Get More When You Invest with Us

Digital tools to help you plan and save

Stay connected to your money and save automatically with smart tools.

Advice if you need it

Get advice, whether you're investing $100 or $5,000.

Reliability and security

Feel confident with a company that Canadians have trusted for over 150 years.

Ways to Invest with RBC®

Call the shots yourself, let us invest for you, or work with an advisor. Use one or more of our services—whatever’s right for you.

Trade and

Invest Yourself

RBC Direct Investing

- Do it yourself, choosing from stocks, bonds, ETFs and more

- Access powerful tools and resources to inform your decisions

Invest Online—Without all the Work

RBC InvestEase

- Let our pros pick, buy and manage your investments for you

- Get a personalized investment plan created with low-fee ETFs

Get Advice from an RBC Advisor

RBC Royal Bank

- Create a savings plan and get help with choosing investments (GICs, mutual funds or cash) in a full range of accounts such as RRSPs & TFSAs

- Meet in person, by phone or over video chat5

Work with a Dedicated Financial Planner

RBC Financial Planning

- Develop a personalized comprehensive financial plan based on your unique goals with an accredited professional

- Get strategies on building wealth, retirement planning, estate and tax planning

Get Custom Advice from a Dedicated Wealth Advisor

RBC Wealth Management

- Customize your investment portfolio and wealth plan with a dedicated wealth advisor

- Access top-tier investment insights and award-winning research

Need more guidance?

Popular Accounts & Products to Grow Your Money

Grow Your Investments Faster with a TFSA, RRSP or FHSA

When it comes to saving for the future, many Canadians use a tax-smart registered account such as a TFSA, RRSP or FHSA. Like other types of investment accounts—both registered and non-registered — you can hold a variety of investments in either plan.

Tax-Free Savings Account (TFSA)

Registered Retirement Savings Plan (RRSP)

Keep Your Savings Safe and Secure

If you’re looking for a risk-free option with a steady rate of return, consider a GIC or savings account. You can hold a GIC in your registered accounts (TFSA, RRSP, etc.) or as a non-registered investment.

Guaranteed Investment Certificates (GICs)

RBC High Interest eSavings Account

Invest for Growth, Income and More

Choose from a wide range of investment products, including:

Exchange-Traded Funds (ETFs)

With RBC Direct Investing & RBC InvestEase

Invest in a fund that holds a variety of investments and trades like a stock.Tips and Advice to Help You Reach Your Goals

Explore our “how to” guides for tips on saving for the things that matter to you.

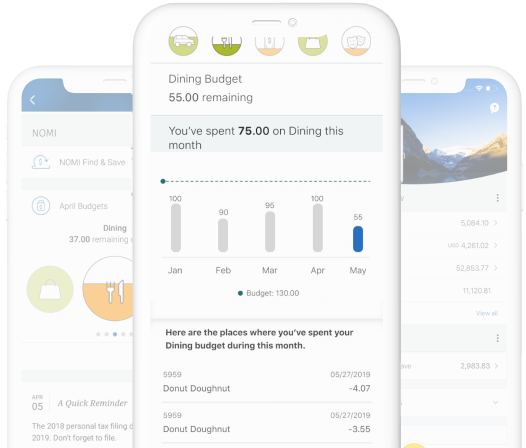

Smart Tools to Help You Plan and Save

Get Personalized Advice & Tips

Set goals, get tips and see all your investments in one spot!

MyAdvisor is a digital service that combines interactive planning tools and advice from a live advisor to help you stay on top of your savings goals. It’s exclusive to RBC clients, easy to use and available to you at no extra cost.

Save on AutoPilot

Put your savings on autopilot.

Grow your investments faster by setting up regular (weekly, monthly, etc.) contributions into your investment account. Simply choose how much you want to save automatically—and how often.

Save Extra Dollars

Start saving for any goal—quickly and easily!

NOMI Find & Save is a digital savings account that looks at your spending, finds extra dollars in your cash flow that it thinks you won’t miss and automatically moves them to savings. Turn on NOMI Find & Save in the RBC Mobile2 app.

Your Top Questions Answered

There are 2 ways you can open an account:

1. Through RBC Direct Investing

- Call your own shots with our low-cost online trading and investing service

- Hold stocks, bonds, exchange-traded funds (ETFs) and more in your FHSA

- Make informed investment decisions using expert research and other resources like free real-time streaming quotes3

2. Through RBC InvestEase

- Our pros will pick, buy and manage the investments in your FHSA for you

- We match you to a low-cost, expertly constructed portfolio of exchange-traded funds (ETFs) based on your answers to a few simple questions

- Track your progress online anytime and speak to a Portfolio Advisor if you have questions or need advice

Have Questions? Call 1-800-769-2563 (1-800-ROYAL-63).

