Published November 8, 2022 • 4 Min Read

This article was originally published on RBC Global Asset Management.

2022 has been difficult for investors, with both stocks and bonds down sharply. For equities in particular, many regions have fallen into bear market territory, down more than 20 per cent from their peaks.

Not surprisingly, this year’s market declines have dampened investor sentiment. A recent U.S. survey suggests that the only times we’ve seen more pessimistic and fearful investor sentiment were in October 1990 and March 2009.1 Interestingly, both were months where the U.S. stock market bottomed following a meaningful drawdown. The market subsequently recovered in the months and years that followed.

Large drawdowns are extremely uncomfortable and emotional for investors – even if losses are on paper only. Not helping matters is the considerable uncertainty moving forward. Question marks remain around the economy, interest rates and inflation. Given this backdrop, some investors may be wondering if the best option at the moment is to exit markets. Nine months into 2022, markets were down almost 24 per cent. This prompts the question:

Has abandoning equities after large declines been a good strategy for long-term investors in the past?

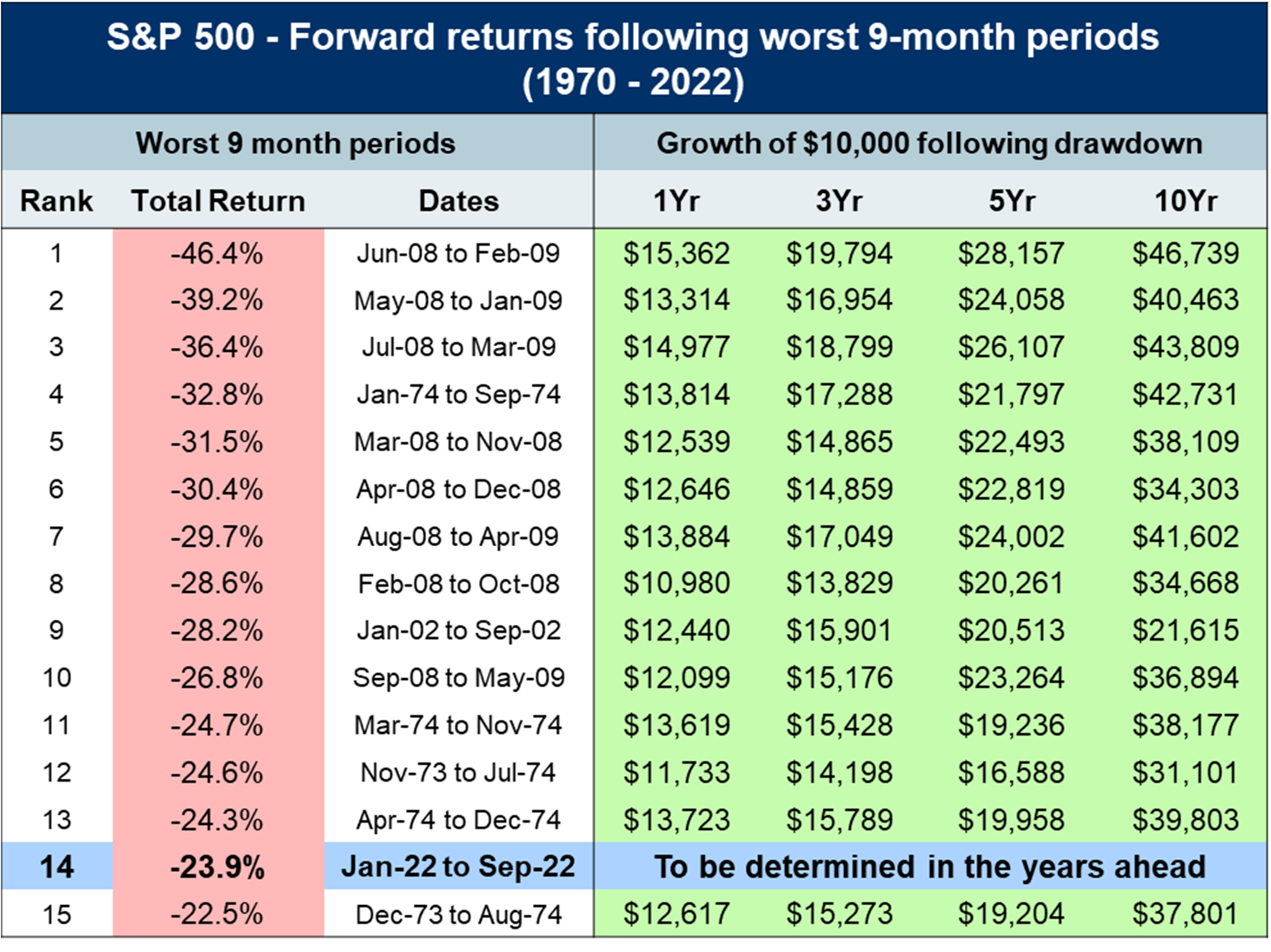

Historically, the answer has been a resounding no. In contrast, periods of large declines have presented long-term investors with attractive entry points and better long-term returns. To illustrate this, let’s look at 14 other time periods like this year. These represent 15 of the worst nine-month periods for the S&P 500 Index since 1970. What would have happened if you had invested $10,000 in the S&P 500 at the end of each nine-month period? In the table below, you’ll see the results after one year, three years, five years and 10.

Source: Morningstar Direct, RBC GAM. As of September 30, 2022. Returns reflect the S&P 500 Total Return Index in U.S. dollars. This table does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. An investment cannot be made directly into an index.

1 Based on AAII Sentiment Survey data between July 1987 and September 2022

Key takeaways:

-

The first nine months of 2022 rank #14 on the chart of worst nine-month periods for U.S. equities.

