Why Join RBC Investment Advantage?

Get personalized advice6, which could help you build more wealth.

RBC Financial Planners will take a comprehensive view of your needs and design a strategy tailored to your goals.

Plus, they’ll work with you to put your plan into action by leveraging a wide range of RBC mutual funds and financial solutions.

Over a 15-year period, investors who work with an advisor end up with more wealth compared to investors who don’t.7

A wide range of investment accounts and products to fit your unique needs.

Benefit from a variety of plan types and - RBC Global Asset Management® Series F mutual funds. Your Financial Planner can help you choose what’s right for you.

- Non-Registered Canadian Dollar Investment Account

- Registered Retirement Savings Plan (RRSP)

- Registered Retirement Income Fund (RRIF)

- Tax-Free Savings Account (TFSA)

- Registered Education Savings Plan (RESP)

- Registered Disability Savings Plan (RDSP)

How Investment Advantage Works

Investing individually while getting collective benefits is as easy as 1-2-3:

Select your Inner Circle.

You and each member of your Inner Circle will receive financial planning advice6 and a personalized plan powered by MyAdvisor®.

Maintain your individual, separate accounts while enjoying

collective benefits.

More Premium Features and Benefits

- Access to digital advice capabilities powered by MyAdvisor, including portfolio monitoring and rebalancing

- Discounted fees on the RBC BankTM Premium Cross-Border Bundle7 banking package, which includes preferred foreign exchange rates and financing services for purchasing property in the U.S.

Frequently Asked Questions

You can participate individually in this program as long as you have a minimum of $250,000 to invest in mutual funds.

You can also participate with your family and certain professional colleagues within your Inner Circle as long as the collective assets amount to a minimum of $250,000. Each investor must be a Canadian resident who has reached the age of majority (18 or 19, depending on the province or territory) with a Social Insurance Number (SIN).

You can extend the RBC Investment Advantage benefits to others in your Inner Circle who may not otherwise have access to Financial Planning advice or member-only offers. For example, your children can get professional financial planning advice to help them save for future goals. Or your parents can benefit from fund recommendations and regular updates to keep them on track through retirement.

You can invest in a wide range of RBC mutual funds.

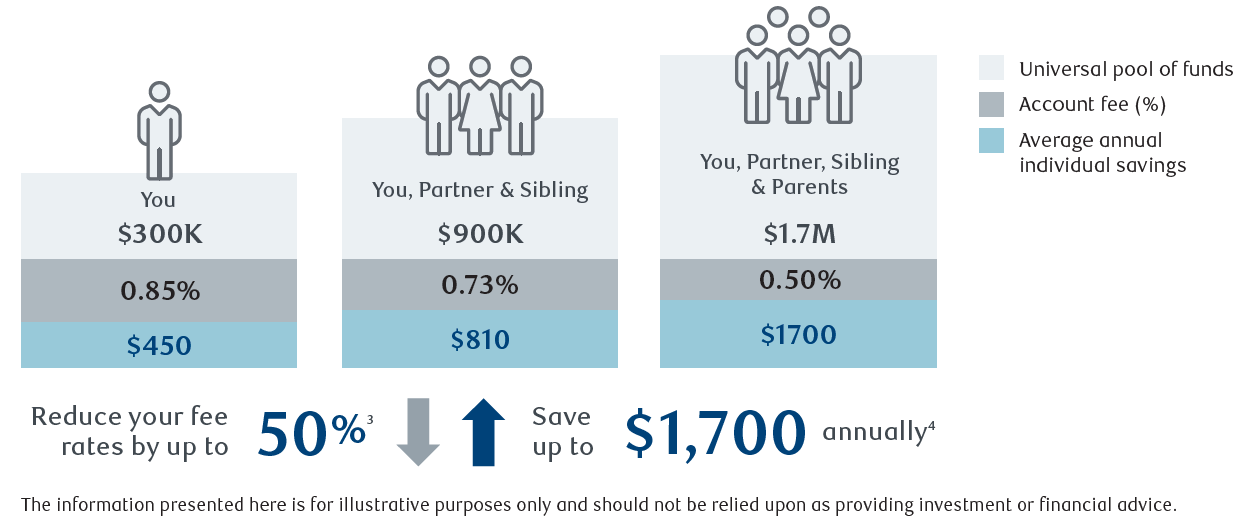

Learn more about RBC mutual fundsRBC Investment Advantage clients are charged a fee rate based on the total value of assets in each Inner Circle account (or for the individual account, if just one person is investing) for ongoing access, advice and service that Royal Mutual Funds Inc. provides.

No, you will need to contact a Financial Planner, Digital Financial Specialist or an Invest-by-Phone advisor, depending on your total assets.

Account fees and trailing commissions are both fees for the advice, access and services provided to an investor.

Embedded advice series mutual funds (Series A units) include a trailing commission paid by the mutual fund company to the investment firm the advisor works for (mutual fund dealer) for ongoing advice, access and service. The trailing commission is embedded in the management expense ratio (MER) of a mutual fund.

For fee-based investors, who purchase Series F units of a mutual fund, the trailing commission is replaced with an account fee. Account fees are charged directly to the investor by the investment firm the advisor works for. With the RBC Investment Advantage account your account fee is based on a tiered scale that offers you a lower fee rate when you hold a higher balance with us, either on your own or by grouping assets with family members and certain professional colleagues.

Get Started with RBC Investment Advantage

To join this program and get the most out of your investments, speak to a Financial Planner.

Get Started with RBC Investment Advantage

To join this program and get the most out of your investments, speak to a Financial Planner.

View Legal DisclaimersHide Legal Disclaimers

RBC Financial Planning is a business name used by Royal Mutual Funds Inc. (RMFI). Financial planning services and investment advice are provided by RMFI. RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

Mutual Funds are sold by Royal Mutual Funds Inc. (RMFI). There may be commissions, trailing commissions, management fees and expenses associated with mutual fund investments. Please read the Fund Facts/prospectus before investing. Mutual fund securities are not insured by the Canada Deposit Insurance Corporation. For funds other than money market funds, unit values change frequently. For money market funds, there can be no assurances that a fund will be able to maintain its net asset value per security at a constant amount or that the full amount of your investment in a fund will be returned to you. Past performance may not be repeated. RMFI is licensed as a financial services firm in the province of Quebec.

® / ™ Trademark(s) of Royal Bank of Canada. RBC and Royal Bank are registered trademarks of Royal Bank of Canada. © 2022 Royal Bank of Canada.

“Inner Circle” is defined as your “Grouping”. “Grouping” means the process of combining your RBC Investment Advantage account balance with the account balance(s) of another or other eligible holder(s) of RBC Investment Advantage accounts for account fee rate calculation purposes. “Grouping” members are currently defined as your immediate and extended family, as well as Medical Professionals within the same practice. Medical Professionals is defined as: Student Physician, Resident Physician, Practicing Physician, Retired Physician. Medical Professional Network is defined as members associated through a common employer (practice, hospital, clinic).

Your Inner Circle may have access to benefits such as lower fees because the account fee is based on a tiered scale that offers a lower fee rate when holding a higher balance within the Inner Circle’s grouped accounts.

Overall, you may or may not benefit from lower fees or costs when compared with other types of Royal Mutual Funds Inc. (RMFI) investment accounts because of the RBC Investment Advantage annual account fee. This account fee is not in any way linked to the mix of your fund holdings. Your account will hold Series F and Series FT5 funds, which generally have lower product level costs than Series A and Series T5 funds you may hold in other types of accounts with RMFI. Any additional potential for cost savings in your account depends on the specific mutual funds you hold (for example, a fixed income fund, an equity fund, a balanced fund), the total balance of all members’ accounts within your Inner Circle and the tax rates applicable to your province of residence.

Average annual fee savings range from $450 per year to $1,700 per year based on an individual/Inner Circle total balance ranging from $300,000 to $1,700,000. These annual fee savings are in comparison to Series A funds, which charge an annual rate of 1.00%

The account fee rate will not increase due to market fluctuations as it will be calculated based on the higher of the net contribution value or the average daily balances of your or your grouping’s RBC Investment Advantage Account(s).

Not all clients may be eligible to work with an accredited financial planner. Eligibility may depend on a number of factors including, but not limited to: type and amount of investments, client’s investment and financial goals, availability and capacity of accredited financial planners.

2019 Canada Lipper Fund Award for the 10th time for outstanding investment performance: rbc.com/newsroom/news/2019/20191115-lipper-awards.html.

