What Matters Now

What’s On Your Mind?

Latest Articles

How can you spot the clues that a website is a fake? Learn the common traits of a copycat website and simple steps to take before you click.

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

Manufactured homes offer a range of benefits for Canadians. Discover what makes them so appealing – and how they could help more buyers access…

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Bank of Canada Interest Rate Explained and How It Shapes Your Mortgage

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

-

How do airport lounge passes work with credit cards?

With the right credit card, you could relax in a lounge before your flight—for free

-

How AI is changing the nature of cybercrime

The scams that are popular today have been around for years. Artificial intelligence (AI) is making them more effective than ever.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (44.46%)

- Recognizing phishing attempts (9.35%)

- Keeping devices secure from hackers (20.16%)

- Staying up to date with security practices (0%)

Your essential guide to separating assets, updating accounts and financial planning after divorce.

Considering a consumer proposal or bankruptcy to deal with debt? Here are the main benefits — and challenges — to know for each one.

Discover why online scams surge during the holidays and learn what you can do to fend them off.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Edison Motors is paving the way for lower emission commercial vehicles in Canada by converting diesel engines into hybrids, reducing emissions on…

Planning a wedding is an exciting journey but can also be financially daunting without a well-thought-out budget. Learning how to set & manage…

A holding company, also known as a “Holdco,” is a company that doesn’t produce goods or services. Rather, it’s a place to hold assets such as…

Did You Know?

Over half of Canadians believe retiring comfortably is their most important investing goal

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Considering a consumer proposal or bankruptcy to deal with debt? Here are the main benefits — and challenges — to know for each one.

Consumer proposals are an alternative to declaring bankruptcy that may be worth considering. Here is how they work.

Debt can be an effective tool for managing and growing your business, but only when managed wisely. Discover the 6Rs of managing business debt.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

5 Myths about Your Credit Score

Canadians have a lot of misconceptions about how credit scores work, from how they’re calculated to what makes them go up or down. We debunk 5 common credit score myths so you can improve your financial health.

-

How to Maintain a Strong Credit Score During Challenging Times

While credit can act as a financial safety net during tight times, it’s important to maintain a strong credit score in the meantime. Here’s why – and how.

-

5 Tips to Help Keep Your Credit Score in Good Standing

Keeping a healthy credit score is about more than just watching what you spend. Follow these tips to help keep your score credit-worthy.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (44.46%)

- Recognizing phishing attempts (9.35%)

- Keeping devices secure from hackers (20.16%)

- Staying up to date with security practices (0%)

A consumer proposal can make it easier to manage debt to become debt-free, but it may take a toll on your credit score.

A consumer proposal is a less-known alternative to filing for personal bankruptcy. Here are answers to the top questions about consumer proposals.

Non-sufficient funds (NSF) fees can happen to anyone. Heres how to stay on top of your money, avoid fees and protect your credit score.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

Manufactured homes offer a range of benefits for Canadians. Discover what makes them so appealing – and how they could help more buyers access…

If you're shopping for gifts online this season, here are some guidelines for cyber-safe holiday browsing and buying.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Bank of Canada Interest Rate Explained and How It Shapes Your Mortgage

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

-

The Do’s and Don’ts of Online Shopping

If you're shopping for gifts online this season, here are some guidelines for cyber-safe holiday browsing and buying.

-

Why Manufactured Homes are Redefining Affordability, Comfort and Community Across Canada

Manufactured homes offer a range of benefits for Canadians. Discover what makes them so appealing – and how they could help more buyers access homeownership.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (44.46%)

- Recognizing phishing attempts (9.35%)

- Keeping devices secure from hackers (20.16%)

- Staying up to date with security practices (0%)

If you’re studying in the U.S., building a student credit history might not be the first thing on your mind. But it can make everyday life easier…

Buying Your First Home with FHSA and Lower Rates – My Money Matters

Ready for a winter escape? Here are 5 travel insurance considerations to review before you head south of the border.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

If you own a home, there's a good chance its value has increased over the last few years. By refinancing your home, you may be able to use that value…

Looking for the home of your dreams? Many homeowners think the first step is to start researching the market.

