TLDR

-

Organize your financial documents in advance to ensure negotiations proceed smoothly.

-

Divorce can have tax implications. Set aside money to pay any future taxes owing.

-

Start thinking about your financial recovery after divorce.

-

Update your beneficiaries in your estate plan, investments and insurance policies.

Divorce may be one of the most challenging financial transitions you’ll ever face, even in the most amicable circumstances. While emotions run high, shifting from a shared income to financial independence requires a thoughtful strategy. A well-considered approach to managing your finances during divorce can help you protect your assets and build a stable foundation for the future.

This guide is designed to help you move past your emotions and create a clear plan. Here’s what you need to know about asset division, financial planning after divorce, and the steps that can help you start your next chapter confidently.

Steps to take before tackling your divorce and finances

The planning you do before negotiation or mediation begins will ensure a smoother, faster asset division and divorce process. Before diving into the details, take a moment to prepare your mindset and create a strategy.

Emotionally prepare

Prioritize logic and facts

Understandably, emotions run high whenever significant life changes take place, and it’s important to acknowledge them. But as you begin discussing and negotiating over divorce and money, try as best you can to separate feelings from finances. Create a list of topics that need to be addressed before any meetings take place. You can refer to your list throughout the process to help keep you on track.

Reframe how you think about divorce

It’s easy to operate from the heart when going through a hard time, and divorce is no exception. But when you approach everything with anger or shame, it will be a lot harder to have productive conversations. Remember:

-

Divorce is not a competition. It’s a life change where there are no winners and losers. Try to keep your discussions civil so that the process keeps moving.

-

Focus on resolution. The more productive the conversation, the closer you are to the finish line.

-

Do your part to keep the peace. Divorce can be a long process, and starting every conversation with hostility will take a toll on you. If you’re dissatisfied with how things are going, communicate directly and state why it doesn’t work for you. Then get the conversation back on track as quickly as possible.

Prioritize your needs, but prepare for compromise

Before any meeting or negotiation, identify what you need for your financial recovery after divorce. Have a clear idea of what you financially brought into the marriage and what you feel is a fair settlement. When you list your wants and needs in order of importance, you’ll better understand where you’re willing to compromise. Have an idea of what your post-divorce budget will look like after accepting a compromise. Knowing what your finances will look like makes it easier not to squabble over assets that won’t make much difference to your long-term goals.

Embrace mediation over litigation

When things become litigious, costs start adding up (and progress can stall). If you’re having trouble negotiating, consider dispute resolution options like mediation, which is often faster and less costly than leaving decisions to a judge, and the process gives you and your ex-spouse more control over the results. If you must engage the help of a lawyer, make sure you have all your paperwork to avoid wasting time or incurring additional costs

Financially prepare

Gather and organize financial documents

The more information you have, the faster negotiations can take place. Find and organize the following so they’re at your fingertips when needed:

-

income records

-

at least three years’ worth of tax returns

-

asset and investment statements

-

mortgage statements

-

retirement account information

-

recent joint credit card statements

-

any debts

-

a list of property and valuables

-

insurance policies and estate information

Plan for future tax implications

Certain aspects of divorce can substantially impact your taxes. For example, in Canada, child support received is not taxable for the recipient and not deductible to the payer; however, spousal support is taxable for the recipient and deductible for the payer. If you suspect you’ll receive spousal support, put money aside to cover future tax obligations. It’s worth consulting with a tax professional, like an accountant, to get divorce financial advice and fully understand the tax implications. For instance, disposition of certain assets (like the family home and investment accounts) can trigger capital gains that could impact your finances.