The RBC Bank Premium Cross-Border Banking Bundle (“the Bundle”) offer is available for new and existing RBC Investment Advantage (IA) clients. To be eligible for the individual Bundle refund on the monthly fee of your RBC Bank U.S. Premium Checking account for the first 12 months, the RBC IA client must also be a new RBC Bank client, defined as an individual who has not been a primary or secondary accountholder of any RBC Bank U.S. Premium Checking account for the 18 months prior to the Bundle opening date. To qualify, the RBC IA client must open a new RBC Bank Premium Checking account and apply for any RBC Bank U.S. credit card using promo code “IAA2019”. The Premium Checking account and credit card application must be submitted on the same day and have the same accountholder(s) on both accounts. The Premium Checking account must be funded according to the Personal Schedule of Fees. All other checking account fees apply. This offer may be withdrawn at any time. For full details visit rbcroyalbank.com/dms/cross-border-banking/iaa-or.html. RBC Bank, Equal Housing Lender. Member FDIC. RBC Bank is RBC Bank (Georgia), National Association (“RBC Bank”), a wholly owned U.S. banking subsidiary of Royal Bank of Canada, and is a member of the U.S. Federal Deposit Insurance Corporation (“FDIC”). U.S. deposit accounts are insured by the FDIC up to the maximum amount permissible by law. U.S. banking products and services are offered and provided by RBC Bank. Canadian banking products and services are offered and provided by Royal Bank of Canada. U.S. deposit accounts are not insured by the Canada Deposit Insurance Corporation (“CDIC”).

{{card.params.annualfee}}

{{card.params.additionalcard}}

Card Details

![]() This card requires a minimum personal income of {{card.params.minimumincome}}household income of {{card.params.minimumincomeannual}} or a minimum household income of {{card.params.minimumincomeannual}}

This card requires a minimum personal income of {{card.params.minimumincome}}household income of {{card.params.minimumincomeannual}} or a minimum household income of {{card.params.minimumincomeannual}}

![]() {{card.params.merchantfees}}

{{card.params.merchantfees}}

Avion Rewards

Additional Features

Optional Extras

Make the most of your RBC credit card by adding Value Added Services such as:

View Legal DisclaimersHide Legal Disclaimers

21.99% if you reside in Quebec.

Air Travel Reward redemptions from the Air Travel Redemption Schedule start at 55,000 Avion points for a round trip flight from eastern Canada or the United States to Mexico, Hawaii or Alaska; or from western Canada or the United States to Bermuda, Central America or the Caribbean, with a maximum ticket price of $1,100. All applicable taxes, service fees and surcharges are the responsibility of the traveller. For more details, including information on redeeming for first class and business class seats, visit: www.avionrewards.com/travel/index.html. For general redemption terms, conditions and restrictions that apply to the Avion Rewards program, please visit: www.avionrewards.com or call 1-800 ROYAL 1-2 (1-800-769-2512).

To be eligible for this offer your application for the RBC Avion Visa Infinite, RBC Avion Visa Platinum, or RBC Avion Visa Infinite Privilege credit card must be received by the date indicated on this page and must be approved by us. Upon enrolment, 35,000 Avion points (or "welcome points") will appear within the first two monthly statements. The 20,000 additional Avion points will be awarded to you once a total of $5,000 or more in qualifying net purchases and pre-authorized bill payment transactions (“Qualifying Transactions) are posted to your credit card account within the first 6 months from the date your account is opened, provided your account is open and in good standing at the time you reach $5,000 in Qualifying Transactions. Please allow 60 days after this requirement is fulfilled for the additional Avion points to be awarded to your account. Qualifying Transactions exclude cash advances (balance transfers, cash-like transactions and bill payments that are not pre-authorized charges that you set up with a merchant), interest charges and fees. Additional cardholder(s), as well as existing cardholders of any RBC Royal Bank personal credit cards, applying for or transferring to an RBC Avion Visa Infinite, RBC Avion Visa Platinum, or RBC Avion Visa Infinite Privilege card as of the offer eligibility period, are not eligible for this offer. This offer may not be combined or used in conjunction with any other offer. Royal Bank of Canada reserves the right to cancel, modify or withdraw this offer at any time. For complete terms and conditions that apply to the Avion Rewards Program, please visit www.avionrewards.com or call 1-800-769-2512.

Avion points are earned on qualifying net purchases only; they are not earned on cash advances (including balance transfers, cash-like transactions and certain bill payments), interest charges or fees, and credits for returns and adjustments will reduce or cancel the points earned by the amounts originally charged.

For any type of travel you book through Avion Rewards other than flights from the Air Travel Redemption Schedule, you may redeem Avion points at the rate of 1.0% (100 points per CAD $1.00) to pay for all or part of your booking, including associated taxes and fees. When you book a flight from the Air Travel Redemption Schedule, you may also decide to redeem Avion Rewards at the rate of 1% to pay for any taxes and service fees (including sales, GST, departure and transportation taxes and fees, airport improvement fees, or other taxes), excess baggage charges, immigration fees, governmental fees and levies, customs charges and passenger facilities charges, health or other inspection fees, fuel surcharges and other non-ticket costs or charges which may be imposed. For complete terms, conditions and restrictions that apply to the Avion Rewards program, visit: www.rbcrewards.com.

For full details on Visa Infinite Privilege, visit www.visainfinite.ca/privilege. You must be an eligible Visa Infinite Privilege cardholder with a valid Visa Infinite Privilege card to take advantage of the Visa Infinite Privilege offers, benefits and services. Certain benefits and services require enrolment. Offers and benefits are non-transferable and discounts cannot be combined with any other offer or discount. Neither Visa nor Royal Bank of Canada is responsible for any claims or damages arising from use of any benefits or services provided by a third party. Visa reserves the right to modify or cancel offers, benefits and services at any time and without notice. All offers, benefits and services made available through Visa are subject to complete terms and conditions, including third party suppliers’ terms and conditions. The Visa Infinite Privilege privacy policy applies to all benefits and services that require enrolment through, or are otherwise provided by, the Visa Infinite Privilege Concierge or the Visa Infinite Privilege website. The collection, use and disclosure of cardholders’ personal information by third party suppliers of services and benefits to Visa Infinite Privilege cardholders are subject to such third parties’ own privacy policies.

All rewards are subject to availability. For complete terms, conditions and restrictions that apply to the Avion Rewards program please visit https://www.avionrewards.com/terms-and-conditions/index.html or call 1-888-769-2581.

Please note that it will take two (2) to three (3) business days for your payment to be credited to your credit card account and to adjust your available credit. Redemptions are final and cannot be cancelled or reversed once submitted. For complete details, please consult the Avion Rewards Terms and Conditions

Each time you use your linked Eligible RBC Card to purchase any grade of gasoline, including diesel, at a Retail Petro-Canada Location, you will save three cents ($0.03) per litre at the time of the transaction. Card linking may take up to 2 business days to process before savings and bonus points can be applied to purchases.

Each time you use your linked Eligible RBC Card to pay for qualifying purchases at a Retail Petro-Canada Location, you will earn a bonus of twenty percent (20%) more Petro-Points than you normally earn, in accordance with the Petro-Points Terms and Conditions.

Each time you use your linked Eligible Avion Rewards Credit Card to pay for purchases at a Retail Petro-Canada Location, you will earn a bonus of twenty percent (20%) more Avion points than you normally earn for every $1 in purchases in accordance with the Avion Rewards Terms and Conditions. Please allow up to ninety (90) days from the date the transaction is posted on your credit card statement for the bonus points to be deposited into Avion Rewards account. Authorized Users are excluded from earning Avion points bonus.

All insurance is subject to limitations and exclusions. Please refer to the insurance certificates included in your printed Welcome Kit for complete details or online in Credit Card Documentation.

Coverage underwritten by Aviva General Insurance Company in the Province of Quebec and by RBC Insurance Company of Canada in the rest of Canada. Please refer to the insurance certificates for complete details. Click here

Coverage underwritten by RBC Insurance Company of Canada

Under 65 years of age, 15 days of coverage. For age 65 and over, 3 days of coverage. Coverage underwritten by RBC Insurance Company of Canada.

To participate in this offer, you must have an eligible RBC Debit Card, Personal Credit Card or Business Credit Card which is issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”). RBC Business Owners will only be able to link up to two (2) Business Credit Cards and one RBC Debit Card to a Be Well Card.

Eligible RBC Debit Cards are debit cards tied to a personal banking or savings account or a business banking or savings account in good standing that is set up to pay for goods and services at a store or merchant that has point of sale or other designated debit card terminals that accept debit card payments.