This is pretty big: graduating high school! It's a major accomplishment. Now, for the first time, you get to decide what your next steps will be.

Did You Know?

Over half of Canadians believe retiring comfortably is their most important investing goal

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Your essential guide to separating assets, updating accounts and financial planning after divorce.

New to Canada? Here is a simple guide to understanding credit score, why it matters and how to build your credit history from scratch, easily and…

Nearly half of young Canadians live with parents, learn how families can thrive together.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

What is a credit card cash advance rate — and how does it work?

If you're short on cash, a credit card cash advance can be a great option to afford a purchase. Here's your guide to all things cash advance rates and how they work.

-

How does credit card interest rate work

Credit cards can be a helpful financial tool but beware of interest charges. Here’s how credit card interest rates work.

-

Bringing Money to Canada and Sending Money Overseas as a Newcomer

Whether you’re bringing funds to Canada with you or sending money back to your loved ones, here’s how to transfer money securely.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (44.46%)

- Recognizing phishing attempts (9.35%)

- Keeping devices secure from hackers (20.16%)

- Staying up to date with security practices (0%)

Six smart money tips to budget, save and ensure a stress-free parental leave.

Parents can empower their kids to explore the digital world safely by using the right tools and setting healthy boundaries. Here’s how.

New to Canada? Learn how loyalty rewards credit cards work, why they matter, how they can help you earn rewards and build credit as you build your new…

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

If you own a home, there's a good chance its value has increased over the last few years. By refinancing your home, you may be able to use that value…

Looking for the home of your dreams? Many homeowners think the first step is to start researching the market.

This is pretty big: graduating high school! It's a major accomplishment. Now, for the first time, you get to decide what your next steps will be.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

How can you spot the clues that a website is a fake? Learn the common traits of a copycat website and simple steps to take before you click.

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

Discover why online scams surge during the holidays and learn what you can do to fend them off.

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Bank of Canada Interest Rate Explained and How It Shapes Your Mortgage

The Bank of Canada announcement: interest rates are holding steady. Learn how you could benefit from buying a pre-construction home

-

How do airport lounge passes work with credit cards?

With the right credit card, you could relax in a lounge before your flight—for free

-

How AI is changing the nature of cybercrime

The scams that are popular today have been around for years. Artificial intelligence (AI) is making them more effective than ever.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (44.46%)

- Recognizing phishing attempts (9.35%)

- Keeping devices secure from hackers (20.16%)

- Staying up to date with security practices (0%)

Learn everything you need to know before you increase your credit limit, including the pros and cons, and how to do it.

Follow RBC’s Cyber Security Checklist for Seniors to learn how to protect yourself, your family, and your digital assets from cyber crime.

Learn how CDIC (Canadian Deposit Insurance Corporation) works, what accounts it protects, how much it covers and how to maximize your coverage.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model.

Ideas & Voices

Here are five ideas to spark age-appropriate conversations with your kids about investing, without being met with the dreaded eye-roll.

Saving doesn't have to mean sacrifice. With a balance of spending and saving, you may maximize your money without minimizing your lifestyle.

Is there a difference between where you are financially, and where you want to be?Discover how to overcome and redefine your financial gap.

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FHSA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Debt can be an effective tool for managing and growing your business, but only when managed wisely. Discover the 6Rs of managing business debt.

No matter how long you’ve been in business, closing out 2025 efficiently helps you tie up loose ends, save time and hit the ground running in 2026….

The 2025 Federal Budget outlines new and expanding funding programs designed to help Canadian businesses spur growth and productivity, innovate and…

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

Learn How the Canada Small Business Financing Program Can Help Grow Your Business

The CSBF program helps business owners access financing to start and grow their businesses. Here are answers to the top questions about CSBF.

