TLDR

-

Diversification involves investing across a variety of industries and asset types, such as stocks, bonds and cash.

-

It can provide a measure of financial stability in today’s shifting economy and unpredictable market.

-

Having a range of holdings can reduce risk and help stabilize returns over time.

In today’s shifting economy, diversifying your investment portfolio is more important than ever. Consider it a hedge against inflation and volatile markets. With a strategy of investing in a variety of asset types, regions, companies and sectors, you can help reduce risk.

What is investment diversification?

A diversified portfolio contains a selection of different kinds of investments. Diversifying across a variety of asset types, such as stocks, bonds and GICs, as well as industries, geographic regions, and stock market value, can help keep your investments on an even keel by reducing risk when the economy is uncertain.

What’s a simple way to understand diversification?

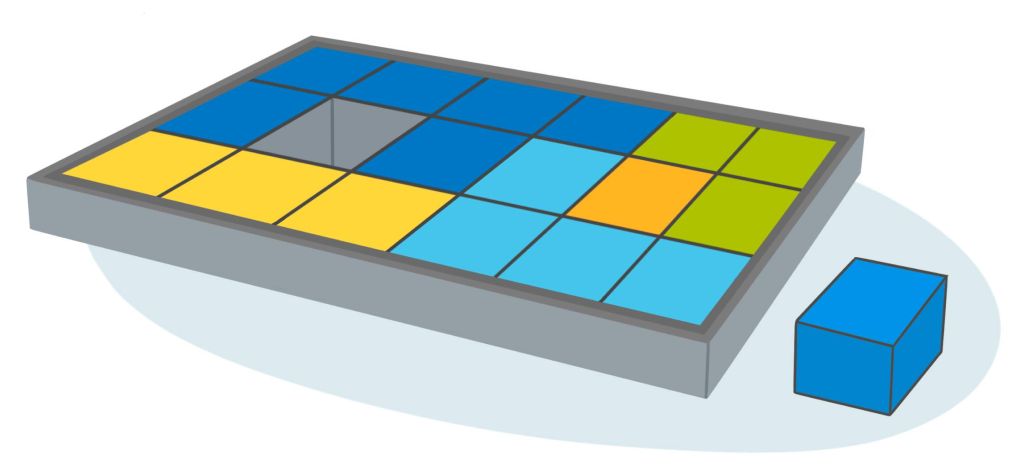

Think of your portfolio as a pie, with slices that represent the various asset types you own. The size of these slices often varies depending on your investment investment objectives, time horizon and risk tolerance, but together they make up the whole.

How does diversification work in a portfolio?

Investments rise and fall in value all the time. At any given moment, some assets are going up when others are going down. In a diversified portfolio mix, the assets on an upswing or holding steady can balance those on their way down.

Why is diversification important for my investments?

In today’s uncertain — and, at times, volatile — economic landscape, fluctuations in the market can become less predictable and more frequent. The value of your investments will rise and fall, but if you have a portfolio of investments that respond differently to fluctuations, you’ll be better prepared to ride out the ups and downs.

How does investment diversification manage risk?

Having a balanced portfolio can help to reduce overall risk in your portfolio and stabilize your returns over time. Some of your investments may carry higher risk but offer higher returns. Others might offer a lower return but preserve more of the principal. By taking both of these approaches, your portfolio can manage risks more effectively.

How can I avoid common misconceptions about diversifying?

Myths about how diversification works can lead to poor investment decisions. Steer clear of the most common misconceptions by keeping these rebuttals in mind:

-

Diversification does not eliminate all risk. But it does help guard against market crashes and economic downturns.

-

Owning stocks in a lot of different companies doesn’t mean you’re diversified — especially if they are in the same industry, region or asset class.

-

Diversification doesn’t guarantee performance. It’s a way to manage risk.

-

Balancing your portfolio is important no matter how big it is — even when you’re just starting to invest.

How do I diversify my investment portfolio?

The best way to diversify your portfolio is to invest in a variety of different asset classes. These include cash, fixed income and equities (or stocks). Your asset mix will depend on your investment objective and other factors, such as time horizon and comfort with volatility. Make an appointment to meet with an RBC advisor to help you tailor a strategy that fits your needs and goals.

What are the main ways to diversify my investments?

Diversification means not only having a variety of asset classes but taking into account various economic sectors and industries, company size and geographic location, and other factors:

Asset classes

-

Cash and cash equivalent investments can provide you with a stable base for your portfolio and easy access to cash to tap into on short notice. One potential drawback is that returns may not keep up with inflation.

-

Fixed-income investments generate cash flow and can provide some stability to your portfolio. However, they can be sensitive to movements in interest rates. Explore and learn more in What Are Fixed-Income Securities?

-

Equity, or stock, investments provide the greatest potential for long-term growth along with a higher degree of risk. Explore and learn more in Stocks: Understanding the Risk-Return Relationship.

Sectors

Economic sectors — such as retail, manufacturing and technology — perform differently from each other. Investing across different sectors helps balance the risk of a downturn in a particular sector.

Geography

The same can be said for different parts of the world. The economies of Asia, Europe and North America experience ups and downs at different times. This affects the performance of companies in those regions. Diversifying your geographic reach with a mix of domestic and international stocks is a great way to balance your portfolio because your investments aren’t concentrated in any one country or region. This also gives you access to opportunities not available in Canada and North America.

Market Capitalization

Diversify your portfolio by including companies of varying sizes. Stocks are categorized by the level of their capitalization. Large-cap stocks are typically more stable and established. Small-cap companies often deliver higher rewards but are more volatile. And mid-cap stocks offer a balance between stability and growth potential, depending on market conditions and other factors.

More ways to diversify

-

Keep an eye on the number and concentration of your holdings. A larger, more diverse number of investments with less concentration in any one holding can reduce your risk exposure.

-

Some alternative investments don’t tend to fluctuate in the same way or at the same time as other sectors. Examples of this are precious metals and real estate investment trusts, or REITs.

How can RBC help me build a diversified portfolio?

Diversification is an excellent strategy to help keep your portfolio balanced and to help shield you from the ups and downs of today’s volatile market. Here’s how we can help:

-

With our Direct Investing online trading platform, you can trade and invest in markets in Canada and around the world. Place trades on your investments, track stock prices in real time, check your portfolio diversification and more.

-

Investease is RBC’s low-cost, online investment service that combines smart technology and personalized advice to manage your investment portfolio for you.

-

RBC’s investment advisors can help you create a diversified portfolio strategy tailored to your investing goals. Make an appointment to meet with one of our advisors to learn more.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.