You must be enrolled in RBC Online Banking or the RBC Mobile app in order to link your RBC Card to your Be Well Card. Card linking may take up to 2 business days to process before Be Well points can be applied to purchases. Each time you scan your Be Well Card and pay with your Linked RBC Card, you will earn 50 Be Well points for every $1 spent on eligible purchases at Rexall Locations, in accordance with the Be Well Terms and Conditions available at https://www.letsbewell.ca/terms-conditions.

Be Well points are not awarded on taxes; tobacco products; products containing codeine; lottery tickets; alcohol; bottle deposits; gift cards; prepaid cards and wireless or long distance phone cards; event tickets; transit tickets and passes; post office transactions; stamps; passport photos; cash back; gifts with purchases; delivery charges; environmental levies; Home Health Care services/rentals and any other products or services that we may specify from time to time or where prohibited by law.

To "redeem" means to use your Be Well points to pay, or partially pay, for eligible purchases by using your Be Well card at the point of sale in participating Rexall stores following the instructions provided by the cashier, the point-of-sale terminal or other payment processing device. You can redeem the Be Well points you collect for eligible purchases, see Section 5 of the Be Well Terms and Conditions (available at https://www.letsbewell.ca/terms-conditions), or for any other purposes of which we may advise you from time to time.

You must have enrolled in the Be Well program and have registered your Be Well card, or otherwise have called customer service, in order to redeem Be Well points. Any Be Well points collected on a Be Well card will remain the property of the Be Well Administrator until the enrolment and registration process has been completed.

You must redeem a minimum of 25,000 Be Well points at any one time, which are worth $10. Be Well points may be redeemed in increments of $10 up to a maximum of $200 (500,000 Be Well points) in a single transaction. A maximum of 500,000 Be Well points can be redeemed within a 24-hour period.

In Ontario and British Columbia, Be Well points cannot be redeemed on prescriptions. The laws in each province and territory may change from time to time and you are advised to consult with your pharmacist for additional information in this respect.

Be Well points you collect upon making a purchase cannot be redeemed for that purchase and can only be redeemed for a subsequent eligible purchase provided 12 hours have passed since the Be Well points were collected.

Avion points will be forfeited if they remain unredeemed within twelve (12) months following the termination of the Avion Rewards program or after you voluntarily close your RBC Royal Bank credit card account.

To receive a complimentary DashPass subscription for $0 delivery

fees on orders of $15 or more at eligible restaurants when you pay

with your Eligible RBC Credit Card, you must subscribe to DashPass

by adding an Eligible RBC Credit Card, accept the DoorDash terms

and conditions, and activate your benefit by clicking “Activate

Free DashPass” before July 31, 2024 (“Offer Period”). If you are

an existing DashPass subscriber and have already added an Eligible

RBC Credit Card to your account you must activate your benefit by

clicking “Activate Free DashPass” during the Offer Period. If you

have been charged for DashPass you will receive a refund to the

method of original payment, in the amount of the monthly

subscription fee for the month you activate your complimentary

subscription. For all clients, by clicking on “Activate Free

DashPass” you agree to the DoorDash terms and conditions which can

be found at

https://help.doordash.com/consumers/s/terms-and-conditions .

Eligible RBC Credit cardholders include primary cardholders,

co-applicants, authorized users, primary business cardholders and

secondary business cardholders on an Eligible RBC Credit Card

account.

The DashPass monthly subscription fee will be waived (“Complimentary DashPass Subscription”) and you will receive either a 3 month or 12 month

Complimentary DashPass Subscription based on the Eligible RBC

Credit Card you use to subscribe to DashPass.

DashPass subscriptions purchased through third parties, including

third-party payment accounts, or online or mobile digital wallets

(like Apply Pay and Google Pay) are not eligible for the

Complimentary DashPass Subscription.

Eligible RBC Credit Cards: Your Eligible RBC

Credit Card may only be used with one DoorDash account to receive

a Complimentary DashPass Subscription. Once you have received a

Complimentary DashPass Subscription you cannot use the same

eligible RBC Credit Card to obtain a Complimentary DashPass

Subscription with another DoorDash account.

You are only eligible for one 12 month Complimentary DashPass

Subscription and one 3 month Complimentary DashPass Subscription

during the Offer Period. The Complimentary DashPass Subscription

commences on the date you subscribe to receive the Complimentary

DashPass Subscription. For example, if you subscribe to a 12 month

Complimentary DashPass Subscription in on the last day of your

second month of a 3 month Complimentary DashPass Subscription you

will receive a total of 14 months of Complimentary DashPass

Subscription.

In order to validate your credit card as an Eligible RBC Credit

Card, Royal Bank may need to administer a $0.50 charge to validate

your card enrollment. This charge will be reversed in 3 to 5 days

once your account has been validated.

12 Month Complimentary DashPass Subscription is available for the

following Eligible RBC Credit Cards:

As an RBC Avion Visa Platinum, RBC Avion Visa Infinite , RBC Avion

Visa Infinite Privilege, RBC Avion Visa Infinite Privilege for

Private Banking, WestJet RBC World Elite Mastercard, RBC Rewards

Visa Preferred, RBC Cash Back Preferred World Elite Mastercard,

RBC Cathay Pacific Visa Platinum, RBC British Airways Visa

Infinite, RBC Avion Visa Business, RBC Avion Visa Infinite

Business cardholder.

You are eligible for a Complimentary DashPass Subscription for 12

months from the date you subscribe to receive the Complimentary

DashPass Subscription. You will be auto-enrolled into full-price

membership at the then-current rate after the end of the 12 month

Complimentary DashPass Subscription. Your RBC credit card account

must be open and not in default to maintain the benefits of

DashPass.

3 Month Complimentary DashPass Subscription is available for the

following Eligible RBC Credit Cards:

As an RBC Rewards+ Visa, Signature RBC Rewards Visa, RBC Visa

Platinum, RBC Visa Cash Back, RBC Cash Back Mastercard, RBC Visa

Classic Low Rate Option, RBC Visa Classic, RBC Student Visa

Classic, RBC Visa Classic II Student, RBC Visa Gold, RBC U.S.

Dollar Visa Gold, RBC Rewards Visa Gold, RBC RateAdvantage Visa,

WestJet RBC Mastercard, RBC Visa Business, RBC Visa Business Gold,

RBC Visa CreditLine for Small Business, or RBC Business Cash Back

Mastercard.

You are eligible for a Complimentary DashPass Subscription for 3

months from the date you subscribed to the Complimentary DashPass

Subscription. You will be auto-enrolled into full-price membership

at the then-current rate after the end of the 3 month

Complimentary DashPass Subscription. Your RBC credit card account

must be open and not in default to maintain the benefits of

DashPass.

DoorDash not Royal Bank of Canada, is responsible for (i) services

and products provided through DoorDash; (ii) DashPass, including

the DashPass Benefits, the administration of DashPass and (iii)

the DoorDash terms and conditions. The Complimentary DashPass

Subscription offer may be amended or withdrawn at any time. To

learn more about DashPass, visit

www.doordash.com/dashpass

(opens to external site). For full DashPass for RBC Program Terms and Conditions, visit

rbcroyalbank.com/credit-cards/documentation/pdf/full-doordash-tcs-en.pdf.

DashPass is a DoorDash subscription service that offers unlimited deliveries for $0 delivery fee on eligible restaurant purchases (minimum order amount of $15.00 CAD before taxes and fees) at a monthly subscription fee of $9.99 CAD plus tax. To learn more about DashPass visit www.doordash.com/dashpass (opens to external site).

This offer is not transferable. To earn 3X the Avion points you normally earn (“Bonus Points”) for every one dollar ($1.00) in purchases, including taxes, you make at any corporately owned Hertz location in Canada, U.S., UK, Germany, Italy, Switzerland, Netherlands, Belgium, Spain, Australia and Luxembourg, beginning February 7th, 2020 to February 7th, 2024 (“Offer Period”), click the “Load Offer” button and pay using your RBC Avion Visa Infinite Privilege card (“Eligible RBC Rewards Card”) (“Qualifying Purchase”). Franchised Hertz locations are not eligible for this offer.

The up to 20% discount rate applies to the base rate only (time

and mileage charges) (“Discount”) and is available at

participating Hertz corporate locations in Canada and the U.S..The

Discount excludes taxes, tax reimbursements, fees, surcharges and

optional service charges, such as refueling. You must enter the

first 6-digits of your Eligible RBC Rewards Card in the CDP ID #

field when making a booking to receive the Discount.