-

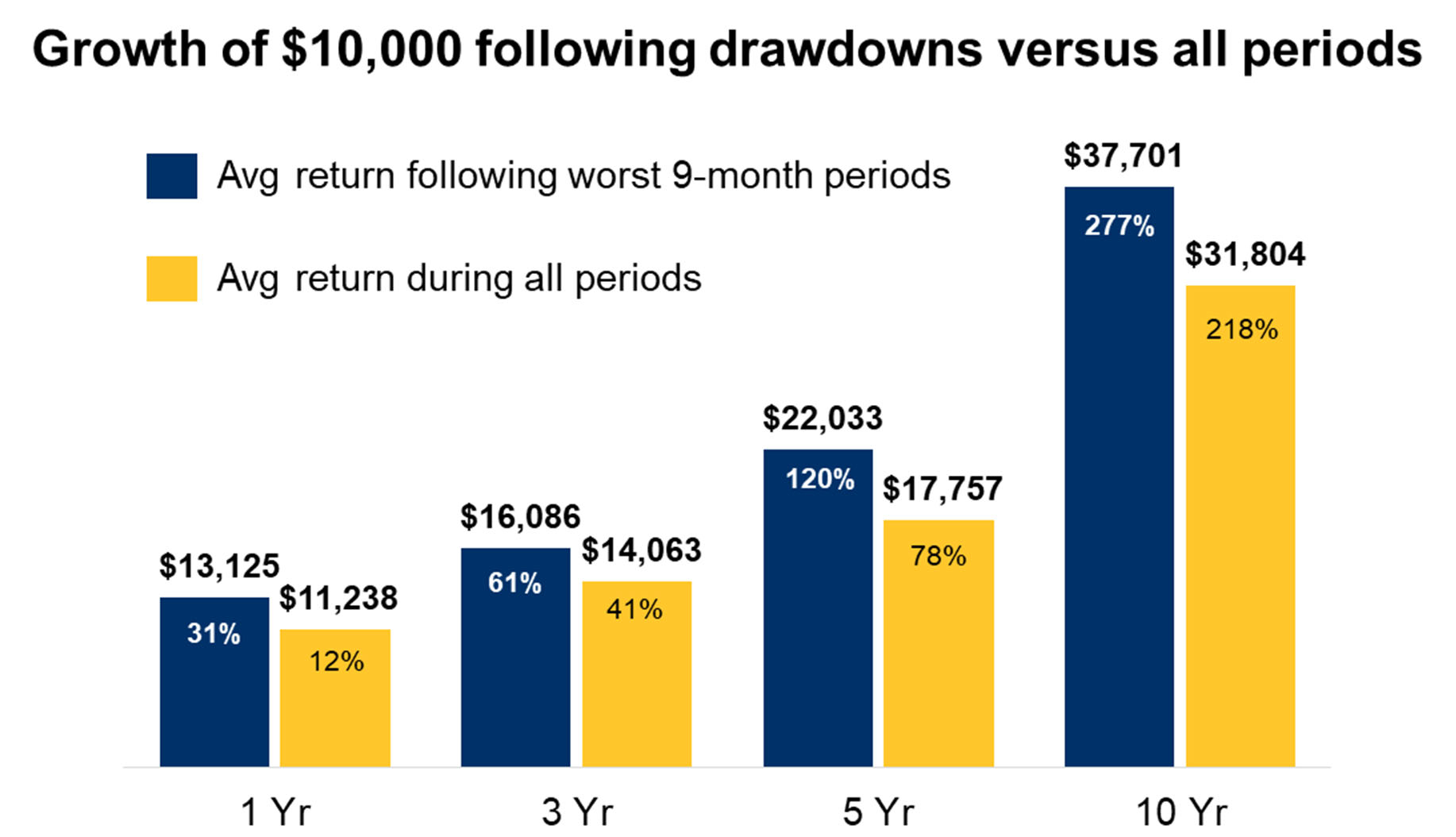

We don’t know yet where markets will go from here. But forward returns that have followed the other poor nine-month periods for U.S. equities have been extremely strong. The average value five years out is $22,033 (a cumulative return of 120 per cent). The average value 10 years out is $37,701 (a cumulative return of 277 per cent).

How do the stellar returns in the table above compare to historical averages in the markets? As you can see in the chart below, the largest nine-month declines have historically been followed by above-average returns going forward.

Source: Morningstar Direct, RBC GAM. Data is from January 1970 to September 2022. Returns reflect the S&P 500 Total Return Index in U.S. dollars, comparing the average forward cumulative returns following the worst 9-month declines (from the table on page 1) to the average cumulative returns during all periods between 1970 and 2022. Dollar figures above the bars represent the growth of $10,000 based on these cumulative returns. This graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. An investment cannot be made directly into an index.

Improved long-term return potential

Looking ahead, it’s possible that stocks could fall further in the near term, especially given the heightened uncertainties we face around rising inflation, interest rates, recession risks and more. A long-term view is essential. It’s also worth remembering financial plans are built with tough periods like 2022 in mind. Despite the decline in markets so far this year, investors can find a silver lining in the potential for improved long-term returns moving forward, regardless of how markets may look in the near term.

This article is intended as general information only and is not to be relied upon as constituting legal, financial or other professional advice. A professional advisor should be consulted regarding your specific situation. Information presented is believed to be factual and up-to-date but we do not guarantee its accuracy and it should not be regarded as a complete analysis of the subjects discussed. All expressions of opinion reflect the judgment of the authors as of the date of publication and are subject to change. No endorsement of any third parties or their advice, opinions, information, products or services is expressly given or implied by Royal Bank of Canada or any of its affiliates.

Share This Article