Published May 8, 2024 • 4 Min Read

In collaboration with RBC

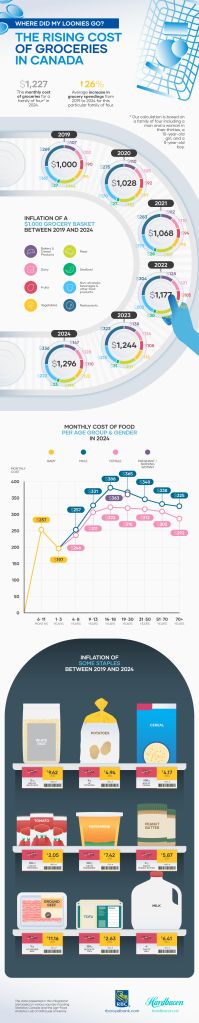

There was a time when a filling a grocery cart was quick and painless. Today, it can feel like a one-two punch. Over the last five years, rising prices of staples like potatoes (+36%) and ground beef (+27%) caused many Canadians to change their shopping habits. And despite the changes, Canadians still face substantially higher food costs.

Here’s how food inflation is impacting Canadian families.

Infographic: The Rising Cost of Groceries in Canada

Families are paying the price

Take a look at a family of four: A couple with a 5-year-old boy and a 10-year-old girl. Over the last five years, their food expenses jumped 26%, according to data from the Agri-Food Analytics Lab at Dalhousie University. In 2019, they spent an average of $974 per month on food. Fast forward to 2024, and the average monthly spend now tips the scales at $1,227.

Since Canadians have adapted their spending habits, this scenario doesn’t capture the full impact of food inflation. To give you a more accurate idea, a $1,000 grocery basket in 2019 increased to $1296 in 2024 – a 29.6% hike.

Inflation of family favourites

Food inflation has been a problem for Canadians for some time.

| 2020 | 2021 | 2022 | 2023 | 2024 (prediction) | |

| Bakery and cereal products | 2.20% | 1.70% | 14.80% | 8.00% | 6.00% |

| Dairy | 3.10% | 5.10% | 9.70% | 4.00% | 2.00% |

| Fruits | 1.80% | 2.50% | 11.40% | 3.00% | 2.00% |

| Vegetables | 2.40% | -2.10% | 12.70% | 7.60% | 6.00% |

| Meat | 6.10% | 9.50% | 7.60% | 4.40% | 6.00% |

| Seafood | 2.60% | 2.50% | 7.60% | 4.30% | 4.00% |

| Non-alcoholic beverages and other food products | 1.80% | 5.30% | 12.80% | 6.70% | 3.00% |

| Restaurant | 2.10% | 3.10% | 7.50% | 6.10% | 4.00% |

Source: Annual food price reports from the Agri-Food Analytics Lab at Dalhousie University

Food expenses increased by more than 30% in three of the eight categories: bakery and cereals, meat, beverages and other food products. But all categories increased by at least 20%.

Given a grocery budget of $1,000 per month in 2019, the average household would have spent $144 on meat. Now they would spend $199 on meat. And for people who like takeout or dining at restaurants, costs have increased from $269 to $336 per month.

Other products have seen significant price increases. Ground beef increased from $8.88/ kg to $11.16. Non-meat eaters haven’t fared much better. The price of tofu (350 g) increased 16%. Canned tomatoes, a popular pantry staple, increased 54%. Should margarine be considered a luxury product? Perhaps, given its dramatic 71% price increase over the last five years.

Shrinkflation: Why you don’t always realize you’re paying more

Many companies adopted shrinkflation: Reducing the size of packaging to increase profit margins in the face of increasing costs. The problem is so pervasive that CBC recently covered the topic.

Do you like to bake? Buyer beware that Redpath sugar shrunk from 2 kg to 1.5 kg, a 25% cut. The 80 g Doritos bag is now 72 g, and Dawn soap went from 479 ml to 431 ml, staying at the same price. Pantry products, like snacks and frozen foods, are the most common shrinkflation offenders.

What is the monthly cost to feed your family?

Because nutritional needs vary across gender and age, the cost of food varies. The most expensive family members to feed are pregnant and breastfeeding women and teenagers between 14 and 18. Their monthly food expenses, in 2024, rings in at $363 and $388 per month respectively. Toddlers cost less, with an average of $197 monthly. Based on this research, Canadians can expect their grocery bill to be 26% to 30.25% higher today than it was in 2019.

Strategies for saving

Faced with food inflation, there are few choices: change brands or stores, or hunt for discounts. To adapt, Canadians are moving away from traditional grocery stores in favour of big box stores.

In fact, the share of sales at big box stores increased from 21.6% at the start of 2021 to 25.9% at the end of 2022. Canadians also reduced the quantity of food purchased. According to the same study, 86% of Canadians have changed their consumption habits, with most of them now purchasing fewer items than before. Fresh produce is the most purchased discounted item, closely followed by meats. As a result, 29.8% of Canadians now choose their store based on relevant discounts.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article