TLDR

-

Planning your wedding is a big milestone, but it can also be expensive. Creating a wedding budget is crucial.

-

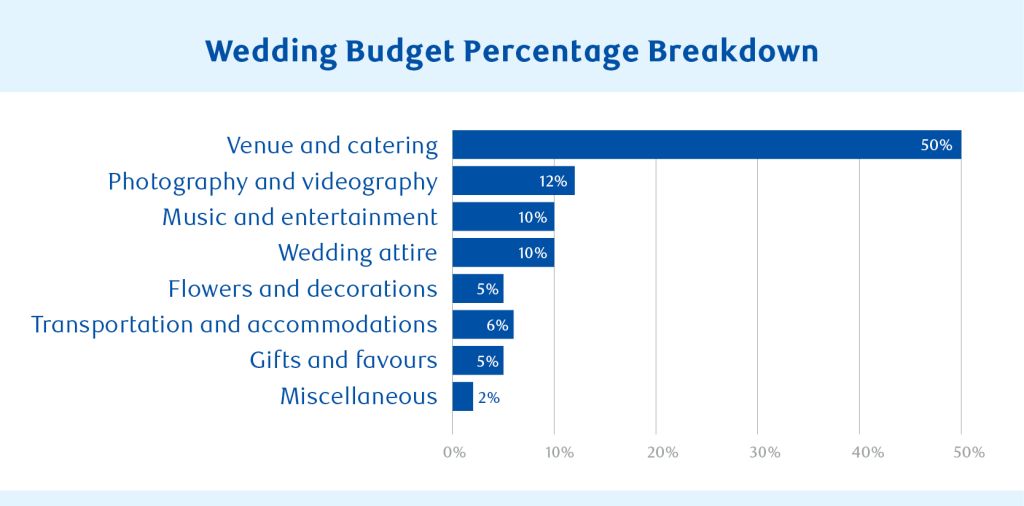

By categorizing your budget, you can focus on allocating more funds to big-ticket items (like the venue and catering) than to smaller expenses (like the cake and stationery).

-

Adjusting each spending category by preference will keep you on track and pinpoint areas to save money on your dream wedding.

-

To prevent wedding debt, prioritize saving early and set realistic expectations for your budget. If you must borrow, carefully weigh your debt options and establish a clear repayment plan.

A wedding is a huge milestone that comes with plenty of excitement—and expenses. With the average wedding in Canada costing about $32,000 in 2025, it’s important for the newly betrothed to do some careful planning and budgeting to ensure they’re not saying “I do” to unmanageable costs.

Creating a budget for your wedding can help with your planning and to ensure that your wedding costs don’t catch you off guard. Read on for tips to help you keep your wedding costs in check.

How much does a wedding cost in Canada?

The average cost for a wedding in Canada sits between $30,000 and $40,000. This number can be upwards of 25 per cent higher if you live in a city with more expensive venue costs, like Toronto or Vancouver. Costs also depend on your vision for the big day, such as the number of guests, the type of ceremony and any special features (think waffle bar at midnight). To get a better understanding of how your budget will be spread out, consider this list of expenses, which reflects the average Canadian wedding:

| Venue and catering: 40%–60% |

| Photography and videography: 10%–15% |

| Music and entertainment: 8%–12% |

| Wedding attire: 8%–10% |

| Flowers and decorations: 5–8% |

| Transportation and accommodations: 5%–8% |

| Gifts and favours: 2.5% |

| Misc. such as invitations and cake: 5%–10% |

How to create a realistic wedding budget

Make creating a budget the first item on your wedding-planning checklist. Because every wedding – and every couple’s financial situation – is unique, your budget should reflect what matters most to you. Maybe you’re OK with a backyard wedding, for example, but want to spend big on the honeymoon or save for future life goals like buying a house. Building your wedding budget to fit your priorities will help you estimate how much money you’ll spend and determine what each expense category entails, and ways you can splurge and save. This ensures you’re prioritizing what’s most important without going into debt. Here’s how to do it:

Step 1: Review your current finances

To determine your wedding budget, first look at your finances. How much can you put aside for your big day? Are you planning to save a certain amount or pay as you go? Review your personal budget to get a sense of how much money you could put toward your wedding after you’ve covered your everyday expenses. Create a wedding budget that reflects your situation based on your current income, goals and financial obligations.