Upon Hertz Gold Plus Rewards (GPR) registration, you’ll be

upgraded to Hertz Five Star status in 48 hours. If you’re already

an existing member of Hertz GPR, please follow the prompts on the

landing page.

If you change your Eligible RBC Rewards card, you must load the

Hertz offer again in Offers. If you cancel your Eligible RBC

Rewards card, you will not be eligible for the Discount, Bonus

Points or Hertz Five Star status.

Please allow up to 30 days from the date of your Qualifying

Purchase, provided your credit card account was in good standing

at that time, for the Bonus Points to appear on the account

statement tied to your Eligible RBC Rewards Card. Cancellations or

price adjustments may cancel or reduce the Avion points earned on

your Qualifying Purchase, including Bonus Points. Offer may not be

combined with any other offer, promotion, certificate, voucher or

other discount.

Hertz, not Royal Bank of Canada, is responsible for the sales and

returns terms and conditions applicable to your Qualifying

Purchase(s) and Discount. For complete terms and conditions please

visit:

https://pub.emails.hertz.com/RBC_Status_Match_EN_FS. Royal Bank of Canada reserves the right to cancel, modify or

withdraw this offer at any time, even after you have activated it.

For more details on the Offers program, please visit

https://rbc.com/offers.

View Legal DisclaimersHide Legal Disclaimers

21.99% if you reside in Quebec.

To receive the 15,000 Avios welcome bonus, your application form must be approved by Royal Bank of Canada. Please allow up to 10 weeks after receipt of your card for the 15,000 Avios to be posted to your British Airways Executive Club account. If you are not currently a member of the Executive Club, you will be enrolled automatically once you are approved for the RBC British Airways Visa Infinite card. Please note that the postal address your Executive Club account membership is registered under must match the one for your RBC British Airways Visa Infinite account at all times for the Avios to be posted to your Executive Club account. The 35,000 bonus Avios will be awarded to you if a total of $6,000 CAD or more in qualifying purchases and pre-authorized bill payment transactions is posted to your RBC British Airways Visa Infinite account within the first 3 full monthly statement periods (approximately 3 months from the date your account is opened), provided your credit card account is in good standing at the time you reach $6,000 CAD in qualifying transactions. Qualifying transactions exclude cash advances (balance transfers, cash-like transactions and bill payments that are not pre-authorized charges that you set up with a merchant), interest charges and fees. Please allow up to 15 weeks after this qualifying criteria is fulfilled for the 35,000 bonus Avios to be credited to your Executive Club. An additional 10,000 bonus Avios will be credited to your Executive Club account within 12-15 weeks after the one year anniversary of your account opening provided your credit card account remains active and in good standing. The Avios welcome bonus and the additional bonus Avios are not available to existing or former RBC British Airways Visa Infinite primary cardholders applying for or transferring to an RBC British Airways Visa Infinite credit card. This offer may be revoked at any time if we suspect you may be manipulating or abusing it, or engaging in any suspicious or fraudulent activity, as determined by Royal Bank of Canada in its sole discretion. This offer may not be combined or used in conjunction with any other offer. Royal Bank of Canada and British Airways reserve the right to modify, cancel or withdraw this offer at any time. British Airways, not Royal Bank of Canada, is responsible for this offer and the British Airways Executive Club Programme. For all Executive Club Terms and Conditions, please visit ba.com/theclub.

Earn 2 Avios per $1 CAD spent on British Airways and British Airways Holidays and 1 Avios per $1 CAD spent on all other qualifying net purchases when you use your RBC British Airways Visa Infinite card. Avios are earned on qualifying net purchases only; they are not earned on cash advances (including balance transfers, cash-like transactions and bill payments that are not pre-authorized charges that you set up with a merchant), interest charges or fees, and credits for returns and adjustments will reduce or cancel the Avios earned by the amounts originally charged. Where applicable, Avios are awarded based on the Canadian dollar equivalent of foreign currency purchase transactions. Avios is not refundable, transferable, and has no cash value. Please allow up to 8 weeks after transactions are processed to your credit card account for the Avios to be posted to your British Airways Executive Club account.

Eligible Members who spend a minimum of $30,000 CAD on qualifying purchases on their Card in a calendar year (“calendar year” refers to the time period starting from 1 January through to 31 December) will receive a maximum of one Companion Voucher for that calendar year. As an Eligible Member, you will be able to apply the Companion Voucher towards the purchase of a flight for a companion travelling with you, on the same Reward Flight (“Companion Ticket”).

Alternatively, for all valid Companion Vouchers earned, you can choose to use your Companion Voucher to make a solo Reward Flight booking, which will entitle you to a 50% discount on the Avios fare for your journey. Taxes fees and charges for you will still be payable (if travelling solo) or on your companion’s ticket (if travelling with a companion).

Please note that qualifying purchases exclude cash advances (including balance transfers, cash-like transactions and bill payments that are not pre-authorized charges that you set up with a merchant), interest charges or fees, and credits for returns and adjustments will reduce or cancel the spend amount by the amounts originally charged.

When booking a Companion Ticket with a Companion Voucher, you can choose to make a full Avios redemption or from other Avios and cash price options (subject to payment of the Taxes, Fees and Charges for each seat).

Only one Companion Voucher can be earned in any calendar year. If an Eligible Member reaches their spend target before the end of the calendar year then further spends, it will not accumulate towards another Companion Voucher. Eligible Members can begin earning towards their next Companion Voucher from 1 January each year. Please allow six (6) to eight (8) weeks for the Companion Voucher to be added to the British Airways Executive Club account after meeting the spending requirement.

The Companion Voucher entitles the Eligible Member to purchase a Companion Ticket at the time of booking a Reward Flight, without having to pay for the price of the companion’s flight. The Companion Voucher will be issued in the name of the primary cardholder, who must travel on any Companion Voucher booking. Reservations and bookings for both the Reward Flight of the Eligible Member and the Companion Ticket of the companion must be made at the same time, for the same flight, on the same date, in the same class and cabin and on the same passenger name record (PNR) for travel on the same itinerary.

Eligible Members will be responsible for paying, without limitation, the taxes, fees and carrier charges, related to the Companion Ticket. Prices shown are Reward Flight Saver redemptions. Reward Flight Savers are British Airways’ best value Reward Flights. Reward Flight Saver offers customers great value flights with a low, flat fee to cover taxes, fees and carrier charges and a fixed Avios amount. To be eligible for Reward Flight Saver, you need to have collected at least one Avios in the past 12 months. If you are not eligible for Reward Flight Saver, you’ll be shown the standard Reward Flight price instead with full taxes, fees and charges. To find out more about Reward Flights and/or Reward Flight Saver, click here. At the time of publication, a standard Reward Flight booking or a standard Companion ticket booking (non-Reward Flight Saver) would be subject to taxes of approximately $870 return travel from Vancouver to London in economy class and approximately $1,900 per person based on business class travel. To make a booking, (including the Companion Ticket) Eligible Members must visit ba.com and log in using their membership number and PIN/Password. It is not possible to book a Reward Flight or a Companion Ticket by contacting a travel agent, or at the airport.

The Companion Award Voucher may be used for flights operated by British Airways only. Travel on franchise, codeshare or alliance airlines is not permitted. Return flights must be booked at the same time the outward journey is booked. All travel must originate in and return to Canada. Companion Vouchers can be used on a one way or return flight. Return flights must be booked at the same time the outward journey is booked. All travel must originate in and return to Canada.

A Companion Voucher can only be used if and when an Eligible Member is booking a Reward Flight using Avios and cannot be combined with any other offer, promotion, mileage or frequent flyer programme. Full details of fare rules can be found on ba.com. All Reward Flights and Companion Tickets are subject to availability and there is no guarantee Eligible Members will be able to book a flight for a companion on the Eligible Member’s choice of flight and destination. The Companion Voucher is only valid if it has been acquired in accordance with these Terms and Conditions.

A Companion Voucher is valid for twenty-four (24) months from the date it is issued and must be exchanged for a Companion Ticket with travel commencing from Canada before the expiry date on the Companion Voucher. Eligible Members must still have a Card in good standing at the time of travel. British Airways and/or Royal Bank of Canada reserve(s) the right to refuse to issue or to honour any Companion Voucher in the event that the Eligible Member is in breach of either these RBC British Airways Visa Infinite Companion Voucher Terms and Conditions, their RBC Royal Bank Credit Card Agreement or Executive Club Terms and Conditions.

A maximum of two Companion Vouchers can be redeemed at any one time on the same booking e.g. [2] Avios reward fares plus [2] Companion Voucher tickets.