-

The 2025 Canadian Budget: An Essential Guide to Grants and Funding for Businesses

The 2025 Federal Budget outlines new and expanding funding programs designed to help Canadian businesses spur growth and productivity, innovate and stay competitive in a shifting global economy.

-

What is a Holdco? Unlock the Benefits of a Holding Company for Your Business

A holding company, also known as a “Holdco,” is a company that doesn’t produce goods or services. Rather, it’s a place to hold assets such as excess cash or shares of another company. A Holdco can offer many benefits for businesses – find out if it’s right for yours.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (44.46%)

- Recognizing phishing attempts (9.35%)

- Keeping devices secure from hackers (20.16%)

- Staying up to date with security practices (0%)

Actions for business owners to help prepare and protect your business from cyber threats.

The Government of Canada has recently unveiled funding strategies to help Canadian businesses affected by tariffs. Learn about the program details,…

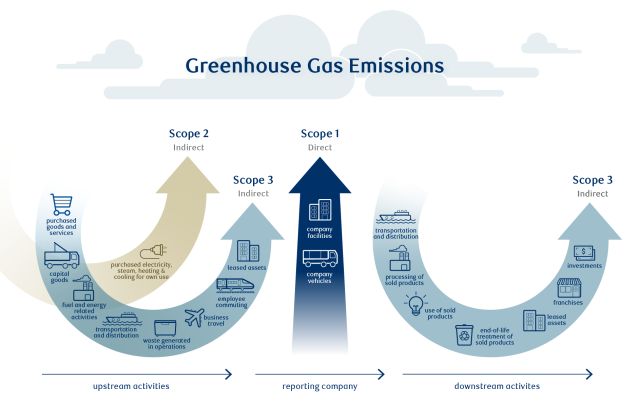

Learn how to categorize greenhouse gas emissions and develop a framework to reduce your environmental impact

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model

Ideas & Voices

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Building family wealth and leaving a legacy you’ll be proud of requires deliberate action across life’s different stages.

Here are 10 tips to help you save money, so you can make your financial goals a reality

A varied asset mix can help boost your portfolio during economic uncertainty

Did You Know?

44% of Canadians were not prepared for the impact of inflation

Source: RBC 2023 Financial Independence Poll

Most Popular

-

TFSA vs RRSP vs FHSA: Your Top Questions Answered

Canadians now have three major registered investments accounts to choose from. Here’s how to determine which ones best meet your needs.

-

What is the TFSA Contribution Limit for 2025?

Every year, the Canada Revenue Agency (CRA) declares the annual TFSA contribution limit, which is indexed to inflation and then rounded to the nearest $500. What else should you know? Read on.

-

When is the FHSA Contribution Deadline?

Mark the date on your calendar and find out how the First Home Savings Account can help you save for the future and on this year's taxes.

Which of the following Cyber Security issues do you struggle with the most?

- Remembering passwords (44.46%)

- Recognizing phishing attempts (9.35%)

- Keeping devices secure from hackers (20.16%)

- Staying up to date with security practices (0%)

This guide outlines the basics of investing in Canada to help you get comfortable before you invest

Here’s a quick rundown on mutual funds – how they work and why they’re popular.

Learn the differences between saving and investing and how to decide the best move for your money.

Did You Know?

67% of Canadians are concerned about their cash flow

Source: RBC 2023 Financial Independence Poll

Tools & Calculators

See How Much You Could Save in a Registered Retirement Savings Plan

Quickly See What Your Mortgage Payments Might Look Like

Estimate the cost to buy and own an electric vehicle in Canada, compared to a gas model

Ideas & Voices

Did You Know?

54% of Canadians are paying more attention to their day-to-day living expenses

Source: RBC 2023 Financial Independence Poll

Additional Resources

First Home Savings Account (FSHA)

Save for your first home, tax-free

A simple way to manage your day to day spending

Stay connected to your money and get help reaching your goals

Money Academy

Learn the basics about budgeting, investing & borrowing, and how interest rates and inflation impact your bottom line.