There are many ways to borrow money. Learn how to match your goals with the loans and lines of credit that are right for you.

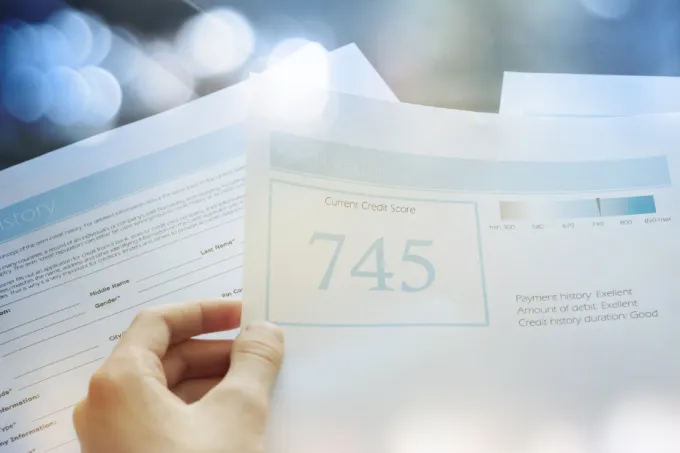

From approvals to interest rates. It's important to understand the significant role your credit score plays when borrowing money.

Understand how credit works in Canada to help you build your financial future.

Helpful strategies for paying down your debt, no matter what your financial situation is.

Understanding the different types of borrowing options can help you determine if one is right for you.

More From Understanding Loans

Buy Now, Pay Later (BNPL) is a popular payment option if you’re looking to spread out the cost of your purchases. Learn how it works, the risks and…

Learn how to get the most out of your line of credit.

A line of credit can be a powerful financial tool, if used properly.

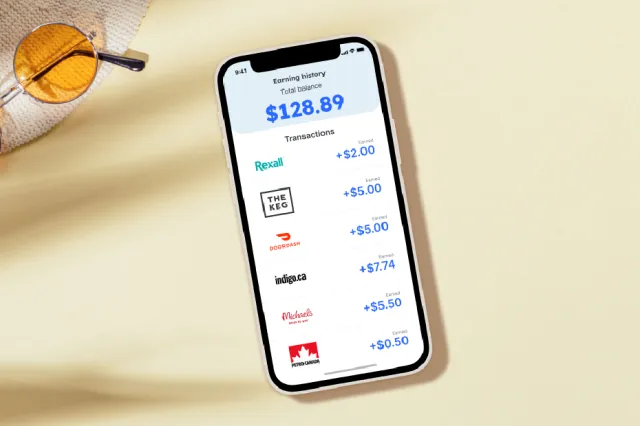

4 ways getting cash back could help you as a student.

A glossary of commonly used for mortgages (and applications) to help you find one that fits your needs and lifestyle.

Skipping a mortgage payment can offer immediate financial relief. But is it the right move for you? RBC Advisors share the pros and cons.