If you’ve ever wondered how a credit card purchase turns into a bill a month later, you’re not alone. Credit cards are powerful financial tools that offer flexibility, security, and rewards—but they also come with responsibilities.

This article explains how credit cards work in Canada, the different types available, the benefits and drawbacks, and practical strategies to help you make the most of your card.

Key Takeaways

- A credit card is a type of payment card that lets you borrow money up to a set limit to pay for goods and services.

- Unlike a debit card, you repay the balance later instead of funds being debited from your account right away.

- There are several types of credit cards. You can choose one that best complements your lifestyle.

- When used responsibly, credit cards can be helpful tools that help you build credit and earn other perks and benefits.

What is a credit card?

A credit card is a payment card with an embedded chip, issued by a bank or financial institution, that lets you use borrowed money up to a set limit to pay for goods and services.

All credit cards display:

- A unique credit card number

- The credit cardholder’s full name

- An expiration date

- A three-digit Card Verification Value (CVV)

Unlike debit cards, which pull money directly from your chequing and/or savings account, credit cards allow you to repay the balance later instead of funds being debited from your account right away.

The modern credit card has its roots in the early 20th century, when retailers offered charge cards to regular customers. By the 1950s, the plastic credit card as we know it took hold, and today they are one of the most common forms of payment worldwide.

How credit cards work

When you tap, insert, or swipe your card, the credit card issuer (the issuing bank) pays the merchant on your behalf, and you agree to pay the issuer back. Here’s how it works:

- Credit limit: The maximum amount you can borrow. For example, if your card has a $3,000 limit, you can’t spend more than that without paying some of the balance down first.

- Interest: If you pay your balance in full each month, you avoid incurring interest. If you carry a balance, interest (often around 19–22% in Canada) is charged.

- Fees: Most cards have additional fees in addition to borrowing interest such as annual fees, cash advance fees, or foreign transaction charges. Be sure to review and consider the fees applicable to the credit cards you are considering before applying.

- Cash advance: You may also be able to access cash advances with your credit card from a bank or ATM. This is useful for quick cash but be aware of higher fees and interest rates.

Tip

Always pay your statement balance in full and on time to avoid interest and late fees. This practice is also a great way to improve your credit score.

Types of credit cards

There are several types of credit cards on the market. When choosing one, consider what benefits matter most to you. Here’s some of the most common types of credit cards:

Earn travel rewards and other benefits such as travel insurance or lounge access.

Collect reward points redeemable for merchandise, gift cards, or other services.

Earn a percentage of purchases back as an account credit.

Offer a lower ongoing interest rate to help reduce the cost of carrying a balance.

Provide business owners and employees with tools and rewards designed to make the most out of business-related expenses.

USD or foreign money credit cards

Allow you to make purchases in a foreign currency while avoiding conversion fees.

Other payment options

These payment options are designed to offer different ways to pay or finance purchases, offering flexibility that goes beyond traditional payment methods.

Virtual credit cards

Virtual cards create temporary numbers for online shopping, adding extra protection against fraud. They can also be linked to digital wallets such as Apple Pay, Google Pay, or Samsung Pay, allowing you to make secure, contactless payments in-store or online without exposing your actual card number.

Secured credit cards

A secured credit card requires collateral. They’re designed for people building or repairing their credit history.

Credit card debt and management

Carrying a balance over time can become very costly. Interest charges can accumulate quickly and increase the total amount you owe. Over time, this can make it harder to pay down your debt and stay on top of your finances.

Best practices for managing credit card debt

- Pay off your entire monthly balance or as much as you can afford, not just the minimum payment.

- Create a budget to monitor spending.

- Consider consolidating high-interest debt into a lower-interest credit card through a balance transfer.

- Set up automatic payments to avoid missed due dates.