The Companion Voucher is not extendable, refundable, transferable, and has no cash or mileage value. At no time may the Companion Voucher be purchased, sold, or bartered but if it is, any such Companion Voucher will become void. Companion Vouchers are applicable to new and future bookings only; they cannot be used to amend or pay for existing bookings.

The Companion Ticket is subject to the Executive Club Terms and Conditions relating to Companion Vouchers. If the Eligible Member cancels the Companion Ticket booking more than twenty-four (24) hours prior to the scheduled departure of the outbound flight from Canada, British Airways will redeposit the Companion Voucher which will only be valid for the remainder of its original twenty-four (24) month expiry period based on the original date of issue. Reward Flight bookings and Companion Tickets cancelled within twenty-four (24) hours of departure will result in the Companion Voucher and Avios being cancelled without any possibility of being reissued or credited to the Eligible Member. Please visit the full British Airways Executive Club Terms and Conditions found online at ba.com/theclub.

10% off British Airways flights round-trip flights originating in and returning to Canada when you book on ba.com/RBC10 and pay with your RBC BA Visa Infinite card. In order to take part in the 10% promotion, RBC British Airways Visa Infinite cardholders must log in at ba.com/RBC10 using their Executive Club username and PIN and make a roundtrip booking now through February 29, 2024 and enter the promotion code CARDOFFERC in the marked box on the Price Quote page of the booking process. A 10% discount is valid on the total roundtrip price, including taxes, fees and carrier charges, on mainline flights operated by British Airways purchased now through February 29, 2024 only. Travel must be fully completed by December 15, 2024 (departure and return). A 10% discount will appear during the final payment page. Fares not purchased through ba.com/RBC10 do not qualify for the discount. Discount is not valid for flights on code share or franchise carriers. All rules of roundtrip fare purchased apply, including advance purchase, minimum stay, weekend add-ons, and cancellation/refund rules. Offer is non-transferable and cannot be combined with any other offer. Valid for new bookings only made by Canadian residents paying in CAD using a valid British Airways Visa‡ card issued by Royal Bank of Canada for roundtrip travel commencing from Canada to London and beyond. Discount is taken off the total roundtrip price of every ticket including taxes and fees on the same booking. 10% discount applies for up to eight passengers booked on the same British Airways booking for the same flights. Cardholder must travel to qualify for the 10% discount. Refunds from previously purchased fare types not permitted. The 10% discount not combinable with any other offer and is taken off valid, published fares only and is subject to availability. Offer is subject to British Airways fare rules and conditions of contract available on ba.com and may be limited or withdrawn at any time without advance notice. Other significant restrictions may apply. Newly enrolled Executive Club members, please allow 24 hours to use the promotion code. British Airways, not Royal Bank of Canada, is responsible for the terms and conditions of this offer and the British Airways Executive Club program.

Each time you use your linked Eligible RBC Card to purchase any grade of gasoline, including diesel, at a Retail Petro-Canada Location, you will save three cents ($0.03) per litre at the time of the transaction. Card linking may take up to 2 business days to process before savings and bonus points can be applied to purchases.

Each time you use your linked Eligible RBC Card to pay for qualifying purchases at a Retail Petro-Canada Location, you will earn a bonus of twenty percent (20%) more Petro-Points than you normally earn, in accordance with the Petro-Points Terms and Conditions.

Under 65 years of age, 31 days of coverage. For age 65 and over, 7 days of coverage. Coverage underwritten by RBC Insurance Company of Canada.

Coverage underwritten by RBC Insurance Company of Canada. Please refer to the insurance certificate for complete details.

Coverage underwritten by RBC Insurance Company of Canada.

Coverage underwritten by Aviva General Insurance Company.

All insurance is subject to limitations and exclusions. Please refer to the insurance certificates included in your printed Welcome Kit for complete details or online in Credit Card Documentation.

Terms and conditions apply, visit www.ba.com for details.

To participate in this offer, you must have an eligible RBC Debit Card, Personal Credit Card or Business Credit Card which is issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”). RBC Business Owners will only be able to link up to two (2) Business Credit Cards and one RBC Debit Card to a Be Well Card.

Eligible RBC Debit Cards are debit cards tied to a personal banking or savings account or a business banking or savings account in good standing that is set up to pay for goods and services at a store or merchant that has point of sale or other designated debit card terminals that accept debit card payments.

You must be enrolled in RBC Online Banking or the RBC Mobile app in order to link your RBC Card to your Be Well Card. Card linking may take up to 2 business days to process before Be Well points can be applied to purchases. Each time you scan your Be Well Card and pay with your Linked RBC Card, you will earn 50 Be Well points for every $1 spent on eligible purchases at Rexall Locations, in accordance with the Be Well Terms and Conditions available at https://www.letsbewell.ca/terms-conditions.

Be Well points are not awarded on taxes; tobacco products; products containing codeine; lottery tickets; alcohol; bottle deposits; gift cards; prepaid cards and wireless or long distance phone cards; event tickets; transit tickets and passes; post office transactions; stamps; passport photos; cash back; gifts with purchases; delivery charges; environmental levies; Home Health Care services/rentals and any other products or services that we may specify from time to time or where prohibited by law.

To "redeem" means to use your Be Well points to pay, or partially pay, for eligible purchases by using your Be Well card at the point of sale in participating Rexall stores following the instructions provided by the cashier, the point-of-sale terminal or other payment processing device. You can redeem the Be Well points you collect for eligible purchases, see Section 5 of the Be Well Terms and Conditions (available at https://www.letsbewell.ca/terms-conditions), or for any other purposes of which we may advise you from time to time.

You must have enrolled in the Be Well program and have registered your Be Well card, or otherwise have called customer service, in order to redeem Be Well points. Any Be Well points collected on a Be Well card will remain the property of the Be Well Administrator until the enrolment and registration process has been completed.

You must redeem a minimum of 25,000 Be Well points at any one time, which are worth $10. Be Well points may be redeemed in increments of $10 up to a maximum of $200 (500,000 Be Well points) in a single transaction. A maximum of 500,000 Be Well points can be redeemed within a 24-hour period.

In Ontario and British Columbia, Be Well points cannot be redeemed on prescriptions. The laws in each province and territory may change from time to time and you are advised to consult with your pharmacist for additional information in this respect.

Be Well points you collect upon making a purchase cannot be redeemed for that purchase and can only be redeemed for a subsequent eligible purchase provided 12 hours have passed since the Be Well points were collected.

To receive a complimentary DashPass subscription for $0 delivery

fees on orders of $15 or more at eligible restaurants when you pay

with your Eligible RBC Credit Card, you must subscribe to DashPass

by adding an Eligible RBC Credit Card, accept the DoorDash terms

and conditions, and activate your benefit by clicking “Activate

Free DashPass” before July 31, 2024 (“Offer Period”). If you are

an existing DashPass subscriber and have already added an Eligible

RBC Credit Card to your account you must activate your benefit by

clicking “Activate Free DashPass” during the Offer Period. If you

have been charged for DashPass you will receive a refund to the

method of original payment, in the amount of the monthly

subscription fee for the month you activate your complimentary

subscription. For all clients, by clicking on “Activate Free

DashPass” you agree to the DoorDash terms and conditions which can

be found at

https://help.doordash.com/consumers/s/terms-and-conditions .

Eligible RBC Credit cardholders include primary cardholders,

co-applicants, authorized users, primary business cardholders and

secondary business cardholders on an Eligible RBC Credit Card

account.

The DashPass monthly subscription fee will be waived (“Complimentary DashPass Subscription”) and you will receive either a 3 month or 12 month

Complimentary DashPass Subscription based on the Eligible RBC

Credit Card you use to subscribe to DashPass.

DashPass subscriptions purchased through third parties, including

third-party payment accounts, or online or mobile digital wallets

(like Apply Pay and Google Pay) are not eligible for the

Complimentary DashPass Subscription.

Eligible RBC Credit Cards: Your Eligible RBC

Credit Card may only be used with one DoorDash account to receive

a Complimentary DashPass Subscription. Once you have received a

Complimentary DashPass Subscription you cannot use the same

eligible RBC Credit Card to obtain a Complimentary DashPass

Subscription with another DoorDash account.

You are only eligible for one 12 month Complimentary DashPass

Subscription and one 3 month Complimentary DashPass Subscription

during the Offer Period. The Complimentary DashPass Subscription

commences on the date you subscribe to receive the Complimentary

DashPass Subscription. For example, if you subscribe to a 12 month

Complimentary DashPass Subscription in on the last day of your

second month of a 3 month Complimentary DashPass Subscription you

will receive a total of 14 months of Complimentary DashPass

Subscription.

