Published April 7, 2025 • 7 Min Read

TLDR

-

There are a few key differences between saving and investing—including purpose, risk, access to money and potential returns.

-

How you prioritize saving and investing depends on your personal goals and financial situation.

-

Diversifying your money can help you reach your financial goals while reducing risk.

-

There’s no one-size-fits-all approach to saving and investing, but some time-tested strategies can help guide your financial decisions.

When the economic environment is uncertain and markets are shifting, it’s natural for investors to feel uneasy. In times like these, security and stability often become top priorities. And that makes perfect sense. But what does financial security look like today—when interest rates are low and the stock market is volatile? Does it mean stashing money under the mattress (or in low-risk savings accounts) until the storm passes? Or is it turning to investments with the potential for long-term growth?

Understanding the differences between saving and investing—and knowing when to prioritize each—can help you make informed decisions that align with your financial goals.

What’s the difference between saving and investing?

While both involve putting money away for future use, they serve different purposes.

Saving involves setting aside money, typically in a savings account. The main goal is to keep your money in a secure account that’s easy to access for short-term needs and emergencies, such as an upcoming vacation or unexpected home repairs. Savings accounts earn modest returns and come with low risk.

Investing, on the other hand, is often focused on medium- to long-term goals. You use your money to buy assets like stocks, bonds, mutual funds or exchange-traded funds (ETFs). You can also invest in registered accounts, such as a Registered Retirement Savings Plan (RRSP) or Tax-Free Savings Account (TFSA), which offer distinct tax advantages. Investments generally offer a better return than savings and have greater opportunities for growth. The level of risk depends on the assets you choose, but generally, high risks lead to higher potential returns. You can choose how you want to invest: on your own, with an advisor or with an automated system.

Advantages of saving

- Stability: Your balance reflects simply your deposits and withdrawals, plus the modest interest accrued.

- Liquidity: Funds are readily available in an emergency.

- Peace of mind: You don’t need to worry about market ups and downs.

- Predictability: You know what to expect—no surprises, just steady growth.

Advantages of investing

- Growth potential: Your money has the opportunity to outpace inflation and increase over time.

- Compound interest: You earn returns on both your original investment and the gains it generates.

- Wealth creation: Long-term investing helps build financial security for the future.

Should I prioritize saving or investing?

The choice to save versus invest depends on your financial situation and goals.

Prioritize saving if:

- You don’t yet have an emergency fund.

- You’ll need the money in the next one to two years.

- You need certainty that your money will be there, untouched by market fluctuations.

Prioritize investing when:

- You have a comfortable base of savings to cover short-term needs.

- You’re looking to grow your wealth over time.

- You have long-term goals that could benefit from market growth.

It’s also important to factor in today’s economic environment. With interest rates remaining low, savings may not keep up with inflation. Over time, parking all your money in a savings account could erode your purchasing power and affect your ability to meet long-term goals.

How much should you save vs. invest?

No answer is right for everyone. A general guideline is this: Save for short-term needs and emergencies. Invest for medium- to long-term growth.

Most financial experts recommend building an emergency fund that covers three to six months of essential expenses. These savings offer a solid foundation and peace of mind. An emergency fund is for planned and unplanned expenses outside of your usual budget in the next one to two years.

Beyond that, any additional funds can be invested. This strategy brings the benefits of compound growth and helps you stay on track for longer-term goals.

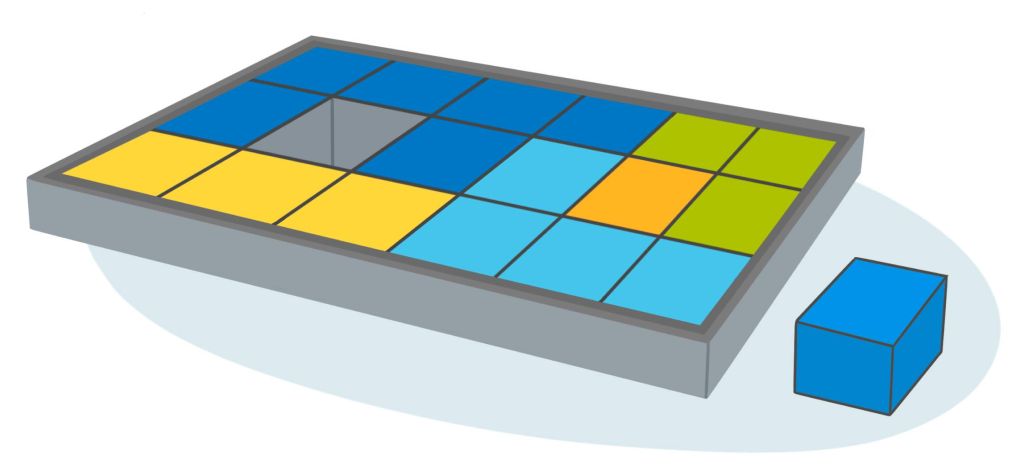

The diversity advantage

When your money is diversified, you hold a range of asset classes—such as cash, stocks and fixed income investments. In any economy, diversification can reduce risk and give your money the opportunity to grow. It keeps your portfolio balanced and helps potentially ease the inevitable ups and downs of the market and economy. Because asset classes perform differently due to market factors at any given time, when one is underperforming, another investment could be doing better to offset the declines.

So, if you’re wondering whether to save or invest your money right now, the easy answer is: If you can, do both. Having your money in a combination of savings accounts, fixed-income investments—such as bonds and guaranteed investment certificates (GICs)—and equities such as stocks provides much-needed balance.

Your personal savings goals and other factors will determine your unique blend of asset classes (also known as your asset mix). These factors include your time horizon (how long you plan to own the investment) and your comfort with volatility (the ups and downs of the market).

Why diversify?

- Cash savings and cash-equivalent investments can provide a base for your portfolio and easy access to cash on short notice. But returns may not keep up with inflation. If you leave too much money sitting in cash, you may lose purchasing power over time and miss out on compound growth.

- Fixed-income investments can generate interest and can provide potential returns to your portfolio.

- Equity investments may be more volatile, but they have high potential for long-term growth.

Deciding how to divide your money between saving and investing doesn’t have to be all or nothing. Start with a solid savings foundation, then gradually invest the rest based on your goals and time horizon. In today’s market, balancing both strategies—with a focus on diversification—can help you stay grounded, confident and financially prepared for whatever comes next.

Book an appointment today through MyAdvisor or RBC Online Banking to arrange a conversation with an advisor who can help you clarify your goals and define the right approach for you.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Financial planning services and investment advice are provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

Share This Article