Published March 9, 2023 • 6 Min Read

With files from RBC Global Asset Management

Net zero greenhouse gas emissions by 2050 – that’s the commitment the Canadian government has made. Sounds impressive, right? But what does it really mean? What exactly is “net zero” and why 2050? Is it achievable and what has to change to make it happen?

Let’s take a closer look at the concept and what it means for Canadian investors.

What does net-zero emissions mean?

The term “net-zero emissions” is about balancing the greenhouse gas (GHG) emissions we produce – like carbon dioxide and methane – and those we take out of the atmosphere. On the ground, it means one of two things:

-

Zero greenhouse gas emissions produced.

-

All emissions are “offset” with decarbonization, which includes things like planting trees or carbon-capture technology.

In order for Canada and the world to achieve a net-zero target, large-scale decarbonization is needed across all sectors, industries and geographies.

There are two elements of successful decarbonization: less carbon in, more carbon out. The first part of that equation is reducing the overall level of greenhouse gas emissions produced in the first place. This can be achieved through a range of strategies, including increasing energy efficiency and expanding the use of cleaner energy sources such as wind, solar, hydroelectric and geothermal. The second part of decarbonization involves offsetting the emissions that are produced. This is done mainly through tree planting and increasing our use of carbon-capture technologies that prevent greenhouse gases from entering the atmosphere.

We won’t get into the nuts and bolts of carbon-capture or clean-energy technologies here, but for investors, it can be valuable to understand net-zero goals, the reasons behind them and how different regions, industries and individual companies are approaching the issue.

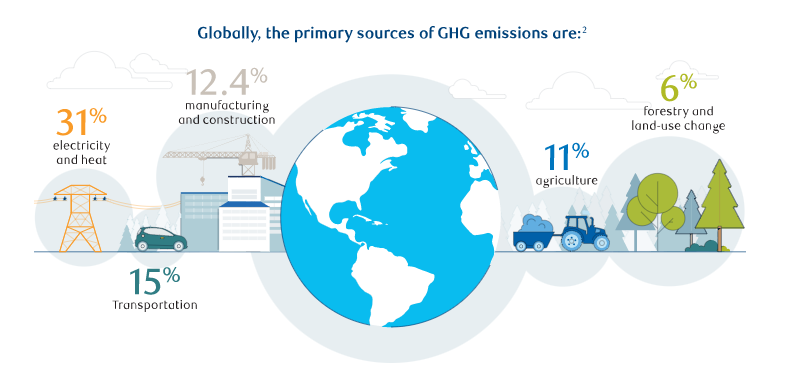

The image below shows the main sectors where decarbonization will need to take place.

Source: RBC Global Asset Management

Why net zero and why 2050?

Dramatic environmental and weather events have made headlines around the globe – wildfires, heat waves, droughts, floods and power shortages — and climate-change discussions dominate both media and everyday conversations. These events are devastating for those directly affected and can have significant long-term economic impacts globally.

With the release of emissions pegged as one of the biggest influences on the world’s changing climate, Canada has made a commitment to reach net zero by 2050. And it’s not only governments that are making this a priority. Across the globe, net zero has become an important goal for other countries, municipalities, companies and even families and individuals. In fact, the United Nations (U.N.) has described the transition to a net-zero world as “one of the greatest challenges humankind has faced.”

The target number and date both stem from the Paris Agreement, which Canada and 194 other countries signed back in 2015. The goal of the agreement was “to strengthen the effort to limit the global average temperature rise to well below 2°C and pursue efforts to limit the increase to 1.5°C.”

According to the International Panel of Climate Change (IPCC), global emissions need to reach net zero around the middle of the century in order to hit that 1.5°C target and meeting this goal requires greenhouse gas (GHG) emissions to decline by approximately 45% by 2030 (relative to 2010 levels) and reach net-zero emissions by 2050 or sooner.1

What does all this mean for investors?

“The net-zero transition has emerged as a key theme impacting financial markets as climate-related risks and opportunities impact companies in different ways,” says the team at RBC Global Asset Management (RBC GAM). It’s also on the mind of Canadian investors. A 2021 survey by the Responsible Investment Association found that 85% of investors surveyed want Canadian corporations to set net-zero emissions goals. Almost eight in 10 stated they would like a portion of their portfolio to be invested in companies that are providing solutions to reduce carbon emissions.3

For investors, considering net-zero as part of your investment decisions can take various forms. For example, if you are a direct investor that buys and sells individual securities, it may mean doing your own research by reviewing company documents (annual reports, corporate governance reports, press releases and reputable media reports etc.) to understand how a company is addressing the net zero targets and if its approach aligns with your views.

If you work with a financial advisor or planner, you can prompt a conversation about responsible investment and any related investment objectives. RBC InvestEase and RBC GAM offer products that meet a variety of ESG preferences through ESG integration, ESG screening and inclusion, and thematic ESG investing.4

To give you a sense of the climate-related factors that an investor may want to consider, here is an example of some of the things RBC GAM may consider when assessing a company’s climate-related risks.

-

What are the company’s current GHG emissions? How does the company’s emissions profile compare to its peers on an intensity basis (e.g. revenue or standard output)?

-

Has the company set comprehensive climate targets to address material financial risks due to climate change? Do they have a robust transition and action plan to meet those targets? Are they making progress in meeting their targets?

-

Does the company have effective governance structures in place to manage climate-related risks and opportunities?

-

Does the company offer transparent disclosure on the climate risks and opportunities they face? How are these integrated into strategic and financial decision-making?

Thinking long-term

For the world to achieve net-zero emissions, significant action will be required. We can all play a part – starting with understanding the targets. When it comes to investing, here’s how the team at RBC GAM views the impact:

“The impacts of climate change are systemic and unprecedented. They’re also already apparent. While climate change has the potential to affect the global economy, the economic impacts on specific markets, regions, and investments are complex, varied, and uncertain. Governments, companies, consumers, and investors each have a role to play in addressing climate change and achieving net-zero emissions by 2050 or sooner. As asset managers and investors, and stewards of our clients’ assets, we believe considering climate-related risks and opportunities in our investment approach can enhance our long-term risk-adjusted returns.”

1 Intergovernmental Panel on Climate Change (2019)

2 Global emissions, Centre for Climate and Energy Solutions, accessed on November 26 2020

3 2021 RIA Investor Opinion Survey

4. Please refer to the relevant prospectuses

Investment advice is provided by Royal Mutual Funds Inc. (RMFI). RMFI, RBC Global Asset Management Inc., Royal Bank of Canada, Royal Trust Corporation of Canada and The Royal Trust Company are separate corporate entities which are affiliated. RMFI is licensed as a financial services firm in the province of Quebec.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article