In order to validate your credit card as an Eligible RBC Credit

Card, Royal Bank may need to administer a $0.50 charge to validate

your card enrollment. This charge will be reversed in 3 to 5 days

once your account has been validated.

12 Month Complimentary DashPass Subscription is available for the

following Eligible RBC Credit Cards:

As an RBC Avion Visa Platinum, RBC Avion Visa Infinite , RBC Avion

Visa Infinite Privilege, RBC Avion Visa Infinite Privilege for

Private Banking, WestJet RBC World Elite Mastercard, RBC Rewards

Visa Preferred, RBC Cash Back Preferred World Elite Mastercard,

RBC Cathay Pacific Visa Platinum, RBC British Airways Visa

Infinite, RBC Avion Visa Business, RBC Avion Visa Infinite

Business cardholder.

You are eligible for a Complimentary DashPass Subscription for 12

months from the date you subscribe to receive the Complimentary

DashPass Subscription. You will be auto-enrolled into full-price

membership at the then-current rate after the end of the 12 month

Complimentary DashPass Subscription. Your RBC credit card account

must be open and not in default to maintain the benefits of

DashPass.

3 Month Complimentary DashPass Subscription is available for the

following Eligible RBC Credit Cards:

As an RBC Rewards+ Visa, Signature RBC Rewards Visa, RBC Visa

Platinum, RBC Visa Cash Back, RBC Cash Back Mastercard, RBC Visa

Classic Low Rate Option, RBC Visa Classic, RBC Student Visa

Classic, RBC Visa Classic II Student, RBC Visa Gold, RBC U.S.

Dollar Visa Gold, RBC Rewards Visa Gold, RBC RateAdvantage Visa,

WestJet RBC Mastercard, RBC Visa Business, RBC Visa Business Gold,

RBC Visa CreditLine for Small Business, or RBC Business Cash Back

Mastercard.

You are eligible for a Complimentary DashPass Subscription for 3

months from the date you subscribed to the Complimentary DashPass

Subscription. You will be auto-enrolled into full-price membership

at the then-current rate after the end of the 3 month

Complimentary DashPass Subscription. Your RBC credit card account

must be open and not in default to maintain the benefits of

DashPass.

DoorDash not Royal Bank of Canada, is responsible for (i) services

and products provided through DoorDash; (ii) DashPass, including

the DashPass Benefits, the administration of DashPass and (iii)

the DoorDash terms and conditions. The Complimentary DashPass

Subscription offer may be amended or withdrawn at any time. To

learn more about DashPass, visit

www.doordash.com/dashpass

(opens to external site). For full DashPass for RBC Program Terms and Conditions, visit

rbcroyalbank.com/credit-cards/documentation/pdf/full-doordash-tcs-en.pdf.

DashPass is a DoorDash subscription service that offers unlimited deliveries for $0 delivery fee on eligible restaurant purchases (minimum order amount of $15.00 CAD before taxes and fees) at a monthly subscription fee of $9.99 CAD plus tax. To learn more about DashPass visit www.doordash.com/dashpass (opens to external site).

View Legal DisclaimersHide Legal Disclaimers

21.99% if you reside in Quebec.

Coverage underwritten by RBC Insurance Company of Canada.

You will earn i) $2.00 back for every $100.00 (2% Cash Back Credit) in Grocery Store Purchases you make, up to a maximum of $6,000 in Grocery Store Purchases and for a maximum Cash Back Reward of $120.00 per Annual Period, ii) $1.00 back for every $100.00 (1% Cash Back Credit) in Grocery Store Purchases you make in excess of $6,000 per Annual Period, unlimited, iii) $0.50 back for every $100.00 (0.5% Cash Back Credit) in Net Purchases you make (including pre-authorized bill payments), other than Grocery Store Purchases, up to a maximum of $6,000 in Net Purchases (other than Grocery Store Purchases) and for a maximum Cash Back Reward of $30.00 per Annual Period, and iv) $1.00 back for every $100.00 (1% Cash Back Credit) in Net Purchases you make (including pre-authorized bill payments), other than Grocery Store Purchases, in excess of $6,000 in Net Purchases (other than Grocery Store Purchases) per Annual Period, unlimited. Grocery Store Purchases are purchases made at merchants classified by Mastercard's "Merchant Category Code" as "grocery stores and supermarkets" (MCC 5411). Royal Bank of Canada ("Royal Bank") cannot guarantee that any merchant, operating in whole or in part as a grocery store, is classified by MCC 5411 and in no event will Royal Bank be liable or responsible for any claims with respect to a grocery store purchase made at a merchant that is not classified by MCC 5411. To consult the list of participating merchants, please visit: www.rbc.com/nofeecashbackinfo. Provided your New Cash Back Balance is $25.00 or more, Cash Back Credits earned during the year will i) automatically be credited to your January Account balance and appear on your February monthly statement, ii) and/or be credited to your account at any other time, upon request. Cash Back Credits are not earned on cash advances (including balance transfers, cash-like transactions and certain bill payments that are not pre-authorized charges that you set up with a merchant), interest charges or fees, and credits for returns and adjustments will reduce or cancel the Cash Back Credits earned by the amounts originally charged. For complete details, please refer to the RBC Cash Back Program Terms and Conditions at www.rbc.com/cashbackterms.

Unlimited means there is no maximum cash back credits you can earn on Grocery Store Purchases and other purchases (up to your available credit limit) per Annual Period. For complete RBC Cash Back Program Terms and Conditions, please visit: www.rbc.com/cashbackterms.

To participate in this offer, you must have an RBC debit or credit card which is issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”). RBC business clients will only be able to link up to two (2) business credit cards and one business debit card to a Petro-Points card. You must be enrolled in RBC Online Banking or RBC Mobile app in order to link your RBC Card to your Petro-Points card. Card linking may take up to 2 business days to process before savings and bonus points can be applied to purchases. A linked RBC Card means an RBC Card linked to a Petro-Points Account. Your linked RBC Card acts as your Petro-Points card. You will automatically earn Petro-Points when you pay for qualifying purchases with your linked RBC Card at Petro-Canada locations and you do not need to swipe your Petro-Points card before you pay. You can redeem your Petro-Points at Petro-Canada using your linked RBC Card. Each time you use your linked RBC Card to purchase any grade of gasoline, or diesel, at a Petro-Canada location, you will save three cents ($0.03) per litre at the time of the transaction.

Each time you use your linked RBC Card to pay for qualifying purchases at a Petro-Canada location, you will earn a bonus of twenty percent (20%) more Petro-Points than you normally earn, in accordance with the Petro-Points terms and conditions available at www.petro-canada.ca/en/personal/terms-conditions. Petro-Points are not awarded on tobacco products, vaping products, gift cards, transit tickets and taxes on non-petroleum purchases.

To participate in this offer, you must have an RBC debit card or a credit card which is issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”). RBC business clients will only be able to link up to two (2) RBC business credit cards and one (1) RBC business debit card to a Petro-Points card.

You must be enrolled in RBC Online Banking or the RBC Mobile app in order to link your RBC Card to your Petro-Points card. Card linking may take up to 2 business days to process before savings and bonus points can be applied to purchases. A linked RBC Card means an RBC Card linked to a Petro-Points Account. Your linked RBC Card acts as your Petro-Points card. You will automatically earn Petro-Points when you pay for qualifying purchases with your linked RBC Card at Petro-Canada locations and you do not need to swipe your Petro-Points card before you pay. You can redeem your Petro-Points at Petro-Canada using your linked RBC Card.

Each time you use your linked RBC Card to purchase any grade of gasoline, or diesel, at a Petro-Canada location, you will save three cents ($0.03) per litre at the time of the transaction.

Each time you use your linked RBC Card to pay for qualifying purchases at a Petro-Canada location, you will earn a bonus of twenty percent (20%) more Petro-Points than you normally earn, in accordance with the Petro-Points terms and conditions available at www.petro-canada.ca/en/personal/terms-conditions.

Petro-Points are not awarded on tobacco products, vaping products, gift cards, transit tickets and taxes on non-petroleum purchases.

Underwritten by RBC Insurance Company of Canada.

All insurance is subject to limitations and exclusions. Please refer to the insurance certificates included in your Welcome Kit for complete details.

You are protected with Zero Liability protection, which means you are not liable for fraudulent charges provided you have taken reasonable precautions to protect your PIN and your card, as set out in your RBC Royal Bank Credit Card Agreement.

