Published January 8, 2024 • 4 Min Read

Since 2024 will be a leap year, we wanted to provide some quick background on this quadrennial occurrence. In 45 BCE, Julius Caesar, a consul of the Roman Republic, recognized that a year was not in fact 365 days long, but rather 365.24 days long. To fix this slightly messy mathematical fraction, the Romans simply added an extra day every four years. Now Caesar’s math still wasn’t perfect, so the Leap Year as we know it was later formalized at a later date thanks to the Gregorian Calendar.

Forecasting leap years can be a relatively easy mathematical equation; however, forecasting what will happen with investment markets is significantly more difficult. Thankfully, we have some talented professionals in RBC Global Asset Management who annually provide their outlook for the year ahead. We have summarized their thoughts below.

What’s going on in the economy?

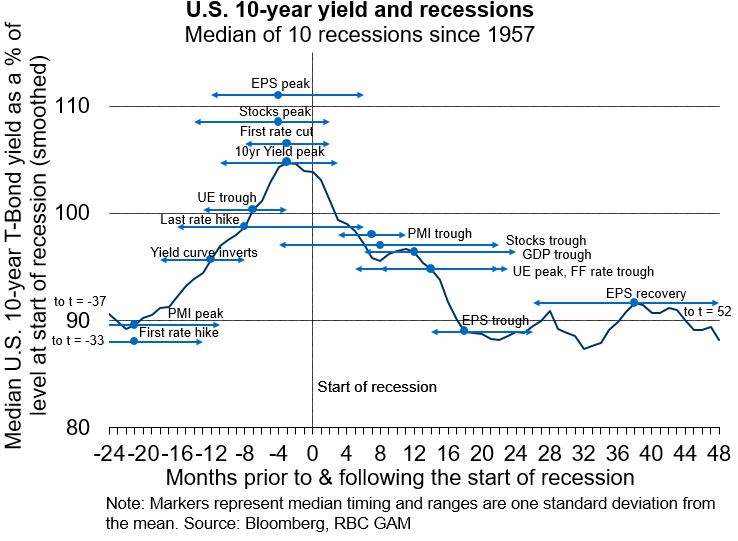

Recession was the watchword heading into 2023 with many economists predicting that global economic conditions would slow. So far, a recession has been avoided in 2023, so the question becomes will one occur in 2024? The main headwind for the global economy is the dramatic rise in interest rates that surged to their highest level in 16 years, and if they remain elevated, higher borrowing costs could discourage business and consumer spending.

There are signs that economic data is now feeling the pressure of higher rates. As the chart above shows, economic recessions typically experience a “lag” of 20-24 months after an initial rate hike. The Federal Reserve Board began raising interest rates in March of 2022, placing the beginning of 2024 well in range of the “lag”.

The Outlook for Markets:

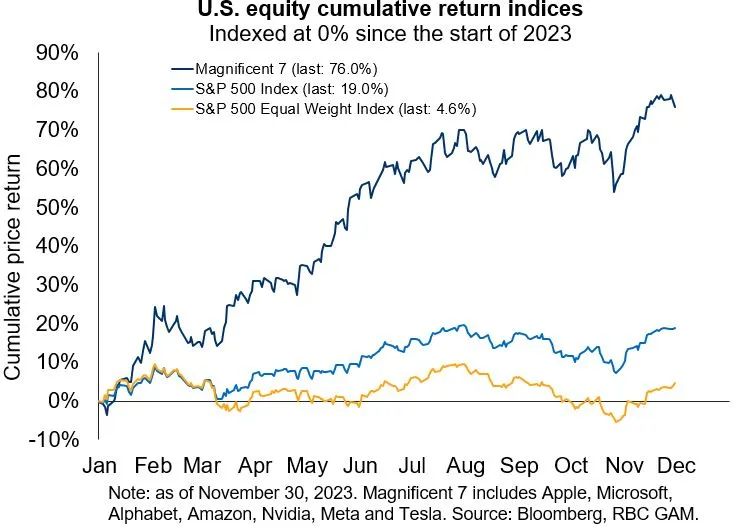

Equities: Lucky Number “7” A distinguishing feature of the rally experienced in equities during 2023 was the narrowness of the advance. The “Magnificent 7” (Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta and Tesla) were up 76% as of November 30, accounting for 15% of the S&P 500 returns. Said another way, an equally weighted index of the 500 largest companies in the U.S. was up only 5% during this period, and many other global indexes produced only low single digit returns over this period.

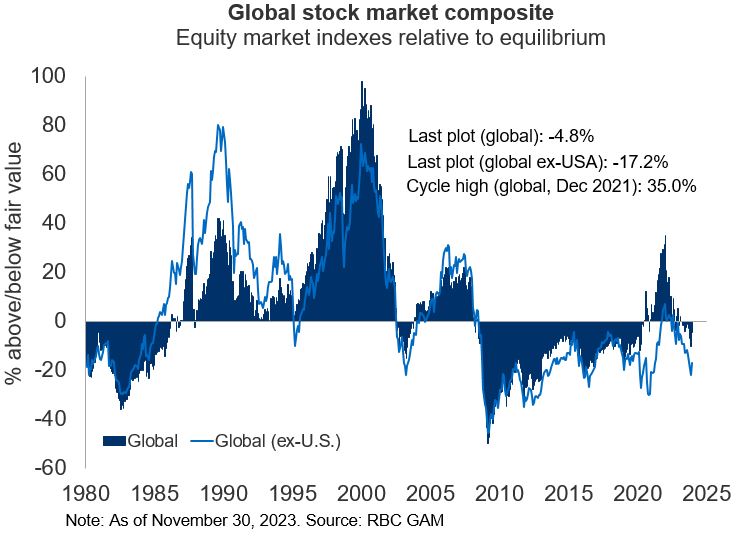

While the lack of depth to the broader index returns may be a harbinger of troubled times, the other side of the coin is that most global equities are not that expensive from a valuation perspective and regions outside the U.S. are trading at particularly attractive discounts to their fair value.

Fixed Income: What goes up…

Policy rates in the developed markets have stabilized at an elevated level in the range of 5% following a rapid and unusually large response to the shock of inflation. With the surge in rates over the past couple of years, the yield on 10-year Treasury bonds rose towards 5% during the fall. The higher rates appear to be having the desired effect as inflation has moderated towards the end of the year, thus reducing the need for further interest rate hikes. This scenario creates a very attractive situation for bond investors as rates remain at attractive levels relative to the past decade. Furthermore, should global economic growth slow, central banks may reverse course and begin to lower interest rates. Such a scenario, while potentially undesirable for the economy, would generate price appreciation of those bonds in addition to the income they generate.

Conclusion:

While Leap years are relatively easy to predict, recessions and the future performance of investment markets are much more difficult to forecast. For this reason, it is important for investors to remember the importance of having an investment plan that incorporates your objectives, risk tolerance, time horizon and financial situation.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article