Published February 28, 2022 • 2 Min Read

This article was originally published in RBC Direct Investing’s Inspired Investor magazine.

It’s no secret that markets don’t like uncertainty. It’s also no secret that markets have been facing a lot of it lately as a result of the pandemic, inflation fears and more recently, Russia’s attack on Ukraine.

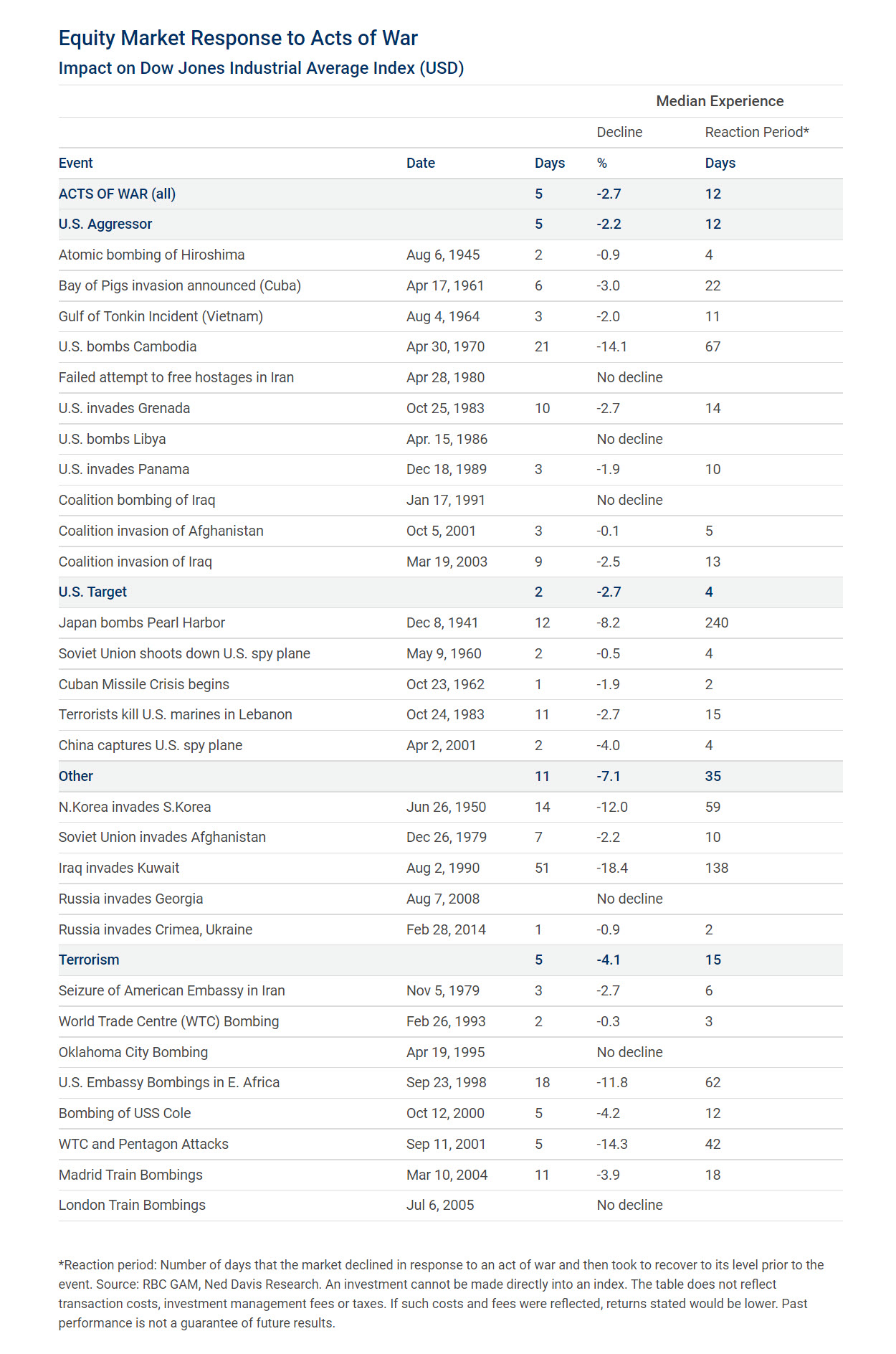

While there’s no way to accurately predict how long uncertainties will persist or how markets will react in the future, it can be helpful to take a look back to gauge how markets have responded to major events in the past. With the help of RBC Global Asset Management (RBC GAM), here we’ll focus on equity market reactions to acts of war and terrorism.

In a recently released commentary, RBC GAM noted that acts of war rarely have large or lasting impacts on markets, though periods of heightened uncertainty are common. The following chart looks at how U.S. equity markets have reacted historically.

RBC GAM highlights a few specifics to take note of:

-

Market declines tend to be short, lasting 5-11 days on average, depending on the situation

-

The actual change in the market is relatively benign, and often more muted than what investors might believe

Again, while past reactions don’t determine what will happen in the future, they can provide some context to help us boost our resiliency as investors when markets are volatile.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article