All insurance is subject to limitations and exclusions. Please refer to the insurance certificates included in your printed Welcome Kit for complete details or online in Credit Card Documentation.

The Offers program is available to clients with an RBC Royal Bank (i) debit card tied to a personal or business chequing account, and/or (ii) personal or business credit card, other than an RBC Commercial Visa or RBC US Dollar Visa card. Eligibility criteria for an RBC Offer: (a) is determined by RBC, (b) may vary depending on the offer, and (c) may be based on the client’s preferences and account status. Eligible clients will refer to the terms and conditions applicable to each specific RBC Offer for more details. For complete terms and conditions that apply to the Avion Rewards program, please visit: www.rbcrewards.com or call 1-800-769-2512.

To participate in this offer, you must have an eligible RBC Debit Card, Personal Credit Card or Business Credit Card which is issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”). RBC Business Owners will only be able to link up to two (2) Business Credit Cards and one RBC Debit Card to a Be Well Card.

Eligible RBC Debit Cards are debit cards tied to a personal banking or savings account or a business banking or savings account in good standing that is set up to pay for goods and services at a store or merchant that has point of sale or other designated debit card terminals that accept debit card payments.

You must be enrolled in RBC Online Banking or the RBC Mobile app in order to link your RBC Card to your Be Well Card. Card linking may take up to 2 business days to process before Be Well points can be applied to purchases. Each time you scan your Be Well Card and pay with your Linked RBC Card, you will earn 50 Be Well points for every $1 spent on eligible purchases at Rexall Locations, in accordance with the Be Well Terms and Conditions available at https://www.letsbewell.ca/terms-conditions.

Be Well points are not awarded on taxes; tobacco products; products containing codeine; lottery tickets; alcohol; bottle deposits; gift cards; prepaid cards and wireless or long distance phone cards; event tickets; transit tickets and passes; post office transactions; stamps; passport photos; cash back; gifts with purchases; delivery charges; environmental levies; Home Health Care services/rentals and any other products or services that we may specify from time to time or where prohibited by law.

To "redeem" means to use your Be Well points to pay, or partially pay, for eligible purchases by using your Be Well card at the point of sale in participating Rexall stores following the instructions provided by the cashier, the point-of-sale terminal or other payment processing device. You can redeem the Be Well points you collect for eligible purchases, see Section 5 of the Be Well Terms and Conditions (available at https://www.letsbewell.ca/terms-conditions), or for any other purposes of which we may advise you from time to time.

You must have enrolled in the Be Well program and have registered your Be Well card, or otherwise have called customer service, in order to redeem Be Well points. Any Be Well points collected on a Be Well card will remain the property of the Be Well Administrator until the enrolment and registration process has been completed.

You must redeem a minimum of 25,000 Be Well points at any one time, which are worth $10. Be Well points may be redeemed in increments of $10 up to a maximum of $200 (500,000 Be Well points) in a single transaction. A maximum of 500,000 Be Well points can be redeemed within a 24-hour period.

In Ontario and British Columbia, Be Well points cannot be redeemed on prescriptions. The laws in each province and territory may change from time to time and you are advised to consult with your pharmacist for additional information in this respect.

Be Well points you collect upon making a purchase cannot be redeemed for that purchase and can only be redeemed for a subsequent eligible purchase provided 12 hours have passed since the Be Well points were collected.

To receive a complimentary DashPass subscription for $0 delivery

fees on orders of $15 or more at eligible restaurants when you pay

with your Eligible RBC Credit Card, you must subscribe to DashPass

by adding an Eligible RBC Credit Card, accept the DoorDash terms

and conditions, and activate your benefit by clicking “Activate

Free DashPass” before July 31, 2024 (“Offer Period”). If you are

an existing DashPass subscriber and have already added an Eligible

RBC Credit Card to your account you must activate your benefit by

clicking “Activate Free DashPass” during the Offer Period. If you

have been charged for DashPass you will receive a refund to the

method of original payment, in the amount of the monthly

subscription fee for the month you activate your complimentary

subscription. For all clients, by clicking on “Activate Free

DashPass” you agree to the DoorDash terms and conditions which can

be found at

https://help.doordash.com/consumers/s/terms-and-conditions .

Eligible RBC Credit cardholders include primary cardholders,

co-applicants, authorized users, primary business cardholders and

secondary business cardholders on an Eligible RBC Credit Card

account.

The DashPass monthly subscription fee will be waived (“Complimentary DashPass Subscription”) and you will receive either a 3 month or 12 month

Complimentary DashPass Subscription based on the Eligible RBC

Credit Card you use to subscribe to DashPass.

DashPass subscriptions purchased through third parties, including

third-party payment accounts, or online or mobile digital wallets

(like Apply Pay and Google Pay) are not eligible for the

Complimentary DashPass Subscription.

Eligible RBC Credit Cards: Your Eligible RBC

Credit Card may only be used with one DoorDash account to receive

a Complimentary DashPass Subscription. Once you have received a

Complimentary DashPass Subscription you cannot use the same

eligible RBC Credit Card to obtain a Complimentary DashPass

Subscription with another DoorDash account.

You are only eligible for one 12 month Complimentary DashPass

Subscription and one 3 month Complimentary DashPass Subscription

during the Offer Period. The Complimentary DashPass Subscription

commences on the date you subscribe to receive the Complimentary

DashPass Subscription. For example, if you subscribe to a 12 month

Complimentary DashPass Subscription in on the last day of your

second month of a 3 month Complimentary DashPass Subscription you

will receive a total of 14 months of Complimentary DashPass

Subscription.

In order to validate your credit card as an Eligible RBC Credit

Card, Royal Bank may need to administer a $0.50 charge to validate

your card enrollment. This charge will be reversed in 3 to 5 days

once your account has been validated.

12 Month Complimentary DashPass Subscription is available for the

following Eligible RBC Credit Cards:

As an RBC Avion Visa Platinum, RBC Avion Visa Infinite , RBC Avion

Visa Infinite Privilege, RBC Avion Visa Infinite Privilege for

Private Banking, WestJet RBC World Elite Mastercard, RBC Rewards

Visa Preferred, RBC Cash Back Preferred World Elite Mastercard, RBC British Airways Visa

Infinite, RBC Avion Visa Business, RBC Avion Visa Infinite

Business cardholder.

You are eligible for a Complimentary DashPass Subscription for 12

months from the date you subscribe to receive the Complimentary

DashPass Subscription. You will be auto-enrolled into full-price

membership at the then-current rate after the end of the 12 month

Complimentary DashPass Subscription. Your RBC credit card account

must be open and not in default to maintain the benefits of

DashPass.

3 Month Complimentary DashPass Subscription is available for the

following Eligible RBC Credit Cards:

As an RBC Rewards+ Visa, Signature RBC Rewards Visa, RBC Visa

Platinum, RBC Visa Cash Back, RBC Cash Back Mastercard, RBC Visa

Classic Low Rate Option, RBC Visa Classic, RBC Student Visa

Classic, RBC Visa Classic II Student, RBC Visa Gold, RBC U.S.

Dollar Visa Gold, RBC Rewards Visa Gold, RBC RateAdvantage Visa,

WestJet RBC Mastercard, RBC Visa Business, RBC Visa Business Gold,

RBC Visa CreditLine for Small Business, or RBC Business Cash Back

Mastercard.

You are eligible for a Complimentary DashPass Subscription for 3

months from the date you subscribed to the Complimentary DashPass

Subscription. You will be auto-enrolled into full-price membership

at the then-current rate after the end of the 3 month

Complimentary DashPass Subscription. Your RBC credit card account

must be open and not in default to maintain the benefits of

DashPass.

DoorDash not Royal Bank of Canada, is responsible for (i) services

and products provided through DoorDash; (ii) DashPass, including

the DashPass Benefits, the administration of DashPass and (iii)

the DoorDash terms and conditions. The Complimentary DashPass

Subscription offer may be amended or withdrawn at any time. To

learn more about DashPass, visit

www.doordash.com/dashpass

(opens to external site). For full DashPass for RBC Program Terms and Conditions, visit

rbcroyalbank.com/credit-cards/documentation/pdf/full-doordash-tcs-en.pdf.

DashPass is a DoorDash subscription service that offers unlimited deliveries for $0 delivery fee on eligible restaurant purchases (minimum order amount of $15.00 CAD before taxes and fees) at a monthly subscription fee of $9.99 CAD plus tax. To learn more about DashPass visit www.doordash.com/dashpass (opens to external site).