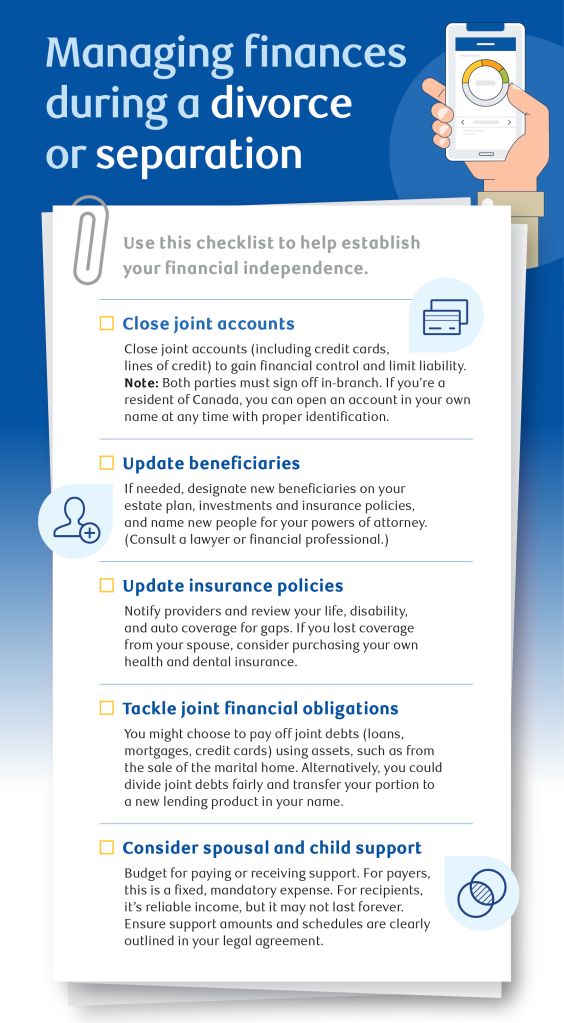

Managing finances during a divorce or separation

The legal process may take time, but securing your financial wellbeing should start right away. Here’s a checklist of admin tasks to help establish your independence.

Close joint accounts

Closing all joint accounts, credit cards and lines of credit will give you more control over your finances and reduce the chance of being held liable for new debts that don’t belong to you. To do this, both parties need to agree. First, decide how you want to distribute the remaining balance and remove all automatic transactions. Then, both parties will need to visit your branch together and present the appropriate identification. If you’re a resident of Canada, you can open new bank accounts in your name at any time with the proper identification.

Update beneficiaries

Review your estate plan, investments, and insurance policies, and consider who you would like to name as your new beneficiaries. If you’re removing your ex as the beneficiary, you’ll need to make an appointment with a lawyer or financial professional to appoint a new one. Also, name a new healthcare proxy while reviewing your estate plan.

Update insurance policies

Contact your insurance provider or advisor to notify them of your life change, to ensure you’re protected from gaps in your coverage. If you’ve been on your spouse’s health and dental insurance policy and they’ve removed you, start thinking about whether you want to purchase your own insurance.

Tackle joint financial obligations

One potential strategy is to use assets from the sale of a marital home to pay off jointly held debts like loans, mortgages and credit card balances. You could also consider dividing the joint debt fairly between both parties, opening new lending products for each and transferring the respective portions to the new ones, meaning you’re each responsible for paying off your half of the debt.

Consider spousal and child support

If you’re receiving or paying child or spousal support, you must account for that in your divorce budgeting. As the one paying, this is a fixed, mandatory expense that will cut into your monthly spending. As the recipient, you’ll get money you can count on, but it may not last forever. Ensure that the amounts and payment schedules for all support are clearly outlined in your legal agreement.

How to start your financial recovery after divorce

Once you’ve navigated the divorce process, you can start to focus on your future. Seize this opportunity to take complete control of your finances so you can confidently start your new chapter.

Calculate your net worth

Take inventory of assets. Gather your latest statements for bank accounts, investments, RRSPs, real estate and pension plans. Also, ensure you have a solid understanding of all the debts in your name. Knowing your exact net worth is necessary to building a strong financial future.

Set financial goals

Are you hoping to pay off debt, save for a new home, or build up your retirement savings? Setting clear financial goals will inspire you to achieve them. If that feels overwhelming, you can break your goals down into smaller milestones (I’d like to add $8,000 to my savings by the end of the year, for example). Don’t forget to celebrate your wins, big or small—it will keep you motivated.

