What is a Credit Card?

A credit card is a type of payment card that lets you borrow money up to a set limit to pay for goods and services. Unlike a debit card, you repay the balance later instead of funds being debited from your account right away. If you don’t pay the full balance each month, interest is charged on your outstanding balance, which can make your purchases more expensive over time. When used responsibly, credit cards can be helpful tools. They can assist in building credit, and some credit cards protect your purchases and let you earn rewards like cashback or travel points.

Learn More

Explore Our Best Current Credit Card Offers

Find and Compare our Best Credit Cards

Find the Best Credit Card for You

Help Me Choose

Compare our Top Credit Cards

Compare Credit Cards

Calculate your Cash Back Potential

Calculate Cash Back

See the Reward Points You Can Earn

Calculate Reward Points

Popular Credit Cards from RBC

Find and compare our popular Canadian credit cards and apply online in minutes.

We couldn’t find any resources that match your search.

Get to Know our Different Types of Credit Cards

Explore all the credit cards RBC offers to find the perfect card for you and your lifestyle.

Earn points to redeem towards planning your next trip

Benefits

- Earn points on every purchase

- Redeem for flights, hotels and other travel expenses

- Get extensive insurance to cover you on your trip

Earn points on everyday spending and redeem them your way

Benefits

- Earn points on every purchase

- Redeem your points for gift cards, merchandise and more

- Get insurance to cover you and your purchases

Earn cash back on all your purchases

Benefits

- Earn unlimited cash back on every purchase

- Redeem your cash back at anytime throughout the year

- Get insurance to cover your purchases

Save money with a low, fixed annual interest rate

Benefits

- Get a fixed annual interest rate of 12.99%

- Get insurance to cover your purchases

Experience Even More Great Features From RBC

Get an Award Winning Credit Card

RBC has been recognized and awarded as having some of the top credit cards in Canada.

Avion Visa Infinite Privilege

Avion Visa Infinite

ION+ Visa

Avion Visa Infinite Privilege

Avion Visa Infinite

ION+ Visa

NOMI

Stay on top of your finances with NOMI. Receive personalized alerts, reminders, and insights delivered right to you, making it easier to make informed financial decisions.

Credit Card Resources

Explore articles and resources designed to help you build confidence and achieve your financial goals by effectively managing your credit card.

Top Canadian Credit Card Questions

If your card has been stolen or permanently lost, call our 24-hour toll-free number 1-800-769-2512. We’ll block the card from future use and issue you a new card.

