Advantages of RBC International Money Transfer

$0 Transfer Fees1:

Send money with $0 transfer fees and competitive exchange rates to keep overall costs low.

Quickly Delivered Globally:

Most payments are received within 2 business days.

Safe & Secure:

The RBC Digital Banking Security Guarantee4 stands behind every transfer made. Your money is safeguarded from potential fraudsters with 2-step verification.

Send an International Money Transfer in 3 Simple Steps

Sign in to RBC Online Banking or the RBC Mobile app and select International Money Transfer.

Enter the recipient information including address and account number. You’ll also need the destination bank's name and location, SWIFT/BIC code, or APA Routing Number.

Most payments are received within 2 business days.

New to Canada?

Get started with RBC Online Banking or the RBC Mobile app today and send online money transfers securely.

Your Top Questions Answered

Most personal clients with access to RBC Online Banking or the RBC Mobile app can send an International Money Transfer2.

Using the International Money Transfer service, you can send money to more than 200 countries worldwide. While IMT is not available to recipients in Canada, clients can use the Interac e-Transfer service in RBC Online Banking or the RBC Mobile app – FREE for all RBC Royal Bank personal chequing accounts.

You can use the service as much as you like, provided you don't exceed your daily limit, and there are enough funds in the account.

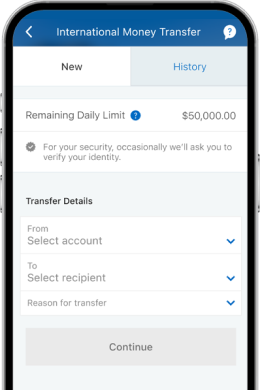

Clients can send a minimum of $100, up to a maximum of $50,000 per day using International Money Transfer. For your security, occasionally we’ll ask you to verify your identity.

Typically, the recipient can access the funds within 2 business days. However, in some cases, payments may take additional time and take up to 7 business days before being completed. If 6 business days or more have passed since the date you sent the transfer and you've confirmed that the recipient has still not received the funds, we can investigate the transfer for you. There is a fee for investigations.

While RBC doesn't charge the recipient any fees for receiving money, an intermediary financial institution or the recipient's financial institution may require additional fees or service charges to be paid.

You will need:

- An eligible RBC Royal Bank personal chequing account2

- Access to RBC Online Banking or the RBC Mobile app

- The recipient's bank account number, IBAN (for IBAN countries), CLABE (for Mexico), or the Business Identifier Code (SWIFT BIC or ABA for the USA) for the bank/branch where the funds are to be sent to or picked up.

If signed into RBC Online Banking:

- On the right side of the Accounts Summary page, under Quick Payments & Transfers, select "International Money Transfer".

- Follow the on-screen instructions.

On the RBC Mobile app:

- Open and sign in to the RBC Mobile app

- Select "Send Money" for Android or "Move Money" for iOS

- Select "International Money Transfer"

- Follow the on-screen instructions. Please note, to send a transfer through the RBC Mobile app, the recipient must have been preregistered through RBC Online Banking.

There are two ways your recipient can receive the funds:

- Deposit to Account: If you know your recipient's bank name, SWIFT BIC, or ABA (for the USA) and account number, IBAN (for IBAN countries), or CLABE (for Mexico), we'll simply transfer the funds directly into the recipient's account.

- Pay Upon Identification: If your recipient doesn't have a bank account, we can transfer the funds to an international bank branch at an address you specify. The bank will release the funds to your recipient with proof of identity (such as a government-issued photo I.D.). Please ask the recipient to confirm with their bank if this payment method is available before sending the funds. In addition, it's a good idea to have the recipient also check with their bank what type of identification is needed.

Typically, your recipient will receive the funds in the currency you specify. However, some countries may convert the funds into local currency (conversion fees may apply).

For assistance with your payment online, call us at 1-800-769-2555. We're here 24 hours a day, 7 days a week.

For information on what BIC to use, please contact SWIFT; for information on ABAs, contact FEDwire.

For information on IBANs, please contact your recipient.

No, once a transfer has been sent, it can't be changed and typically can't be reversed, which is why it's essential to verify all the information you've provided is accurate before sending a transfer. Additionally, transfer fees are non-refundable.

- transactions that occur after you notify us that you believe that any of your Passwords may have become known by someone, or that you noticed unusual, suspicious or fraudulent activity on any of your Accounts;

- transactions where it can be shown that you have been a victim of fraud, theft or have been coerced by trickery, force or intimidation, so long as you report the incident to us immediately and cooperate and assist us fully in any investigation;

- transactions resulting from negligent conduct by us, our employees or Third-Party Service Providers;

- Interac Online Payment transactions resulting from negligent conduct by any Third Party participating in Interac Online Payment; and

- any failure, error, malfunction, or technical problem of our system or equipment or that of any Third-Party Service Provider or any Third Party participating in Interac Online Payment.

- you do not comply with any of your obligations under this Agreement or you do not comply with any instructions we may provide to you in connection with Digital Banking or Mobile Payments;

- you engage in any fraudulent, criminal or dishonest acts related to Digital Banking or Mobile Payments;

- you access Digital Banking or Mobile Payments via a Device that you know or reasonably should know contains software that has the ability to reveal or otherwise compromise any of your Passwords, Personal Verification Questions or an e-Transfer Question and Answer;

- you carry out the transaction, including if the transaction is a result of any mistake, error, omission, inaccuracy or other inadequacy of, or contained in any data or information that you give to us;

- you share any of your Passwords or Personal Verification Questions; or

- you consent to, contribute to or authorize a transaction in any way.

For full details regarding the protections and limitations of the RBC Digital Banking Security Guarantee, including your responsibilities in ensuring the safety and security of your transactions, please see your Electronic Access Agreement and your Client Card Agreement for personal banking clients, and the Master Client Agreement for business clients. This guarantee is given by Royal Bank of Canada in connection with its Online and Mobile Banking services. Formerly known as the RBC Online Banking Security Guarantee.