*

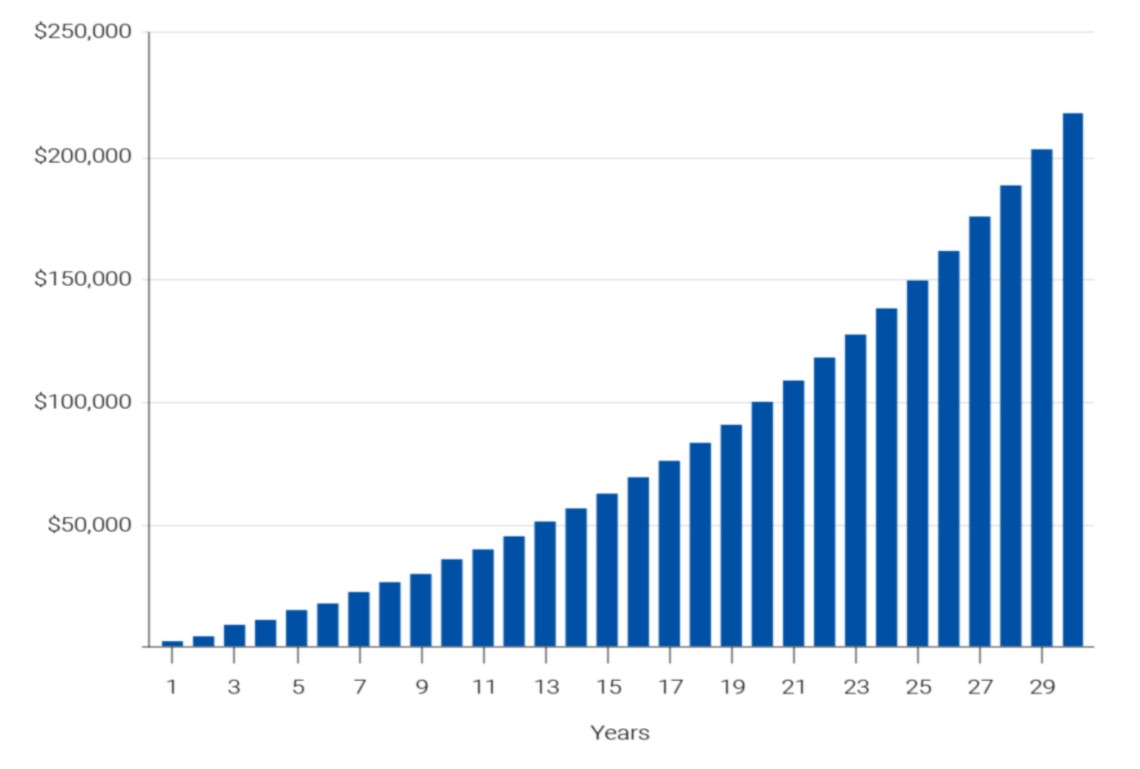

These results are general estimates only and

(i) are based on the accuracy and completeness of the data you have entered,

(ii) are based on assumptions that are believed to be reasonable, and

(iii) are for informational purposes only and should not be relied on for

advice.

Actual results may vary, perhaps to a large degree.

You should consult your professional advisor before taking any action.This

calculator tool does not represent or replace a comprehensive financial plan or

represent any type of financial planning service. The scope of this analysis is

limited to one aspect of your financial goals.

Royal Bank of Canada does not make any express or implied warranties or

representations with respect to any information or results in connection with

this calculator.

Royal Bank of Canada will not be liable for any losses or damages arising from

any errors or omissions in any information or results, or any action or decision

made by you in reliance on any information or results in connection with this

calculator tool.

1)

RBC

2020 Financial Independence in Retirement Poll. Findings from the 30th

annual RBC RRSP Poll, conducted by Ipsos from December 10 to 17, 2019 on behalf

of RBC Financial Planning, through a national survey of 2,000 Canadians aged 18+

who completed their surveys online. Quota sampling and weighting are employed to

balance demographics to ensure that the sample's composition reflects that of

the adult population according to Census data and to provide results intended to

approximate the sample universe. The precision of Ipsos online polls is measured

using a credibility interval. In this case, the poll is accurate to within

±2.2 percentage points had all Canadian adults been polled. All sample

surveys and polls may be subject to other sources of error, including, but not

limited to coverage error, and measurement error.