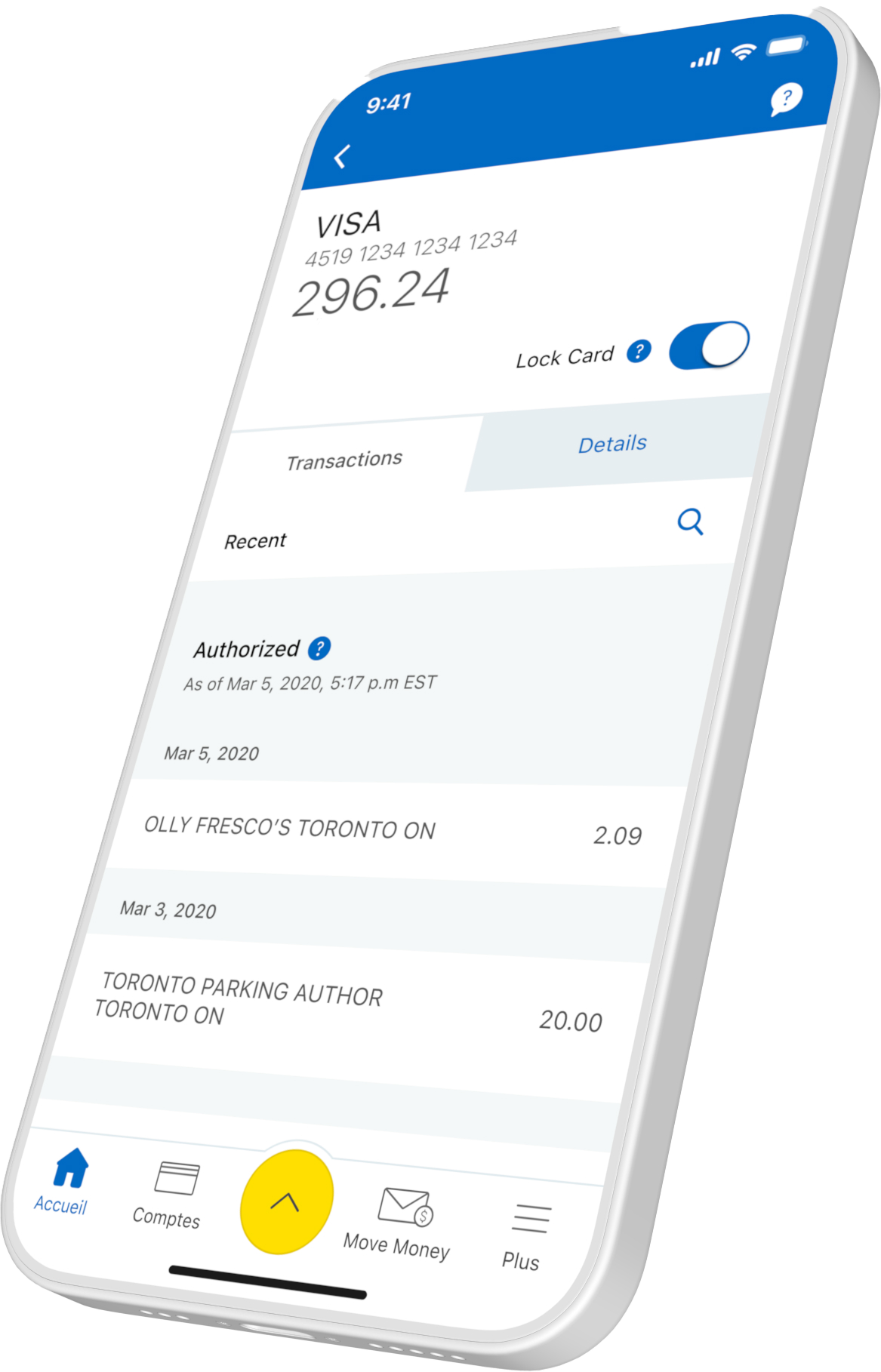

Learn moreyour card being lost or stolenYou can easily lock and unlock your card through RBC Online Banking or the RBC Mobile app by selecting the card you want to lock and switching the toggle for Lock Card.

Learn more about credit card lockIf you’re ever a victim of credit card fraud, take a deep breath--you’re ok. Call 1-800-769-2512 and we’ll be happy to help you. Provided you’ve take reasonable precautions to protect your PIN and your card, you’re covered for any fraudulent charges both online and in-store. For more information, view the Zero Liability policies by Visa and Mastercard.

Credit cards are important for things like making hotel reservations, car rentals, or online purchases. They’re convenient and secure, and help give you the freedom to manage your finances, cover unexpected emergencies and also take advantage of rewards and special insurances. They’re also an easy way to establish a credit history! Use our credit card selector to find a card that's right for you and apply online in just a few easy steps.

That depends on the card you choose. Some of our cards offer more benefits with an annual fee, while others have no annual fee at all. Browse our no annual fee cards or use our card selector to help narrow down the benefits that are most important to you. To see a detailed breakdown of annual fees for all our credit cards, visit our dedicated Annual Fee Comparison page.

If you collect Avion points, you can easily redeem them for travel, merchandise, gift cards and more at avionrewards.com. If you earn WestJet dollars, Avios or Asia Miles, you can redeem directly with the airline loyalty program connected to your card.

You can make a payment through any of the methods below:

- RBC Online Banking

- RBC Mobile app

- automated payments (so you’ll never need to worry about making your payment on time)

- by phone

- by mail

- in person at an RBC branch

- at an RBC Royal Bank ATM