- The First Home Savings Account (FHSA) is an individual account and cannot be held jointly. However, you and your spouse could each have an FHSA and can combine your savings to buy a qualifying home.

- The attribution rules will not apply to amounts that you receive from your spouse or common-law partner that you contribute to your FHSA—and vice versa. This means that any investment earnings in your FHSA will not be added to your or your spouse’s taxable income regardless of whether you or your spouse fund the contribution, as long as they are used to purchase a qualifying home.

- You will be able to hold multiple First Home Savings Accounts (FHSAs), but your total contribution room will remain the same as if you had only one FHSA. Plus, your maximum participation period of 15 years will be based on the date you open your first account.

We have a broad range of GICs that can fit any goal. You can use our handy GIC Selector tool to help you determine the best solution for you.

You can also work with an RBC advisor to help you choose the right investment that best fits your objectives. We encourage you to use our online booking tool to schedule a time to speak with an advisor by phone.

You can open a new RRSP in two ways:

- Call us at 1-877-798-1406. We'll be happy to discuss your goals for retirement and help you choose the type of investments that best suit your objectives.

- Visit your branch. We recommend booking an appointment ahead of time by calling us at 1-844-512-4949.

You can buy GICs:

- Through RBC Online Banking if you have an RBC Royal Bank chequing or savings account, or an existing GIC.

- Or if you have questions, we encourage you to use our online booking tool to schedule a time to speak with us by phone.

Other Resources You Might Like

Retirement Planning

Get help planning—whether you’re just starting to save or you’re already retired.

Financial Planning

Get helpful tips, advice and information on a broad range of money matters.

Most Recent Investments Articles

Saving for your First Home? Understanding how the First Home Savings Account (FHSA) Works

Presented by InvestEase Insights

Let's Connect.

We'd Love to Help.

Talk to an advisor for one-on-one investment advice, help making a plan and more.

Book an Appointment

RBC InvestEase Inc. is a restricted portfolio manager providing access to model portfolios consisting of RBC iShares ETFs. Each model portfolio holds up to 100% of RBC iShares ETFs. RBC iShares ETFs are comprised of RBC ETFs managed by RBC Global Asset Management Inc. (RBC GAM) and iShares ETFs managed by BlackRock Canada Limited (BlackRock Canada). RBC GAM and BlackRock Canada entered into a strategic alliance to bring together their respective ETF products under the RBC iShares brand, and to offer a unified distribution support and service model for RBC iShares ETFs.

Other products and services may be offered by one or more separate corporate entities that are affiliated to RBC InvestEase Inc., including without limitation: Royal Bank of Canada, RBC Direct Investing Inc., RBC Dominion Securities Inc., RBC Global Asset Management Inc., Royal Trust Corporation of Canada and The Royal Trust Company. RBC InvestEase Inc. is a wholly-owned subsidiary of Royal Bank of Canada and uses the business name RBC InvestEase.

RBC Financial Planning is a business name used by Royal Mutual Funds Inc. (RMFI). Financial planning services and investment advice are provided by RMFI. RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec

Products and services may be offered by Royal Bank of Canada or by a separate corporate entity affiliated with Royal Bank of Canada, including but not limited to Royal Mutual Funds Inc., RBC Direct Investing Inc., RBC Global Asset Management Inc., Royal Trust Company or The Royal Trust Corporation of Canada.

MyAdvisor is an online platform from RBC where you can view your financial information including visual representations (charts and graphs) of your retirement readiness, net worth, cash flow, and financial goal tracking. You can also see how varying your current approach can affect your savings and goals. The MyAdvisor platform also enables you to book an appointment with an RBC advisor and to meet with your advisor using video chat or phone to open new accounts, including investment accounts, and get advice on meeting your financial goals.

Royal Bank of Canada and Royal Mutual Funds Inc. (RMFI) make no warranties, express or implied, as to the accuracy or completeness of the information contained herein.

Royal Bank of Canada and RMFI shall not be liable for any losses or damages arising from any errors or omissions in information contained in this calculator.

Financial planning and investment advice are provided by RMFI. Mutual Funds are sold by RMFI. RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

Information about the Tax-Free Savings Account is based on what is currently available from the Canadian government and can be subject to change.

Registered Retirement Savings Plan (RRSP) lets you defer the taxes you pay on investment income until you withdraw that money in retirement.

Registered Retirement Savings Plan (RRSP) lets you defer the taxes you pay on investment income until you withdraw that money in retirement.