2)

Under the Lifelong Learning Plan, you can withdraw up to $10,000 per calendar

year for your own or your spouse's full–time training or post–secondary

education.

The total amount that can be withdrawn is $20,000 each with withdrawals over a

maximum of four consecutive years.

At least 10% of the amount borrowed must be repaid each year, over a maximum

period of 10 years.

3)

You can withdraw up to $60,000 from your RRSP to buy your first home under the Home Buyer’ Plan. To be eligible, you must be a Canadian resident and considered a first-time homebuyer. The funds must have been on deposit at least 90 days before you withdrew them, and a signed written agreement to buy or build a qualifying home is required. Funds withdrawn under the HBP must be repaid to their RRSP over a 15-year period. At least 1/15 of your withdrawal must be repaid to the RRSP each year. The repayment period begins as of the second year after the first withdrawal was made under the Home Buyers Plan (HBP).

For withdrawals between January 1, 2022 and December 31, 2025, the repayment period begins as of the fifth year after the withdrawal was made. For details see Canada Revenue Agency Home Buyers’ Plan

4)

Assets in an RRSP must be Qualified Investments under the Income Tax Act. If the

TFSA holds non-Qualified Investments, it could be subject to tax.

5)

Real-time streaming quotes are available on stocks and ETFs for all clients.

Real-time streaming quotes are also available on options and over-the-counter

(OTC) securities for Royal Circle and Active Trader clients, upon accepting the

terms and conditions of all exchange agreements on the RBC Direct Investing

online site.

6)

RBC InvestEase is a restricted portfolio manager providing access to model

portfolios consisting of RBC iShares ETFs with each model portfolio holding up

to 100% of RBC iShares ETFs. RBC iShares ETFs are comprised of RBC ETFs managed

by RBC Global Asset Management Inc. (RBC GAM) and iShares ETFs managed by

BlackRock Canada Limited (BlackRock Canada). RBC GAM and BlackRock Canada have

entered into a strategic alliance to bring together their respective ETF

products under the RBC iShares brand, and to offer a unified distribution

support and service model for RBC iShares ETFs.

Other products and services may be offered by one or more separate corporate

entities that are affiliated to RBC InvestEase Inc., including without

limitation: Royal Bank of Canada, RBC Direct Investing Inc., RBC Dominion

Securities Inc., RBC Global Asset Management Inc., Royal Trust Corporation of

Canada and The Royal Trust Company. RBC InvestEase Inc. is a wholly-owned

subsidiary of Royal Bank of Canada and uses the business name RBC InvestEase.

The services provided by RBC InvestEase are only available in Canada.

7)

RBC Direct Investing Inc. and Royal Bank of Canada are separate corporate

entities which are affiliated. RBC Direct Investing Inc. is a wholly owned

subsidiary of Royal Bank of Canada and is a Member of the Canadian Investment Regulatory Organization and the Canadian Investor Protection Fund.

Royal Bank of Canada and certain of its issuers are related to RBC Direct

Investing Inc. RBC Direct Investing Inc. does not provide investment advice or

recommendations regarding the purchase or sale of any securities. Investors are

responsible for their own investment decisions. RBC Direct Investing is a

business name used by RBC Direct Investing Inc.

Royal Bank of Canada and Royal Mutual Funds Inc. (RMFI) make no warranties,

express or implied, as to the accuracy or completeness of the information

contained herein.

Royal Bank of Canada and RMFI shall not be liable for any losses or damages

arising from any errors or omissions in information contained in this

calculator.

Financial planning and investment advice are provided by RMFI. RMFI, RBC Global

Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada

and The Royal Trust Company are separate corporate entities which are

affiliated. RMFI is licensed as a financial services firm in the province of

Quebec.

Information about the Registered Retirement Savings Plan is based on what is

currently available from the Canadian government and can be subject to change.