Remember that many of the components of wedding planning can be adjusted. You can find ways to save in some areas so you can splurge in others. Having a detailed budget tracked in a spreadsheet or finance app can help you stay nimble.

Step 2: Clarify who’s paying for the wedding

If you think your loved ones might chip in for your big day, it’s a good idea to talk with them early. Find out how much they plan to give and whether they’d like to pay for something specific, like the wedding dress or food. Once you know the details, you can confidently include these contributions in your budget and prevent any misunderstandings that could leave you footing an unexpected bill.

Step 3: Consider your guest count

This one is important, as the size of the guest list is the magic number that determines a large chunk of your wedding budget. Every additional guest means another meal to serve, another chair to rent, and often additional costs for invitations, favours, and bar service. When you speak to family about their potential contributions, it’s also a good time to ask if there are certain people that they feel should be included. Ultimately, it’s your special day, but these discussions will help iron out the final numbers early on.

With a large guest count, you’ll need a larger venue and a bigger budget for food and drinks. The average cost per guest can range from $75 to $100, and be as high as $200 for a plated formal dinner.

Reducing the number of guests is a good way to keep your costs manageable. If the budget doesn’t allow for a lot of extended family, you might consider hosting a casual (and less expensive) post-wedding brunch or picnic. If this is your plan, make sure to account for that cost as well.

Step 4: Calculate the costs of your wedding venue

The cost of your venue is likely to be one of your biggest budget lines. Venues and catering generally eat up about 40 to 50 per cent of the total cost. Larger and more premium venues will cost more than smaller venues with fewer amenities.

Think about the style of your wedding when you choose a venue. If you’re going for a formal affair, consider how much you’re willing to spend on a fancier (and likely more expensive) venue. A more casual wedding can be held somewhere informal, like a restaurant, legion hall or park. The location — be it city, small town or destination resort — will also affect venue costs. Getting quotes and exploring your options can help you narrow down your choices.

Step 5: Factor in seasonal costs

The time of year you get married will also be a big factor in your budget. Prices for things like wedding catering and flowers can be higher in the peak summer season, when venues and vendors may charge more due to demand.

Conversely, off-season winter dates could mean more savings due to lower demand. The in-between shoulder seasons in spring and fall could also offer discounts.

The day of the week matters, too, in that weekends will likely cost more than weekdays. If you don’t already have a specific season or day in mind, you could find some savings with an off-season or mid-week date.

Step 6: Think about your other financial goals

A wedding can be very special and worthy of your efforts and savings. But remember to consider longer-term financial goals as a married couple. Maybe you’d like to buy a house or save up for future kids. Retirement planning should always be part of the equation.

As you build your wedding budget, talk to your partner about whether specific expenses are worth slowing your progress on other life goals. Adjust your plan if the impact feels too significant.

Step 7: Don’t forget your honeymoon

Many couples opt to take a honeymoon straight after their wedding, but no rule says you have to. While not technically part of your event costs, a honeymoon is a typical wedding expense that could add thousands of dollars to your budget.

If you’re at your financial limit with the main event, consider taking your honeymoon once you’ve had more time to save. You could also explore inexpensive destinations or even play tourist in your own town with a staycation. Another option: use a honeymoon registry website to ask guests to contribute to your trip instead of other gifts.

Tips to set the right wedding budget

It can be easy to get swept up in the excitement and overspend on your big day. Consider these five steps to fine-tune a realistic wedding budget:

Determine your overall budget

-

Decide how much you can afford to spend without sacrificing your other financial goals.

