Published February 4, 2022 • 3 Min Read

This article was originally published in RBC Thought Leadership magazine.

Coming off a banner year for sales and prices in 2021, Canada’s housing market is expected to cool slightly but remain strong overall in the year ahead, according to a new report from RBC Economics.

The report forecasts that 579,600 existing Canadian homes will change hands in 2022, down from 667,000 last year. While that’s a 13.1 per cent drop, the report points out it’s still the second-highest number in history.

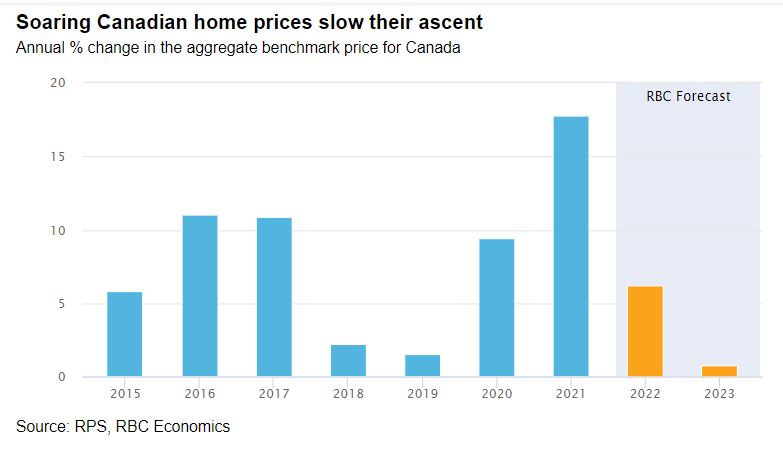

This year, Canada’s benchmark home price is expected to rise 6.2 per cent, which is just shy of one-third of last year’s record rate of 17.8 per cent, the report says.

“Plenty of unmet demand remains and will continue to fuel tremendous activity across the country. Still, we expect the Bank of Canada’s rate liftoff to turn down the market’s heat in 2022 as deteriorating affordability sends buyers to the sidelines,” it notes.

The new report dives deep into factors that will push and pull market prices over the coming months. Notable findings include:

-

An ongoing construction boom that will ease supply issues and reduce upward pressure on prices. In spite of construction delays, builders are expected to push completions in 2022 to nearly 250,000 units

-

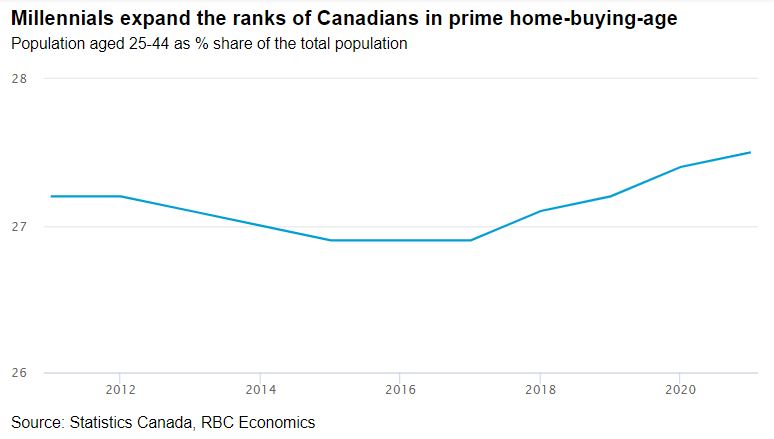

Demographics will play a crucial role, with Millennials continuing to fuel significant activity in the market, especially around family-suitable homes. In 2021, there were 10.5 million Millennials (people age 25 to 44) in Canada, an increase of 800,000 over the past five years. They are expected to remain the biggest source of first-time home buyers and increase significantly as a source of move-up buyers

-

More expensive markets such as Toronto, Vancouver and Victoria will be affected the most by rising interest rates because of mortgage sizes and their carrying costs

-

Foreign buyers and flippers beware. ‘Speculators,’ who accounted for more than 20 per cent of purchases last year, will soon face new restrictions. The federal government is looking to ban foreign buyers from purchasing non-recreational properties for two years; tighten down payment requirements for investment properties; tax gains on flipping properties; and curb excessive profits on investment properties. The spring federal budget will likely flesh these measures out more

-

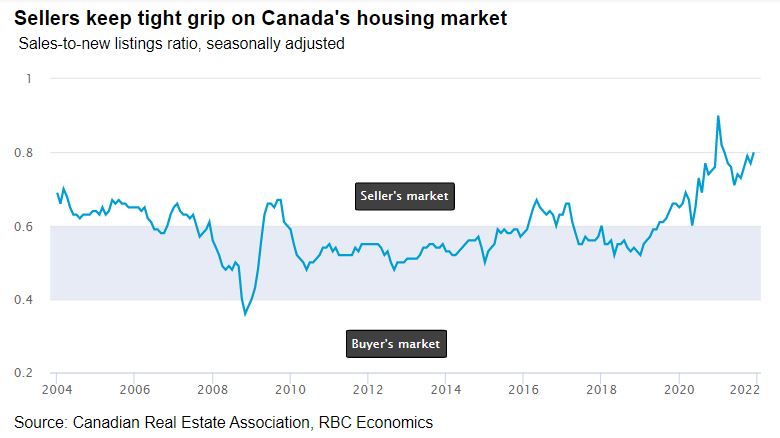

More bidding wars are expected in Toronto and Vancouver markets throughout the year, with all-time low inventories in provincial housing markets accounting for 80 percent of activity across the country at the end of 2021—with only the Prairies, and Newfoundland Labrador seeing slightly less of a listing shortage. Sellers are expected to maintain the upper hand

Related story:

Go in depth on Canada’s 2022 housing outlook at The fever breaks: Canada’s housing market will cool but stay strong in 2022

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article