Build a post-divorce budget

You’ve gone from having two incomes to one, and from sharing expenses to covering them on your own. This is a big change. Take some time to get a clear understanding of your spending habits.

| Track everything | Track every dollar spent for at least a month (using an app or spreadsheet) to clarify spending. |

| Identify new costs | Note new or increased costs you now cover alone (e.g., subscriptions, rent/mortgage). |

| Separate essentials from non-essentials | Identify essentials, such as housing, food, transportation, support payments. Reduce non-essential spending until you adjust to your new financial reality. |

| Keep saving | Any money remaining after costs are covered could be used to build an emergency fund and invest for your future. |

Check your credit score

You may not realize it, but divorce and credit scores can be connected. If you aren’t managing the accounts that are still linked to your name, or if you or your spouse didn’t make timely payments on joint debts, your score may be affected. That’s why it’s important to verify the health of your personal credit score when you’re starting on your own financially. If you haven’t checked your score in a while and find yourself with a lower rating than anticipated, there are ways to improve your credit scenario. You can check your credit score directly in your mobile app if you’re an RBC client.

To build and keep a healthy credit score, always make payments on time and aim to keep your credit card balances low. Although it may seem counterintuitive, responsibly using more of your credit may help you achieve higher gains on your overall score. Make a note to review your credit score regularly to ensure its accuracy. Improving your credit score won’t happen overnight, but adopting good financial habits will help set you up for the long term.

Review and modify your retirement savings

Going from two incomes to one may affect your ability to save for retirement. A financial professional can help you revise your savings strategy to reflect your priorities and new, single-income reality.

Set up a network of support

If building budgets and financial plans isn’t your thing, that’s okay. This is a stressful time, and it’s reasonable to ask for help when you need it. Consider building a network of professionals and friends who can offer expertise and support to help you through this transition.

Seek professional financial guidance

Not everyone has time to build a budget and manage the intricacies of finances. If that’s you, consider booking an appointment with a financial professional for guidance to help with your financial recovery after divorce. Consulting a tax professional (like an accountant) can also help shed light on tax implications and what you’ll need come tax filing time.

Consult a legal or mediation expert

Even if you have an amicable separation, you’ll need to formalize your divorce via a legal professional (a separation does not have to be legalized, while a separation agreement does). A lawyer specializing in family law can advise on asset division and child and spousal support. If you’re looking for something a little less formal, a mediator will help guide you to an agreement without needing court involvement.

Consider emotional support

It might sound obvious, but it’s worth recognizing that divorce is a life-changing process that can take a huge toll on your emotional wellbeing. Find a trusted therapist or counsellor so you have a safe space to discuss your feelings and talk candidly about how the process is going for you. Your support network can go beyond paid professionals, too. Find out if anyone in your area hosts a divorce support group so you can connect with people in a similar life stage. And don’t forget to make plans with friends and family – it’s important to carve out some time for fun!

FAQs

Divorce can raise many questions, from dividing assets to filing taxes. Here are answers to a few you may be asking.

Generally, the net value of assets acquired during the marriage is divided equally. This involves calculating each person’s net worth from the date of marriage to the date of separation. The spouse with the larger share makes equalization payments (spousal support) to the other. Assets brought into the marriage or inherited are typically excluded, but any increase in their value during the marriage is usually divided.

While this principle generally applies across Canada, there may be regional differences because each province has its own family law legislation. For example, provincial laws define common-law relationships differently. You may want to consult a lawyer to help you navigate these differences.

Divorce can have significant tax implications. For example, in Canada, child support received is not taxable; however, spousal support is taxable. Remember this as you negotiate your settlement and set aside money to cover any future taxes owing if you do receive spousal support.

Determining how to manage joint debts such as loans, mortgages, and credit card balances is essential. One option is to use assets from the sale of the marital home to pay off jointly held debts. Another option is to divide the joint debt fairly between the parties, opening new lending products for each and transferring the respective portions to the new ones.

No. Canadian tax rules don’t even allow married or common-law spouses to file joint tax returns. However, you must alert the CRA of your change in marital status by the end of the following month after your status changed. Alerting the CRA to your new marital status allows them to accurately calculate any benefits or credits, which will now be based on a single income rather than family income.

While divorce itself won’t directly impact your scores, the process can leave both parties financially drained and unfamiliar with navigating their new financial reality. Missed debt or support payments may hurt your credit score. If this is the case, rebuild your credit score by making timely payments to your creditors, paying off credit card balances, and avoiding the use of new credit.

RBC Financial Specialists can offer advice on cash flow management, tax strategies, and new banking arrangements to support financial independence during a difficult life transition. Contact an RBC Advisor to Protect Your Finances.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.