-

Prioritize the most important components of your wedding and allocate your budget accordingly.

See where you can save

-

Examine each category — from wedding venue to catering to attire — and look for ways to save.

-

Make choices according to your priorities. Consider lower-cost options like an off-season date, a buffet rather than a sit-down meal, or perhaps a second-hand dress.

Research and compare prices

-

Get quotes from multiple venues and vendors to compare prices and packages.

-

Ask questions about how you can reduce costs.

-

Think about joining a local wedding group on social media to find vendors and reviews.

Consider DIY options

-

Identify things you can do yourself, like making wedding favours or decorations.

-

Consider inviting your wedding party to a crafting night to help.

Watch out for extra costs

-

Don’t forget to budget for costs like transportation, licenses and permits.

-

Regularly adjust your budget to stay on top of your spending.

Breaking down your wedding costs

What costs most at a wedding? That depends on your priorities. Here’s an example of an average Canadian wedding cost breakdown, including how much you might spend on each expense category:

Wedding venue — 30%

Your venue sets the vibe of your event, so you’ll want to choose carefully. A celebration in a park will look very different from a black-tie event in a hotel ballroom. What you want will dictate the amount you allocate, but generally, Canadian wedding venues make up about a third of the overall budget.

Wedding catering — 20%

A multi-course meal and an open bar aren’t cheap. A casual brunch or backyard barbecue will ring up much less than a formal sit-down meal with servers. Calculating the food expense also depends on the size of your guest list, as caterers typically charge per person. It’s good to anticipate that food and beverages will eat up about 20 percent of your budget.

Wedding attire — 10%

Unless it’s your “something borrowed,” your wedding dress will be part of your budget. What you pick is deeply personal; some brides may opt for couture, while others might feel happy picking something more casual. It’s common for men to wear a suit or tuxedo, and renting is a smart way to reduce attire costs. You’re likely to spend about 10 per cent of your budget on clothing and another two per cent on shoes and alterations.

Wedding photography — 12%

Once the cake is cut and the bouquet is thrown, the only lasting component of your wedding will be your videos and photographs. So, finding the right fit for documenting your special day is very important to many couples. It’s common for wedding photographers to offer a range of packages, with options like combined photo and video, and capturing the whole day or just the ceremony. You can count on this fee being about 12 per cent of your overall wedding budget, but rates can vary drastically depending on your needs and the photography style you prefer.

Wedding planning — 5%

Having an expert help coordinate details on your behalf can be a lifesaver, especially if you have a lot of logistics to work out (like organizing a destination or out-of-town event). A professional planner can also connect you with their network of vendors and advise on packages and potential savings. This service isn’t for everyone, so the five per cent could be allocated elsewhere. But if you’re worried about the stress of planning on your own, hiring a professional could be a worthwhile expense.

Wedding flowers — 5%

It’s incredible how much of a statement flowers can make. Couples often work with florists to choose everything from ornate arrangements to sweet and simple accents like boutonnieres. A good bouquet can look effortless, but flower arranging is an art, so hiring a professional to advise, produce and deliver can take up about five per cent of your overall wedding budget.

DJ and music — 10%

The ceremony is important, but guests might argue that a fun party is equally valued. For some couples, the best reception is one with a live DJ, lots of dancing and maybe even a choreographed moment or two. Expect to spend up to eight per cent of your budget on hiring a DJ, but this can change depending on where you live and the DJ’s level of experience. If a live band is more your style, you’ll likely spend more to cover the cost of multiple performers and transporting their equipment.

Hair and makeup — 2%

Hiring a professional to do your hair and makeup doesn’t just yield beautiful results; it provides some added relaxation and pampering on the morning of your big day. Typically, members of your wedding party will pay for their own services, so you would cover just your own and those of anyone else you choose, like your mom or mother-in-law. The cost of professional services often includes a pre-wedding trial, so you can decide what look is right for you. Rates will depend on the stylist’s experience and location.