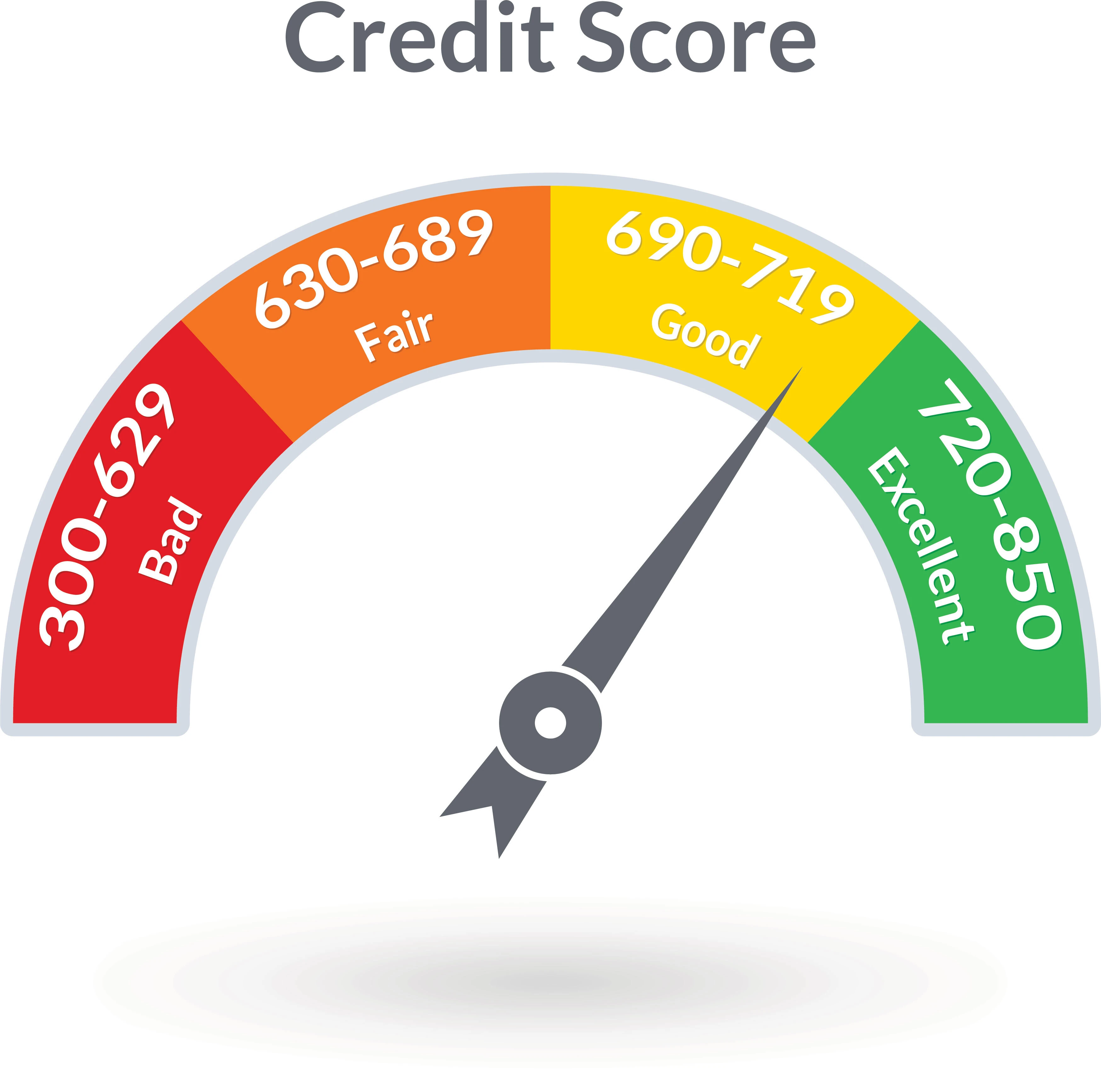

Credit score and credit cards

When you apply for a credit card, the lender performs a hard inquiry on your credit report. A hard inquiry can cause a small, short-term drop in your credit score. A soft inquiry happens when you check your own credit or when a company pre-qualifies you for an offer. Soft inquiries do not affect your credit score.

For more information on how credit scores are calculated or to get yours, visit TransUnion and Equifax.

Comparison to debit cards

Here’s a helpful chart when comparing debit cards and credit cards:

| Feature | Debit Card | Credit Card |

|---|---|---|

| Source of funds | Your bank account | Borrowed money |

| Builds credit history | No | Yes |

| Risk of debt | Low | High if not managed well |

| Rewards & perks | Less Common | Common (cashback, travel, grocery) |

Credit card benefits and rewards

Different types of credit cards can offer different rewards, perks or benefits. Here are some of the ways you can get even more from your credit card:

No annual fee credit cards

Some cards offer no annual fee, making them a great choice if you prefer to avoid ongoing fees.

Student offers

Student credit cards are often more affordable, while still offering great benefits for those starting out.

Other benefits

Other cards can include purchase protection, extended warranties, and discounts on services such as roadside assistance.

Credit card fees and charges

Every card charges different fees, which are covered in your credit card agreement. Reading it can help you make informed choices, and reduce costs to improve your financial health. These are some common credit card fees to look out for:

Annual fees and interest rates

Premium cards generally have higher annual fees but provide greater rewards. Standard interest rates in Canada are usually 19–22%.

Late payment fees and other charges

Missing a payment can trigger late fees and penalty interest rates, and it may harm your credit score. Other fees can include balance transfer, cash advance, and foreign transaction fees.

How to avoid fees and charges

- Pay your balance in full each month.

- Set up reminders or automatic payments by the due date.

- Select a no annual fee credit card.

Find the right credit card for you

Credit cards, when used responsibly, are more than just a way to pay—they’re a tool to build credit, earn rewards, and protect purchases. But they also carry risks if mismanaged. Understanding their function, comparing options, and paying balances in full are key to maximizing benefits and avoiding costs.

Ready to get started? RBC offers a variety of top-rated credit cards in Canada, catering to different lifestyles, from everyday use to travel rewards and student options. Find and compare our popular Canadian credit cards and apply online in minutes.

FAQ

Can you get a credit card if you’re under 18?

In Canada, you must be at least 18 years old to apply for a credit card on your own. If you’re under 18, you may be able to use a credit card as an authorized user on a parent’s account, which can help you start building credit history responsibly.

Does applying for a credit card affect your credit score?

When you apply for a credit card, the lender performs a hard inquiry on your credit report. A hard inquiry can cause a small, short-term drop in your credit score. Responsible card use, such as paying balances on time and keeping credit utilization low, will help improve your score over time.

How do you pay a credit card bill?

You can pay your credit card bill through your bank or financial institution’s online banking, mobile app, in-branch, or by setting up automatic payments. You can choose to pay the minimum, the full balance, or any amount in between. Paying in full each month avoids interest charges.