can authenticate with a government-issued ID like a passport or a driver's license. If this verification method isn't available, you can reset your PIN by going to an ATM or point of sale machine or visiting an RBC branch.