Wedding ceremony — Less than 1%

In Canada, you need a licensed officiant to perform your ceremony. It doesn’t have to be a religious figure, and you can find someone on an officiant database or celebrant service online. Some people opt to have a licensed friend or family member officiate, which may cost you nothing. You’ll also need a marriage license to seal the deal.

Wedding cake — Less than 1%

The cost of your cake will depend on how fancy you want it to be and how many people you’re serving. Some couples opt for a small, symbolic cake for the cutting tradition and serve another type of dessert to their guests. On average, you can expect to spend less than one per cent of the budget on a wedding cake.

Wedding favours, stationery, rentals and other expenses — 5%

This category is a catchall for expenses like paper invites, guest favours, décor and lights. These things might seem small, but they can add up quickly. Reserving five per cent of your budget to cover these small items can make a big difference to your overall planning experience.

Wedding budget mistakes to avoid

There are a few common financial mistakes that couples make when creating their wedding budget. While every couple’s financial situation is different, understanding your potential pitfalls can help you avoid adding stress to your special day. Use these tips to help avoid the four most common wedding budget mistakes:

1. Not discussing your wedding priorities

Communication with your partner is key. It’s important to talk early and often about what you want to prioritize for your wedding. You may be on the same page, or you may have different ideas of where to spend and where to save. Finding compromises and ensuring you each have a say in your celebration will keep you in the black and help make the day a great collaboration.

2. Not tracking your spending

Between vendor deposits and wedding-related purchases like an engagement or bachelorette party, there are a lot of costs that add up before the actual wedding day. Start keeping tabs on your spending from day one so you can easily identify and curb overspending.

3. Misallocating or under-allocating your budget

Wedding costs can range widely, and you may start planning with a certain idea of what your wedding will be like. Ask for quotes to create an accurate budget, including high and low estimates. This will help you get a better sense of potential costs and root yourself back in reality. If a three-course meal is more affordable than five courses, maybe you’re living in a three-course kind of world. It’s better to temper expectations now and trust that whatever you pick will ultimately be great on the big day.

4. Not weighing your options

Fetching quotes and weighing your options can feel like a lot of work, but investigating ways to save can really pay off. Shop around for different vendors, venues and caterers, and keep an open mind about changing course if your budget can’t accommodate your first choices. Think about your priorities to help yourself decide what compromises to make.