View Legal DisclaimersHide Legal Disclaimers

21.99% if you reside in Quebec.

You will earn i) $1.50 cash back for every $100.00 (1.5% Cash Back Credit) in Net Purchases you make (including pre-authorized bill payments), up to a maximum of $25,000 in Net Purchases per Annual Period and for a maximum Cash Back Reward of $375.00, and ii) $1.00 cash back for every $100.00 (1% Cash Back Credit) in Net Purchases you make (including pre-authorized bill payments) in excess of $25,000 per Annual Period, unlimited. Provided your New Cash Back Balance is $25 or greater, Cash Back Credits earned during the Annual Period will i) automatically be credited to your January Account balance and appear on your February Account Statement, and/or ii) be credited at any other time, upon request. Cash Back Credits are earned on Net Purchases only; they are not earned on Cash Advances (including balance transfers, cash-like transactions and bill payments that are not pre-authorized charges that you set up with a merchant), interest charges or fees, and credits for returns and adjustments will reduce or cancel the Cash Back Credits earned by the amounts originally charged. For complete details, please refer to the RBC Cash Back Program Terms and Conditions at www.rbc.com/cashbackterms.

Mastercard Travel Pass, provided by DragonPass, is being provided as a benefit to cardholders with eligible and valid WestJet RBC World Elite Mastercard cards. Each eligible World Elite Mastercard cardholder is entitled to a complimentary membership to DragonPass Airport Lounges Program (as long as they remain a World Elite Mastercard cardholder). Access to participating DragonPass Airport Lounges is at the cost of US$32 per person (subject to change), per visit, and lounge access charges will be billed to the World Elite Mastercard card connected to the cardholder’s DragonPass membership. DragonPass benefits do not apply to all lounges, including (as of May 30, 2022) the Calgary WestJet Elevation lounge. To view a full list of participating DragonPass Airport Lounges, their facilities, opening times and restrictions, cardholders can visit airport.mastercard.com. By using this benefit, you agree to all of DragonPass terms and conditions, including privacy and security policies available at mastercardtravelpass.dragonpass.com. These policies may be amended or updated at any time and without notice. RBC reserves the right to modify or cancel this benefit at any time and without notice. Mastercard Travel Pass, DragonPass Airport Lounges and associated services are provided by DragonPass, not Royal Bank of Canada (“RBC”), and RBC is not responsible for any claims or damages arising from the use of the Mastercard Travel Pass or the DragonPass Airport Lounges services. Mastercard reserves the right to cancel, modify or withdraw this benefit at any time, even after you have enrolled in Mastercard Travel Pass.

Unlimited means there is no maximum cash back credits you can earn on eligible purchases (up to your available credit limit) per Annual Period. For complete RBC Cash Back Program Terms and Conditions, please visit: www.rbc.com/cashbackterms .

Each time you use your linked Eligible RBC Card to purchase any grade of gasoline, including diesel, at a Retail Petro-Canada Location, you will save three cents ($0.03) per litre at the time of the transaction. Card linking may take up to 2 business days to process before savings and bonus points can be applied to purchases.

Each time you use your linked Eligible RBC Card to pay for qualifying purchases at a Retail Petro-Canada Location, you will earn a bonus of twenty percent (20%) more Petro-Points than you normally earn, in accordance with the Petro-Points Terms and Conditions.

Terms and conditions apply. Boingo services provided by Boingo Wireless, Inc. See mastercard.boingo.com for full details.

Coverage underwritten by RBC Insurance Company of Canada.

Coverage underwritten by Aviva General Insurance Company.

All insurance is subject to limitations and exclusions. Please refer to the insurance certificates included in your printed Welcome Kit for complete details or online in Credit Card Documentation.

Mastercard On-Demand Apps and Subscription Services is provided by Mastercard as a benefit to cardholders of eligible World Elite Mastercard credit cards. Mastercard, not Royal Bank of Canada, is responsible for this benefit. Offers are subject to terms and conditions and may be subject to change without notice, detailed at www.mastercard.ca/worldelite

Mastercard Travel Rewards is provided by Mastercard as a benefit to cardholders of eligible World Elite Mastercard credit cards. Mastercard, not Royal Bank of Canada, is responsible for this benefit. Offers are available for a limited time and subject to partner terms and conditions, detailed at www.traveloffers.mastercard.com. Offer eligibility requires spend in local currency and minimum spend requirements apply. Offers may be subject to change without notice.

To participate in this offer, you must have an eligible RBC Debit Card, Personal Credit Card or Business Credit Card which is issued by Royal Bank of Canada (excluding RBC commercial credit cards) (“RBC Card”). RBC Business Owners will only be able to link up to two (2) Business Credit Cards and one RBC Debit Card to a Be Well Card.

Eligible RBC Debit Cards are debit cards tied to a personal banking or savings account or a business banking or savings account in good standing that is set up to pay for goods and services at a store or merchant that has point of sale or other designated debit card terminals that accept debit card payments.

You must be enrolled in RBC Online Banking or the RBC Mobile app in order to link your RBC Card to your Be Well Card. Card linking may take up to 2 business days to process before Be Well points can be applied to purchases. Each time you scan your Be Well Card and pay with your Linked RBC Card, you will earn 50 Be Well points for every $1 spent on eligible purchases at Rexall Locations, in accordance with the Be Well Terms and Conditions available at https://www.letsbewell.ca/terms-conditions.

Be Well points are not awarded on taxes; tobacco products; products containing codeine; lottery tickets; alcohol; bottle deposits; gift cards; prepaid cards and wireless or long distance phone cards; event tickets; transit tickets and passes; post office transactions; stamps; passport photos; cash back; gifts with purchases; delivery charges; environmental levies; Home Health Care services/rentals and any other products or services that we may specify from time to time or where prohibited by law.

To "redeem" means to use your Be Well points to pay, or partially pay, for eligible purchases by using your Be Well card at the point of sale in participating Rexall stores following the instructions provided by the cashier, the point-of-sale terminal or other payment processing device. You can redeem the Be Well points you collect for eligible purchases, see Section 5 of the Be Well Terms and Conditions (available at https://www.letsbewell.ca/terms-conditions), or for any other purposes of which we may advise you from time to time.

You must have enrolled in the Be Well program and have registered your Be Well card, or otherwise have called customer service, in order to redeem Be Well points. Any Be Well points collected on a Be Well card will remain the property of the Be Well Administrator until the enrolment and registration process has been completed.

You must redeem a minimum of 25,000 Be Well points at any one time, which are worth $10. Be Well points may be redeemed in increments of $10 up to a maximum of $200 (500,000 Be Well points) in a single transaction. A maximum of 500,000 Be Well points can be redeemed within a 24-hour period.

In Ontario and British Columbia, Be Well points cannot be redeemed on prescriptions. The laws in each province and territory may change from time to time and you are advised to consult with your pharmacist for additional information in this respect.

Be Well points you collect upon making a purchase cannot be redeemed for that purchase and can only be redeemed for a subsequent eligible purchase provided 12 hours have passed since the Be Well points were collected.

To receive a complimentary DashPass subscription for $0 delivery

fees on orders of $15 or more at eligible restaurants when you pay

with your Eligible RBC Credit Card, you must subscribe to DashPass

by adding an Eligible RBC Credit Card, accept the DoorDash terms

and conditions, and activate your benefit by clicking “Activate

Free DashPass” before July 31, 2024 (“Offer Period”). If you are

an existing DashPass subscriber and have already added an Eligible

RBC Credit Card to your account you must activate your benefit by

clicking “Activate Free DashPass” during the Offer Period. If you

have been charged for DashPass you will receive a refund to the

method of original payment, in the amount of the monthly

subscription fee for the month you activate your complimentary

subscription. For all clients, by clicking on “Activate Free

DashPass” you agree to the DoorDash terms and conditions which can

be found at

https://help.doordash.com/consumers/s/terms-and-conditions .

Eligible RBC Credit cardholders include primary cardholders,

co-applicants, authorized users, primary business cardholders and

secondary business cardholders on an Eligible RBC Credit Card

account.

The DashPass monthly subscription fee will be waived (“Complimentary DashPass Subscription”) and you will receive either a 3 month or 12 month

Complimentary DashPass Subscription based on the Eligible RBC

Credit Card you use to subscribe to DashPass.

DashPass subscriptions purchased through third parties, including

third-party payment accounts, or online or mobile digital wallets

(like Apply Pay and Google Pay) are not eligible for the

Complimentary DashPass Subscription.