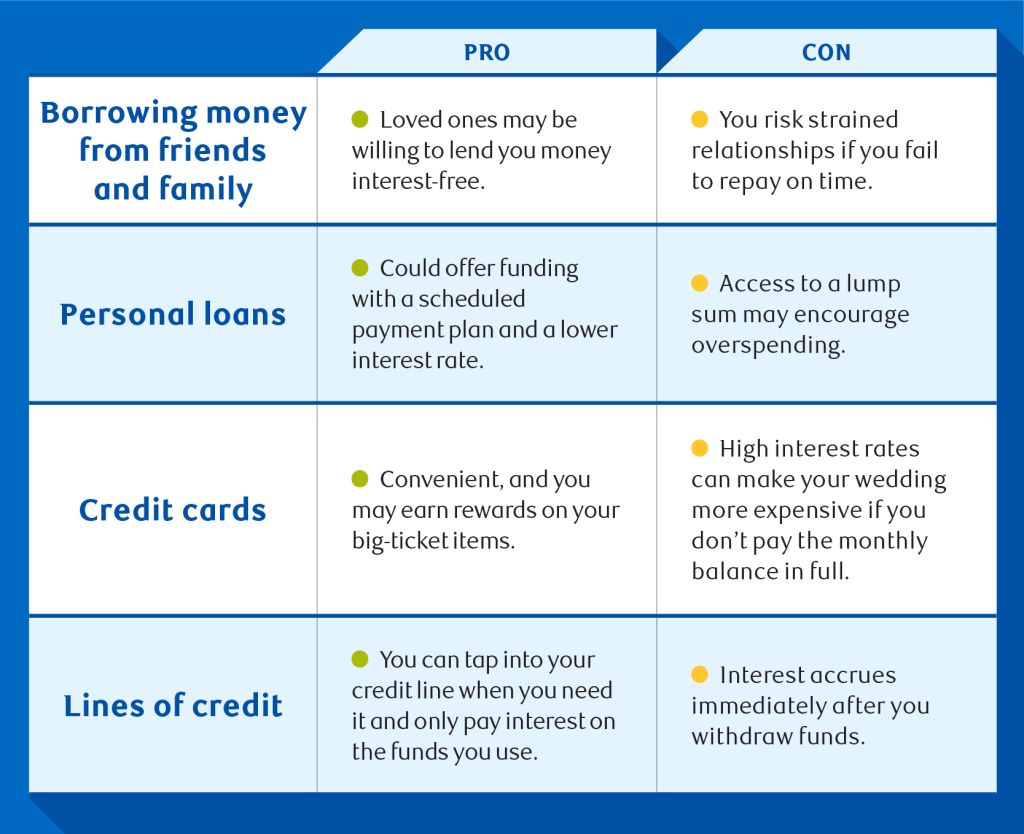

Navigating wedding debt

When the celebration is over, many newlyweds find themselves facing some wedding debt. In fact, 31 percent of couples say that they took on debt to pay for their celebration, either with credit cards or loans. Before going into debt to finance your special day, ask yourself the following questions:

-

Is this expense necessary? Remember your priorities when making the budget.

-

Can I afford the payments? If you’re incurring wedding debt, make sure you’re not exceeding your household budget to repay it.

-

Are there alternatives? Take a minute and think about other solutions, like cutting back on certain expenses or asking your family for financial help.

Tips for a debt-free wedding

| Save in advance | If you know a wedding is in your future, start saving as early as possible. Many couples consider longer engagements to give themselves time to get wedding funds together. |

| Set realistic expectations | Do your research to find out how much things cost. |

| Communicate with your partner | Discussfinancial goals and expectations regularly so you both stay on the same page. |

| Seek professional advice | Consulting a financial advisor will get you personalized guidance on managing your wedding costs.[1] Chart |

Weigh your debt options

Before saying “I do” to wedding debt, discuss these three things with your partner:

1. The household budget

Work out a budget that includes both of your incomes, joint expenses and other debts like credit cards or student loans.

2. A wedding debt timeline

Using your household budget, determine how much of a wedding budget you can afford to pay monthly and how long it will take you to pay off the balance.

3. Your borrowing options

All debt isn’t created equally. If you’re considering borrowing to cover wedding costs, it’s important to strategize and determine what’s best for you:

Borrowing money from friends and family

Pro: Loved ones may be willing to lend you money interest-free.

Con: You risk strained relationships if you fail to repay on time.

Credit cards

Pro: Convenient, and you may earn rewards on your big-ticket items.

Con: High interest rates can make your wedding more expensive if you don’t pay the monthly balance in full.

Explore our best credit card offers > Apply for an RBC credit card

Personal loans

Pro: Could offer funding with a scheduled payment plan and a lower interest rate.

Con: Access to a lump sum may encourage overspending.

Learn more about our personal loans and lines of credit.

Lines of credit

Pro: You can tap into your credit line when you need it and only pay interest on the funds you use.

Con: Interest accrues immediately after you withdraw funds.

Use our loan calculators to estimate your wedding budget affordability.

By creating a rock-solid wedding budget and carefully managing your debt options, you and your partner will not only plan a beautiful (and fiscally responsible) wedding day, but you’ll also establish smart financial habits that will serve you well throughout your married life.

Still have questions about your wedding budget?

We can help! Talk to an RBC Financial Advisor to assess your finances so you can plan a dream wedding within budget.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.